1 Legal and regulatory framework

1.1 What role does the state play in the renewables industry and which national legislative and regulatory provisions have relevance for the renewables industry in your jurisdiction?

The state controls and manages all natural resources, including renewable energy resources, to optimise the welfare of the people. This is well established under the Indonesian Constitution. In acting as the administrator of the renewables industry, the state also creates policy by serving as the regulatory authority and supervising the industry, including issuing licences to business players that want to enter the Indonesian renewables market.

The main umbrella regulation on energy is Law 30/2007 on Energy, as amended by Law 6/2023 on the Stipulation of Government Regulation in Lieu of Law 2/2022 regarding Job Creation ('Job Creation Law'). The umbrella regulation on renewable energy will be the New and Renewable Energy Bill ('NRE Bill'), which the Indonesian Parliament has been discussing for the last three years.

Pending the enactment of the NRE Bill, renewable energy is governed under various laws and regulations, including:

- Law 17/2019 on Water Resources, as amended by the Job Creation Law;

- Law 21 of 2014 on Geothermal Energy, as amended by the Job Creation Law;

- Government Regulation 79/2014 on National Energy Policy ('GR 79/2014');

- Presidential Regulation 22/2017 on the National Energy Plan ('PR 22/2017');

- Presidential Regulation 112/2022 on the Acceleration of Renewable Energy Development for Electricity Generation ('PR 112/2022');

- Presidential Regulation 11/2023 on Additional Concurrent Government Affairs in the Field of Energy and Mineral Resources in the New Renewable Energy Sub-Field ('PR 11/2023');

- Ministry of Energy and Mineral Resources (MEMR) Regulation 50/2017 on the Utilisation of Renewable Energy for the Production of Electricity, as last amended by MEMR Regulation 4/2020 ('MEMR Regulation 50/2017'); and

- MEMR Regulation 26/2021 on Rooftop Solar-Power Plants Connected to Electrical Power Networks of Holders of Business Licences for the Provision of Electrical Power for the Public Interest.

1.2 Which bilateral or multilateral instruments or treaties with effect in your jurisdiction have relevance for the renewables industry?

Indonesia has ratified the three main climate change treaties – that is:

- the United Nations Framework Convention on Climate Change and its Kyoto Protocol; and

- the Paris Agreement.

Specifically for the renewables industry, at a G20 event in 2022, Indonesia signed a memorandum of understanding (MOU) with 14 international institutions and philanthropists to accelerate the country's energy transition through the Indonesia Energy Transition Mechanism Country Platform, known as the ETM Platform.

Over the years, the Indonesian government had also signed various cooperation agreements with different counterparts, including:

- an MOU on the Clean Energy Working Group between Indonesia and the United States in 2023;

- an MOU on the Indonesia-Denmark Energy Partnership Programme 2020–2025 between Indonesia and Denmark; and

- the Indonesia and Norway Bilateral Energy Consultation.

Indonesia is also a member of the International Renewable Energy Agency, an intergovernmental organisation that:

- supports countries in their transition to a sustainable energy future; and

- serves as a platform for international cooperation and a repository of policies, technology, resources and knowledge on renewable energy.

Several Indonesian cities – including Jakarta, Surabaya, Bandung, Padang, Bogor, Malang, Tangerang, Makassar, Denpasar, Palembang and Depok – are part of the Global Covenant of Mayors for Climate & Energy (GCoM). GCoM is an alliance of cities and local governments through which mayors and local governments work with partners to accelerate ambitious, measurable climate and energy initiatives that lead to an inclusive, just, low-emission and climate-resilient future, meeting and exceeding the objectives of the Paris Agreement.

More recently, Indonesia and the International Partners Group launched the Just Energy Transition Partnership (JETP), which will mobilise $20 billion over three to five years with the aim of ensuring a just transition in the decarbonisation of the electricity sector in Indonesia.

1.3 Which national regulatory bodies are responsible for enforcing the applicable laws and regulations? What powers do they have and what is their general approach in regulating the renewables industry?

The leading government institution overseeing the renewable energy industry is the Ministry of Energy and Mineral Resources (MEMR). The MEMR is responsible for developing policies for renewable energy. Its authority includes:

- exercising regulatory authority;

- issuing and overseeing licensing for electricity generation from renewables; and

- setting renewable energy tariffs.

Other government institutions responsible for supervising the renewable energy sector include the following:

- The Ministry of Public Works and Housing oversees hydropower and floating solar power plants;

- The Ministry of Industry oversees and supervises the local content requirement for numerous renewable energy industries;

- The Ministry of Finance governs the applicable subsidies and fiscal incentives for renewable energy industries;

- The Ministry of Environment and Forestry (MOEF) oversees and supervises environmental and forestry approvals and the compliance of renewable energy projects;

- The Ministry of National Development Planning formulates the National Mid-Term Development Plan, a five-year development plan for 2020 to 2024 that foresees an increase in renewable power capacity and other green policies envisaged for the near future; and

- The Coordinating Ministry for Maritime and Investment Affairs supervises, coordinates and synchronises policies and affairs with ministries and agencies such as the MEMR and the MOEF. Its role is also to streamline investment and expedite the implementation of projects in Indonesia.

1.4 What role do regional or local government or public bodies play in the renewables industry?

Regional and local governments play an important role in supporting the renewables industry in each region. Each regional government must prepare a provincial energy plan to implement the National Energy Plan (RUEN). The RUEN is the central government's national energy management plan for the implementation of the National Energy Policy (KEN) 2014–2050, which is governed by GR 79/2014 and PR 22/2017.

Since the enactment of PR 11/2023, regional governments overseeing provincial affairs have more authority to manage and oversee renewable energy. Their authority includes:

- managing the supply and use of biomass and/or biogas as fuel at the provincial level; and

- managing solar, wind, hydroelectric and ocean thermal energy, among other things, at the provincial level.

Local government can also play a significant role in expediting renewable energy projects in their area. In the waste-to-energy industry, local government is the governing authority with the right to determine the tipping fee for waste management.

2 Renewables industry

2.1 Which renewable technologies are considered relatively mature in your jurisdiction, and which are emerging as potentially new technologies in the market?

Geothermal power and hydropower are among the relatively mature renewable technologies in Indonesia. In 2021, the installed capacity was:

- 55 megawatts (MW) for geothermal energy; and

- 291 MW for hydropower.

The Indonesian government projects that geothermal, hydropower and bioenergy will be the prime sources of energy in Indonesia from 2015 until 2050. This projection is set out in Presidential Regulation 22/2017 regarding the National Energy Plan (RUEN) ('PR 22/2017') and the PT Perusahaan Listrik Negara (Persero) (PLN) Electricity Supply Business Plan (RUPTL). The RUPTL stipulates that PLN will prioritise the utilisation of geothermal, hydropower and bioenergy to achieve the state's National Energy Policy (KEN) targets by 2025, with bioenergy contributing the largest share to the growth of renewables.

There have also been major developments concerning solar power plants. According to the Indonesian Energy Transition Outlook (IETO) 2022, rooftop solar photovoltaic (PV) is leading in terms of annual growth rate for renewable energy sources, with an increase of 17.9 MW. Continued development of rooftop solar PV is foreseeable, especially with the introduction of MEMR Regulation 26/2021 on Rooftop Solar-Power Plants Connected to Electrical Power Networks of Holders of Business Licences for the Provision of Electrical Power for the Public Interest.

Renewable technologies with the most potential due to the availability of new and renewable energy (NRE) sources include:

- hydropower (with a potential of 10.391 gigawatt-hours (GWh));

- solar (with a potential of 4.68 GWh);

- geothermal (with a potential of 3.355 GWh); and

- wind power plants (with a potential of 0.597 GWh).

