In updated guidance from ASIC in relation to the financial resource requirements that apply to some types of Australian Financial Services Licensees (Licensees) published in Report 769 (Report), ASIC has also made comments on the issue of dormant Licensees.

ASIC's guidance in relation to dormant Licensees means that any Licensee which is subject to a financial obligation by way of the authorisations included on its Licence, must meet the applicable requirement, from the date the Licence authorisations take effect. For many Licensees, and those looking to apply for or acquire an AFSL, this will mean future planning to ensure the appropriate cash reserves are held.

ASIC's commentary states that where a Licensee holds an authorisation which triggers particular financial obligations, these obligations apply regardless of whether the Licence authorisation is currently being utilised by the Licensee. An example of this is the NTA requirement that applies to custodians.

In the context of the Report, ASIC did not agree with the submission to Consultation Paper 367 that the NTA requirement should not take effect if the Licensee is dormant or is not currently utilising the authorisations that trigger the NTA requirement. Under the updated instrument and as detailed in Appendix 4 of Regulatory Guide 166, licensed custodians are required to hold a specified amount of NTA. The NTA requirement is tiered to account for smaller Licensees, or Licensees that have lower levels of business activity under their AFSL.

Other considerations

As Sophie Grace has previously noted, ASIC has the power to cancel a Licence as a result of inactivity. This power extends to:

- Licensees that have not commenced operations within six months of being granted a Licence; and

- to Licensees that have ceased to operate a financial services business.

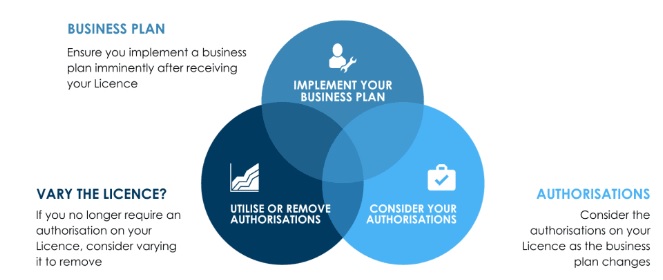

Licensees need to consider any level of inactivity, whether holistically, or limited to particular authorisations and address it. This means:

- implementing a business plan immediately after receiving a Licence from ASIC;

- considering the authorisations required to implement the business plan, particularly as the business plan changes over time;

- determining whether authorisations that are not utilised are actually required and if not, lodging a variation with ASIC to remove them.

What Next?

Affected Licensees should review their Licence conditions and the financial obligations and the NTA calculations (if any) which apply. ASIC will not look favourably on Licensees to which a financial requirement applies but have failed to meet this financial obligation.

Further Reading

ASIC Consultation Paper 367 – Remaking ASIC class orders on financial requirements

ASIC Regulatory Guide 166 – AFS Licensing: Financial Requirements