Corporate governance manual introduced in Malta

The NED - February 2013

The Malta Financial Services Authority (MFSA) has published a corporate governance manual for directors of investment companies and collective investment schemes this February.

The MFSA says, in the manual’s introduction, that it “considers the director role to be vital to the proper operation of an investment fund and accordingly issues this Corporate Governance Manual for Investment Funds”. It adds that the manual is intended to provide “general guidance to a director on how to implement a good corporate governance practice for an investment fund including some thoughts on typical issues that affect fund directors”.

The manual covers directors’ roles, appointments, board size, board meetings, reports from the investment manager, administrator, custodian and auditor as well as conflicts of interest, code of conduct, shareholder communications, anti-money laundering, indemnity and insurance, advisors to the board, crisis management, director resignation, fund termination and general issues faced by directors.

Malta’s corporate governance manual is by far the most comprehensive such document that The NED has seen and provides directors with a practical ‘how to’ guide that other jurisdictions might well consider emulating.

The role of corporate governance in the fund industry in general is also covered in the manual and includes the following, “Why is corporate governance important? Corporate governance is a tool that assures investors in a company that the company’s objectives and operations will be carried out in a manner that benefits the best interests of the company. This is true whether the company is a public or private company, a fund or a special purpose vehicle, a corporate general partner of a limited partnership or a corporate investment manager, or a holding company with limited activity or a company with extensive operational activities.” And also the following: ‘“Ultimately corporate governance is about engendering trust: “If management is about running the business, governance is about seeing that it is run properly.”’

Professor Joseph Bannister, Chairman of The MFSA, told The NED that there is stringent verification of governance standards in Malta. The MFSA checks that meetings are held and ensures that minutes are taken properly. There are three teams within the MFSA that do this, including one focusing upon investment funds. Professor Bannister says that it is essential to get corporate governance right as “it is a reputational issue.”

William Jones, founder and managing partner of ManagementPlus Group, advised the MFSA on the manual and added: “The MFSA’s initiative in issuing the manual provides much needed guidance to directors in the funds industry. While other corporate governance codes follow a principle based approach, which is definitely better than no guidance, such an approach often falls short from a practical perspective. Directors from all jurisdictions approach us continually seeking practical guidance. The MFSA’s manual goes a long way in this direction. I expect that fund managers and investors in funds will develop a deeper understanding of corporate governance from the manual and its application. The entire fund management industry will benefit from it.”

As previously covered in The NED, Malta is introducing a system of capacity weighting to monitor fund directors. To be included on the list the individual in question has first to be able to demonstrate his (or her) competence. All directors have to respond to a personal questionnaire. They have to demonstrate that they have the right professional experience in order to be approved by the MFSA. The personal questionnaire is submitted every five years and directors have to report any changes to their position in the interim.

Reproduced from The NED’s February 2013 issue. For more information please go to: nedglobal.com.

Click here to view: Corporate Governance Manual for Directors of Investment Services and Collective Investment Schemes.

Re-Domiciliation of funds and companies to Malta

As from July 1, 2013, fund managers who wish to set up, manage or market alternative investment funds in the EU must be compliant with the Alternative Investment Fund Managers Directive (AIFMD)1. The date is fast approaching and managers who wish to set up base in Europe ahead of this important date must be prepared. Malta has all the legal infrastructure in place to help them get AIFMD-licensed from day one. For some, the re-domiciliation route could be their best option in the present circumstances. Malta’s tried and tested re-domiciliation procedures for both funds and fund managers, and the guiding approach the domicile is renowned for, could indeed be the best proposition.

MALTA: A DOMICILE OF CHOICE

Re-domiciliation is an efficient way of migrating a fund or a fund management operation into Malta without having to dissolve and re-incorporate the investment company. The process ensures continuity of performance resulting in little disturbance to the investors and to the fund’s assets which do not need to be transferred to a new entity. In certain cases the fund may even keep in place its contractual relationships with its service providers as the Maltese regulatory regime allows funds to have certain providers based in other jurisdictions which are recognized by the Regulator.

Malta’s fund industry is internationally recognized as one of the European domiciles of choice both for UCITS funds and fund managers, as well as for alternative investment funds and their managers. Low costs and a meticulous and accessible regulator make Malta an attractive place for start-up funds to open. The Investment Services Act, the main legislation regulating the fund industry, provides a comprehensive regulatory framework for the setting up, licensing and marketing of all types of collective investment schemes and investment services providers. Malta’s regulatory framework provides the flexibility necessary to al-low the setting up of a range of fund types and fund structures.

