GOODS AND SERVICES TAX (GST)

a.The Petitioner is an Online Intermediary Company engaged in providing platform to play skill based online games to its users, for which it charged platform fee from the participants, and deposited GST @18% on such platform fee. In November 2021, the Directorate General of Goods Services Tax Intelligence (the DGGSTI) conducted search & seizure on the Petitioner's business premises and subsequently passed attachment orders attaching the Petitioner's bank account. Thereafter, the DGGI issued show cause notice (the SCN) proposing demand of INR 21,000 crore, alleging evasion of tax by the Petitioner on the ground that the game of rummy is betting and gambling activities liable to GST @28%.

The Petitioner filed writ petition (WP) before the High Court challenging the demand proposed in the SCN. The question before the High Court was whether the game of rummy hosted by the Petitioner is a game of skill or game of chance.

The High Court while applying the test of predominance held that games like rummy are games of skill and not gambling, whether played online or offline, with or without stakes, as success in a game of rummy substantially depends upon skills, and not chance. Further, it has been held that the terms "betting" and "gambling" under Entry 6 of Schedule III of the Central Goods and Services Tax Act, 2017 (the CGST Act) must be given the same interpretation given to them by the courts, in the context of Entry 34 of List II of the Seventh Schedule to the Constitution and the Public Gambling Act, 1867. Therefore, the terms "betting" and "gambling" appearing in Entry 6 of Schedule III of the CGST Act does not and cannot include games of skill within its ambit. Thus, the subject online/electronic/digital rummy game played on Petitioner's platforms are not taxable as "betting" and "gambling". Accordingly, the High Court allowed WP and quashed the SCN as being illegal, arbitrary and issued without jurisdiction or authority of law.

Takeaway: Online games like rummy are game of skill and not game of chance and thus, outside the scope of supply under the CGST Act

[Gameskraft Technologies Pvt. Ltd. Vs. DGGSTI, W.P. No. 19570 / 2022, Order dated May 11, 2023 (High Court, Karnataka)]

b.The Petitioner, a subsidiary of McDonald's Corporation, USA (the holding company) entered into two separate agreements vis., Service Agreement and Master Licence Agreement (the MLA) with the holding company. In terms of Service Agreement, the Petitioner was required to provide research and training services for desirable modification of the holding company's existing system. Whereas the MLA granted the Petitioner non-exclusive intellectual property and sublicensing rights of the holding company, basis which the Petitioner had entered into franchisee agreements with various third parties in India. The Petitioner filed an application for refund of input tax credit paid on inputs used for the services rendered to the holding company, which was rejected by the Department on the ground that the services rendered by the Petitioner were intermediary services and do not qualify as export of services as the place of supply was in India. The Petitioner's appeal against the order-in-original was rejected as well by the Appellate Authority vide the impugned order.

The issue before the Court was whether the Petitioner was an intermediary within the meaning of Section 2(13) of the Integrated Goods and Services Tax Act, 2017 (the IGST Act) in respect of services rendered under the Service Agreement.

The High Court while setting aside the impugned order held that the Appellate Authority did not consider the Services Agreement but MLA, which was a separate agreement which entitled the Petitioner to enter into sub-licenses with franchisees. It further held that the scope of services under Service Agreement do not entail procurement or facilitation of service from third-party suppliers. The SCN was issued in broad terms and did not specifically set out any reason in detail for denial of refund of Input Tax Credit (ITC) as claimed by the Petitioner. Further, rendering service on behalf of another person does not render the service provider an intermediary. It is essential that the principal service, the supplier of such services, and the service recipient are identified to ascertain whether the services performed by the Petitioner are those of a facilitator of such services. The adjudicating authority did not analyse the services rendered by the Petitioner on these anvils. Accordingly, the matter was remanded to the Adjudicating Authority for fresh consideration in light of the Service Agreement.

Takeaway: Terms of agreement must be considered properly to determine the nature of services

[M/s McDonalds India Pvt Ltd Vs. Additional Commissioner, W.P.(C) 11430/ 2022, Order dated May 18, 2023 (High Court, New Delhi)]

c.The Petitioner is engaged in the business of manufacturing aluminium frames, windows/shutters and similar goods. The business premises of the Petitioner was inspected on January 24, 2019 for alleged bill trading in violation of the CGST Act, and various documents and electronic devices were seized. Thereafter, an order under Section 83 of the CGST Act, provisionally attaching various bank accounts of the Petitioner, was issued. The Department issued SCN on October 8, 2022 in respect of inspection that took place in January 2019 for alleged bill trading. Aggrieved by the attachment of his bank accounts even after a period of one year, the Petitioner filed the instant WP seeking directions for the Respondent to remove the provisional attachment and return the seized devices.

The High Court, while allowing the WP, held that proceedings cannot be kept pending endlessly such that attachments of bank accounts traverse three to four years seamlessly. In the present case, the SCN had been issued on October 8, 2022 for the inspection happened in January 2019, provisional attachment cannot be deployed continuously for several years. The respondents have to adhere to the procedure set out under statute in a timely fashion, in accordance with law.

Takeaway: Delay in issuance of SCN cannot be a reason to prolong an attachment which is provisional in nature

[Nitesh Jain Mangal Chand Vs. Senior Intelligence Officer, DGGSTI, W.P.No.18776 of 2020, Order dated April 3, 2023 (High Court, Madras)]

d. The Petitioner sought refund of ITC availed on inputs/ input services used for providing export of services. The Petitioner's claims for refund were rejected on the ground that the services provided by the Petitioner were intermediary services and did not qualify as export of services. The Petitioner's appeal before the Appellate Authority was allowed. However, Department did not process the Petitioner's claim for refund and issued Deficiency Memos against the refund claim and subsequently SCN proposing to reject the refund claim. Aggrieved by such actions, the Petitioner filed the present WP. The High Court, while allowing the WP, declared the Deficiency Memos and SCN non est.

The Court held that Department cannot ignore the Appellate Authority's orders mainly on the ground that it proposes to file an appeal once the Tribunal is constituted. Further Department neither passed an order staying the effect of order-in-appeal nor did Department take any steps to secure an order to that effect and significant time elapsed since the passing of order-in-appeal. The High Court directed Department to disburse the refund claim of the Petitioner along with interest.

Takeaway: Department cannot ignore orders of adjudicating authority on the ground that it proposes to file an appeal

[Alex Tour and Travel Pvt. Ltd. Vs. Assistant Commissioner, W.P.(C) 5722/ 2023, Order dated May 8, 2023, (High Court, New Delhi)]

e.The Applicant is engaged in providing canteen services to ITC Ltd. (service recipient). Apart from issuing the invoices for their regular canteen services with GST @5%, the Applicant was also receiving a lump sum amount of bonus from the service recipient, for paying their employees, on which they were charging GST @18% with a view that they were acting as an intermediary. The service receipient did not accept 18% GST and claimed that they should be charged 5% as part of canteen services.

The Applicant sought advance ruling seeking clarification regarding the applicable rate of tax on reimbursement of bonus amount.

The Authority for Advance Ruling (the AAR) held that the Applicant was not providing any ancillary or incidental services to the service recipient apart from canteen services and, therefore, the amounts received by them were in relation to supply of canteen services only. The bonus amount was given that nomenclature probably as an inducement/response to the employees of the service provider for providing the said canteen services with quality. Sl No. 7, SAC heading 9963 (Accommodation, food and beverage services) of Notification No. 11/2017 prescribed tax rate of 2.5% under the CGST & SGST Acts, respectively. The State Tax Member opined that the reimbursement of bonus amount would also be taxable at 5% as that of the canteen services amount. However, the Central Tax Member concluded that if the Applicant retains a portion of the lump sum/bonus amount received as commission, then it would be liable to pay GST @18% on the commission amount and GST @5% would be payable on the rest of the amount.

Takeaway: All amounts pertaining to canteen services are chargeable to GST at the rate of 5%

[M/s Foodsutra Art of Spices Pvt. Ltd., A.R.Com/19/2022, Order dated April 12, 2023 (AAR, Telangana)]

f.The Appellant, a builder of residential apartments sold apartments to buyers with an option to acquire car parking space along with the apartment for certain sum that formed part of the total consideration charged.

