Under the erstwhile provisions of the Income tax Act, 1961 ("the Act"), where the partner withdrew money from capital account with the partnership firm, there was no provision to tax the same, either in the hands of the partnership firm or the partner. On the basis of the jurisprudence that prevailed at that time, it was held that when a partner retires, what the partner receives is his share in the partnership; the consequence of such distribution or division of assets on retirement of a partner was nothing but mutual adjustment of pre-existing rights between the partners and consequently, there was no transfer for the purposes of levy of capital gains tax under the Act [refer Dewas Cine Corporation: 68 ITR 240 (SC), CIT vs. Mohanbhai Pamabhai: 165 ITR 166 (SC)].

Though in terms of the earlier provisions of section 45(4), by virtue of the deeming fiction, tax was imposed in the hands of the firm in a situation where capital asset(s) of the firm was distributed to the partner on dissolution or otherwise, the scope of the said section was, however, limited to distribution of capital asset(s) and not to distribution of money on withdrawal of amount in excess of the balance lying in the capital account of the partner.

Apart from the above, there was a debate whether distribution of capital asset in case of re-constitution of firm by way of retirement or change in profit sharing ratio, etc., was covered within the scope of the provisions of section 45(4) of the Act [Favourable: Dynamic Enterprises: 359 ITR 83 (Kar); CIT vs. G. Seshagiri Rao : 213 ITR 304 (AP); Against : CIT vs. A.N. Naik Associates: 265 ITR 346 (Bom); ACT vs. Gurunath Talkies: 226 CTR 474 (Kar)].

To put quietus to the above controversy, to tax withdrawal of enhanced capital balance by way of money and to also tax distribution of assets, the Finance Act, 2021 has made substantive amendments by insertion of new section 9B and also substituted existing section 45(4), retrospectively effective from the previous year 2020-21.

The new section 45(4) applies when a partner receives "money or any other asset" from the firm in excess of the balance in the capital account at the time of reconstitution of the firm; the same is deemed to be "capital gains" in the hands of the firm. Further, balance in the capital account is to be calculated ignoring increase / credit to the account due to revaluation of any asset or recording of selfgenerated goodwill or any other self-generated asset.

Further, new section 9B, which shall operate in addition to the provisions of section 45(4), has been inserted to deem receipt of capital asset or stock in trade or both by the partner (from the firm / LLP) as 'transfer' by the firm/ Limited Liability Partnership ("LLP") in the year of receipt of asset by the partner. Income arising on such transfer shall be chargeable to tax under the head "capital gains" or under the head "profits and gains of business or profession", as the case maybe, in accordance with the provisions of the Act.

Consequential amendment has been made in section 48(iii) to provide that the amount of capital gains offered to tax by the firm under section 45(4) shall be allowed as reduction while computing capital gains on transfer of any remaining capital asset by the firm, in future, in the manner to be prescribed.

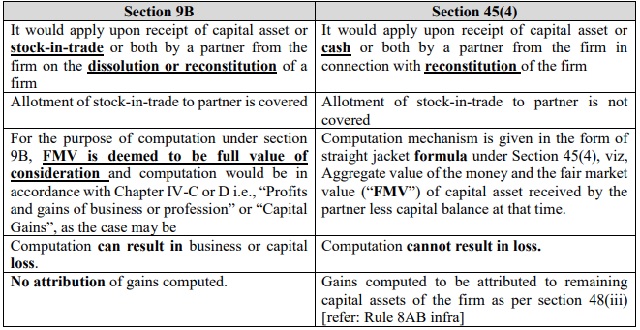

The scope and operation of the two new sections, viz, sections 9B and 45(4) is tabulated as under:

Pursuant to the aforesaid provisions, Income Tax Rules, 1962 ("IT Rules") have been amended/ supplemented vide Notification No.76 of 2021 dated 2nd July 2021 issued by CBDT, to provide as under:

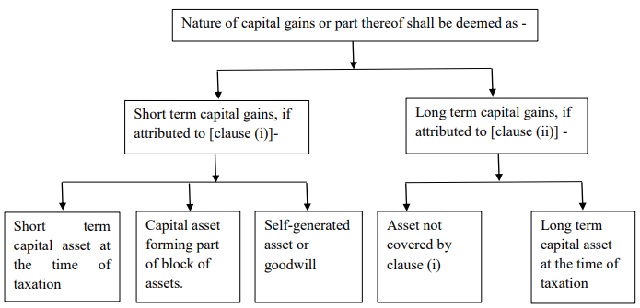

Nature of capital gains under section 45(4) of the Act

For determination of the nature of capital gains computed under section 45(4) of the Act, viz, whether short-term or long-term capital gains ("LTCG"), sub-rule (5) has been inserted in Rule 8AA to provide as under:

To read the full article click here

© 2020, Vaish Associates Advocates,

All rights reserved

Advocates, 1st & 11th Floors, Mohan Dev Building 13, Tolstoy

Marg New Delhi-110001 (India).

The content of this article is intended to provide a general guide to the subject matter. Specialist professional advice should be sought about your specific circumstances. The views expressed in this article are solely of the authors of this article.