As per the annual report published by the Ministry of Road Transport and Highways on "Road Accidents in the year 2022" a total of 4,61,312 road accidents have been reported by States and Union Territories (UTs) during the calendar year 2022, which claimed 1,68,491 lives and caused injuries to 4,43,366 persons. This marks an increase of 11.9% in accidents, 9.4% in fatalities, and 15.3% in injuries compared to the previous year 1.

In this Article2, we have tried to cover certain basic provisions under the Indian law dealing with road accidents, where cases of any employee or the vehicle of the Company is involved in road accident.

1. Can any liability be fastened to the Company in case when vehicle of the Company is involved in a road accident?

Yes, in cases where the vehicle is owned by the Company for transportation has caused grievous hurt or death of any person, the Company as the owner of the vehicle will be held liable under the principle of " vicarious liability "3 and shall be liable to pay compensation under " no fault liability " as envisaged in section 164 of Motor Vehicles Act, 1988 ("MV Act").

Under section 164 of the MV Act, the owner, or the authorized insurer of the Vehicle shall be liable to pay the compensation in case of death or grievous hurt due to any accident arising out of the use of motor vehicle.

The quantum of the compensation may differ, but the section provides for compensation of Rs. 5,00,000/- in case of death or of Rs. 2,50,000/- in case of grievous hurt to the legal heirs or the victim, as the case may be.

This provision was recently introduced, and the quantum of compensation was enhanced from Rs. 50,000/- to Rs. 5,00,000/- in case of death and from Rs. 25,000/- to Rs. 2,50,000/- in case grievous hurt. It is important to note that under this provision, the claimant of compensation is not required to plead or establish the fault of the owner of vehicle.

2. Can any liability be imposed on a company in case when vehicle (involved in road accident) is only used by the company personnel, but the vehicle is owned by a third Party?

Yes, while it should be noted that generally, in case of accident the owner of the vehicle will be held liable as stated above, in such cases, the Company may be held jointly and severally liable for the accident of the vehicle which is either used for carrying company goods or for transportation services of its staff. Such liability may be imposed in cases like:

a. A proper road permit from the state transport authorities was not obtained by the Company.

b. Vehicles are overloaded with goods.

c. The driver of the vehicle doesn 't have a valid driving license.

d. The vehicle is not in good running condition.

3. Are there any criminal liabilities of the owner or driver in case of accident of commercial vehicles used by the Company for transportation?

Yes, under Indian law, the owner and driver of a commercial vehicle can face various criminal liabilities in the event of an accident.

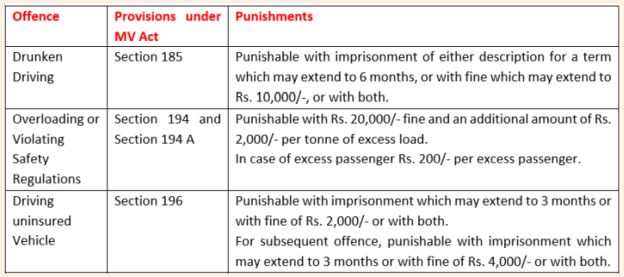

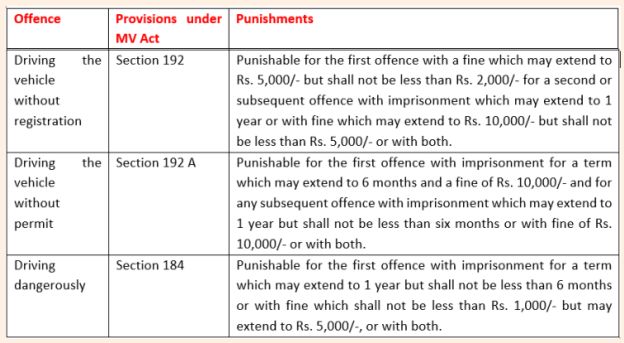

Section 199 of the MV Act deals with offences by companies which makes the Company liable for the conduct of business for the offences under the MV Act. Some potential liabilities of the Company and /or its personnel along with its consequence may be listed as below:

The Company and/or its personnel may also be held liable under Bhartiya Nyaya Sanhita, 2023 (BNS), which will come in force from 1st July 2024 4 for negligent or rash driving on the public way under section 281 which shall be punishable with imprisonment of either description for a term which may extend to 6 months, or with fine which may extend to Rs. 1,000/-, or with both.

BNS also covers the offence for causing death by negligent or rash driving of the vehicle not amounting to culpable homicide, escapes without reporting to police officer or a magistrate soon after the accident ("hit and run ") which shall be punishable under section 106(2) with imprisonment of the term which may extend to 10 years and shall also be liable to fine. Due to nationwide agitation this clause is put on hold and will not come into effect until further notification.

4. What are the general obligations of vehicle motor owners under the MV Act for insurance?

Under the provision of MV Act a motor vehicle cannot ply in public places unless insured as per the new amendment in section 146 of MV Act.

In the case of a vehicle carrying, or meant to carry, dangerous or hazardous goods, there shall also be a policy of insurance under the Public Liability Insurance Act, 1991.