The Appellant filed an application before the AAR regarding the applicable rate of GST on the right to use parking space. The AAR held that the service of right to use open parking space was taxable @ 18%, if sold before or after the receipt of completion certificate. The decision of the AAR was challenged by the Appellant before the Appellate Authority for Advance Ruling (the AAAR).

The AAAR, while confirming the order of AAR, held that uncovered parking space is not included in the definition of garage and comes within the ambit of common area that belongs to all apartment owners jointly. Therefore, the amount charged by the Appellant for right to use parking, though not permissible as per the Real Estate (Regulation and Development) Act, 2016, (constitutes a separate supply under the CGST Act, taxable @ 18%. It has been further held that right to use parking service and construction services were not naturally bundled and could not be treated as composite supply as they are separate services not dependent on sale and purchase of each other.

Takeaway: Supply of parking space and supply of apartment construction service are two independent supplies and cannot be treated composite supply

[M/s Eden Real Estates Private Limited, Appeal Case No. 01/WBAAAR/ APPEAL/2023, Order dated April 20, 2023 (AAAR, West Bengal)]

VAT/SALES TAX

a.M/s Tata Motors Ltd. (the Appellant) is engaged in manufacture and sale of automobiles to automobile dealers, who in turn, sold them to the end customers and also provide replacement of warranty goods to such customers. For every spare part replaced by the automobile dealers free of cost, under warranty, the Appellant issued a credit note to the automobile dealers.

The assessing authority invoked reassessment proceedings against the Appellant under Section 30 of the Rajasthan Sales Tax Act, 1994 and imposed tax for the assessment years 2000-2001 to 2003-2004. Regular assessment proceedings were initiated for assessment years 2004-2005 and 2005-2006. Thereafter, the Deputy Commissioner (Appeals) passed an order upholding the levy of tax upon the Appellant. Aggrieved against such order, appeal was preferred before Rajasthan Tax Board which set aside the order of Deputy Commissioner (Appeals). The Rajasthan Tax Board held that replacing the defective parts did not fall within the definition of 'sale'.

The Department filed revision petition before the Rajasthan High Court, which was dismissed, and the order of Rajasthan Tax Board was affirmed. Aggrieved by such order of High Court, appeal was filed before the Supreme Court. The issue for consideration before the Supreme Court was whether Credit note issued by the manufacturer to a dealer for replacement of a defective part under warranty was exigible to Sales Tax.

The Supreme Court, held that a credit note issued by a manufacturer to the dealer, is a valuable consideration within the meaning of the definition of 'sale' and hence, exigible to sales tax under the respective State enactments. It further held that the expression valuable consideration takes colour from the preceding expression, cash or deferred payment, and hence, consideration in the form of a credit note is also monetary in nature. The said transaction cannot be viewed in a myopic sense by truncating or excluding the role or action of a dealer under the warranty and viewing it only from the perspective of a transaction simpliciter between manufacturer and a dealer. The dealership agreements between the manufacturer and dealers are principal to principal agreements, and the person who pays the valuable consideration in a sale transaction is irrelevant so long as it is paid. Therefore, the replacement of defective part by the dealer to customer is a transfer of property and the credit note received by the dealer from the manufacturer is consideration making the transaction liable to be taxed.

Takeaway: Credit note issued by manufacturer to a dealer for replacement of a defective part under warranty is exigible to sales tax

[M/s Tata Motors Ltd. Vs. the Deputy Commissioner of Commercial Taxes (SPL) & Anr., CA No. 3715 of 2023, Order dated May 15, 2023 (Supreme Court)]

SERVICE TAX

a.The Assessee entered into Joint Venture agreement with the Airport Authority of India (AAI) to undertake some activities enjoined upon the AAI for which it was authorised by the Central Government to collect a "development fee" (UDF) from passengers. The UDF collected by assessee went to an Escrow account monitored and regulated by the AAI as per the Airports Authority of India (Major Airports) Development Fees Rules, 2011. The Commissioner of Service Tax issued SCN and thereafter, confirmed the demand for payment of service tax on the development fee. On appeal before the Customs, Excise and Service Tax Appellate Tribunal (the CESTAT) it was held that UDF collected was not liable to service tax. Aggrieved by the order of the CESTAT, the Department filed an appeal before the Supreme Court.

