Welcome back to our Regulatory Affairs series, developed to provide timely updates on hot topics across the vast world of regulatory law; strategic insights on regulatory fundamentals; and a look at environmental and Aboriginal law topics, which frequently intersect with regulatory matters. As always, we are here to help.

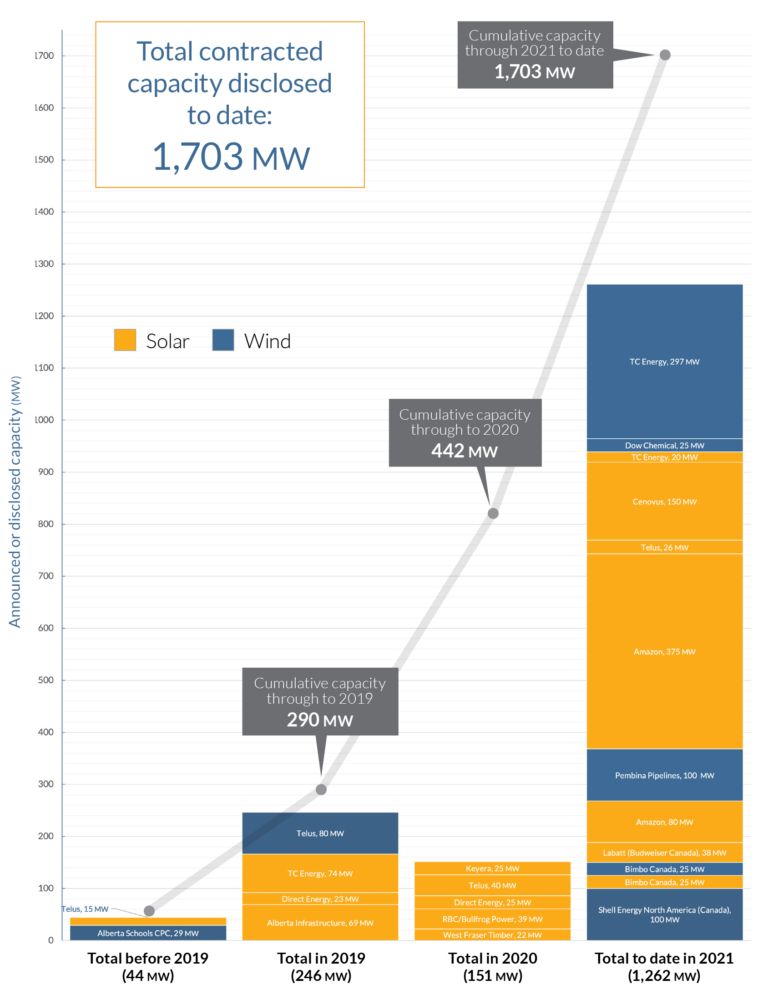

In August 2019, we wrote that an increasing number of renewable energy projects were being built and we see that trend continuing. As shown in the Business Renewables Centre Canada deal tracker below, the total contracted renewable energy capacity in Canada has surged from 290 MW in 2019 to 1,262 MW as of Q3 2021.1 The total contracted capacity in Canada to date is more than 1,703 MW.

Credit: Business Renewables Centre Canada

It is clear that the number and size of renewable energy deals in Canada is surging. To facilitate these deals, external legal counsel work with the client through the various renewable energy deal stages. These deal stages include the request for proposal, term sheet, and definitive agreement, regulatory approval and project construction and operations. External legal counsel typically focus on the structure of the definitive agreement, including the term, ownership of renewable attributes and termination provisions.

Determine the Correct Type of Agreement

If your organization would like to procure renewable energy, the first question to consider is what form of legal agreement to pursue. There are a number of ways in which parties can structure the purchase and sale of electricity and corresponding renewable attributes. The three most common structures are power purchase agreements, virtual power purchase agreements and lease agreements for electricity generation equipment.

