By James Shady and Craig Morgan

From its cottage industry beginnings, the retirement village industry has grown into a sophisticated and complex sector. Originally the domain of religious and charitable organisations, operators now include ASX-listed corporations, property trusts, superannuation funds, private equity backed ventures, SMEs and family enterprises.

The retirement village sector is undergoing signifcant change – a consolidation phase which will no doubt see listed multi-facilities continue to expand their holdings at the expense of single operator facilities. This is the corporatisation of the retirement industry and it requires scale, deep pockets and a strategic, corporate approach.

At the same time the sector is going corporate, the baby boomer generation is changing the landscape. Baby boomers have different expectations of retirement and demand village communities offer more space and privacy with a provision for extended family visits. This is a generation used to getting what it wants, so why would retirement be any different?

In this article we examine how the retirement industry works, the changing expectations of retirees, the impact of the Global Financial Crisis (GFC) on retirees' wealth and what that means for retirement village operators, and common pitfalls that investors and fnanciers should avoid.

The greying landscape

The Retirement Village Association ('RVA') estimates there are approximately 1,850 retirement villages in Australia, accommodating around 180,000 people. Given Australia's ageing population, the RVA expects the sector to increase almost threefold over the next four decades.

The number of Australians aged 85 years and over is projected to increase from 0.4 million in 2010 (0.2 percent of the population) to 1.8 million (5.1 percent of the population) by 2050, when more than 3.5 million Australians are expected to use aged care services each year.

The baby boomer generation continues to infuence Australian culture, resulting in an ageing population and placing strain on current aged care facilities. Governments acknowledge that reform is needed to meet the challenges of an ageing population and legislation is being refned to protect retirees' interests in onerous and complex retirement village contracts.

Over the last few years, retirees' wealth has diminished as a result of the GFC's impact on residential property prices and share market volatility. The sector is watching nervously to see whether this will lead to baby boomers delaying their retirement.

As the property market has fattened, retirement village operators have found they are not experiencing capital growth to the same extent as in the previous 10-15 years. For some operators who are highly leveraged, this is impacting on cash fow and their ability to repay debt. This diffculty is compounded by the majority of exit fees being tied to the resale value of units and, in turn, house price movements. In an environment where retirees' asset wealth is reducing, so too are the incomes of operators.

The retirement village cycle

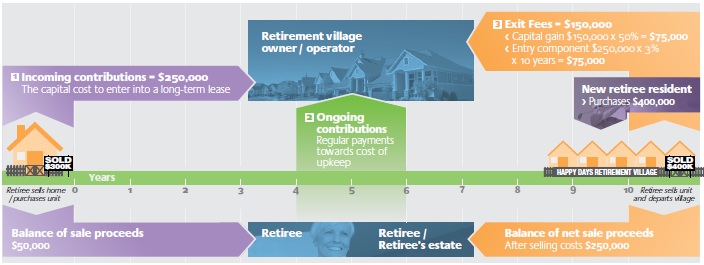

This diagram illustrates the cash fow generated by a typical retiree's residence in a retirement village, based on (lifetime) lease, assuming an ingoing contribution of $250,000 and sale proceeds of $400,000 in 10 years:

Notes:

- There are many variants to calculate exit fees and it is common for exit fees to be calculated differently within a village

- Excludes selling costs

- The above example is intended for illustrative purposes only.

How does it work?

The two most common ways retirees fund entry into retirement villages are through the sale of the family home or through their superannuation savings. Over the last few years, retirees have discovered they are not as wealthy as they were pre-GFC, which has forced many to plan for their retirement more conservatively – in some instances delaying their retirement.

Retirees entering a retirement village soon learn they are complex and sophisticated legal structures. So, how does it work? How do operators make money?

There are three main income-generating streams.

- Ingoing contributions

Ingoing contributions are fees that a retiree pays to an operato upon entry. These usually equate to the capital value of either an Independent Living Unit ('ILU') or Serviced Apartment ('SA') and entitle the retiree to a lifelong lease on the premises. Generally, price movements for ILUs and SAs are positively correlated to house prices within the locality of the village.

- Ongoing contributions

In most retirement villages, ongoing costs are minimal and generally cover the operator's cost of upkeep and are often based on a percentage of the aged pension.

- Exit fees

Exit fees are payable by a retiree when they leave a retirement village – usually when moving to higher aged care facilities or upon death. They incorporate income from the on-selling of the unit and operators' subsidies over the retiree's period of residence. These fees are charged on exit in order to ensure retirees have suffcient funds to enjoy their retirement years. Exit fees are deducted from the ingoing contribution lump sum of the next resident of an ILU or SA and the balance or redemption sum is paid to the outgoing retiree or their estate.

Retirees' changing demands

Since birth, the baby boomer generation has dominated Australia's culture and much of the western world. As the baby boomer generation reaches retirement age, it is changing the traditional business model of retirement villages and unless operators are quick to adapt, they may be left behind.

According to RVA/Grant Thornton research, retirees today have greater expectations of their life in retirement. They expect operators to provide more space and privacy: for example, a single bedroom won't cut it – they expect their ILU to have two or even three bedrooms, provisions for extended family visits, storage, entertainment and solitude, while also catering for a community feel and offering quality resident amenities.