2.2 Who are the key players in the renewables industry in your jurisdiction?

The key players consist of parties that play a significant role in regulating, implementing and supervising the renewables industry, as follows:

- MEMR is the main regulator, which develops relevant policies and oversees the implementation of the renewables industry.

- Local/regional governments are the main regulators and supervisors of the renewables industry at the local and regional levels, and also issue the relevant licences for renewables industry projects.

- PLN is the main player in the renewables industry, acting as both the key supplier and purchaser of NRE. In addition, PLN issues renewable energy certificates.

- Independent power producers (IPPs) also act as suppliers of NRE. IPPs include both:

-

- non-PLN subsidiary IPPs; and

- PLN subsidiary IPPs such as PT Nusantara Power and PT Pembangkitan Jawa-Bali.

- Pertamina, the state-owned oil and natural gas company, is involved in the management of NRE power plants and in numerous projects related to the energy transition.

2.3 How much do renewables currently contribute to the domestic energy mix? What are the near-term projections for the role they will play?

Based on the third Biennial Update Report to the United Nations Framework Convention on Climate Change submitted in December 2021, Indonesia is still heavily reliant on fossil fuels, including natural gas and oil, which in 2019 accounted for 89% of the country's primary energy supply, with the remaining 11% accounted for by renewable energy.

According to the IETO 2023, renewable energy makes up only 10.4% of the energy mix in Indonesia, down from 11.2% the previous year; while coal's share of the energy mix rose to an all-time high of 43%.

The following are the energy mix targets under Government Regulation 79/2014 on KEN:

- By 2025, the role of:

-

- NRE energy should be at least 23%;

- petroleum should be less than 25%;

- coal should be at least 30%; and

- natural gas should be at least 22%.

- By 2050, the role of:

-

- NRE should be at least 31%;

- petroleum should be less than 20%;

- coal should be at least 25%; and

- natural gas should be at least 24%.

3 Utility-scale renewables projects

3.1 What utility-scale renewables projects are currently operational or planned in your jurisdiction? What are their key features?

Under Ministry of Energy and Mineral Resources (MEMR) Regulation 50/2017 on the Utilisation of Renewable Energy Sources for Electricity Supply ('MEMR Regulation 50/2017'), utility-scale renewables projects have a capacity of 10 megawatts (MW) or more. Indonesia has a few operational utility-scale renewables projects, including:

- the Patuha geothermal power plant, with a total capacity of 60 MW; and

- the Batang Toru hydropower plant, with a total capacity of 510 MW.

The combined construction and operation of medium and large-scale hydropower plants in Indonesia between 2010 and 2013 reached a total capacity of 111.8 MW.

Most utility-scale renewables projects in Indonesia are at the construction stage. The government has projected the development of renewable energy power generation projects to reach 45.2 GW in 2025 and 167.7 GW in 2050. Under PT Perusahaan Listrik Negara (Persero)'s (PLN) 2021–2030 Electricity Supply Business Plan (RUPTL), the development of these projects will account for 51.6% of the total capacity of renewable energy projects in Indonesia. These projects include the following:

| Projects | Expected operation date | Capacity |

| Peusangan hydropower plant | July 2023 | 55 MW |

| Asahan hydropower plant | March 2024 | 45 MW |

| Cirata solar floating PV | Early 2024 | 145 MWac |

| Patuha geothermal power plant II | 2033 | 60 MW |

Noting the above, the government subsequently implemented co-firing projects in coal-fired power plants (CFPPs) by mixing the use of coal with renewable energy.

3.2 What authorisations are required for the construction and operation of utility-scale renewables projects in your jurisdiction?

The required authorisations for these projects are divided into:

- general business licences; and

- specific operating licences for utility-scale renewables projects in Indonesia.

First, business licences in Indonesia are obtained through the Online Single Submission Risk-Based Licensing (OSS RBL) system. Under this regime, business licensing is modulated on the basis of the risk posed by the business activity – namely:

- business identification number (NIB) for low-risk business;

- NIB and a verified standard certificate for medium-risk business; and

- NIB and business licence for high-risk business.

In addition, all business activities in Indonesia are classified by five-digit numbers from a catalogue known as the Indonesian Standard Classification of Business Fields (KBLI).

The relevant KBLI number for utility-scale renewables projects is KBLI 35111, which includes power generation from renewable energy. KBLI 35111 is categorised as a high-risk business and thus requires an NIB and business licence. The business licences required to operate utility-scale renewables projects are as follows.

Electricity supply business licence (IUPTL): Any business engaged in the provision of electricity must obtain a business licence in the form of an IUPTL, which is categorised into two types:

- an IUPTL for public use (IUPTLU); and

- an IUPTL for self-use (IUPTLS).

An IUPTLU is required for a business providing electricity for public use and the electricity will be on-grid with PLN's electricity system. An IUPTLS is required for a business generating electricity to be used for its own business operations – for example, for industrial activities – and the electricity will be off-grid. An IUPLTS is typically granted to independent power producers (IPPs) of any power plant for self-use with a capacity of more than 500 kilowatts within one electricity installation system.

Certificate of worthiness (SLO): An SLO is a supporting business licence that certifies the satisfaction of safety and worthiness requirements for the power plant operation, based on commissioning and testing performed by the authorised entity. The SLO must be issued by an accredited technical inspection institution, as appointed by and registered in the database of the MEMR. The type of SLO issued is based on the scale of the installation:

- an SLO for low-voltage installation; and

- an SLO for medium to high-voltage installation.

Environmental licences: Business actors engaging in the electricity supply business must comply with required environmental standards. Business actors must obtain an environmental approval from the central or regional government via the OSS RBL system. To obtain an environmental approval, the power company must obtain the following environmental assessment documentation:

- an environmental impact assessment (AMDAL);

- an environmental management efforts/environmental monitoring efforts (UKL-UPL); or

- an environmental management statement letter (SPPL).

The type of environmental assessment documentation required depends on:

- the type of power source; and

- the capacity of the power plant.

An AMDAL or UKL/UPL must be prepared by the initiator of a business activity (ie, the power generator) during the planning stage, depending on the relevant level of environmental impact. In this case, businesses with KBLI 35111 (power generation) must apply for:

- a UKL-UPL if their electricity generation capacity is less than 100 MW; and

- an AMDAL if it exceeds 100 MW.

Spatial utilisation suitability assessment: Business actors must:

- submit the location where they will conduct their power supply business to the OSS RBL system; and

- confirm that the location is properly zoned for the intended use.

Business actors must obtain a spatial utilisation suitability confirmation (KKKPR) or a spatial utilisation suitability approval (PKKPR), depending on the spatial utilisation activity location plan.

Business area stipulation: IUPTL holders must obtain a business area stipulation for the transmission, distribution and direct sale of electricity to end customers. IUPTL holders are limited to power generation, with the distribution of electricity to end customers handled by PLN.

Approval of the electricity supply business plan: Business area stipulation holders must submit an RUPTL to be approved by the director general of electricity under the MEMR, which will become the basis for:

- power supply business activities for public interest; and

- the purchase of electricity and/or lease of power grid from other IUPTLU holders.

3.3 Do these authorisations vary in respect of the location of the energy source, the location of the asset or the involvement of a foreign entity?

In general, the applicable authorisations provided to business actors are the same as those outlined in question 3.2 above through the OSS RBL system. However, these authorisations are issued by different authorities:

- The central government (ie, the MEMR) issues authorisations at the national level; and

- Local/regional governments manage projects at the provincial level.

The division of government affairs in the field of energy and mineral resources is governed by:

- Law 23/2014 regarding Regional Government; and

- Presidential Regulation 11/2023 regarding Additional Concurrent Government Affairs in the Field of Energy and Mineral Resources in the New Renewable Energy Sub-Field.