The Department alleged that the assessee was responsible for development, design and upgradation of airport and consequently was permitted to collect UDF from the passengers, thus liable to service tax. The Department argued that UDF is discretionary and subject to the approval of the Central Government. Hence, UDF cannot be termed as levy as it is not deposited with the Government treasury.

The Supreme Court while dismissing the Department's appeal has held that for any taxable event, there must be a nexus between the services rendered and consideration charged. Goods or services provided without consideration would not be a taxing incident. No additional benefit accrued to the passengers upon levy of UDF in the form of 'tax or cess', as it was collected to bridge the funding gap of project cost for the development of future establishment at the airports as per the Airports Authority of India Act, 1994. The Apex Court held that UDF are statutory exactions, not fees or tariffs, and it is not premised on rendering of any service. Further, such amounts collected were deposited in the escrow account which was not within the control of the assessee. The utilisation of funds is monitored and regulated by law. The fact that the amount is not deposited in a government treasury, per se, does not make it any less than a statutory levy or compulsory exaction. Nor does its discretionary nature, (in the sense that it may not be necessarily levied always) render it any less a statutory levy.

Takeaway: No service is provided by charging UDF from passengers at airport and hence, no Service tax is leviable

[CGST Vs. Delhi International Airport Ltd., CA No. 8996 of 2019, Order dated May 19, 2023 (SC)]

b.The Appellant is engaged in providing services under the categories of Renting of Immovable Property, Manpower Supply services, Legal Professional & Consultancy services, Rent a Cab services etc.

During the audit proceedings, the Department alleged that service tax is short deposited on legal, professional & consulting services. Thereafter, SCN was issued by the Department wherein demand of service tax under reverse charge mechanism (RCM) was proposed on the difference between value of 'legal, professional & consulting services' received by the Appellant as disclosed in the balance Sheet and that appearing in the service tax return, which was confirmed.

On appeal to the CESTAT, the Appellant contended that the expenses recorded under legal & professional head is not purely of legal services. It further explained the nature of various expenses and earmarked those on which service tax was payable under RCM and also submitted invoices/ vouchers in support.

The CESTAT held that the demand cannot be raised merely on apparent difference between expense appearing in the balance sheet and service tax return. The demand under service tax has to be computed on each invoice on the basis of the transactions. In absence of such exercise, the impugned order was set aside as being based on assumptions and presumptions without verifying the records.

Takeaway: Demand cannot be raised basis assumptions and presumptions without verifying the records

[M.P. Audyogik Kendra Vikas Nigam Ltd. Vs. Pr. CCGST, STA No. 52190 of 2022 (SM) dated May 26, 2023 (CESTAT, Delhi)]

CENTRAL EXCISE

The Appellant received certain taxable services of erection, commissioning, crushing of iron ores. Service tax was not charged on the invoice received with respect to such services by the service provider. Subsequently, the service provider raised a supplementary invoice and charged service tax with cross reference to earlier invoices during which period the Appellant was unregistered. The Appellant availed Cenvat credit basis supplementary invoices.

The Department conducted an investigation and subsequently issued an order disallowing the Cenvat credit availed in respect of such supplementary invoices alleging that the invoice had not been raised within the stipulated time period of 14 days from the date of completion of service, which is in violation of Rule 4A(1) of the Service Tax Rules, 1994 (the Service Tax Rules) and Rule 9(2) of the Cenvat Credit Rules 2004 (the Credit Rules). Further, the Department alleged that the Credit Rules specify availability of credit basis invoice and not supplementary invoice.

Aggrieved by such an order, the Assessee filed an appeal and contended that Rule 4A(1) of the Service Tax Rules is applicable on service provider and not on service recipients. It further contended that credit is availed in terms of proviso to Rule 9(2) of the Credit Rules which provides that even if all particulars are not mentioned on the invoice, credit is available if certain relevant particulars are mentioned. It was further contended that practically there is no difference between invoice and supplementary invoice and that the entire exercise is revenue neutral.