Operators who are unwilling or unable to change their business model to meet these requirements will struggle to maintain relevance and proftability in an increasingly competitive marketplace. However, those that do adapt to this changing landscape are well placed to increase market share over the coming years.

Market turmoil

The recent freefall in share markets and the erosion of house prices is being keenly felt by the retirement sector. A large portion of retirement village income is generated from the sale of the units, so any negative impact on retirees' funds or house prices, impacts on operators' income streams. In the September quarter alone, the ASX 200 lost 12.7 percent of its value while the ABS is expected to report that median house prices continue to fall when the September quarter report is released early next month.

Prior to 2008, operators were riding the residential property boom, with each quarter-on-quarter increase in median house prices correlating to increases in profts from entry and exit fees. However, since 2008, operators have found it increasingly diffcult to generate revenues, resulting in well run, well maintained and well positioned villages increasing market share, while poorly run, poorly maintained villages have struggled to survive under the weight of debt and increased maintenance costs. The graph below illustrates the correlation between Australia's share market movements and median house prices.

Conclusion

The post-GFC market conditions and property downturn are changing the environment for retirement village operators, while the changing expectations of baby boomer retirees are raising the bar. Retirement village operators are fnding that if they don't adapt, they are losing relevance. All this is forcing retirement village operators to re-asses their business models to remain relevant and competitive. Increasingly, those that don't bring scale or a corporate approach to the business will be left behind.

This does not, however, signal doomsday for the sector. There remains healthy and growing demand for retirement villages and those that are well run and maintained, with a focus on the changing expectations of retirees, will remain proftable investments for both operators and fnanciers.

Greenfield development

Greenfield development site near a popular coastal resort with:

- Approval to build a retirement village

- A small number of display ILUs

A developer acquired the site from an adjoining property owner undertaking a substantial residential subdivision. The property was subject to a restrictive covenant related to the sell through of vendors' adjoining residential subdivision.

Ferrier Hodgson partners were appointed to manage the realisation of the site by a major fnancier.

Recently constructed

A recently constructed retirement village, comprising a mix of ILUs, SAs and community facilities, was constructed on the urban fringe of a major city. The exceptionally high quality development was refected in the construction costs.

The appointment of Ferrier Hodgson partners as receivers and managers occurred when the development was over 90 percent complete and the majority of ILUs had been built and sold. However, SAs were not selling and debt amortisation from the builder's margin on the various stages had not occurred as planned.

Completion issues were managed and the retirement village was sold by Ferrier Hodgson.

Mature village

Mature retirement village comprising ILUs, SAs and community facilities was a debt-funded acquisition by a listed property trust.

The trust had multiple retirement assets, funded by lenders on unilateral bases. Following the GFC, underperformance of certain assets in the portfolio was exacerbated and poor sales results led to a signifcant funding defciency.

To address the defciency, management determined to sell the long-term management rights of the portfolio to a competitor and become a landlord. Whilst debt was reduced, the continued underperformance of key assets ultimately led to its fnancial collapse.

Due to the existence of multiple unilateral loan facilities, following the appointment of a voluntary administrator, various lenders appointed Ferrier Hodgson partners as receivers and managers of the largest retirement village in the portfolio.

In the post-GFC marketplace, it is imperative to maintain a keen eye on details during the due diligence process to avoid poorly managed villages which have not kept pace with the changing needs of retirees. Other things to keep in mind:

- Are the valuations reasonable? Reduced exit fees have negatively impacted on valuations and fnanciers should ensure valuers have specifc experience in the retirement village and aged care sectors.

- For a mature village, does the design and layout meet current accessibility requirements? Has capital maintenance been sustained and will it meet the future needs of retirees?

- For new developments, does the entry price correlate to location? Does it correctly target the region and its socio-economic situation?

- In multiple asset and lender scenarios, are the rights of the various participants clearly documented and aligned?

- Will future exit-fee cash fows be suffcient to meet future refurbishment costs?

How we can help

Ferrier Hodgson partners are experienced in providing innovative solutions for businesses in distressed and non-distressed situations. We are well placed to help retirement village operators fnd new approaches and remain relevant.

Ferrier Hodgson is able to assist lenders and prospective purchasers of retirement village and aged care assets:

- Our fnancial and operating reviews of acquisitions determine whether reported performance is accurate and identify opportunities to improve results.

- Our reviews of proposed developments provide critical assessment of the forecasts and the fnancial implications of the proposed phasing of construction.

- Our valuation reviews provide decisive insights into the assumptions underlying asset valuations and risks to the valuations.

- Our formal business reviews provide stakeholders with genuinely commercial assessments of a business, identify performance improvement opportunities and can be extended to include initiative implementation.

- Our property professionals are experienced in the retirement living and aged care sectors and are able to provide stakeholders with real views on construction quality and capital expenditure needs.

- We are able to act in a formal capacity as receivers and managers or voluntary administrators to operate and ultimately realise retirement villages, aged care hostels and/or nursing homes.

- Ferrier Hodgson is able to effectively and cooperatively manage the outcomes for the disparate stakeholders (operators, residents and creditors) in most scenarios.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.