OUTLOOK 2022: INSIGHTS FROM MILLER THOMSON PARTNERS

Jay practices corporate-commercial law including mergers and acquisitions, corporate governance, debt financings, and private equity transactions in Miller Thomson's Toronto office.

John practices corporate-commercial law focused on mergers and acquisitions, complex corporate reorganizations, and secured credit and loan transactions in Miller Thomson's Vancouver office.

Miller Thomson: What is your outlook for deal activity in 2022?

Jay: At this point, as we approach the end of Q1 2022, nothing has slowed down. For the most part, I am busier than I was last year with new deals coming in steadily. Certainly, I expect the first two quarters of 2022 are going to be active over a broad spectrum of industries, but particularly in the technology and healthcare sectors. More generally, the outlook seems to be that deal activity will remain very positive and robust.

John: BC M&A deal activity has continued to be strong in Q1 2022. Both technology and health care have been the busiest sectors. Without the current events in Eastern Europe, I would have anticipated private M&A activity to be strong throughout the year but, in spite of this, I remain cautiously optimistic that 2022 will remain strong.

Miller Thomson: We have just completed another year amidst COVID-19. In the early months of 2022, what impacts are you seeing on deal processes and particularly, on deal structures? How are buyers addressing targets where performance has been impacted positively or negatively by the pandemic?

Jay: Transactions are geared around the shifting of risk, who sits with it and who doesn't want to sit with it. This rings very true in terms of purchase price payments. Earn-outs, particularly, have made a fierce comeback and are a part of virtually every deal we are currently doing. I believe that they are one of the most equitable tools to lower risk to both buyers and sellers.

Of course, we have also seen the emergence of pandemic clauses when it comes to addressing material adverse effects; I don't think these will decline in use as time goes on.

Another aspect of a deal to mention is diligence: we have seen how diligence can be a challenge due to the hurdles brought on by the pandemic. Live meetings have always been an important part of the diligence process, and while virtual meetings such as Zoom are a helpful alternative, they are not a perfect substitute especially when you really want to get to know the folks you are working with and working for on transactions.

Miller Thomson: As we are hopefully nearing the tail-end of the pandemic and as government-funding will eventually start to taper off, do you expect to see an increase in distressed deals over 2022 and beyond?

John: I don't expect to see any increase in distressed deals flowing from the tapering off of government COVID-19 business assistance. I anticipate the BC economy particularly to remain strong and be one of the fastest growing provinces in Canada over both the short and long-term.

Miller Thomson: Supply chain issues are plaguing many sectors. Is this having an impact on M&A - for example, impacting valuations positively or negatively?

John: I do not see supply chain issues affecting BC M&A deal valuations or having other impacts. Most supply chain disruptions have been viewed as transitory. For example the Fall 2021 flooding in the Fraser Valley caused temporary transportation disruptions, but they were resolved surprisingly quickly.

Miller Thomson: How do you see inflation and potential rising interest rates impacting deal activity in 2022?

Jay: The interest rate moves will likely have a relatively quick impact. However, there is still a tremendous amount of capital sitting on the sidelines which will continue to drive deal activity and competition amongst prospective buyers. Interest rates are important for the borrowing of additional funds to facilitate purchases and, in this regard, I think rising rates have the potential to chill things a bit. But I don't think that will bring activity to a screeching halt, especially because I think the increases will be quite calculated and deliberate.

Miller Thomson: Canadian inbound and outbound cross border deals rose significantly in 2021. Based on your own cross-border deal experience, whether with Canadian or foreign buyers and sellers, can you comment on this trend, and the expectations you see for future growth in 2022?

John: The major cross-border trend in BC is a large and increasing investment by US companies across multiple sectors of our economy. Technology, health care and online retail infrastructure have been major drivers and I look forward to seeing how this trend will continue in 2022.

Jay: It's also going to be interesting to see how the unfortunate situation in Ukraine is going to play out. We can think that Russia and Ukraine are far away from many perspectives, but this is a global issue. The reaction of other countries, including Canada, is going to play a role and there will most certainly be an effect on what that does to markets and banks. The effects will also certainly not be limited to those players and businesses based in Europe- the whole world is going to feel this unfortunate conflict.

Q4 2021 MARKET INSIGHTS

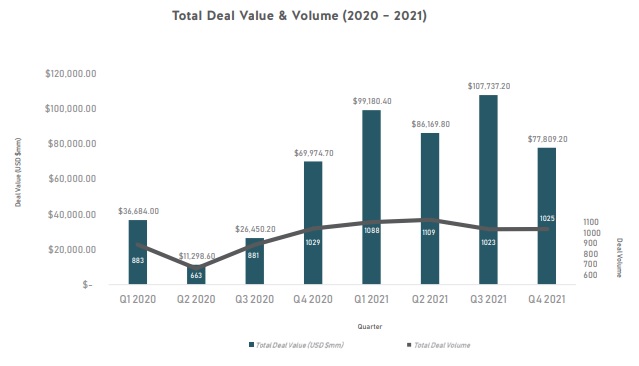

Despite the return of increased public health restrictions throughout the country, Canadian M&A activity rounded out 2021 with strength, building off a strong third quarter and capping off a record year. Deal activity in Q4/21 outpaced Q4/2020, while dropping off slightly from Q3/21. Geographically, inbound and outbound cross-border activity continued to surge in the quarter, sustaining the cross-border trend seen through 2021.

Note: Dollar values are in USD.

DEAL ACTIVITY

Source: Capital IQ January 12, 2022

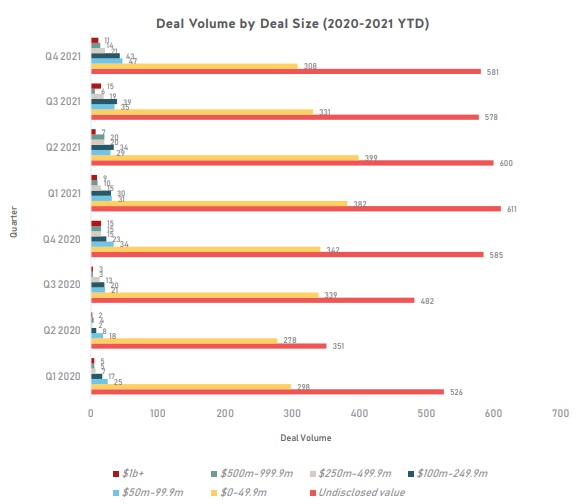

There were 1,025 announced deals in the quarter, relatively flat with the 1,029 deals that were announced in Q4/20 and the 1,023 deals announced in Q3/21. Average deal size declined in the fourth quarter to approximately $75 million from $105 million in Q3/21, largely attributable to a decline in mega-deals ($1 billion +). Sub $50 million deal volume declined 7% from Q3/21 to Q4/21, while deal volume between $50 million and $100 million increased by 34%.

At the other end of the spectrum, deal volume in the $500 - $999 million category ramped up, increasing to 14 announced deals from 6 in the previous quarter. However, that increase was offset by a decline in mega-deals, contributing to a decline in total deal value to approximately $78 billion, down from $108 billion in the previous quarter. A notable deal, Advent International Corporation's announcement of a $20.8 billion acquisition of McAfee Corp. led the way on the mega-deal front, alongside multiple domestic and cross-border deals in the $1-$4 billion range.

Source: Capital IQ January 12, 2022

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.