The CESTAT, while setting aside the impugned order, held that Cenvat credit cannot be disallowed in the hands of service recipient by invoking Rule 4(1) of the Service Tax Rules even if invoice is issued beyond prescribed period of 14 days from the date of completion of service. The obligation to issue the invoice timely is cast on the service provider and not service recipient. With respect to the issue of supplementary invoice, it has been held that during the period in dispute (period prior to April 01, 2011), there was no restriction on availing Cenvat credit even assuming that the tax paid by the service provider is deliberate evasion on his part.

Takeaway: Cenvat credit cannot be disallowed to service recipient for non-issuance of invoice within the time prescribed as it is the duty of service provider to issue invoices properly.

[Usha Martin Limited Vs. CCE & ST, EA No. 80 of 2011, Order dated May 16, 2023 (CESTAT, Kolkata)]

CUSTOMS

a.The Appellant, an entity in Dubai, exported confectionary items to India. As per the information gathered by the Department of Revenue (DRI), in relation to exports made by the Appellant, certain importers were evading customs duty by under-invoicing the goods and mis-declaring the transaction value and retail sales price. The Appellant had issued two invoices – one with the actual value and the other with lower value which was used for clearance of goods by the Importers. DRI issued SCN to various importers and also to the Appellant proposing penalty under the Customs Act, 1962 (the Customs Act) for short payment of customs duty. SCN issued upon the Appellant was adjudicated by the Joint Commissioner of Customs (the Adjudicating Authority), who held that the Appellant had participated in evasion of duty by raising false invoices, and accordingly penalty under Section 112(a) of the Customs Act was imposed. The Adjudication Order was upheld by the Commissioner (Appeals) and the CESTAT.

Aggrieved by the order of the CESTAT, the Appellant filed an appeal before the High Court on three issues, (i) whether penalty could be imposed against an exporter, who is an overseas supplier, (ii) when proceedings against importer other co-noticees have been dropped by the Settlement Commission, can the Appellant still be penalized, and (iii) whether the officers of DRI were "proper officer" to issue SCN under the Customs Act.

The High Court held that the Appellant, though had its head office in Dubai, but was very well present in India through its Indian representative. The Appellant had actively colluded and abetted with the Indian importers by various acts of commission to evade Customs duty, and accordingly, penalty was rightly imposed under Section 112(a) of the Customs Act. The proceedings were for imposition of penalty and not for demand of customs duty. It has been further held that the Customs Act does not have any provision that would automatically extend the settlement benefit given to a party to other noticees as well, and hence, the settlement of liability by co-noticees is no ground for absolving the Appellant from its liability. Lastly, the CESTAT held that the adjudication order vide which penalty was levied was passed by the Adjudicating Authority who is a proper officer and therefore, the question as to whether DRI is proper officer for issuance of SCN does not arise. Accordingly, the appeal was dismissed.

Takeaway: Overseas suppliers can be penalized for their offences committed within the territory of India under the Customs Act if they collude evasion of customs duty in India

[M/s Seville Products Ltd. Vs. CC, CUSAA 88/2022 and CM APPL. 34721/2022, Order dated May 18, 2023 (High Court, New Delhi)]

b. The Petitioner imported goods that were subjected to examination by Department. Subsequently, summons was issued to the Petitioner and during investigation, the officer concerned misbehaved with the Petitioner and coerced him to waive off the right to have an advocate for recording the statement. As the Petitioner was under apprehension of being coerced to give self-incriminating statements, it preferred a WP seeking directions for Department to permit presence of Advocate during interrogation and recording of the statements.