Worth mentioning is the latest innovative fund platform structure which has been put in place through the Companies Act (Recognised Incorporated Cell Companies) Regulations, 2012. This new vehicle enables fund platform promoters to offer a broad range of administrative services to fund clusters through a Recognised Incorporated Cell Company (RICC). The launching of the RICC has had an encouraging response from fund managers seeking to set up umbrella funds and is also proving of interest to managers whose overall investment fund strategy involves the separation of different investment strategies into separate legal entities for the purposes of appointing specialist managers or multiple promoters following similar strategies. Fund platforms provide the ideal solution for start-up funds because they reduce costs considerably while pooling expertise. The RICC can also serve as a framework for developing new managers who could eventually take over as managers of funds moving out of the RICC. The RICC itself is not a fund and does not require a collective investment scheme licence. It only requires a recognition certificate through which, with the approval of the MFSA, an RICC may service different types of funds – UCITS, non-UCITS or PIFs – which it will set up as incorporated cells. The incorporated cells are independent from both the central RICC and other related incorporated cells allowing each incorporated cell to make its own outsourcing and other arrangements. In the context of the AIFM Directive requiring a single manager and a single depository for each investment fund, an RICC can offer incorporated cells with different managers or allow a depository of choice for each incorporated cell promoter. Incorporated cells can adopt different currencies and financial year ends from other incorporated cells within the same RICCs structure, and can be quoted independently of each other and of the RICC on the Malta Stock Exchange.

Part of Malta’s attractiveness as a fund domicile is also undoubtedly due to the Passporting Regime and global distribution tools for EU fund managers under the UCITS Directive. The European Passport Regime which will come into force as from July 2013 under the AIFMD is also to be factored in. The MFSA is on track to have all legislation in place ahead of the date when the AIFMD comes into effect. Consultations on new legislation have closed and provisions for further technical rules are well under way. Shortly the industry will receive a briefing on the application of all the Rules and Regulations and Malta will have a clear framework in place well ahead of the July deadline. Non-European alternative investment fund managers, on their part, are attempting to place themselves strategically within Europe in the event that the AIFMD may remove the private placements regimes therefore restricting their options for accessing EU investors.

REDOMICILIATION DEFINITION AND TRENDS

Both inward and outward re-domiciliations in Malta are regulated by the Continuation of Companies Regulations 2002 as subsequently amended issued under the Companies Act (hereinafter referred to as the “Continuation Regulations”. The Continuation Regulations provide that a body corporate formed and incorporated or registered under the laws of an approved country or jurisdiction other than Malta which is similar in nature to a company as known under the Laws of Malta, may, request the Registrar to be registered as being continued in Malta under the Companies Act.

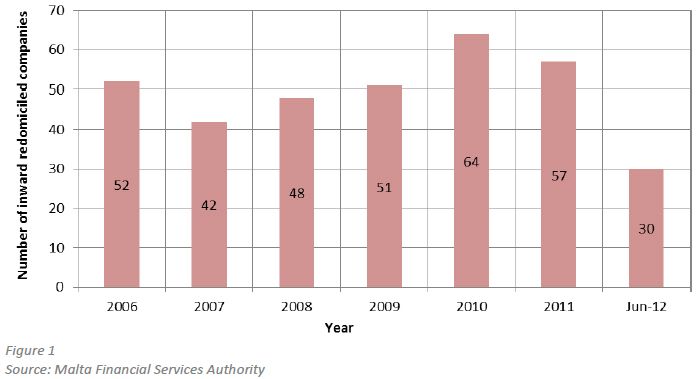

Since promulgation of the Continuation Regulations, way back in 2002, there has been a steady flow of incoming companies every year. The statistics for the last five years show a satisfactory trend. In particular, Figure 1 illustrates the number of re-domiciliations from 2006 to date with a steady increase as from 2007 culminating in the highest number in 2010 and 2011. Most of the re-domiciliations in 2011 were of private investment companies and property companies.

