Welcome to the December edition of Blakes upRound, a

regular publication from the Blakes Emerging Companies &

Venture Capital (EC&VC) group that highlights legal

developments relevant to venture investors and emerging companies

and provides concise insights on recent trends and market

developments.

The Blakes EC&VC group is a nationwide practice with lawyers in

Toronto, Calgary, Vancouver and Montréal providing

transactional and ongoing legal assistance to some of the most

dynamic emerging companies in Canada and venture investors from

Canada, the United States and beyond. As a full-service business

law firm, Blakes provides advice on all aspects of Canadian law

relevant to our clients. Our EC&VC practice includes Blakes

Ventures, an innovative service offering to support the entire

emerging company ecosystem, and Nitro, our legal support program

for early-stage companies and founders.

In this Edition

- Your burning questions on developing a fundraising strategy answered

- Cybersecurity insights, the use of artificial intelligence in the workplace, trends in private equity and other need-to-know topics

- Canadian venture financing continues to have a slow year, but certain industries see growth

Market Insights

Q&A with Paul Ciriello: Developing a Fundraising

Strategy — For this year-end

edition of Blakes upRound, Paul Ciriello, Strategic

Advisor to Blakes and our clients, answered our in-depth questions

about the current fundraising environment, and the dos and

don'ts of raising capital as we head into 2024.

Paul is the founder and Managing General Partner of Fairhaven

Capital Partners and Milk Street Investments, a predictive

analytics augmented investment platform. Together, these funds have

invested about US$500-million in over 80 early-stage companies in

the United States and Canada. Based in Boston and Cambridge, Paul

led investments and generated substantial exits in cybersecurity,

enterprise infrastructure, mobile technology, financial services,

food and beverage, logistics and supply chain, and property

technology startups. He has served as a director on the boards of

many startup companies and an advisor to many others.

Read on for Paul's perspective in our Blakes Bulletin: Q&A with Paul Ciriello:

Developing a Fundraising Strategy.

If you have your own questions and would like to hear Paul's

thoughts, please submit your questions here.

Legal Update

Founders and investors may find the following insights from our Blakes colleagues helpful and instructive:

- Cybersecurity — Rising data breaches put companies at the crossroads of tech innovation and legal risk. Dive into Canada's cybersecurity litigation landscape with these five top trends from our fourth annual Canadian Cybersecurity Trends Study and in our Blakes Five Under 5: Cybersecurity Litigation: Five Trends Unpacked.

- Artificial Intelligence (AI) — AI presents a promising frontier for employers by enhancing workplace productivity, automating routine tasks, and in some cases, improving employee performance. However, as employers navigate this evolving digital landscape, prudence and best practices remain paramount. Read Blakes Five Under 5: Artificial Intelligence in the Workplace: Top Tips and Takeaways to learn about five key considerations for employers using AI in the workplace.

- Payments and FinTech — The final regulations to the Retail Payment Activities Act was published in the Canada Gazette on November 22, 2023 (Regulations). Since the release of the draft regulations (Draft Regulations) in February 2023, the Bank of Canada has been consulting with the industry to obtain feedback on the content of the Regulations. Although there was some accommodation made to address certain industry comments, the Regulations are substantially similar to the Draft Regulations released earlier this year. Read more about the final changes in our Blakes Bulletin: The Wait Is Over: Final Regulations to the Retail Payment Activities Act.

- Private Equity — We are pleased to release the fourth edition of our Canadian Private Equity Deal Study, an exclusive and proprietary analysis of hundreds of Canadian private equity acquisitions and investments in which Blakes was involved. The Blakes study is the most in-depth view into Canadian private equity buyout and investment transactions in the legal industry, identifying recent trends and providing an understanding of "what is market" in Canadian private equity. To learn more and register for a sample of the study, see here.

- Managing Business Storms — Commercial insolvencies are expected to steadily increase in the near-term due to higher interest rates, supply chain disruption and corresponding increased commodity costs. A rise in commercial insolvencies will increase the likelihood that businesses will be impacted by a formal insolvency proceeding, whether as a creditor, supplier, customer or other stakeholder. It is, therefore, important for businesses to understand how to strategize in the context of both newly initiated and ongoing insolvency proceedings. Read more about potential impacts in our Blakes Bulletin: Managing Business Storms: A Guide to Handling Customer and Supplier Insolvency.

Deal Monitor

Data sourced from PitchBook.

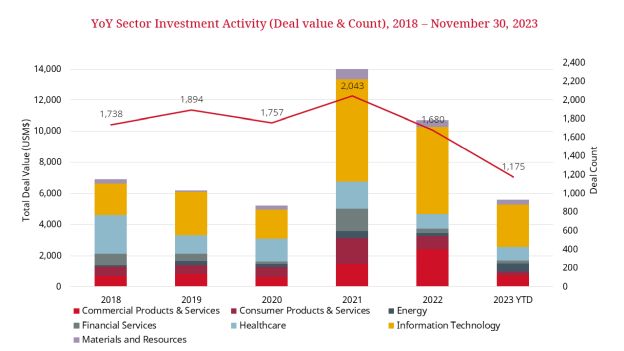

- The year-over-year decline in overall transaction activity in Canada continues. The year-to-date dollars invested was approximately 44% lower in 2023 than the same period in 2022, which itself was 23% lower than the same period in the record-breaking 2021 year. The year-to-date number of venture finance transactions fell 40% compared to the same period last year, which was only 5% lower than the same period in 2021.

- However, the energy industry was a bright spot. It saw a 143% jump in venture investment compared to the same period in 2022, from US$216-million to US$525-million. As well, investment in the healthcare and materials and resources industries fell by only 8% and 10% respectively, significantly less than the average.

- The lift in energy deals appears to have benefitted energy-producing provinces, with the year-to-date value of venture investment in Alberta and Newfoundland already at 11% (US$82-million) and a whopping 597% (US$17-million) greater than the full-year 2022 values. Nova Scotia also saw record-breaking venture investment at 141% (US$99-million) of its full-year2022 value.

- As many would expect, companies in the artificial intelligence and cleantech verticals dominated the largest Canadian venture deals in 2023, including Cohere's US$270-million Series C, Eavor's C$182-million Series B, Tenstorrent's US$100-million strategic financing and CarbonCure's US$80-million Series F.

For permission to reprint articles, please contact the Blakes Marketing Department.

© 2020 Blake, Cassels & Graydon LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.