The High Court while relying on the judgment of the Supreme Court in the case of Vijay Sajnani vs. UOI1, held that the presence of lawyer at visible but not audible distance is an aspect of fair investigation which cannot be denied to the Petitioner. It further held that it is for the Petitioner to ensure that the presence or non-presence of their lawyer cannot be a ground for seeking extension from appearing in the interrogation, as and when called. Takeaway: Right to have an advocate during recording of statement at visible but not audible distance cannot be denied. [Amit Kumar Sharma Vs. DRI & Ors., Cr.W.P. No. 943 of 2023, Order dated April 28, 2023 (High Court, Bombay)]

FOREIGN TRADE POLICY NOTIFICATIONS

a.Pursuant to the enactment of the Finance Bill, 2023, changes have been made to the Remission of Duties or Taxes on Export Products Scheme (RoDTEP) Schedule to align it with the First Schedule of the Customs Tariff Act, 1975. Accordingly, 149 tariff line items at 8 Digit level have been added and 52 tariff line items at 8 Digit level have been deleted from RoDTEP Schedule (Appendix 4R) w.e.f., May 01, 2023. [Notification No. 04/2023 dated May 01, 2023].

b. The benefit under the Interest Equalisation Scheme has been capped at INR 10 crores per Import Export Code (IEC) in a Financial Year (FY) with immediate effect. Further, disbursements made for FY 2023-24 post April 01, 2023 will be counted for an IEC in the prescribed limit of INR 10 crores for FY 2023-24. [Trade Notice No. 05/2023 dated May 25, 2023].

c. ITC (HS) 2022, Schedule-I Import Policy is amended in sync with the Finance Act, 2023 and the Foreign Trade Policy, 2023 with immediate effect. [Notification No. 08/2023 dated May 29, 2023].

d. Online facility for requesting appointment for virtual meeting/ personal hearing to the exporter introduced w.e.f. June 01, 2023. [Trade Notice No. 06/2023-24 dated May 31, 2023].

THE DIRECTORATE GENERAL OF TRADE REMEDIES, MINISTRY OF COMMERCE & INDUSTRY

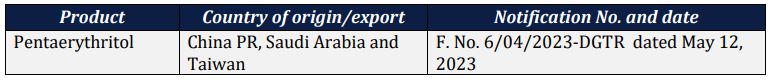

a.Initiation of Anti-Dumping Duty Investigation on import of:

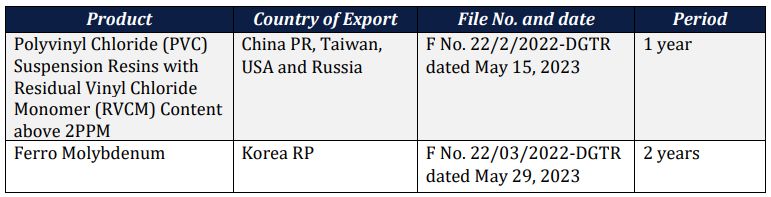

b. Final Findings regarding Anti-Dumping Duty Investigation on import of

c. Final Findings issued in safeguard investigation on import of:

MINISTRY OF FINANCE

d. Levy of Anti-Dumping Duty on import of goods from specified producers:

INDIAN CUSTOMS HIGHLIGHTS

a.Concessional rate of duty benefit restored on import of open cell

- Notification No. 35/2022–Cus dated April 29, 2023 vide which concessional rate of duty benefit on import of open cell for use in manufacture of Liquid Crystal Display (LCD) and Light Emitting Diode (LED) TV panels with drivers or control circuits was withdrawn has been amended.

- Concessional rate of duty benefit has been restored on import of open cell used in manufacture of LCD and LED TV panels with drivers or control circuits.

[Corrigendum dated May 16, 2023]

b. Electronic Certificate of Origin (E-COO) acceptable under India Sri Lanka Free Trade Agreement (FTA)

- E-COO issued by the issuing authority of Sri Lanka is a valid document for the purposes of claiming preferential benefit under India-Sri Lanka FTA.

- The authenticity of E-COO should be verified by using specimen seals, signatures or unique QR code printed on the certificate.

- E-COO to be mandatorily uploaded on e-Sanchit by the importer for availing preferential benefit and particulars of E-COO to be entered while filing the bill of entry.

- Printed copy of E-COO to be presented to the Customs officer for verifying the particulars mentioned in the bill of entry.

[Instruction No. 15/2023- Cus dated May 3, 2023]

INDIA GST HIGHLIGHTS

NOTIFICATIONS

a. Mechanism for opting for payment of GST on forward charge basis for Goods Transport Agency (GTA) services notified

- GTA service provider had the option to deposit GST under forward charge mechanism for Financial Year 2023-2024 on or before May 31, 2023.