Section 147 further requires insurance policy to comply with the following:

i.The insurance must be issued by the authorized insurer;

ii.The insurance must insure person or classes of person:

a) against any liability which may be incurred by insured person in respect of the death of or bodily injury to any person including owner of the goods or his authorized representative carried in the motor vehicle or damage to any property of a third party caused by or arising out of the use of the motor vehicle in a public place.

b) against the death of or bodily injury to any passenger of a public service vehicle caused by or arising out of the use of the vehicle in a public place.

iii. The insurer must issue a certificate of insurance in favor of the person by whom the policy is affected and must contain the prescribed conditions for which policy is issued.

5. What are the best practices a Company is required to follow for prevention of such liabilities in case of vehicle used by the Company is owned by Third Party?

a. Obtaining an Insurance Coverage as obtaining insurance for vehicles used in transportation of staff or for delivery of goods is insured against third parties ' claim as required under Section 146 and 147 of MV Act.

b. Vehicle Maintenance and Inspection: The Company must inspect the vehicles regularly and ensure that the vehicles used for transportation are registered under the applicable laws and are regularly maintained and kept in good running conditions.

c. Documentation and Record-keeping: The Company must obtain a permit for operation of vehicle from the state transport authority for carriage of goods/ passengers and shall maintain records of all required documents under the law.

d. Driver selection and Training: The Company must select drivers after background checks, driving history verification and verifying the driving license of the driver and should conduct training programs for drivers focused on safe driving practices, traffic laws, and defensive driving techniques.

e. Emergency Response Plan: Companies may develop and implement an emergency response plan to handle accidents or breakdowns promptly and effectively, including procedures for reporting incidents, providing medical assistance, and coordinating with authorities.

f. Zero-tolerance Policies: Company can adopt cogent policies against alcohol or drug consumption while operating company vehicles, as well as speeding, reckless driving, distracted driving, and other unsafe behaviors, with strict consequences for violations. Companies may have restrictions on speed limits so that the drivers do not exceed speed beyond such limits. Company may also implement vehicle tracking systems or other monitoring mechanisms to track speed and ensure compliance with speed limits.

In case the Company utilizes a vehicle owned by a third party, it is important to establish a legally binding contract with said third party. This contract must explicitly outline all above responsibilities and liabilities associated with the vehicle, thereby transferring them to the third party as the vehicle's owner.

Case Study

In Uttar Pradesh State Road Transport Corporation vs. National Insurance Co. Ltd. & Others5 the question came for consideration before Hon 'ble Supreme Court was that if an insured vehicle is plying under an agreement with the Corporation on the route as per permit granted in favour of the Corporation and in case of any accident during that period, whether the Insurance Company would be liable to pay compensation or would it be the responsibility of the Corporation or the owner?

While considering the issue the Hon 'ble Supreme Court reiterated its decision in Uttar Pradesh State Road Transport Corporation vs. Kulsum and Others 6 and held that when the effective control and command of the bus is with the Corporation, the Corporation becomes the owner of the vehicle for the specified period. It was further held that when the actual possession of the vehicle is with the Corporation, the vehicle, the driver and the conductor were under the direct control and supervision of the Corporation. Therefore, through the definition of " vicarious liability " it can be inferred that the person supervising the driver is liable to pay compensation to the victim. During such time, however, it will be deemed that that vehicle was transferred along with the insurance policy, even if it were insured at the instance of the original owner. Thus, the Insurance Company would not be able to escape its liability to pay the amount of compensation.

6. Do you know about the new Good Samaritan scheme launched by the Ministry of Road Transport & Highways?

The Ministry of Road Transport & Highways (Road Safety) has launched a scheme for grant of award to Good Samaritan who saves a life of victim of a fatal accident involving a motor vehicle administering immediate assistance and rushing to Hospital/Trauma Centre within the Golden Hour of accident to provide medical treatment ("Good Samaritan Scheme ")7. Section 134A of the MV Act provides protection to Good Samaritan. "Good Samaritan" means a person, who in good faith, voluntarily and without expectation of any reward or compensation renders emergency medical or nonmedical care or assistance at the scene of an accident to the victim or transports such victim to the hospital.

Any person who saves the life of a victim of fatal accident by administering immediate assistance and rushing to hospital within golden hour i.e., time period within one hour following traumatic injury to provide medical treatment shall be awarded with Rs. 5000/- along with "Certification of Appreciation ". This scheme is currently valid 31st March 2026.

Conclusion :

It is worth noting that generally when a road accident occurs involving a company's vehicle or employee, legal responsibility is likely to be fastened on the company under various legal principles, including vicarious liability, negligence, and statutory obligations. Thus, adoption of best practices is very important to ensure that the usage of vehicles does not result in any liability against the vehicle user/owners. Further, as a responsible corporate entity, the company can also educate its employees and drivers about Good Samaritan guidelines to commend individuals assisting road accident victims through training programs.

Footnotes

1. https://pib.gov.in/PressReleasePage.aspx?PRID=1973295

2. The article reflects the general work of the authors and the views expressed are personal. No reader should act on any statement contained herein without seeking detailed professional advice.

3. Vicarious liability is a legal principle that holds a person or entity responsible for the actions of its personnel, agents, employees etc.

4. Gazette Notification dated 23.02.2024 regarding the Bharatiya Nyaya Sanhita, 2023 (45 of 2023)

5. CIVIL APPEAL NOS. 18490-18491 OF 2017

6. 1 (2011) 8 SCC 142

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.