On 22 March 2020, the Federal Government announced the second stage of its economic plan to support Australian businesses and their workers through the unchartered waters created by the spread of the Coronavirus. The stimulus package extends a number of the key measures announced in the first package on 12 March 2020 (see our recent publication on stage one of the package here).

Both stage one and stage two of the stimulus package were passed by Parliament on 23 March 2020, and received Royal Assent on 24 March 2020. The Federal Government has also now announced that a third stage to the stimulus package will follow shortly.

From a tax perspective, stage two of the stimulus package contains key measures aimed at providing:

- assistance to businesses to keep their workers employed; and

- support for workers and their households.

In addition to the Federal Government measures, the States and Territories have each announced stimulus packages to assist both businesses and individuals.

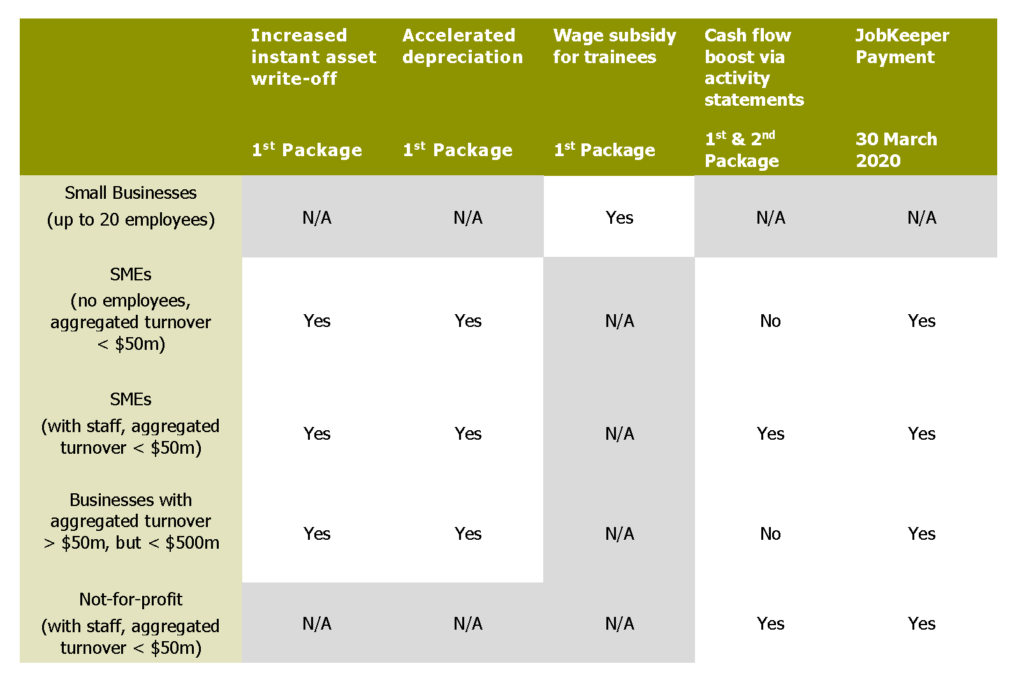

The table below provides a summary of the measures now available to businesses under the first and second stimulus packages. The new stimulus package announced by the Federal Government comprises one key taxation component aimed at providing relief to businesses. These packages are also complemented by various administrative concessions announced by the Australian Taxation Office (ATO).

Boosting Cash Flow for Employers

Both small to medium businesses (SME's) and not for profit entities, with aggregated (group) annual turnover under $50 million, will be eligible to receive a cash flow boost aimed at keeping their employees engaged.

In effect, the cash flow boost introduced under stage one of the stimulus package has now been enhanced under stage two such that eligible businesses can receive a total credit equal to either 100% of their liability for PAYG-withholding in relation to salaries and wages paid to their employees (increased from 50%). The Government also announced that a second round of credits will be introduced for tax periods from July to September 2020.

As a result of these measures:

- the minimum credit for PAYG-withholding has been increased from $2,000 to $10,000; and

- the maximum credit for PAYG-withholding has increased from $25,000 to $50,000 for the 2020 financial year.

This means that eligible employers will receive payments of at least $20,000 and up to a total of $100,000. However, to qualify for the additional payments, businesses must continue to be active into the 2020-21 financial year.

Practically, for those businesses lodging quarterly business activity statements:

- 100% of the March quarter payment, and 100% of June quarter payment is credited upon lodgment (up to $50,000); and

- an additional 50% of the total credit for the 2020 financial year will be credited in June 2020, and 50% credited in September (again, up to $50,000).

For those businesses lodging monthly business activity statements:

- 300% of the March monthly payment is credited, and 100% of the April, May and June monthly statements will be automatically credited, up to the limit of $50,000; and

- 25% of the total amount due for the 2020 financial year will be automatically credited in June, July, August and September upon lodgment (again, up to the $50,000 limit).

Administrative relief measures

To date, the ATO has also announced that they are willing to work with taxpayers affected by the pandemic. The ATO website details a number of measures that a taxpayer can seek to access.Importantly, these include:

- an ability to defer income tax, FBT and excise payments due in the period leading up to 12 September 2020. Businesses should contact the ATO directly when experiencing difficulty meeting these obligations;

- an option to change over GST reporting from quarterly to monthly reporting from the start of a new quarter (for example, 1 April 2020) in order to obtain faster access to GST refunds;

- an option to vary PAYG-Instalments, and the ATO have stated that they will not apply interest or penalties for varied instalments for the 2020 financial year;

- the ATO will also consider remitting interest and penalties from 23 January 2020 for those affected by COVID-19. Low interest payment plans will also be available; and

- the ATO have stated that the residency status of temporary or non-residents visiting Australia should not be affected if they are required to remain in Australia due to COVID-19.

States and Territories

Payroll Tax relief

To date, every state and territory (except South Australia) has announced payroll tax relief packages for eligible businesses.Each state has offered a slightly different form of payroll tax relief – with a focus largely on refunds, referrals and even the waiver of payroll tax liabilities for a certain period.

In Queensland, the State Government has already expanded the relief we outlined on 19 March 2020, such that employers that pay less than $6.5 million in Australian taxable wages can now apply:

- for a refund of two months' of recently paid payroll tax;

- for a three month 'holiday' from paying any payroll tax; and

- to defer all payroll tax liability for the 2020 calendar year, with payment not due until 14 January 2021.

Employers that pay more than $6.5 million in Australian taxable wages can also access the two month refund and payroll tax deferral, but will not be eligible for the three month payroll tax 'holiday'.

Applications for the deferral and 'holiday' must be lodged by 31 May 2020.

A table outlining the payroll tax relief offered by each State and the Australian Capital Territory can be found here. In addition, the Northern Territory has extended its ongoing payroll tax exemption for those who employ Northern Territory residents to 30 June 2021.

Additional relief

In addition to the payroll tax measures, the States and Territories have each announced other relief measures for businesses. In Queensland, these measures include:

- rent relief for commercial tenants in government buildings;

- offering a $500 rebate on electricity bills for small and medium sized businesses that consume less than 100,000 kilowatt hours (automatically applied to eligible electricity bills); and

- waiving liquor licensing fees for businesses impacted by the enforced shutdowns.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.