In essence:

- the central government is authorised to:

-

- determine work areas and energy pricing; and

- issue licences and other relevant documents at the national level; and

- regional governments are only authorised to issue relevant licences within their specific provinces.

In addition, most electricity generation activities in Indonesia are no longer restricted by foreign ownership limitations, save for electricity generation projects with a capacity of less than 1 MW, which are only open to domestic cooperatives and micro, small and medium enterprises. The minimum capital requirement for a foreign investment company is IDR 10 billion in paid-up capital.

3.4 What is the procedure for obtaining such authorisations? How long does this typically take? Who is responsible for issuing them?

As mentioned in question 3.2, the procedure for obtaining a general business licence (eg, NIB) and a specific operating licence for utility-scale renewables projects in Indonesia (eg, IUPTL, SLO and environmental licences) involves submitting an application through the OSS RBL system. The applicant will typically have to upload to the system:

- company information (eg, address and intended business activities); and

- general business plan data (eg, the status of land and building, the area of office space).

As utility-scale renewables projects are categorised as a high-risk business, in addition to obtaining an NIB and IUPTL, the applicant must also obtain several prerequisites through the OSS RBL system, such as:

- environmental (ie, AMDAL/UKL-UPL/SPPL) and spatial (ie, KKKPR and PKKPR) commitments; and

- an SLO as the supporting business licence.

The time required to obtain these licences varies; but once an applicant has completed all the required data and other prerequisites to obtain an IUPTL, the MEMR will verify the information within five business days of submission of the application and subsequently issue the IUPTL.

An IUPTLU is valid for a maximum of 30 years and may be extended; while an IUPTLS is valid for a maximum of 10 years and may also be extended.

An SLO may be issued by the MEMR or an accredited technical inspection institution. The issuance of an SLO for a low-voltage installation may take up to three business days after the submission of a complete application and the SLO will be valid for 15 years, which may be extended. The issuance of an SLO for a medium to high-voltage installation will take up to four business days and will be valid for 10 years, which may also be extended.

The prerequisite licences are typically those which take the longest to obtain, ranging from six months to a year, subject to the completion of the required documents. Once the submission is deemed complete, environmental licences are issued by:

- the Ministry of Environment and Forestry (MOEF) at the national level;

- the governor at the provincial level; or

- the regent/mayor at the regency/city level.

An AMDAL application will be examined no later than 50 business days after the submission of a complete application; while the process for examining a UKL-UPL application takes around three business days and the approval will be given no later than two business days after the examination process. An SPPL will be integrated into the business actor's NIB upon submission in around one business day. These environmental licences will be issued in the form of a recommendation and will be valid as long as the business continues to operate.

A KKKPR is issued within one day of submission of the application and payment of non-tax state revenue; and a PKKPR is issued no later than 20 days from the application submission and payment of non-tax state revenue by the Ministry of Agrarian Affairs and Spatial Planning/National Land Agency. Both are valid for three years. However, the timelines are as set out in the relevant regulation; whereas the process for obtaining these licences is usually longer in practice.

A business area stipulation is issued by the MEMR through the director general of electricity. The MEMR may conduct a site visit as part of the assessment prior to issuing the approval. MEMR Regulation 11/2021 on the Implementation of Electricity Business, which governs the procedure for the issuance of a business area stipulation, does not provide an indicative timeline for the process.

3.5 What are the key features of such authorisations, including any process for renewal and the rights and obligations of the holder?

Business actors may apply for an IUPTL renewal no later than 60 business days before the expiration of the current IUPTL. The MEMR will evaluate the renewal application, which must focus on the applicant's compliance with the requirement to submit IUPLTU implementation reports.

The SLO may be renewed following the same procedure as the initial application. The NIB and environmental licences (ie. AMDAL, UKL-UPL and SPPL) remain valid for as long as the relevant business continues to operate, so no renewal is needed.

The KKPR may be renewed once for two years for applicants which have not obtained the entirety of the land in accordance with the issued KKPR. This renewal can be applied for at the earliest three months before the expiration of the current KKPR. KKPR renewal is possible only if at least 30% of the approved land area has been acquired in one expanse in accordance with the assessment of the land office. The renewal process is done through the OSS RBL system.

3.6 Can these authorisations be transferred? If so, how and subject to what consents? Do any restrictions apply to the transfer?

The transfer of authorisations is prohibited. In general, all licences issued to conduct business are attached to the entity obtaining the licences.

3.7 What obligations apply in relation to decommissioning? How is this funded?

The issuance of Presidential Regulation 112/2022 on the Acceleration of Renewable Energy Development for Power Supply ('PR 112/2022') sets out decommissioning obligations which the government hopes will help to push the development of renewable energy in Indonesia. Notably, through PR 112/2022, the government has formally banned the development of new CFPPs, with certain exceptions (including CFFPs already included in the RUPTL).

Moreover, PR 112/2022 mandates that the MEMR should draw up an energy transition roadmap to accelerate the decommissioning of CFPPs. This roadmap should address the following issues:

- reducing greenhouse gas (GHG) emissions from CFPPs;

- accelerating the decommissioning of CFPPs; and

- ensuring policy alignment.

PR 112/2022 also mandates that PLN should draw up and implement a RUPTL optimising the development of renewable energy. During the implementation of the acceleration, PLN must take the following aspects into account:

- capacity;

- the age of the power plant;

- utilisation;

- GHG emissions;

- added economic value; and

- the availability of future technological support from domestic and foreign parties.

The government may provide fiscal support through a funding and financing framework including blended finance sourced from the state budget and other legitimate sources aimed at accelerating the decommissioning of CFPPs and the early termination of CFPP power purchase agreement (PPA) contracts with IPPs.

In addition, upon the launch of the Just Energy Transition Partnership (JETP) by Indonesia and the International Partners Group, $20 billion of funds will be mobilised through private and public financing mechanisms such as loans, grants, equity and guarantees. The Indonesian government aims that the JETP secretariat will finalise its investment plan by August 2023.

3.8 What are the main barriers to the development of utility-scale renewables projects in your jurisdiction?

There are a few identified aspects that can limit investment in and the development of renewable energy projects in Indonesia, as follows.

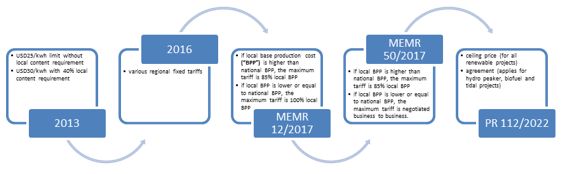

Changes in the regulatory framework: In recent years, the main regulatory framework for renewable energy development has gone through frequent changes. For example, in 2013, tariffs for selling renewable energy were limited to:

- $25 per kilowatt-hour (kWh) without a local content requirement; and

- $30/kWh with a 40% local content requirement.

Then in 2016, various regional fixed tariffs were implemented.

Under MEMR 12/2017:

- if the local base production cost (BPP) is higher than the national BPP, the maximum benchmark price is set at 85% of the local BPP; and

- if the local BPP is lower or equal to the national BPP, the maximum benchmark price is set at 100% of the local BPP.

However, MEMR Regulation 50/2017 provides that if the local BPP is lower than or equal to the national BPP, the maximum tariff benchmark price will be negotiated from business to business.

These frequent changes have hampered the business process, as the parties must make frequent adjustments. Under MEMR Regulation 50/2017, the benchmarking of renewable energy tariffs against production cost adds more uncertainty for investors, as the BPP is updated annually. Moreover, under PR 112/2022, the electricity purchase price for renewable projects is based on either:

- the staging ceiling price, which will be evaluated annually by the MEMR; or

- an agreement which is applied to hydro peaker, biofuel and tidal projects.

