It is indicated in the IBBI reports that around 76% of CIRPs that were previously with the Board for Industrial Financial Reconstruction ("BIFR") and/or defunct have ended in liquidation, and these CDs had nearly entirely deteriorated before they were admitted into CIRP. The average asset value of these CDs was less than 8% of the total amount of the outstanding debt. However, 35% of the total yielded Resolution Plans in various CIRPs were previously with BIFR or were defunct companies.

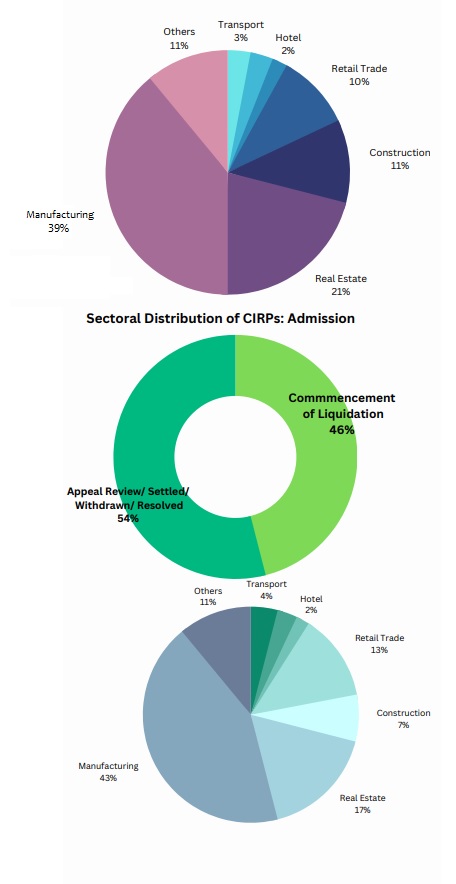

As of 30.09.2022, the number of CIRPs admitted sector-wise was highest in manufacturing, followed by real estate and construction. Within manufacturing, the highest number of CIRPs have been initiated against companies engaged in textiles, leather, and apparel products. A total of 5,893 CIRPs have commenced by the end of September 2022. Of these, 3,946 have been closed. Of the CIRPs closed, the CD was rescued in 2,139 cases, of which 846 have been completed on appeal or review or settled; 740 have been withdrawn; 553 cases have ended in approval of resolution plans. In 1,807 cases, the orders for liquidation were passed.

When the CDs were admitted to CIRP, the resolved CDs had assets valued at 1.37 lakh crore, while the CDs designated for liquidation had assets valued at 0.60 lakh crore. The creditors have realised almost 177% of the liquidation value and 84 % of the fair value of their assets. Thus, almost 70% of the distressed assets were resolved in terms of value. One-third of the businesses that were resolved and three-fourths of the CDs submitted for liquidation were either sick or inactive.

Sectoral Distribution of CIRPs: Commencement of Liquidation

Originally Published January 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.