Cuckoo Smurfing has recently been highlighted by AUSTRAC as a method of money laundering used by criminals to disguise their movements of funds across borders. By disguising their international funds transfers, criminals can further enable their criminal activities and profit from such activities.

Cuckoo Smurfing is a method of money laundering which relies on the exploitation of bank accounts of customers expecting to receive legitimate funds due to a cross-border payment. In most instances the customers are unaware that the funds received are derived from criminal activities. Cuckoo Smurfing arises where a professional money laundering syndicate works with a corrupt remitter based overseas who:

- Accepts instructions from a customer to make a payment to an Australian based beneficiary; and

- Hijacks the money transfer coming into Australia in order to place funds in the Australian beneficiary's bank account which are derived from criminal activities.

AUSTRAC has indicated that remittance service providers, banking and financial services providers ("Providers") are those most at risk of having their services exploited due to Cuckoo Smurfing.

AUSTRAC has developed indicators that can be used by Providers to assist in identifying whether an account is being used for the purposes of Cuckoo Smurfing. These include but are not limited to:

| Demographic Indicators |

|

| Account Indicators |

|

| Depositor Indicators |

|

It is important to note that a single indicator is not a definitive way to identify instances of Cuckoo Smurfing. Rather, Providers should use a number of the above indicators to conduct further monitoring. Further monitoring should include:

- Identifying whether there is no apparent relationship between the third party and account holder;

- Investigating if deposits received are related to remittance and if the account holder is aware of the overseas and/or Australian remittance business details;

- where possible:

- engaging with overseas counterparts to identify further information in relation to the source of overseas funds; and

- retaining video footage or images of third-party depositors to identify patterns and support law enforcement.

Where a Provider is of the belief an account is being used for the purposes of Cuckoo Smurfing, the Provider should conduct further monitoring and make a determination as to whether a Suspicious Matter Report should be lodged with AUSTRAC.

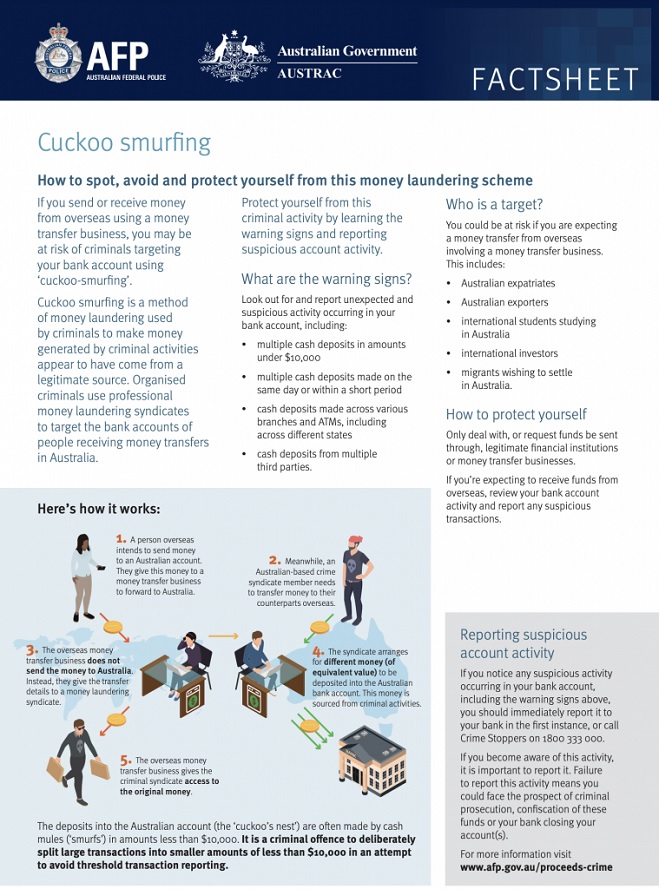

AUSTRAC, in partnership with the Australian Federal Police, has released a factsheet on how customers can protect themselves against Cuckoo Smurfing: