2013 will be the year when we start to see how the world economy will look for the rest of the century. It will be the year when businesses recognise beyond any doubt that global growth and commodity prices are now driven primarily by developments in China and India, not the US and Europe. In the first issue of Global Economy Watch for 2013, we set out the themes we believe will dominate the global economic outlook this year and how this will impact the wider business agenda.

Key messages:

1.Advanced economies projected to be smaller than emerging economies in 2013 for first time since reliable records began.

2.Emerging economies in the 'driving seat' of global growth in 2013.

3.Expanding cities of the emerging world a gateway to young and new affluent consumers of the world.

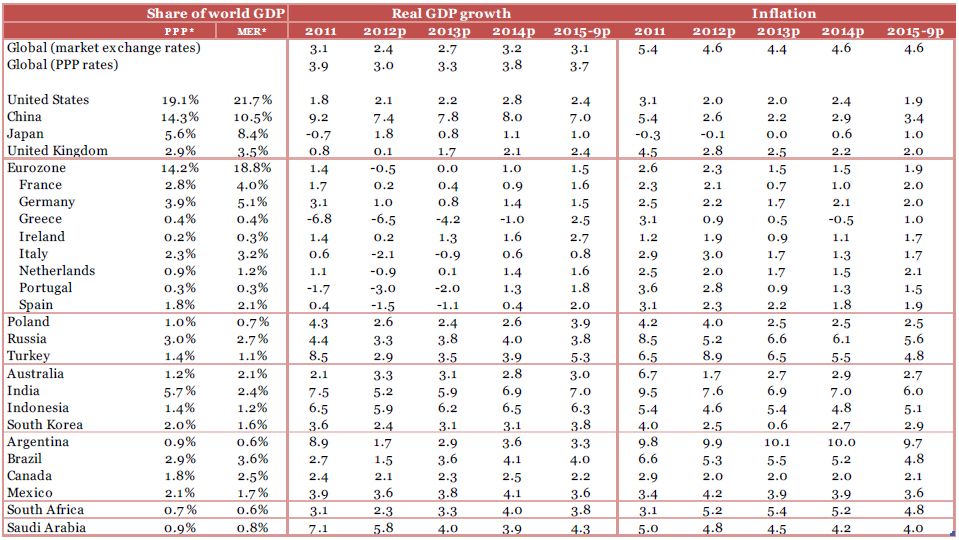

4.US growing by around 2% but Eurozone still flat at best.

5.Commodity price instability to continue.

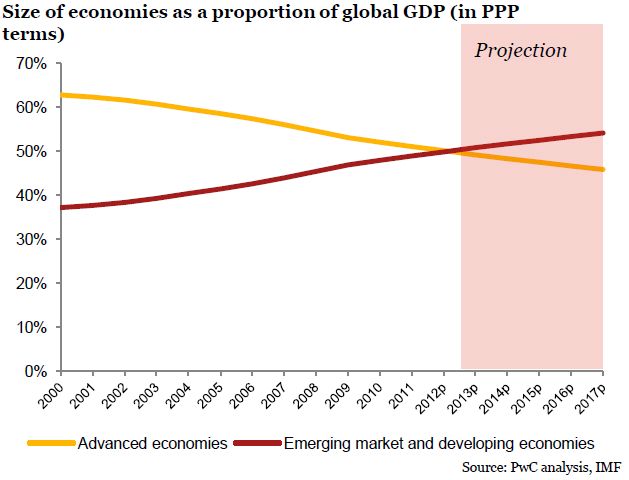

Emerging markets bigger than ever: 2013 will be the first time since reliable records began when what are today the emerging and developing economies will be bigger than the advanced economies (see Figure 1) Although this is only true for GDP measured in purchasing power parity (PPP) terms, which takes into account price differentials across the economies and overstates the size of less developed economies at current market exchange rates, this will be a symbolic event that is expected to set the trend for decades to come.