The prospects for the Maltese fund industry in 2013 are encouraging. Malta has become a very attractive choice for fund man-agers re-domiciling existing funds from an offshore to an onshore jurisdiction within the European Union. Particularly Malta has distinguished itself from the traditional hedge fund jurisdictions for its innovative legislation and quality of service. The recent developments in the regulation of hedge funds in the EU are expected to ensure that Malta will continue to offer an attractive legal and regulatory framework for hedge fund managers to operate with the European Union as well as internationally. The AIFMD is proving to be a real game-changer for hedge fund managers, and its implementation will bring with it high compliance costs. For these reasons there has been great impetus on economies of scale which can be seen from the increase in the establishment of umbrella funds with different sub-funds set up for different clients and different purposes. This trend is expected to continue and attract a consistent flow of funds with a wide range of strategies targeting different categories of investors.

CONDITIONS FOR REDOMICILIATION

In terms of the Continuation Regulation, companies are required to satisfy four general requirements to be eligible to re-domicile to Malta:

1. The body corporate planning to move to Malta must be set up in a structure which is similar to the corporate structures recognised by the Maltese Companies Act

2. The body corporate must be registered or incorporated in an approved jurisdiction2

3. The laws of the foreign jurisdiction must make provision for re-domiciliation of companies

4. The foreign company’s memorandum and articles of association or constituting act must allow the re-domiciliation of the company to another jurisdiction or be amended to that effect.

REDOMICILIATION OF FUNDS

Investment services have led the growth in Malta’s financial sector in 2012, as they have done over the past five years, with Professional Investor Funds seeing the biggest increase. Evidence of the growth can be found not just in the number of licenses and approvals issued by the MFSA but also in the increased number of foreign arrivals in all areas of investment services in 2012. Fund administration and, increasingly, fund management services are widening and deepening the range of skills and expertise available to clients by the day. For the latter, a growing number of service providers also means more competition in products, service and price.

Availability of global service providers, a stable economic, fiscal and tax regime, and a robust legal and regulatory framework are some of the most important factors driving the selection of a fund domicile. Malta delivers in all these areas and also offers a trusted re-domiciliation framework that has been in place since 2002. Malta’s re-domiciliation framework also works in tandem with an efficient fund authorisation procedure resulting in a complete and seamless process.

All foreign companies proposing to carry on a licensable activity in Malta require a licence. For a licensed entity such as a fund, the re-domiciliation process takes place simultaneously with the licensing of the investment vehicle in Malta. In the case of continuation of a foreign collective investment scheme, reference should be made to article 31 of the Investment Services Act, 1994 which deals with continuance of a foreign body corporate carrying on the business of a collective investment scheme in Malta. The Recognised Incorporated Cell Companies Regulations 2012 contain provisions for the continuation of companies in order for foreign funds to be able to make use of the innovative structure of the RICC. To this end, a foreign body corporate which carries out similar activities to those of a collective investment scheme, which is similar in nature to a company or multi-fund under Maltese Law, may be continued as an incorporated cell of an RICC.

The first step in the re-domiciliation process of a collective investment scheme is the submission of an application for a collective investment scheme licence. The application needs to be accompanied by the relevant prescribed documentation to be annexed with the Application Form3, drafted on the basis of the scheme post-redomiciliation.

Subsequently, the Registrar of Companies is approached with regards to the proposed re-domiciliation. Relevant due diligence enquires are undertaken by the Malta Financial Services Authority where necessary, with the cooperation of the regulator of the overseas scheme. The proposed structure and the documentation to be used by the Scheme would need to be in line with requirements specified in the Maltese Investment Services Rules for Retail Collective Investment Schemes or the Investment Services Rules for Professional Investor Funds depending on the type of fund which one is seeking to re-domicile to Malta.

Six Steps to Redomiciliation of Funds (CISs)

1. Submit an application for a CIS licence accompanied with the relevant draft documentation;

2. Approach the Registrar of Companies regarding redomiciliation;

3. The Authority will carry out its due diligence enquiries with the overseas scheme and vet the documentation;

4. The Authority will proceed to issue its ‘in principle’ decision;

5. If the decision is an approval the promoters can proceed to finalise the documentation;

6. The Scheme will be licensed and redomiciled on the same day.

If all applicable requirements have been fulfilled, the Malta Financial Services Authority will issue an ‘in principle’ decision of approval, and the promoters can proceed to finalise all relevant documentation previously in draft form. The Authorisation Unit set up within the Malta Financial Services Authority and the Registrar of Companies liaise between themselves through the process of re-domiciliation and the Scheme will be licensed and re-domiciled on the same date.