Power Purchase Agreements

The purchase and sale of electricity and renewable attributes between buyers and generators/sellers is typically governed by a power purchase agreement (PPA). PPAs can be complex legal documents that require expertise in market terms and project financing. Electricity to a certain capacity (nameplate capacity of the renewable energy system) is purchased at a purchase price of $/kWh or $/MWh over a fixed term. The fixed price is locked in throughout the duration of the term regardless of how the market changes.

Virtual Power Purchase Agreements

Buyers and sellers can also enter into a virtual power purchase agreement (VPPA). These agreements also involve the acquisition of energy and associated renewable attributes. VPPAs are "virtual" in the sense that the physical electricity generated by the project is not transferred to the buyer and the buyer does not take legal title. Rather, the parties settle the transaction based on a contract for differences or the difference between the fixed price and spot price in the open market.

VPPAs involve reconciling a monthly settlement amount where the buyer tops up the seller to the extent the spot price is less than the strike price. Conversely, the seller pays the buyer if the spot price or pool price is greater than the strike price. The buyer still purchases physical electricity from the utility to fulfil its energy needs.

The duration of the agreement typically lasts anywhere between 5 and 25 years, with sellers preferring longer terms and buyers preferring shorter terms. The trade-off for a shorter term usually results in a greater cost of electricity.

Onsite Generation

If your organization is considering generating electricity or procuring renewable energy onsite at a commercial or residential premises, such as by way of batteries or rooftop solar panels, there are a number of factors that you will need to address before doing so. A lease agreement might make sense for onsite generation in order to mitigate the effects of consumer protection laws designed to protect unsophisticated parties. In some jurisdictions, buyers may need approval from their local utility to qualify as a micro generator and enter into an interconnection agreement with their utility in order to generate electricity behind the meter.

Consider Ownership of Renewable Electricity Certificates

Your organization will also want to consider how to handle the renewable energy attributes of the energy generated. Renewable energy certificates (RECs) can be retired by the owner to offset against its own emissions or monetized by conveying them to other organizations who need the RECs to meet their own emission reduction targets. RECs are the legal instruments used in renewable electricity markets to account for renewable electricity and its attributes whether that renewable electricity is generated at the organization's facility or purchased elsewhere.2 The owner of a REC has exclusive rights to the attributes of one megawatt-hour (MWh) of renewable electricity and may make unique claims associated with renewable electricity that generated the REC. Such claims could be that the REC-holder is supplied by renewable energy or has reduced its carbon footprint and contributed to greenhouse gas emissions reductions by way of its electricity use. RECs earned may be sold to other entities as a carbon credit to offset their scope 2 emissions, or emissions generated from equipment not owned by the entity.

Other Key Legal Considerations in Corporate Renewable Energy Deals

Legal counsel will typically draft or comment on the definitive agreement with a focus on the following key legal considerations:

- Project Development - how the project will be developed

- Operations - how the project will be operated

- Creditworthiness - whether the parties are financially capable of performance under the agreement

- Unforeseen Circumstances - how force majeure events and changes in law will be treated under the agreement

- Disputes - how disputes will be treated under the agreement

- Termination - how the agreement can be terminated

The risk, cost, and timing of constructing or installing a renewable energy facility and the operational obligations of the parties are key factors to consider in structuring any renewable energy deal. Parties will want to consider the creditworthiness of the counterparty and whether financial assurances or assignment of rights to lenders are necessary. These and other considerations can be discussed with legal counsel to develop an agreement that achieves the objectives of your organization.

Read our first article in this series here.

Footnotes

1. "Corporate Renewable Energy Deals in Canada (Q3

2021)" (last accessed 18 November 2021), online: (https://businessrenewables.ca/deal-tracker).

2. "Offsets and RECs: What's the

Difference?" (last accessed 18 November 2021), online: (https://www.epa.gov/sites/default/files/2018-03/documents/gpp_guide_recs_offsets.pdf).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.