Bankability issues: The primary factor influencing the bankability of renewable energy projects is the power purchase agreement (PPA), as it outlines the terms for the entire project lifecycle, including in relation to:

- construction;

- financing;

- commercial operation;

- tariff; and

- termination.

Thus, the bankability of the project relies heavily on the tariff structure within the PPA, which takes into account factors such as:

- technology;

- operations;

- credit; and

- return on investment.

However, due to the diverse and relatively new nature of renewable energy technology compared to conventional energy sources, some commercial banks may need to familiarise themselves with renewable energy technology as reflected in the PPA in order to assess the bankability of a project.

Competing incentives: Since Presidential Regulation 10/2021 on Investment Business Fields came into effect, renewable energy projects now receive significantly improved incentives. However, the incentives for renewable energy projects still lag behind those provided for conventional energy projects. For example, Law 4/2009 regarding Mineral and Coal Mining, as amended by the Job Creation Law, and its derivatives, provide incentives in the form of:

- lengthy permit extension; and

- a 0% royalty.

These competing incentives are critical for the development of renewable energy – in particular with the tariffs for renewable energy still higher than those for CFPPs. Thus, more significant incentives must be provided to attract more investment to the renewable energy sector.

3.9 Environmental issues

- What environmental regulations or requirements must renewables generators in your jurisdiction observe on an ongoing basis (from pre-development to decommissioning)?

- What are the potential consequences of breach of these requirements – both for the renewables generator and for its directors, managers and employees?

- Which national and regional regulatory bodies are responsible for the enforcement of environmental obligations, and what is their general approach in regulating the renewables industry?

(a) What environmental regulations or requirements must renewables generators in your jurisdiction observe on an ongoing basis (from pre-development to decommissioning)?

Important regulations to observe include:

- Law 32/2009 regarding Environmental Protection and Management, as amended by Government Regulation in Lieu of Law 2/2022 regarding Job Creation ('Environmental Law');

- Government Regulation 22/2021 on the Implementation of Environmental Protection and Management ('GR 22/2021'); and

- MOEF Regulation 4/2021 on the List of Businesses and/or Activities Required to Secure an Environmental Impact Assessment ('MOEF Regulation 4/2021').

As mentioned in question 3.2, generally, each business activity requires either an AMDAL, a UKL-UPL or an SPPL, depending on the type of environmental compliance document required under MOEF Regulation 4/2021.

Renewable energy projects generally require an AMDAL, as provided under GR 22/2021. GR 22/2021 stipulates that an AMDAL is required for activities and/or business sectors that may have a significant impact on the environment, which includes renewable energy projects. The AMDAL requirement is dependent on the scale and potential environmental impact of the specific renewable energy project. Larger-scale renewable energy projects, such as hydropower plants and geothermal power plants, are typically subject to an AMDAL; while smaller-scale projects may be subject to a less comprehensive environmental assessment known as a UKL-UPL. For example, KBLI 35101, the KBLI number for electric power generation, requires:

- an AMDAL for solar power plants generating more than 50 MW;

- a UKL-UPL for projects generating 1 MW–50 MW; and

- an SPPL for projects generating less than 1 MW.

(b) What are the potential consequences of breach of these requirements – both for the renewables generator and for its directors, managers and employees?

A breach of environmental requirements can be subject to three types of liabilities – administrative, criminal and civil – pursuant to the Environmental Law and GR 22/2021.

Administrative liability: The government may impose administrative sanctions on business actors that violate the provisions regarding environmental management as stipulated in the business licensing and governmental approvals. This may take the form of:

- a written warning;

- coercive measures by the government;

- administrative fines;

- suspension of business licensing; and/or

- revocation of business licensing.

The MOEF will generally have an initial discussion with the business player before imposing administrative sanctions.

Civil liability: Any qualified party whose rights were violated or that suffered a loss due to the actions of the renewable energy generator in violation of environmental regulations may file a civil lawsuit against the company. There is no statute of limitations to file a lawsuit for environmental pollution or damage attributable to the use, production and/or management of hazardous waste.

Criminal liability: Imprisonment and fines due to breach of environmental obligations are governed under the Environmental Law and GR 22/2021 and these penalties can be imposed against the power generator. The duration of imprisonment and the amount of the fines will depend on the type of criminal action.

The Environmental Law imposes corporate criminal liability. Pursuant to Article 116(1), if the environmental crime is committed by, for or on behalf of the business entity, the penalty will be imposed on:

- the business entity; and/or

- any person that gave the order to commit such criminal activity or that acted as a leader in such crime.

If the crime was conducted by a person within the scope of his or her employment, the criminal sanction will be given to the person who gave the order or led the crime, regardless of whether the crime was committed together or individually. The perpetrator of a corporate crime in general is referred to as a 'functional perpetrator'. Individuals are subject to prosecution for corporate criminal liability – for example, the leader of the corporation who authorised and accepted the crime. Sanctions for individuals can take the form of imprisonment and fines, and additional penalties can be imposed on the corporation. Therefore, the directors, managers or employees of a renewable energy generator can be subject to criminal liability if deemed a functional perpetrator. If the criminal charge is directed at a functional perpetrator, any jail term or fine handed down by the court will be increased by one-third.

(c) Which national and regional regulatory bodies are responsible for the enforcement of environmental obligations, and what is their general approach in regulating the renewables industry?

The main national regulatory body responsible for enforcing environmental obligations in Indonesia is the MOEF, which oversees environmental policies and regulations relating to natural resources, pollution control and biodiversity conservation. At the regional level, the local/regional environmental management agency under the regional government is responsible for enforcing environmental regulations within its jurisdiction.

The MOEF may impose administrative sanctions if it deems that the regional government intentionally refused to impose administrative sanctions for serious violations of the protection and management of the environment. Therefore, should the MOEF determine that the regional environmental authority has not imposed appropriate sanctions, it may use its authority to impose sanctions.

In addition, pursuant to Article 94(1) of the Environmental Law, environment and forestry civil servant investigators and the police are authorised to carry out investigations of criminal cases relating to the environment. Upon completion of the investigation, the public prosecutor may bring the case to court and criminal sanctions may be imposed once the court has issued a decision.

In general, the regulatory approach to the renewables industry in Indonesia is to encourage its development while ensuring that environmental obligations are met. The government has introduced various incentives and initiatives to promote renewable energy, such as feed-in tariffs and tax exemptions. However, companies must also:

- comply with environmental impact assessment requirements;

- obtain the necessary permits and licences; and

- implement measures to minimise environmental harm.

3.10 Health and safety issues

- What key health and safety requirements apply to renewables projects in your jurisdiction and are there best practices in relation to health and safety that should be adopted?

- What are the potential consequences of breach of these requirements – both for the renewables generator and for its directors, managers and employees?

(a) What key health and safety requirements apply to renewables projects in your jurisdiction and are there best practices in relation to health and safety that should be adopted?

The main health and safety requirements are regulated under Ministry of Manpower Regulation 12/2015, as amended, regarding Electrical Occupational Safety and Health in the Workplace ('MOM Regulation 12/2015'), which implements Article 2(2)(q) and Article paragraph (1)(q) of Law 1/1970 on Occupational Safety. The implementation of electrical safety, as referred to in Article 2, aims to:

- protect the safety and health of workers and other people in the workplace from potential electrical hazards;

- create electrical installations that are safe and reliable, and that ensure the safety of the building and its contents; and

- create a safe and healthy workplace to encourage productivity.

Thus, the health and safety requirements under MOM Regulation 12/2015 cover the full range of the electricity business.

According to the regulation, the safety standards used refer to:

- Indonesian national standards;

- international standards; and

- even the national standards of other countries as determined by the labour inspector specialising in electrical occupational safety and health in the workplace.

Generally, renewable projects will be required to hire experts and technicians specialising in the fields of electrical occupational safety and health.

