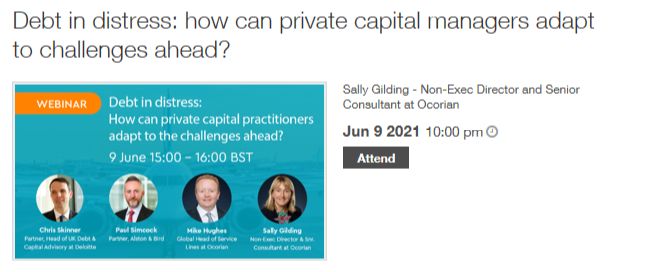

Register below for our upcoming webinar on June 9, Debt in distress: how can private capital practitioners adapt to the challenges ahead?

In the months ahead, many corporates will need to address their viability, seek refinancing and revaluate their operating models, whilst investors revise their investment strategies to capitalise on opportunities. But any investment strategy is only as good as its execution.

In response to this need for clarity, we're bringing together a panel of senior figures from the capital markets to provide practical advice for investment managers as they seek to optimise their investment strategies and build a competitive advantage in the debt space.

Register for the webinar by clicking attend below.

Following the release of our global capital markets report Navigating CovExit: searching for value in the debt markets, we're gathering senior figures from the capital markets to discuss the key takeaways and provide practical advice to help you optimise your investment strategies and build your competitive advantage in the debt space.

Agenda:

- As fiscal support schemes are withdrawn, what is the outlook for turnaround, restructuring and insolvency activity?

- With direct lending now the most popular private debt strategy in both Europe and the US, how can funds execute an effective direct lending strategy in such a competitive market?

- Our recent survey of capital markets practitioners revealed a clear trend towards outsourcing more business functions. So how can outsource providers optimise investment strategies?

Speakers:

- Chris

Skinner - Partner, Head of UK Debt and Capital Advisory,

Deloitte

- Paul

Simcock - Partner, Alston & Bird

- Mike

Hughes - Newly appointed Global Head of Service Lines, Ocorian,

formerly JP Morgan, Global Head of Custody

- Sally Gilding - Senior Consultant and Non-Executive Director, Ocorian (moderator)

Download our global capital markets report

The webinar will discuss central themes emerging from our new research report, Navigating CovExit: searching for value in the debt markets which can be downloaded here.

From direct lending strategies to expectations for turnaround and restructuring activity, the report draws upon responses from senior level decision makers in the capital markets to highlight how investment managers are planning for 'CovExit' and the important role administration and compliance can play in helping them to act with clarity as economies begin to unwind.

For more information about our capital markets services, click here or contact our team below.