- Supplier of GTA services who commences new business, or crosses the threshold for registration, was required to exercise such option before the expiry of 45 days from the date of applying for GST registration, or before one month from the date of obtaining registration, whichever is later.

- [Notification No. 05/2023-CT(R), IT(R) & UT(R) dated May 9, 2023]

- b. Notification implementing E-Invoicing for Taxpayers amended

- Any registered person having aggregate turnover above INR 5 crores in any Financial Year (FY) from FY 2017-18 onwards is required to issue E-invoice w.e.f., August 1, 2023.

[Notification No. 10/2023-CT dated May 10, 2023]

INSTRUCTIONS

a. Guidelines issued for Special All-India Drive against fake registrations

- The guidelines have been issued subsequent to the National Co-ordination Meeting of the State and Central GST officers held at New Delhi on April 24, 2023 and may be launched by all Central and State Tax administrations during the period May 16, 2023 to July 15, 2023.

- Details of fraudulent GSTIN identified through data analytics and risk parameters will be shared with concerned State/ Central Tax administration for initiation of verification drive and conducting necessary action

- Suspicious GSTINs shall be subjected to verification by the concerned jurisdictional tax officer(s). Action for suspension and cancellation of the registration may be initiated for non-existent and fictitious taxpayers and Input Tax Credit in Electronic Credit Ledger may also be blocked.

- Each state and CGST Zone will provide action taken report on weekly basis.

- National Coordination Committee shall monitor the progress of this special drive

[Instruction No. 01/2023-GST dated May 4, 2023}

b.Standard Operating Procedure for Scrutiny of Returns for FY 2019-20 onwards issued

- Functionality "Scrutiny of Returns" developed, containing online workflow for scrutiny of returns in the CBIC ACES-GST application. The functionality provides detailed workflow for communication between the proper officer and registered person, of the discrepancies noticed, in relation to the details furnished in the returns.

- Selection of returns for scrutiny will be done by the Directorate General of Analytics and Risk Management (DGARM) based on various risk parameters identified by them, details of which will be shown on the scrutiny dashboard of the proper officer for their convenience.

- Scrutiny schedule in specified format shall be finalized. Riskier GSTINs based on the likely higher revenue implication may be prioritized. Returns pertaining to 4 GSTINs shall be scrutinized by the proper officer per month.

- Various returns and statements furnished by the registered person and the data/details made available through various sources like DGARM, E-Way Bill Portal, etc. may be relied upon for scrutinizing the returns and verifying the correctness of returns. There should be a minimal interface between the proper officer and the registered person.

- Specified timelines may be observed for conducting scrutiny of returns in a time bound manner for cases to take logical conclusion expeditiously.

- MIS report in the scrutiny dashboard on the ACES-GST application shall contain the details of action taken by the proper officer in respect of GSTINs allocated to them for scrutiny.

[Instruction No. 02/2023-GST dated May 26, 2023]

GST Portal update

a. Advisory issued for deferment of implementation of time limit on reporting old E-Invoices

- Implementation of time limit of 7 days on reporting old e-Invoices was deferred. Next date of implementation would be shared by Goods and Services Tax Network in due course of time. [GST Portal Update dated May 6, 2023] PRESS RELEASE b. Automated Return Scrutiny Module (the Module) for GST returns rolled out

- The Module would enable the officers to carry out scrutiny of GST returns of Centre Administered Taxpayers selected on the basis of data analytics and risks identified by the System.

- Tax officers would be able to interact with the Taxpayers through the GSTN Common Portal for communicating the discrepancies displayed to them in the Module.

- Implementation of the Module commenced with the scrutiny of GST returns for FY 2019-20.

[Press Release dated May 11, 2023]

GST ON ONLINE GAMING – AN UNRESOLVED ISSUE

The last couple of decades have seen an accelerated growth in the Indian gaming industry. With easier availability of the internet and mobile technology, there has been an incentivized and rampant access to online gaming. In 2021, the revenue from online gaming grew 28% to reach $1.2 billion and by 2024, this figure is estimated to reach $1.9 billion.