(b) What are the potential consequences of breach of these requirements – both for the renewables generator and for its directors, managers and employees?

As stipulated under Law 13/2003 on Manpower, the consequences of a breach may be criminal or administrative sanctions. Criminal sanctions are stipulated under Articles 183 to 190 and, depending on the type of breach, can range from:

- imprisonment for a minimum term of one month to a maximum term of five years; and/or

- a minimum fine of IDR 5 million and a maximum fine of IDR 500 million.

Under Article 190, administrative sanctions may take the form of:

- a rebuke;

- a written warning;

- restrictions/limitations on the business activities of the relevant enterprise;

- a freeze on the business activities of the relevant enterprise;

- cancellation of approval;

- cancellation of registration;

- the temporary suspension of the operations of certain or all production tools/instruments; and

- the abolishment/revocation of a licence or permission to operate.

MOM Regulation 12/2015 provides that breaches by business entities and persons acting as leaders/directors of the company will be sanctioned in accordance with Law 1/1970 on Occupational Safety and Law 13/2003 on Labour, as amended. Applicable sanctions include criminal and administrative penalties.

4 Distributed generation projects

4.1 What are the key differences in relation to small-scale distributed generation projects compared to utility-scale projects in your jurisdiction with regard to the regime discussed in question 3?

Small-scale distributed generation projects, also referred to as microgrids, are regulated under Ministry of Energy and Mineral Resources (MEMR) Regulation 38/2016 on the Acceleration of Electrification in Underdeveloped, Remote, Border Villages and Small Islands through Small-Scale Electricity Business Supply ('MEMR Regulation 38/2016').

Under MEMR Regulation 38/2016, a 'microgrid' is understood as an electricity provision business with a total maximum capacity of 50 megawatts, intended for undeveloped and remote rural areas, border villages and small inhabited islands. The implementation of a small-scale electricity business is categorised based on the source of funding (ie, with or without a government subsidy). If with a subsidy, the MEMR will require the business area stipulation to be tendered through a selection process by the governor of the relevant area after coordinating with PT Perusahaan Listrik Negara (Persero) (PLN). Once the designated business area has been established, the selected business actor is encouraged to provide its electricity supply from renewable sources. If a business actor uses renewable sources, it will be entitled to certain fiscal incentives such as a tax holiday and corporate income tax reduction. It will also propose to the MEMR the applicable pricing for supplying electricity.

If no business actor participates in the tender process for a microgrid, the governor may ask a regionally owned enterprise to implement the small-scale distributed generation project in the form of an electricity supply business licence (IUPTL) for public use.

4.2 What are the main networks that apply to small-scale distributed generation projects in your jurisdiction?

All electricity grids, including small-scale distributed electricity grids, are connected to PLN's grid as the main network, given that PLN – the state-owned electricity company – is the dominant actor in the electricity provision business in Indonesia. Moreover, the implementation of small-scale electricity business (with subsidy) requires the approval of PLN, further underlining PLN's significant role in small-scale distributed generation projects in Indonesia. Business actors (ie, independent power producers (IPPs)) are also allowed to operate a small-scale electricity provision business for their own use, as long as IPPs with power plants with a capacity of more than 500 kilowatts within one electricity installation system have obtained an IUPTL for self-use.

5 Taxes and incentives

5.1 What national, regional and/or local incentives are available as subsidies or support to facilitate the deployment of renewables projects in your jurisdiction?

Presidential Regulation 4/2016 and Presidential Regulation 112/2022 regarding the Acceleration of Renewable Energy Development for Electricity Generation ('PR 112/2022') set out the incentives available for renewables projects. The regulations stipulate that renewables projects are eligible to obtain:

- fiscal incentives in the form of tax relief, as also discussed in question 5.2; and

- non-fiscal incentives, as stipulated below.

Fiscal incentives may take the form of:

- income tax facilities in accordance with the provisions of laws and regulations in the taxation sector;

- import facilities in the form of exemptions from import duty and/or tax in the context of imports in accordance with the provisions of laws and regulations in the taxation and customs sectors;

- land and property tax facilities in accordance with the provisions of laws and regulations in the taxation sector;

- geothermal development support; and/or

- financing support and/or guarantee facilities through state-owned enterprises assigned by the government.

In general, Article 31A(1) of Law 7/1983 on Income Tax, as amended several times – most recently by Law 7/2021 on the Harmonisation of Tax Regulations – provides that for a business entity to be granted tax incentives, the business entity must either:

- conduct certain business activities; or

- be located in certain areas granted national priority status.

In general, Articles 4(4) and 4(5) of Presidential Regulation 10/2021 on Investment Business Fields provide that a business entity conducting certain business activities codified in Annex I may be granted the following tax incentives:

| Tax incentives | Remarks |

| Tax allowance |

This tax incentive comprises:

|

| Tax holiday |

This tax incentive comprises a reduction in the corporate income tax in the following ranges:

|

| Investment allowance |

This tax incentive comprises a reduction in corporate income tax and net income reduction facilities for the purpose of investment and reduction of gross income for the purpose of certain activities, including:

|

Renewables projects may be carried out within a special economic zone (SEZ). Pursuant to Article 2(1) of Ministry of Finance (MOF) Regulation 237/2020, a business entity conducting business activities (either for its main business office or a branch office) in an SEZ will be granted the following tax incentives:

| Tax incentives | Remarks | ||||||||||

| Tax holiday |

This tax incentive comprises a reduction in corporate income tax in the range of:

After the applicable time period has lapsed, there will be an additional 50% reduction in corporate income tax for the next two years. |

||||||||||

| Tax allowance |

This tax incentive comprises:

|

In respect of tax incentives in an SEZ, Article 2(2) of MOF Regulation 247/2020 provides that only business entities that are conducting business activities classified as the main activities of the SEZ or other activities in the SEZ may be granted tax incentives.

5.2 Are any tax reliefs available for investment in renewables projects?

The fiscal incentives that are applicable to renewables projects are as follows:

- an income tax facility in the form of:

-

- a 30% deduction of net income of investment value for six years;

- accelerated depreciation of tangible assets and accelerated amortisation of intangible assets;

- a 10% dividend withholding tax concession; and

- compensation for losses (for micro and mini power plants with an investment value of less than IDR 100 billion);

- an exemption from import duties for geothermal activities; and

- facilities for income tax, value-added tax and import duty for capital goods.

5.3 Have there been any interventions affecting renewables projects in terms of their ability to be constructed or operated, or their ability to earn revenue, in your jurisdiction?

As mentioned in question 3.8, there have been some interventions in Indonesia that have affected renewable energy projects in terms of their ability to be constructed and operated or to earn revenue, including the following:

- Changes to the regulatory framework: Indonesia has undergone regulatory and policy changes impacting the renewable energy sector – for instance, changes to feed-in-tariff (FIT) rates, which are the tariffs paid to renewable energy generators for the electricity they produce. These frequent changes may hamper the business process, as parties must make frequent adjustments.

- Delays in obtaining permits and licences: The permitting process for renewable energy projects in Indonesia can sometimes be complex and time consuming, leading to delays in project development. This can affect the ability to construct and operate renewable energy projects, and can impact their revenue generation potential. Delays in obtaining necessary permits and licences can also result in increased project costs.

- Grid connection challenges: Renewable energy projects need to be connected to the power grid to sell electricity. In Indonesia, grid connection challenges, such as limited grid capacity and a lack of adequate grid infrastructure, can affect the ability of renewable energy projects to operate and generate revenue. Grid connection issues can result in delays and additional costs for project developers.

