- within Consumer Protection and Transport topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Basic Industries, Business & Consumer Services and Consumer Industries industries

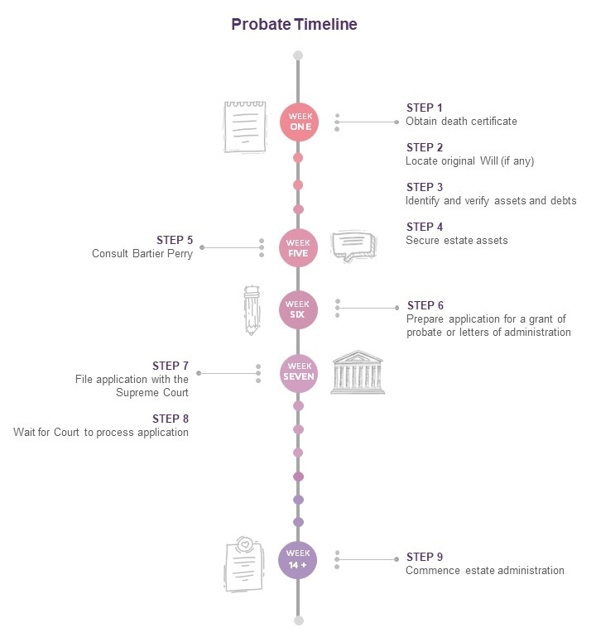

The loss of a loved one can be overwhelming, especially when it comes to handling their estate. Certain legal steps must be followed before an estate can be distributed to beneficiaries.

The relevant procedure will depend on:

- whether the deceased left a Will; and

- the nature and value of the assets owned.

The following steps are New South Wales (NSW) focused, however, they apply equally to the other states and self-governing states of Australia.

Step 1: Obtain the death certificate

After a person dies, the doctor who confirms the death will notify the Registry of Births, Deaths and Marriages of the death and cause of death, through a Medical Certificate of Cause of Death.

Once this has been done, an original death certificate can be ordered either through:

- the funeral director; or

- online, by post, or in person at a Service NSW Centre.

Obtaining the original death certificate can take anywhere between 2 – 4 weeks from the date of passing.

Step 2: Locate original Will and Codicil (if applicable)

The next important task is determining whether the deceased person left a Will or any other document purporting to embody their testamentary intentions. Common places where people may store their Will include:

- their home or digital devices (including a text message, email, or document on their computer);

- with their solicitor (you can phone solicitors in the suburb of which the Deceased last lived);

- in a safety deposit box with their bank; and

- the Supreme Court of NSW or the NSW Trustee and Guardian.

If the Deceased did leave a Will or any other document purporting to embody their testamentary intentions, you will need to locate and obtain the original Will. The named executor in the Will is the person who is entitled to apply for a grant of probate.

If the Deceased did not leave a Will or any other document purporting to embody their testamentary intentions, you will need to document the searches you made for the Will. The deceased's next of kin is the person who is entitled to apply for a grant of letters of administration. This person is called the 'Administrator'.

Step 3: Identify and verify assets and debts

The executor or administrator is responsible for obtaining details of all assets and liabilities of the deceased person at the date of their death, including known or estimated values of the assets and liabilities.

Assets may include real estate, bank accounts, shares, superannuation, an accommodation bond and personal items like jewellery and artwork.

Debts may include mortgages, loans, credit cards, outstanding bills, and tax liabilities.

Step 4: Secure the assets in the estate

After determining the assets in an estate, it is then the executor or administrator's responsibility to protect the assets of the estate (as required). This can be done by confirming current insurance policies on relevant assets, carefully storing valuables and taking over/continuing trade of any businesses.

An executor or administrator could be held legally responsible for any damage to property which has not been secured or insured.

Step 5: Consult Bartier Perry

After determining whether the deceased had a Will, we recommend getting in touch with our deceased estates team at Bartier Perry. Our team can assist you with the remaining legal steps and ensure that all necessary actions are completed.

Step 6: Prepare application for a grant of probate or letters of administration

If there is a Will, the executor appointed under the Will is required to apply for a grant of probate with the Supreme Court of NSW. The grant of probate serves as an official recognition that the appointed executor has the right under the Will to administer the estate in accordance with the Will.

If there is no Will, the deceased's next of kin is required to apply for a grant of letters of administration with the Supreme Court of NSW. The grant of letters of administration serves as an official recognition that the next of kin has the right to administer the estate in accordance with the statutory rules of intestacy.1

Small estates (under $50,000) which may not require a grant

Some estates will not require a grant of probate or letters of administration. This is usually the case if the only asset in the estate is a small bank account or a small shareholding, or if the assets were held jointly with another person, in which case, the asset would automatically pass to the survivor.

Different rules apply to different asset holders, and it is important to check with each asset holder as to their specific redemption requirements to determine whether a grant is required to release the assets.

Applying for Probate or Letters of Administration

Since August 2023, most applications for uncontested grants of representation are applied for and filed online through the NSW Supreme Court Registry website.

The following documents comprise a standard application for probate:

- original Will;

- Notice of intended application for probate (automatically published upon filing of the probate application);

- Summons; and

- Affidavit of executor (including death certificate and inventory of property).

The following documents comprise a standard application for letters of administration:

- Notice of intended application for letters of administration (automatically published upon filing of the letters of administration application);

- Summons;

- Affidavit of executor (including death certificate and inventory of property);

- Affidavit as to relationship status of the deceased; and

- Affidavit with respect to searches for a Will.

Step 7: File application with Supreme Court

Once all the documents comprising an application has been prepared and signed, it can then be filed with the Court.

Step 8: Wait for Court to process application

The Court will then assess the application and either:

- issue a grant with respect to the estate; or

- ask for further information.

The turnaround time for the Court to assess applications varies and can take anywhere between 2 to 8 weeks (depending on the complexity of the application and the availability of the Court).

Step 9: Commence estate administration

Once a grant has been issued with respect to an estate, the named executor or administrator is authorised to commence the estate administration.

Footnote

1 Succession Act 2006, Chapter 4.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.