Authors: TieCheng YANG 丨 Eryin YING 丨 Krystal HE1

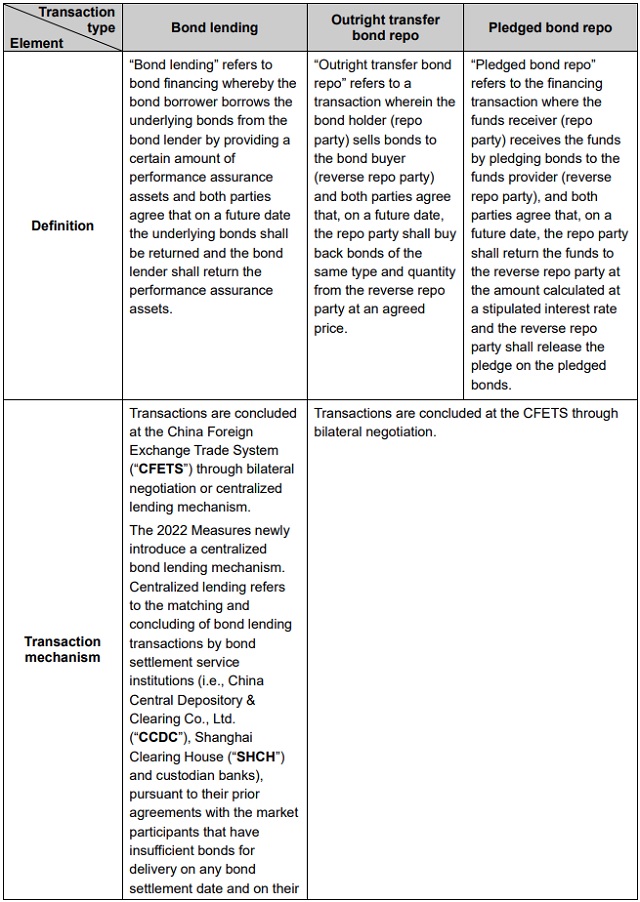

China's unified bond market now comprises the inter-bank market, exchange market, and commercial bank counter market; among these, the inter-bank market serves as the principal market with more than 85% of the total bond custody balance by the end of 20212. Bond transactions in the inter-bank market include cash bond transactions, bond repo transactions (including pledged bond repo transactions and outright transfer bond repo transactions), bond lending transactions, and bond forward transactions, of which the transaction volume of cash bond transactions and bond repo transactions accounts for more than 90%. Bond lending business has facilitated the needs of market participants to borrow bonds and improved liquidity and stability of the overall bond market. With the rapid growth of the transaction volume of bond lending business since 2015, the settlement volume of bond lending business in 2021 has increased about sixfold compared to 2015, making bond lending the third largest business in the inter-bank bond market after pledged bond repo transactions and cash bond transactions3. In response to the rapid development of bond lending business and in order to further enhance regulation and market activity of bond lending business, the People's Bank of China (the "PBoC") has recently promulgated the Measures for Administration of Bond Lending Business in the Inter-bank Bond Market (the "2022 Measures"), which will take effect from July 1, 2022, and the Interim Provisions on Administration of Bond Lending Business in the National Inter-bank Bond Market (the "2006 Provisions") promulgated in 2006 will be invalidated accordingly on the same date.

As for the implications of these two rules on the inter-bank bond market, in comparison to the 2006 Provisions, the 2022 Measures further facilitate the conducting of bond lending business by market participants and improve the efficiency of the bond lending market. For instance, each market participant has to formulate its own bond lending agreement under the 2006 Provisions, which is time-consuming and inefficient when negotiating transaction documents with different counterparties. By contrast, the 2022 Measures will require market participants to sign a unified bond lending master agreement, which is likely to significantly save time in negotiations and facilitate transactions. In addition, the 2022 Measures newly introduce a centralized bond lending mechanism, which may help to avoid the risk of settlement failure under bond transactions and improve market efficiency.

In light of the issuance of the 2022 Measures, this newsletter briefly introduces the differences between bond lending and bond repo business in the inter-bank market as well as the main changes between the 2022 Measures and 2006 Provisions.

Footnotes

1 Shirley Liang and Lin Zhu have contributions to this article.

2 PBoC, Financial Market Operation in 2021 (中国人民银行《2021年金融市场运行情况》) ( http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4463448/index.html).

3 CCDC, Bond Market Statistical Analysis Report 2021中央结算公司《2021年债券市场统计分析报告https://www.chinabond.com.cn/cb/cn/yjfx/zzfx/nb/list.shtml).

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.