Cost effectiveness in this process is key and fund jurisdictions will have to compete based on whether managers will keep a profitable business model post AIFMD. There are a host of other regulatory developments which funds and their service providers will have to adapt to over the next few years, including MIFID II and UCITS V. MiFID II takes a transversal approach and impacts the conduct of business obligations in various ways. Under UCITS IV and AIFMD, Management Companies will have to master operational challenges to cope with their central administration and internal governance requirements. AIF managers will also face increased complexity and will need to adapt their business and operation model accordingly. They will need to take decisions on whether to outsource portfolio or risk management function and define new investment management pro-cesses. In this context, the Maltese Financial Industry is competing head on with other key jurisdictions supported by a highly responsive and business-oriented regulator that is a key consideration going forward given the demanding regulation environment prevailing in Europe and beyond.

ALTERNATIVES TO REDOMICILIATION

Maltese legislation offers various alternative options to re-domiciliation which still enable foreign companies and funds to relocate. One alternative is a cross-border merger. A merger can help raise a company's profile and its competitiveness through introduction into the EU market. It can also allow companies to expand, develop new products or restructure themselves, reducing production and distribution costs. Mergers of one or more foreign companies registered in a Member State or EEA State, with a Maltese company are regulated by the Cross-Border Mergers of Limited Liability Companies Regulations, 2007. Mergers of UCITS funds must comply with the provisions of the UCITS IV Directive as transposed in the Investment Services Act (UCITS Merger) Regulations, 2011. These provide inter alia that mergers of UCITS are subject to prior authorisation by the competent authorities of the merging UCITS home Member State.

Another available option is that of setting up a European Company (SE) in Malta in accordance with Council Regulation 2157/2001. An SE can register in any Member State of the European Union, and transfer its registered office to other member states. SEs can be created in the following ways:

1. By merger of national companies from different member states;

2. By the creation of a joint venture between companies (or other entities) in different member states;

3. By the creation of a SE subsidiary of a national company;

4. By the conversion of a national company into an SE.

A foreign company may also form a branch or place of business in Malta in terms of the Maltese Companies Act. All the relevant documents, including copies of the memorandum and articles of the foreign company and a list of directors and the company secretary, required under article 385, have to be submitted to the Registrar within one month of the establishment of the branch or place of business in Malta.

Alternatively one may set up a new company. A company may prefer to wind up in the foreign country and incorporate a new company in Malta under the Companies Act. The length of time to incorporate a company depends on the type of company being incorporated and on whether all information and documentation is available and in order. Once the Registrar of Companies has all necessary documentation and information, the process may take from as little as 24 hours. Guidelines on the Registration of Companies in Malta are available on the MFSA website.

This article first appeared in Re-Domiciling and Co-Domiciling for Fund Managers 2013 - Clear Path Analysis

MFSA Industry Update on the proposed amendments to the Trusts and Trustees Act and other related legislation

On the 13th February 2013 the MFSA organised an industry update session relating to the proposed amendments to the Trusts and Trustees Act and other related legislation which were published for consultation on the 14th December 2012. The event was attended by over 100 delegates.

Four MFSA officials together with a representative of the Notarial Council delivered presentations during this event. The panel of speakers was chaired by Mr. Mike Duignan, Director of the Securities and Markets Supervision Unit. In his introductory speech the Chairman of the MFSA, Professor Joe Bannister, gave an overview of the process that led to the draft Bill amending the Trusts and Trustees Act and informed the audience that the MFSA was in the process of reviewing other relevant legislation including fiscal legislation.

Dr. Michelle Mizzi Buontempo, Deputy Director of the Securities and Markets Supervision Unit delivered a presentation entitled ‘Overview of Amendments to the Trusts and Trustees Act in relation to the IFSP proposals and new regulatory developments’. Dr. Mizzi Buontempo provided the attendees with an overview of the amendments which the Institute of Financial Services Practitioners had submitted to the MFSA for its consideration to improve Maltese law and practice in relation to trusts. Dr. Mizzi Buontempo also explained the new requirements the Authority is proposing should be introduced to strength-en the robustness of the regulatory framework applicable to trustees and other fiduciaries including the possible introduction of a minimum share capital requirement, mandatory Professional Indemnity Insurance cover and other financial resources requirements.