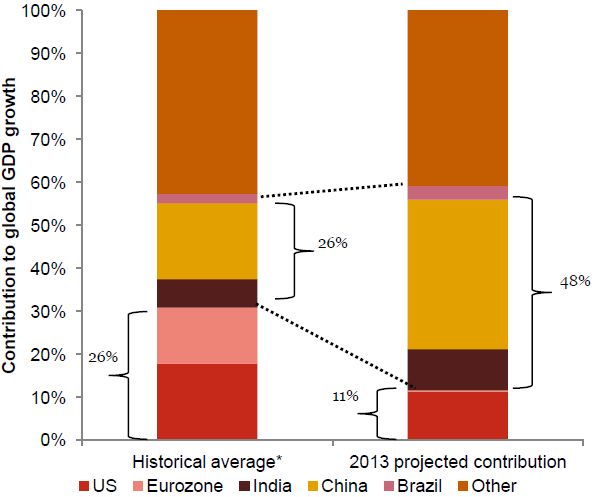

Advanced economies in the back-seat of global growth: In 2013, we expect the world economy to expand by 3.3% in PPP terms - close to its long-term trend rate. But what will change from past cycles is that the emerging economies will be critical in driving global economic growth. Figure 2 shows that China, India and Brazil are projected to contribute around half of global economic growth in 2013. This contrasts with the 25 years preceding the financial crisis, when they contributed only around a quarter of global growth.

We also think, however, that 2013 could be a year when the US, after narrowly avoiding falling off the fiscal cliff, will return to near trend levels of growth. Despite this, the largest economy in the world is still expected to contribute only around 10% of global growth as opposed to around 30% during the 1995 to 2000 period after the last major international recession of the early 1990s. Meanwhile, the Eurozone will not contribute at all to global growth in 2013.

What does this mean for business? The key message is: adapt, because 'business as usual' is changing. Our analysis shows that the importance of emerging economies in driving global growth will persist. China, for example, is projected to have a bigger economy than the US in PPP terms before 20201. Businesses based in advanced economies that want a market growing at more than 2% per annum in real terms (which is the projected per annum real trend rate of advanced economies in the long run) need to look beyond their traditional home markets. In 2013, expansion in the emerging markets will no longer be viewed as a speculative investment, but core to business growth. But it will also bring new risks that have to be assessed and managed.

Charts of the month Key messages:

Figure 1 – In 2013 emerging and developing countries are projected to have bigger economies than advanced countries for the first time since reliable records began.

The International Monetary Fund (IMF) classifies 35 economies with a high level of gross domestic product per capita and significant level of industrialisation as advanced economies.

Figure 2 - China, India and Brazil to account for nearly half of world GDP growth in 2013

*1983-2007 average Source: PwC analysis, IMF

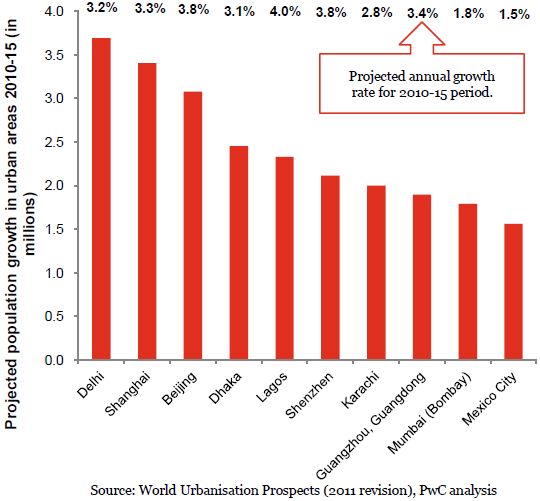

Watch out for young, independent and affluent consumers in the rising new cities of the world: 2007 marked the first year where the world's urban population exceeded the rural one. While urbanisation trends have slowed down in the West, Figure 3 shows that urbanisation will remain a fast-moving and transformational force in emerging markets. The UN estimates that, in the five years to 2015, around 370 million people will move into cities; nine out of the ten main countries undergoing this change will be in emerging markets and Asia alone will make up two thirds of this growth in urban populations.

Businesses will be drawn to these areas because of the scale of urbanisation taking place and the type of citizens being attracted to cities. For example, in 2013, China alone is expected to add 20 million urban citizens, which is equivalent to twice the size of Paris. This growth will help to sustain demand for construction services, utilities and other related industries in 2013 as well as continuing to put immense pressure on the prices of natural resources.

At the same time, the new urban citizens of the emerging cities will tend to be younger, with lower dependency ratios and a lower debt burden than their counterparts in advanced economies. Businesses will have to recognise that the new generation of consumers driving world growth will most likely be young, located in an Asian city, and relatively poorer than their Western counterparts.