In recent years, the main regulatory framework for renewable energy development has gone through frequent changes, as follows:

As the above regulations include the tariff for selling renewable energy, which is one of the primary investment considerations, these frequent changes have hampered the business process, as the parties must make frequent adjustments. Under Ministry of Energy and Mineral Resources Regulation 50/2017 on the Utilisation of Renewable Energy for the Production of Electricity, the benchmarking of renewable energy tariffs against production cost adds more uncertainty for investors, as the base production cost is updated annually. Moreover, under PR 112/2022, the electricity purchase price for renewable projects is based on either:

- the staging ceiling price, which will be evaluated annually by the MEMR; or

- an agreement which is applied to hydro peaker, biofuel and tidal projects.

Competing incentives: Since the enactment of Presidential Regulation 10/2021 on Investment Business Fields, renewable energy projects have been entitled to considerably better incentives. However, the incentives for renewable energy projects still trail those provided for conventional energy projects. For instance, Law 4/2009 on Mineral and Coal Mining and its derivatives provide incentives in the form of:

- a lengthy permit extension; and

- a 0% royalty.

These competing incentives are critical for the development of renewable energy – in particular with the tariffs for renewable energy still higher than those for coal-fired power plants. It is thus crucial that significant incentives be provided to attract more investment in renewable energy.

5.4 What other incentives are available to promote the development of the renewables industry in your jurisdiction?

Please refer to question 5.1. In addition, to incentivise entities to contribute to Indonesia's renewable energy target, the government allows:

- companies in the renewable energy sector to participate in the carbon market; and

- renewable energy certificates (RECs) to be traded to the public.

Regarding carbon markets, the Ministry of Environment and Forestry (MOEF) has enacted MOEF Regulation 21/2022 on the Implementing Governance of Carbon Pricing, which provides mechanisms and guidelines for carbon markets in Indonesia. Specifically for the carbon market in the energy sector, the MEMR has enacted MEMR Regulation 16/2022 on Implementation Procedures for Carbon Pricing in the Power Plant Sub-Sector ('MEMR Regulation 16/2022'), which provides the outline of the carbon market specifically for power plants. Under MEMR Regulation 16/2022, renewable energy power plants are included as a party to the Indonesian carbon market. In effect, renewable energy companies will be able to sell their carbon units to other parties, which may serve as a commercial incentive to promote the development of the renewables industry.

PT Perusahaan Listrik Negara (Persero) (PLN) has also initiated the trade of RECs. Currently, there is no regulatory framework in place for RECs, but PLN has issued PLN RECs from three of its renewable power plants with a total capacity of 350 megawatts and a quota of 916,334 RECs. These RECs must be purchased through PLN's website. Although the trade of RECs is currently conducted only by PLN, it is a sign that in the future, private companies in the renewable energy sector may sell their RECs to the public.

6 Financing structures

6.1 Is debt financing typically used and are there any particular structures that are common for renewables projects in your jurisdiction?

Government-backed projects primarily rely on funding from the state budget, supplemented by financial assistance from international development agencies and other sources of financing from PT Perusahaan Listrik Negara (Persero) (the state-owned electricity company), such as bank loans and bonds. Independent power producer projects are mainly financed by sponsors through capital injection and loans from commercial banks or development institutions.

According to the Indonesian Energy Transition Outlook (IETO) 2023, there has also been growth in more innovative financing, as follows:

- Global energy transition investment: Globally, there has been a rising trend in the growth of clean energy investment, which is expected to make up to two-thirds of total global energy investment.

- Green bonds and green sukuk: Since 2018, the government has offered green bonds and green sukuk to finance or refinance eligible green projects, including renewables projects. As of 2021, the renewable energy sector had received $153 million in such financing.

- Blended finance: Blended finance is catalysed by instruments such as;

-

- concessional capital;

- risk insurance;

- technical assistance funds; and

- design stage grants.

- Municipal bonds: Ministry of Finance Regulation 111/2012, as amended, allows local governments to issue municipal bonds to fund public infrastructure. A Climate Policy Initiative study on renewable energy finance identified the Indonesian capital, Jakarta, and the provinces of West Java, Central Java, East Java and Bali as localities with the greatest potential to generate municipal bonds to finance renewable energy projects.

- Bilateral financing: Ten countries that have committed to finance Indonesia's energy transition efforts through:

-

- financial and technical assistance;

- grants;

- collaborative projects; and

- other pledges and investment plans.

- In total, the financial support from such countries amounts to $14 billion, equal to around 35% of the total projected financing required by 2025.

Common structures for the financing of renewables projects include:

- loans provided by international development agencies and international banks; and

- loans provided by state-owned banks via syndication.

6.2 What are the advantages and disadvantages of these different types of structures?

The main advantages of loans include the following:

- Monthly payments do not normally fluctuate according to interest rate changes; and

- Loans from international development agencies will be provided to the state, which will then provide them to generators. Accordingly, generators do not have to deal directly with the lender, with the condition that generators should fulfil the applicable conditions in the agreement.

The disadvantage of loans is that generators are bound by terms imposed by international development agencies and even the banks providing the loans.

Bonds generally have a lower interest rate than loans and do not come with the restrictions that exist in loan covenants. However, bonds must be paid in full at the bond's maturity. Furthermore, as green bonds issued by local commercial banks are not common in Indonesia, it is more difficult to access green bonds in comparison to loans.

The innovative financing options mentioned above are capable of supporting renewable energy deployment in Indonesia. Blended financing – in particular, public guarantees and risk insurance – has been found to directly or indirectly attract private investors to renewables projects. However, the interest rate is not sufficiently attractive to encourage investors to provide funding through this mechanism. While interest rates for green financing are similar to conventional financing, building a renewable energy infrastructure can carry more risk. However, some investors may still choose to invest in green sectors due to the perceived low risk associated with government involvement in the financing system.

6.3 What other considerations and concerns should parties bear in mind when deciding on a financing structure for a renewables project?

In deciding the financing structure for new and renewable energy projects, the parties must bear in mind the available financial sponsors – particularly:

- their payback period;

- interest rates; and

- specific tax benefits/incentives.

As stated in the IETO 2022, customers have found that current financing options are unattractive due to the high interest rates provided by local banks, thus making the investment cost higher.

6.4 What main financing institutions are active in your jurisdiction?

Renewable energy projects in Indonesia are typically funded by various sources, including:

- commercial banks;

- development financing institutions such as:

-

- the World Bank; and

- the Asian Development Bank (ADB);

- other green financing institutions; and

- local infrastructure financing entitie, such as:

-

- PT Sarana Multi Infrastruktur; and

- PT Indonesia Infrastructure Finance.

Some of these financing institutions have dedicated green financing platforms specifically for environmentally friendly projects, including renewable energy projects.

6.5 Which financing markets are usually turned to for sources of debt in your jurisdiction, (eg, local, London, New York)?

International entities, including international development agencies and international banks, are commonly turned to for sources of debt in Indonesia. GCF and GEF Trust Fund are the most notable international funders that have provided financing for renewables in Indonesia, including capacity building on project preparation. As of November 2021, GCF had approved approximately $453.9 million for renewable energy projects in Indonesia.

Aside from this, significant funding has been provided by multilateral organisations such as the World Bank and the ADB. The ADB, in particular, has provided around $1.5 billion in project loans for renewable energy projects in Indonesia from 2015 to 2020.

There are also bilateral donors from various countries that are contributing to the financing of Indonesia's energy transition, such as:

- Norway, through the Sustainable Landscape Multi-Donor Trust Fund; and

- Japan, through the Joint Crediting Mechanism (JCM). As of June 2021, the JCM financing programmes had supported the implementation of 34 projects and 37 technologies in Indonesia amounting to JPY 26.7 billion.

7 Transmission, distribution and export

7.1 What are the applicable processes for connecting renewables projects with transmission, distribution and export networks in your jurisdiction? Do these processes differ between different types of renewable technologies and between renewables and non-renewable projects?