Dr. Petra Camilleri from the Securities and Markets Supervision Unit provided the audience with an overview of the proposals relating to the setting up of family trusts and the regulation of trustees of family trusts. Family trusts are trusts created to hold property settled by the settlor for the present and future needs of family members or family dependants who are definite and can be ascertained.

Dr. Paula Bonnici from the Authorisation Unit delivered a presentation entitled ‘The use of sub-trusts in pensions and investments’ where the speaker invited the industry to provide the Authority with feedback on a number of questions raised both during the presentation as well as in the consultation document issued by the Authority in December. The industry was invited to provide its views as to whether the constitution of sub-trusts in the area of pensions and investments should be expressly regulated through statutory provisions.

Ms. Alison Cortis from the Securities and Markets Supervision Unit provided the audience with a general overview of the new reporting requirements the MFSA was proposing should be applicable to trustees and other fiduciaries through the introduction of a new Annual Compliance Return. Ms. Cortis explained that this additional supervisory tool was being introduced to enhance the off-site supervision of trustees and other fiduciaries and that the MFSA would shortly be issuing the draft Annual Compliance Return form for consultation.

Notary Annalise Micallef on behalf of the Notarial Council delivered a presentation entitled ‘Trusts and Trustees Act: Proposed Notarial Regulations’. Notary Micallef explained that the aim of the two draft Regulations issued for consultation was to:

-

Create a framework which caters for the registration of notaries wishing to act as qualified persons in terms of article 43 of the Trusts and Trustees Act ; and

-

To provide for a clear framework relating to the registration, conservation and access of trust deeds set up by notarial deed.

A Q&A session followed the presentations. All presentations are available for download from the MFSA website.

Feb 6 2013 - HMRC recognises new Irish/Maltese exchangeBy: Helen Burggraf , Contributing Editor , International Adviser

Feb 28 2013 - Malta’s financial services sector GDP almost doubles post-crisisBy: Helen Burggraf , Contributing Editor , International Adviser

European Supervisory Authorities Press Releases

European Banking Authority (EBA)

21 February 2013 - EBA consults on the process to define highly liquid assets in the Liquidity Coverage Ratio (LCR)

21 February 2013 - Discussion paper on retail deposits subject to higher outflows for the purposes of liquidity reporting under the Capital Requirements Regulation (CRR)

26 February 2013 - EBA interim report on the consistency of risk-weighted assets in the banking book

European Securities and Markets Authority (ESMA)

01 February 2013 - ESMA issues guidelines on market-making and primary dealer exemptions

11 February 2013 - ESMA rules aim to curb excessive risk taking by alternative fund managers

12 February 2013 - ESMA seeks feedback for review of the Short Selling Regulation

14 February 2013 - ESMA issues first risk report on EU securities markets

19 February 2013 - ESMA recommends EU Code of Conduct for proxy advisor industry

28 February 2013 - ESMA and the EBA warn investors about contracts for difference

European Insurance and Occupational Pensions Authority (EIOPA)

22 February 2013 - EIOPA calls for a new approach to information disclosure for defined contribution schemes

MFSA Licences - January 2013

LICENCES ISSUED

Banking

Financial Institutions

-

Financial Institution licence issued to Finance House plc.

Collective Investment Schemes

Professional Investor Funds targeting Qualifying Investors

-

Collective Investment Scheme licence issued to Himalaya SICAV plc in respect of one sub-fund.

-

Collective Investment Scheme licence issued to J&T Advanced Solutions SICAV plc in respect of one sub-fund.

-

Collective Investment Scheme licence issued to Malta IFP SICAV plc in respect of one sub-fund.

-

Collective Investment Scheme licence issued to Taliti Funds SICAV plc in respect of one sub-fund.

-

Collective Investment Scheme licences issued to TGA Funds SICAV plc in respect of one sub-funds.

Investment Services

-

Category 2 licence issued to True Value Fund Management Limited.

-

Category 2 licence issued to Elgin (Europe) Limited.

Trustees & Fiduciaries

Administrators of Private Foundations

-

Authorisation issued to Mr. Jozef Charles Hendriks to act as an administrator of private foundations in terms of article 43(12)(b) of the Trusts and Trustees Act.

