As part of the 2023-24 State Budget, the Victorian Government announced significant reform to stamp duty for commercial and industrial properties that will take effect from 1 July 2024. In December 2023, the Government provided further details on the proposed Commercial and Industrial Property Tax (CIPT) Reform.

Overview

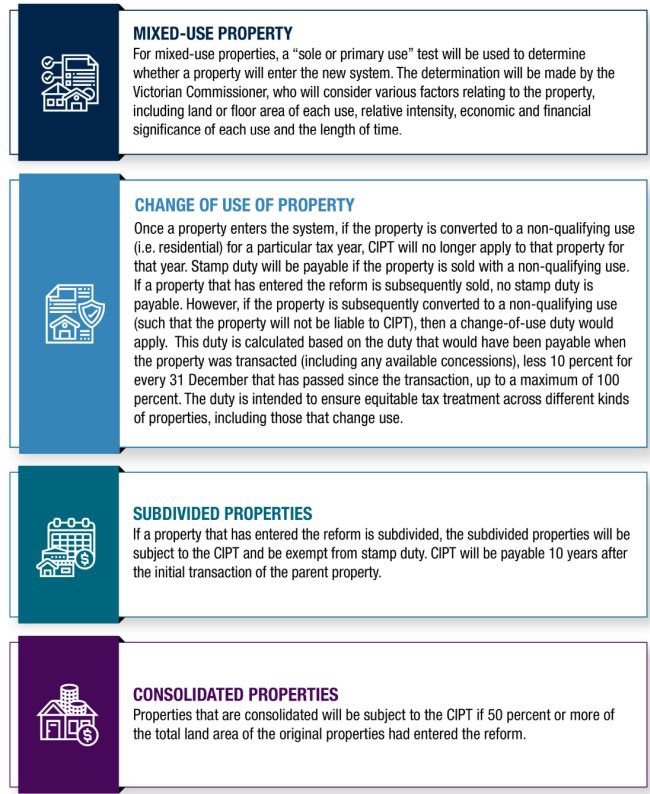

From 1 July 2024 onwards, transactions that involve Victorian commercial and industrial property will trigger one final round of stamp duty. Following this, the property will enter the new CIPT system, and no stamp duty will be payable on any future transactions of that property, provided that the property continues to have a commercial or industrial use. Instead, the CIPT will be payable on an annual basis, commencing 10 years after the initial transaction. CIPT will be calculated at a rate of one percent of the property's unimproved land value, and payable in addition to any land tax ordinarily payable.

Entry into CIPT system

A property will enter into the CIPT system if:

- a contract of sale of the property is entered into on or after 1 July 2024;

50 percent or more of In detail

- the property transacts—either via a direct dealing in the property, or indirectly, such as by way of an acquisition of a company or trust that owns the property;

- there is a stamp duty liability (i.e. no exemptions are available); and

- the property has a qualifying commercial or industrial use.

Stamp duty concessions continue to apply to the transaction, and the property will enter the system provided that other conditions are also met. For example, a sale of qualifying property that is eligible for the regional, commercial and industrial concession will enjoy a 50 percent reduction on the final stamp duty payment, and the property will subsequently enter the system.

A property will not enter the CIPT system if:

- the transaction is exempt from stamp duty—i.e. deceased estate transfers, transfers between spouses/ partners and purchases by charitable organisations; or

- the transaction triggers duty under a particular excluded or complex transaction—i.e. transaction that is eligible for corporate consolidation concession, economic entitlement provisions, sub-sale provisions or dutiable leases.

Anti-avoidance provisions will be put in place to support the integrity of the reform, although details of these are yet to be released by the government.

What types of properties will be affected?

CIPT will apply to Victorian land that has a qualifying commercial or industrial use. This includes:

- land that the Valuer-General has allocated an Australian Valuation Property Classification Code (AVPCC) that falls within the commercial or industrial categories; or

- land that is qualifying student accommodation—i.e. it is primarily used as "commercial residential premises" for goods and services (GST) purposes and is used solely or primarily for providing accommodation to tertiary students, excluding accommodation provided in connection with a university.

The CIPT system will not apply to land coded by the Valuer-General as residential, primary production, community services or sport, heritage and culture purposes.

Government loan for upfront duty

For purchases of qualifying commercial or industrial property on or after 1 July 2024, taxpayers will have a choice of paying the final stamp duty in respect of the property as an upfront payment, or by using a Victorian Government facilitated transition loan with a 10-year repayment term.

The transition loan is available for applicants who are:

- Australian citizens or permanent residents, or Australian businesses;

- the first purchaser of a commercial or industrial property where settlement occurs for contracts entered into on or after 1 July 2024;

- purchasing the property for a price which does not exceed $30 million; and

- approved for finance for the property by an authorised deposit-taking institution or other approved lender.

Foreign owners will not be eligible to apply for the transition loan.

The loan will be issued by the Treasury Corporation of Victoria with a fixed interest rate, which will be a commercial market-based rate calculated at the start of the loan.

Annual loan repayments will be set upfront to provide borrowers with certainty, and the first repayment will be due 12 months after settlement of the property purchase.

Treasury Corporation of Victoria will have a first ranking statutory charge over the interest in the land in relation to the loan, which will be registered on title to inform prospective purchasers.

Originally published by 27 February, 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.