Generally, the current applicable processes for connecting renewables projects and non-renewables projects are the same. The government will typically assign PT Perusahaan Listrik Negara (Persero) (PLN) to run the business, which includes:

- power transmission;

- distribution; and

- export networks.

PLN will either:

- conduct the tasks on its own;

- assign them to its subsidiaries; or

- conduct the tasks in cooperation with independent power producers through power purchase agreements or other transmission networking agreements.

Based on Ministry of Energy and Mineral Resources (MEMR) Regulation 11/2021 on the Implementation of Electricity Business ('MEMR Regulation 11/2021'), business entities supplying electricity (generation, transmission, distribution and/or sale of electricity) must obtain an IUPTL for public use (IUPTLU).

Under the New and Renewable Energy (NRE) Bill, business actors will be permitted to export renewable technologies that are subject to export levies if they have obtained the applicable business licence (with administrative, technical, environmental and financial requirements). In addition, business actors can export all electricity generated from renewable technologies (rooftop solar power plants).

Cross-border electricity transactions are also allowed. Pursuant to Article 36 of MEMR Regulation 11/2021, the cross-border sale, purchase and transmission of electricity are allowed if:

- the local electricity demand has been met;

- the electricity tariff does not contain a subsidy; and

- such cross-border transaction does not interrupt the quality and reliability of electricity supply within such business area.

Indonesia and Singapore have signed a memorandum of understanding regarding electricity sourced from renewable technologies exported from Indonesia to Singapore by companies such as:

- PT PLN Batam;

- PT Medco Power;

- PT Indonesia Power;

- PT Pertamina (Persero); and

- BP Batam.

In 2022, the average electricity export from Indonesia to Singapore was 100 megawatts (MW) and the peak is predicted to reach 600 MW.

7.2 What requirements and restrictions apply to the export of renewable energy onto the network?

While MEMR Regulation 26/2021 on Rooftop Solar-Power Plants Connected to Electrical Power Networks of Holders of Business Licenses for the Provision of Electrical Power for the Public Interest ('MEMR Regulation 26/2021') allows the export of all electricity from rooftop solar power plants against the applicable utility bill, there are challenges to realising such exports in practice. The MEMR and PLN are finalising the technical instructions for MEMR Regulation 26/2021 to determine capacity limitation. The main consideration for such capacity limitation is the relevant user's minimum load to avoid overcapacity on the grid. Due to such challenges, the government of Indonesia is in the process of amending MEMR Regulation 26/2021.

Despite the regulation permitting renewable energy exports, the government announced in 2022 that it would temporarily suspend new and renewable energy (NRE) exports and prioritise domestic demand, as the country's clean energy mix for electricity is only at 11.7% despite the 23% target by 2025. In addition to allowing the export of electricity generated from renewable resources, the government is focused on developing the solar panel industry to increase potential investment.

Under the NRE Bill, the government is set to prioritise the domestic utilisation of NRE products and potential in Indonesia, by using Indonesian manpower, domestic technology, materials and other components related to renewable energy. Notwithstanding the foregoing, there are renewables projects aimed at exporting electricity.

7.3 What other considerations and concerns should be borne in mind in relation to the transmission, distribution and export of renewable energy in your jurisdiction, including participation in ancillary services, wholesale electricity trading markets, network charging arrangements specific to renewables and the ability to construct part of the connection infrastructure? Are there long queues and delays for connection?

The transmission, distribution and export aspects of the renewables industry in Indonesia are still wholly regulated and arranged by PLN as the state-owned electricity company. There is no specific regulatory framework in place for such aspects, save for the temporary export bans in Indonesia as explained in question 7.2, as the government looks to prioritise the domestic utilisation of NRE to reach its clean energy mix target. Specifically for the solar sector, a regulation on rooftop solar licensing explicitly stipulates that up to 100% of the installed solar photovoltaic (PV) can be generated. However, PLN has unofficially announced a policy that limits the amount of power that can be generated from a rooftop solar project to 15% of solar PV capacity that is constructed and installed in PLN's business area. The current bans in place and the legal uncertainties could pose a challenge for renewables generators planning to enter the Indonesian renewables markets.

7.4 Are there any initiatives, reforms or consultations relating to the connection of renewables projects?

The government has launched a few initiatives relating to the connection of renewables projects provided under:

- the National Mid-Term Development Plan;

- the National Energy Policy; and

- the National Energy Plan.

The plan is to reach a renewable energy share of 23% by 2025 and 31% by 2050. The government is currently trying to accelerate these targets, or at the very least ensure that it reaches its 2025 target; although Indonesia's clean energy mix for electricity was still at 11.7% in 2022.

8 Storage

8.1 What processes and rules apply to parties wishing to construct and operate a storage (eg, battery, hydrogen, hydro) project in your jurisdiction?

There is no specific regulatory framework in place for energy storage. However, some renewables projects have been developed in Indonesia which incorporate an energy storage system. Projects currently in the development pipeline that plan to use an energy storage system include:

- the Cisokan hydropower plant;

- the Lampung solar power plant; and

- the Tanah Laut wind power plant.

8.2 Are there any barriers to the development of storage projects in your jurisdiction?

In 2010, the government, through PT Perusahaan Listrik Negara (Persero) (PLN), initiated the development of energy storage projects in Indonesia – specifically, the construction of pumped storage hydropower system for a hydroelectric power plant (PLTA) in Cisokan, West Java. Initially, this project was expected to begin operation in 2014, but that has been delayed by various issues. One of the main issues causing the delay in the operation of the project was clearing the land for the construction of the project. The Cisokan PLTA Project is expected to begin operation in 2025/2026. This underlines that a key issue for energy storage projects in Indonesia is clearing the land, which can cause lengthy delays in operation dates.

Also, a lack of funding from the private sector for energy storage projects is discouraging private investment in the sector. The same issues as apply to the development of renewable energy also apply to energy storage projects, with investors having to consider that energy storage projects are a long-term, high-risk investment that requires significant funding.

8.3 What other considerations and concerns should be borne in mind in relation to the development of storage projects in your jurisdiction?

The main considerations and concerns relating to the development of storage projects are:

- the absence of regulatory provisions relating to energy storage; and

- frequent changes in the regulatory framework for the energy sector, including changes to the tariffs for selling renewable energy.

Due the absence of existing regulations pertaining to energy storage, coupled with frequent regulatory changes, it is unclear whether specific licences will be required for storage projects. The absence of existing regulations may also mean a lack of legal certainty for private investors in energy storage projects.

Further, frequent changes to tariffs could force private investors to make frequent financial adjustments, which may adversely affect them. As of 2023, the latest energy storage project pioneered by PLN – the Cisokan PLTA Project – was estimated to have cost over IDR 8 trillion. Bearing in mind the high cost of storage projects, the frequent changes in energy sector regulations and tariffs for selling renewable energy must be considered, as tariffs are one of the main sources of return on investment for investors.

9 Competition

9.1 Are there any dominant players, including dominant purchasers, in the renewables industry in your jurisdiction?

PT Perusahaan Listrik Negara (Persero) (PLN) continues to maintain its dominant position as the primary purchaser in the renewable energy industry. This is further reinforced by the obligation outlined in Ministry of Energy and Mineral Resources Regulation 50/2017 on the Utilisation of Renewable Energy for the Production of Electricity for PLN to procure electricity from power plants that utilise renewable energy sources. PLN dominates as a purchaser, as it is mandated by the Electricity Law to carry out the electricity supply businesses, which encompass electricity supply, transmission, distribution and sales all over Indonesia. The Electricity Law gives PLN the priority and the designated business areas to conduct such electricity business activities across the country. As the holder of the business areas, PLN has the exclusive privilege to sell electricity to end customers. These provisions have created a restrictive market structure in Indonesia's electricity sector, especially for private entities. Although the Electricity Law permits the participation of private entities in electricity supply businesses, their role is considered as supplemental to PLN's role as the holder of the business areas.