Pensions

Retirement Schemes

-

Certificate of Registration issued to US Pioneer Retirement Plan.

-

Certificate of Registration issued to Pioneer Retirement Plan.

-

Certificate of Registration issued to Voyager Retirement Plan.

-

Certificate of Registration issued to US Voyager Retirement Plan.

Retirement Scheme Administrators

-

Certificate of Registration issued to Trireme Pension Services (Malta) Ltd.

Asset Managers

-

Certificate of Registration issued to Curmi & Partners Ltd.

LICENCES SURRENDERED

Collective Investment Schemes

Professional Investor Funds targeting Qualifying Investors

-

Surrender of licence issued to Innocap Fund SICAV plc in respect of eleven sub-funds.

-

Surrender of licence issued to NBCG Fund SICAV plc in respect of four sub-funds.

-

Surrender of licence issued to NEF Funds SICAV Ltd in respect of one sub-fund.

-

Surrender of licence issued to NEF Global Resources SICAV Ltd in respect of one sub-fund.

-

Surrender of licence issued to NEF Nordic Power SICAV Ltd in respect of one sub-fund.

-

Surrender of licence issued to The Nascent Fund SICAV plc in respect of one sub-fund.

-

Surrender of licence issued to VIP Select Funds SICAV plc in respect of four sub-funds.

UCITS

-

Surrender of licence issued to Celsius Fund SICAV plc in respect of one sub-fund.

LICENCES EXTENDED

Insurance

Insurance Undertakings

-

Extension of licence issued to Axeria Assistance Ltd to carry on business of insurance and reinsurance in one additional class of the general business.

Insurance Agents

-

Extension of licence issued to MIB Insurance Agency Limited to act as insurance agent on behalf of Aegis Syndicate 1225 in respect of one class of the general business.

Registry of Companies - New Registrations - January 2013

|

Companies |

Partnerships |

Total |

|

316 |

7 |

323 |

MFSA Consultations

14/02/2013 - Note regarding an extension of the consultation period

19/02/2013 - Consultation Procedure on the proposed amendments to the Listing Policies

MFSA Circulars

14/02/2013 - Circular to the financial services industry on the Alternative Investment Fund Managers Directive (‘AIFMD’)

MFSA Notices

08/02/2013 - Surrender of Licence by Quest Investment Services Limited

08/02/2013 - Allcare Insurance Agency Ltd

11/02/2013 - Notice to Financial Services Licence Holders - Revision of FIAU Implementing Procedures

19/02/2013 - Surrender of Credit Institution’s Licence by Fortis Bank Malta Ltd

26/02/2013 - Merger of Licence Holders - Axeria Life International PCC Limited

28/02/2013 - Notice to Financial Services Licence Holders - FATF identifies jurisdictions with strategic deficiencies

MFSA Listing Authority Announcements

08/02/2013 - Extension of period of Suspension of public offer - A25 Gold Producers Corp

11/02/2013 - Extension of period of Suspension of Trading - Loqus Holdings plc Ordinary Shares €0.232937 (MT0000150103)

22/02/2013 - Extension of period of Suspension of public offer - A25 Gold Producers Corp

25/02/2013 - Extension of period of Suspension of Trading - Loqus Holdings plc Ordinary Shares €0.232937 (MT0000150103)

Warnings

27/02/2013 - MFSA Warning - SeaMed Finance Savings and Investments

Foreign warnings received by MFSA can be viewed on the MFSA website.

Forthcoming Events

14-15 March 2013 - ESAFON - The 3rd Annual Malta Spring Fund Conference - UCITS – AIFMD – MiFID II - Implications for Funds, Managers, Service Providers

MFSA Education Consultative Council (ECC)

Training by members of the ECC:

Footnotes

1. (AIFMD) Directive 2011/61/EU of the European Parliament and of the Council of 8 June 2011 on Alternative Investment Fund Managers and amending Directives 2003/41/EC and 2009/65/EC and Regulations (EC) No 1060/2009 and (EU) No 1095/2010

2. Funds have been approved from a diversity of locations across Europe and beyond. Presently, the approved jurisdictions are the EU Member States and FATF Countries. Only countries which are blacklisted by FATF are not considered approved jurisdictions.

3. All application documents are available for download from the MFSA website on www.mfsa.com.mt

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.