There has been an ongoing debate for a viable GST framework for this industry, including the appropriate taxable value and the applicable rate of tax. Currently, the online skill-based gaming industry pays tax @ 18% on the platform fee earned by the gaming company on the premise that the money deposited by the participants in the player pool for playing the game qualifies as a transaction in money. Such amount is kept aside in a separate account by the gaming company as a custodian, and it does not have any right or lien over the pool money. Further, it has also been argued that the contribution in the player pool is an actionable claim, which falls under Schedule 3 of the CGST Act2, which provides that "actionable claims, other than lottery, betting and gambling" shall be treated neither as a supply of goods nor a supply of services. The foundation of GST law in India is that the tax is levied on the supply of goods and services for which the consideration is received. Here, the consideration earned by the platform provider (gaming company) is not the whole pool amount, but the platform fees which is actually the consideration against the service rendered by the gaming company.

However, authorities have held contrary views to this and sought to levy tax @ 28% irrespective whether such online games are games of skill or games of chance. There have been multiple judgements on the issue of applicability of GST on platform fees versus pool amount; and games of chance versus games of skill. The issue first came up in the Gurdeep Singh Sachar3 case before the Punjab & Haryana High Court wherein it has been held that GST is to be charged on the amount received towards platform fee and not on the entire pool amount received for a particular contest as the remaining amount other than platform fee is treated as an actionable claim. Recently in the case of Gameskraft Technologies4, the question was whether the online game 'Rummy' amounts to betting and gambling. The High Court held that Online/Electronic/Digital Rummy game and other Online/Electronic/Digital games played on the platform provided by Gameskraft Technologies are not taxable as 'Betting' and 'Gambling' under the CGST Act and Rules. It further held that taxation of games of skill is outside the scope of the term "supply" in view of Section 7(2) read with Schedule III of the CGST Act. Entry 6 in Schedule III to the CGST Act taking actionable claims out of the purview of supply of goods or services, would clearly apply to games of skill and only games of chance such as lottery, betting and gambling would be taxable. It is pointed out that the aforesaid judgements are all passed by jurisdictional High Courts. Finality on the controversy would be put to rest either by an amendment in law, or once the verdict is given by the Supreme Court.

Further, even if we look at foreign jurisdictions on the taxability on gaming industry, although France earlier used to levy tax on the entire pool amount, but later decided to shift to levying taxes on the platform fee after operators started resorting to the black market, leading to a loss of revenue to the government and non-compliance with the licensing and regulatory system. Similarly, Sweden and UK also levy tax on the platform fee and have witnessed higher tax revenue and compliance among gaming operators.

Coming back to India, even after much deliberation and judicial precedents, the stance of the revenue department still stands at levying tax @ 28% on the whole pool amount arguing that these games are games of chance and fall under the category of gambling. A Group of Ministers (GoM) has been constituted by the GST Council to address the issue of GST structure applicable to the gaming industry. There is a recommendation of levying GST at the rate of 28% on the entire pool amount, which definitely would be damaging the entire online gaming industry. There is a possibility that the legitimate game players might divert to illegal offshore gambling apps that won't levy such huge taxes, thus leading to reduction in revenues of legitimate companies and ultimately, the government. Offshore gaming companies, who may not be India GST compliant and outside the purview of the regulatory oversight, might also benefit from such move.

So, to conclude, there is still a lot to mull over the debate of what all kind of games should be games of skill, what would be the appropriate percentage of levy, and what would be the taxable value. However, for an industry which has so much potential of growth, a definitive line of action and decision on taxability would bring clarity, which would be valuable both to the users as well as the industry.

Footnotes

1 Crl.M.P.No.10117 of 2012 in WP (Crl.) No.29 of 2012.

2.The Central Goods and Service Tax Act, 2017

3 Gurdeep Singh Sachar Vs. Union of India, 2019-VIL-283-BOM

4 Gameskraft Technologies Private Limited Vs Directorate General of Goods and Services Tax Intelligence, 2023-VIL-291-KAR

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.