The development of power plant infrastructure is a capital-intensive investment. With due consideration to the mandatory market structure, besides building power plants on its own, PLN often procures electricity from independent power producer (IPP) plants through 20 or 30-year power purchase agreements (PPAs). Sometimes, such PPAs allow PLN to own or buy-out the power plant either at the end of the PPA period or when the agreement is terminated. Most of the main business actors behind the IPPs from which PLN purchases electricity are major energy foreign investors. Occasionally such foreign investors partner up to set up a joint venture with local business actors, whether as an entirely private entity or a PLN subsidiary.

The dominant power generators in Indonesia's renewable energy sector are as follows:

- The largest hydropower plant project – with a total capacity of 1 gigawatt – is PTLA Cirata, developed by PT Pembangkitan Jawa Bali, a subsidiary of PLN.

- PLTS Likupang is considered the largest solar power plant in Indonesia. It started operating in 2019 with a total capacity of 15 megawatts (MW) and was developed by Vena Energy.

- PT UPC Sidrap Bayu Energi developed the first commercial wind power plant in Indonesia, known as PLTB Sidrap. It has a total capacity of 75 MW and has been operational since 2018.

- The largest biomass power plant is being constructed by PT Rezeki Perkasa Sejahtera Lestari in West Kalimantan. It has a planned total capacity of 15 MW, compared to PLTB Bambu Siberut, which has a capacity of 700 kilowatts.

The following players are dominant in the geothermal power sector:

- PT Star Energy Geothermal Salak has developed a geothermal power plant with a total capacity of 377 MW, known as PLTP Salak. PT Star Energy Geothermal owns PLTP Wayang Windu and PLTP Darajat, each with a total capacity of over 200 MW.

- PT Pertamina Geothermal has more than five geothermal power plants, although their total capacity is not as large as that of the PT Star Energy Geothermal plants.

- PLTP Sarulla was developed by Sarulla Operation Ltd and is considered the largest geothermal power project in Indonesia with a single PPA operating under an IPP scheme.

9.2 Are there any pro-competition measures that are targeted specifically at renewables generators?

New and renewable energy (NRE) projects can be 100% owned by foreign parties, as provided by Presidential Regulation 10/2021 on Investment Business Fields, which allows foreign parties to participate easily in the sector. This will create more incentives for foreign investment in the renewable energy sector.

The National Energy Council through the Energy Law and the subsequent adoption of the National Energy Policy introduced several pro-competition measures to the sector. The policy represents a paradigm shift in energy management, focusing on the utilisation of energy resources to guarantee national energy supply. Furthermore, the utilisation of NRE will be maximised, and non-renewables as well as fossil energy exports will be gradually reduced. Finally, the National Energy Policy sets out the energy mix targets for 2025, as explained in question 2.3.

10 Disputes

10.1 In your jurisdiction, do disputes typically go to arbitration or litigation, and does this vary for different types of disputes? What sorts of matters tend to come up in disputes?

Ministry of Energy and Mineral Resources Regulation 10/2017 on the Principles of Power Purchase Agreements (PPAs) requires that a PPA between PT Perusahaan Listrik Negara (Persero) (PLN) and an independent power producers (IPP) include tiered dispute resolution provisions. In effect, the typical dispute resolution mechanism in the renewables sector is comprised of a tiered dispute resolution process involving:

- consultation;

- negotiation;

- mediation;

- conciliation; and

- expert evaluation.

In the event of a dispute between PLN and an IPP, the parties must first try to settle the dispute through amicable discussions. Should the parties fail to reach a settlement, the preferred dispute settlement forum will depend on the preference of the parties. In practice, PPA and large-scale engineering, procurement and construction contracts refer to arbitration centres – such as the Singapore International Arbitration Centre or the Indonesian National Board of Arbitration – as their dispute resolution forum. Some matters relating to the renewables industry that come up in disputes concern the development of power plants, including tendering, financing and licensing.

10.2 Have there been any important disputes in the public domain that relate to or may potentially impact on the renewables industry or the deployment of renewables projects?

Some of the important disputes in the renewables industry have concerned the development of geothermal power plants. These include:

- PT Geo Dipa Energi v PT Bumigas Energi (Dieng-Patuha Geothermal Power Plant), in which Bumigas failed to finance the development of the power plant as agreed in 2018; and

- a 2018 bribery case in connection with the development of PLTU Riau I involving a now former president director of PLN, Sofyan Basir.

There may be other disputes relating to the renewables sector that might not have been made public or that were settled in arbitration or through mediation, which are confidential in nature. The development of the Batang Toru hydropower plant has not been the subject of an official dispute but it has received much negative attention from the public, with claims the plant is built in a protected area and could threaten orangutan habitats and damage the environment.

Two notable cases from the 1990s concerned Karaha Bodas Company (KBC) and Himpurna California Energy. KBC was granted contractual rights to develop a geothermal electricity project and entered into:

- a joint operation contract with Pertamina, under which KBC, as the contractor, was required to develop geothermal energy and build, own and operate electricity-generating facilities; and

- an energy sales contract (ESC) with Pertamina and PLN, under which PLN was required to purchase electricity generated by the project.

Similar to KBC, Himpurna entered into an ESC with PLN under which Himpurna was required to supply PLN with electricity from a geothermal field and make a large investment in wells, plant and other infrastructure. However, the Asian financial crisis hit in 1997 and the government issued presidential decrees in 1997 and 1998 to safeguard the national economy, and both projects were suspended because PLN and Pertamina could not perform their contractual obligations. Both KBC and Himpurna filed notices for arbitration and sought the termination of the relevant contracts and awards of damages.

11 Trends and predictions

11.1 How would you describe the current renewables landscape and prevailing trends in your jurisdiction?

Currently, the government is trying to achieve its goal of having renewable energy make up at least 23% of the total energy mix by 2025 and 31% by 2050 by introducing regulations that are favourable to new and renewable (NRE) energy in the form of:

- greater fiscal and non-fiscal incentives for NRE projects; and

- policies that would ease the development of projects such as the construction of NRE energy power plants.

In an attempt to further incentivise business actors to contribute to the renewables landscape, the government has provided commercial incentives such as allowing:

- business actors to participate in the carbon market; and

- renewable energy certificates (RECs) to be traded to the public.

Following these incentives, the government plans to develop a roadmap for the phaseout of coal-fired power plants (CFPPs).

With regard to the emergence of NRE energy projects, there has been increased development of solar power photovoltaic (PV) projects. According to the Indonesian Energy Transition Outlook (IETO) 2022, three floating solar PV projects have been announced:

- the 40-megawatt project at Nadra Krenceng reservoir; and

- two projects on Batam Island with a total capacity of 2.5 gigawatts.

Regardless, investment in NRE has remained low, below the amount required to achieve national targets.

11.2 What influence are net zero commitments having on the development of the renewables industry in your jurisdiction?

Following the declaration of its net-zero commitments, Indonesia is committed to its mission to reduce carbon emissions to maintain global temperatures by increasing its enhanced nationally determined contribution to 32% from the previous 29%. Indonesia also adopted a carbon tax, as introduced by Law 7/2021 on the Harmonisation of Tax Regulations and Presidential Regulation 112/2022 regarding the Acceleration of Renewable Energy Development for Electricity Generation ('PR 112/2022'), which provide policies that are pro NRE, such as:

- the phaseout of CFPPs;

- a ban on new coal-fired power plants except the CFPPs included in PT Perusahaan Listrik Negara (Persero)'s (PLN) Electricity Supply Business Plan; and

- incentives for NRE projects.