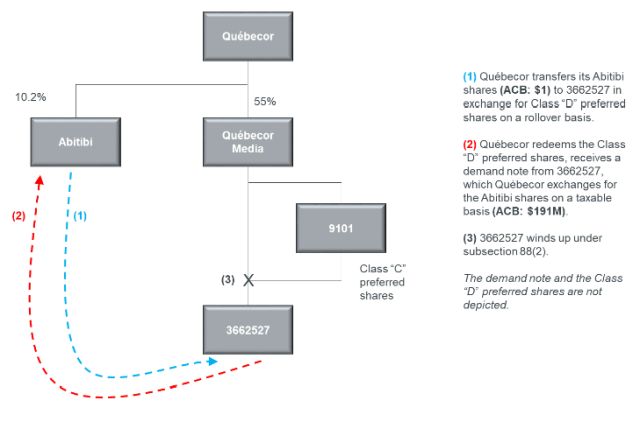

In 2005, Québecor sold shares of Abitibi Consolidated Inc. ("Abitibi") to a subsidiary ("3662527"), and reacquired them shortly thereafter. Those transactions were completed to increase the adjusted cost base ("ACB") of the Abitibi shares. The Minister relied on the General Anti-Avoidance Rule ("GAAR") to negate the ACB increase and to tax a gain on the subsequent disposition of the Abitibi shares as part of its merger with Bowater Inc. ("Bowater") a few years later.

In allowing Québecor's appeal,1 the Tax Court of Canada found that:

- A corporate group can move a property with an accrued capital gain to use a capital loss trapped in a subsidiary.2

- It is not abusive to elect to proceed with a taxable wind-up (subsection 88(2)) instead of a tax-free wind-up (subsection 88(1)).3

The Minister is appealing the decision to the Federal Court of Appeal.4

Key Facts

In a series of transactions, Québecor temporarily transferred its Abitibi shares (which had a large accrued gain) to 3662527 on a rollover basis. When Québecor reacquired the shares, this time as part of a taxable transfer, their ACB was increased up to fair market value.

3662527 was then wound-up after the transactions, which triggered an accrued capital loss on its shares of Vidéotron Telecom Ltd. ("Vidéotron"). Those losses became available because 3662527's wind-up occurred under subsection 88(2), which deemed all its properties to have been disposed of at fair market value rather than at cost (disposition at cost would have been the tax consequence of a wind-up under subsection 88(1)). The wind-up occurred under subsection 88(2) because a different subsidiary, 9101-0827 Québec Inc. ("9101"), had purchased all of the shares of another class of 3662527 as part of the same series of transactions.5 The capital gain realized by 3662527 on its sale of the Abitibi shares back to Québecor was fully shielded by the capital loss on the Vidéotron shares.

Ultimately, as part of Abitibi's merger with Bowater, Québecor exchanged its Abitibi shares for shares of the resulting corporation. The new shares received by Québecor were worth half of the Abitibi shares' ACB,6 such that a capital loss resulted for Québecor from the amalgamation. An additional capital loss resulted from the ultimate disposition of those shares, for no consideration, pursuant to an arrangement with Bowater's creditors.7

Utilizing Capital Losses in a Non-Consolidated Tax System

The Tax Court of Canada found that it was not abusive to complete certain corporate steps in order to secure the tax treatment associated with one kind of wind-up over another. The object, spirit and purpose of section 88 is to create two wind-up regimes available to Canadian corporations: the first regime authorizes the tax-free transfer of assets from a subsidiary to a parent, whereas the second regime requires such a transfer to be taxable.8Accordingly, the Minister failed to demonstrate that Parliament's intention was to prevent corporations from arranging their affairs in a way that effectively permits them to choose whether to wind up under subsection 88(1) or (2).9

The Court also found that the purpose of subsection 85(1) is to allow tax to be deferred by transferring a latent capital gain or loss to another corporation.10 Thus it is not abusive to transfer property within a group of corporations in order to utilize accrued capital losses.11 3662527 owned shares with a significant accrued capital loss (its shares in Vidéotron). The Court confirmed that there was no abuse of the subsection 85(1) rollover provision on the transfer of an asset to 3662527 with an accrued gain (the shares in Abitibi) in order to benefit from the accrued loss.12

Lastly, the Court's comments are consistent with the principal enunciated in Donohue that it was not Parliament's intention to prevent a corporate group from realizing multiple losses from a single economic source.13 When 3662527 was wound-up, there were two losses: the capital loss when it sold its own shares in Vidéotron (the "inside loss"), and the capital loss to Québecor Media on the disposition of shares in 3662527 (the "outside loss").14 The Court stated that none of the relevant transactions which allowed two losses to be triggered were abusive, as the Canadian tax system also allows gains to be triggered at multiple levels of a corporate structure.15

Footnotes

1. Québecor Inc c. Le Roi, 2023 CCI 142 ("Quebecor").

2. Québecor, para 280 and 289.

3. Québecor, para 299 and 303. All legislative references herein are to the Income Tax Act.

4. Federal Court of Appeal number A-302-23.

5. Québecor, para 35. Because of 9101's share ownership, 90% or more of all of the shares in every class of 3662527 was not owned by its parent corporation, thus disqualifying 3662527's wind-up from s. 88(1) treatment.

6. Québecor, para 29.

7. Québecor, para 30.

8. Québecor, para 274 and 275.

9. Québecor, para 298, 299 and 303.

10. Québecor, para 279.

11. Québecor, para 280.

12. Québecor, para 280.

13. Québecor, para 242. See Produits Forestiers Donohue Inc c R, 2001 DTC 823 (TCC), aff'd 2002 FCA 422. See para 18 of the Federal Court of Appeal decision, which confirms that there is no overarching Canadian tax principle that allows for the consolidation of tax consequences.

14. Québecor, para 33.

15. Québecor, para 242.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.