Pieces of the economic puzzle are being put together in the Europe and the US, but major challenges remain: In the Eurozone the biggest challenge policymakers will face is to keep up the pace of reforms on the fiscal, banking, economic and political fronts. This will be tough in the face of continuing bad economic news and potential social unrest, particularly in the peripheral economies. However, if this process is not disrupted, then by the end of the year we could see a glimpse of how the more integrated Eurozone of the future could look in coming decades.

For the US, 2013 could be the year when policymakers not only avert the immediate fiscal cliff but also agree on a long-term plan to bring down the deficit in the next 10 years, eliminating a significant source of uncertainty and helping businesses and households plan their future spending. Meanwhile, in the UK, we anticipate a gradual recovery but with risks weighted to the downside, primarily driven by the uncertainty in the Eurozone.

Continued commodity price instability: Large, fast-growing and resource-hungry economies like China and India will continue to increase their greater buying power in global markets. But, because of their less developed regulatory institutions and lack of significant automatic stabilisers - e.g. income taxes, pensions and welfare payments - their economic growth rates will tend to be more volatile. This means that unstable and erratic commodity prices (which are closely linked to their growth rates) are set to continue for 2013 and indeed beyond.

However, it is the citizens of emerging economies that will remain most vulnerable to commodity price swings. Keeping inflation within pre-set thresholds could prove difficult for policymakers worried about hurting those with lower incomes in the absence of a proper social safety net in many emerging economies. Businesses in these countries – and those reliant on commodity inputs - should look to mitigate this risk by incorporating different scenarios in their business plans.

Other predictions for 2013:

- In 2013, world GDP in real terms is projected to be around 10% above its pre-recession peak in 2008 and around 40% above 2000 levels.

- In 2013, China, India and Brazil will together add around one trillion dollars to the world economy in nominal terms. This is equivalent to the entire annual economic output of Switzerland. China alone will add $788 billion, equivalent to the annual economic output of the Netherlands.

- In 2013, Australia will overtake Spain to become the 12th largest economy in the world. The US and China will remain first and second while the UK will remain sixth.

- OECD governments will need to borrow an additional $2.1 trillion, 1.5 times the projected increase in their money GDP in 2013.

- The population of London will rise to 8.5 million in 2013, an increase of over 120 thousand people, which is equivalent to adding the whole of the population of Cambridge over the year.

- Average house prices in the UK will remain broadly flat in 2013. This will be well below the expected inflation rate of 2.5%, pushing real house prices down further below their pre-crisis 2007 peak.

- Despite only a modest recovery by historic standards, the UK could still be the best performing developed European economy in 2013 given the slow or negative growth expected across other major EU economies.

Figure 3 – The top 10 urban growth areas of the world are emerging cities

Projections

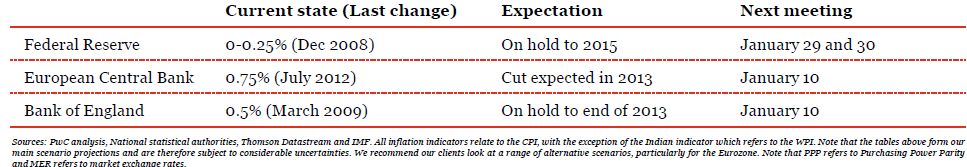

Interest rate outlook of major economies

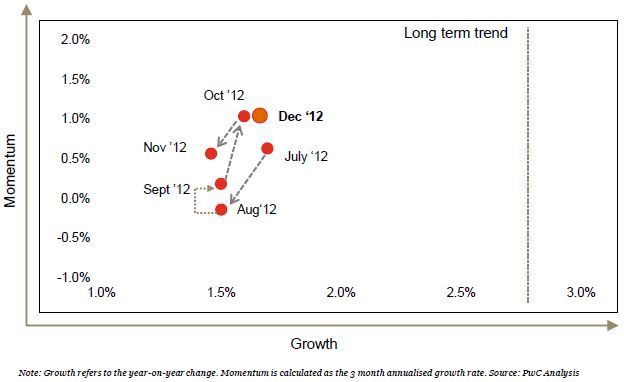

Global consumer index - December 2012

Global consumer increased in December and continues to grow on a year-on-year basis. Please visit: pwc.co.uk/globalconsumerindex for more details.

Footnotes

1 Our updated 'World in 2050' report, to be published later in January 2013, will have further details on this and other longer term trends in global growth.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.