A brief on significant legal developments in Turkey

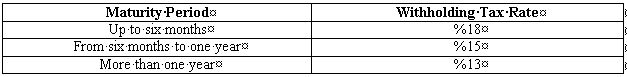

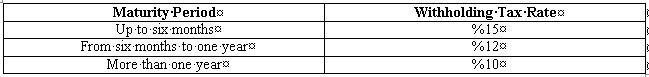

The withholding tax rates on interest paid for time deposits and premiums paid for participation accounts are determined based on the maturity period and the currency of the deposit, pursuant to the Council of Ministers Decree No. 2012/4116 (published in the Official Gazette in January 1, 2013 and No. 28515), which amended the Council of Ministers Decree No. 2006/10731 (published in the Official Gazette in July 23, 2006 and No. 26237). Please find below the new withholding tax rates;

- Interest paid for foreign currency deposits and premiums paid for the foreign currency participation accounts will be subject to below withholding tax rates;

- Interest paid for Turkish currency deposits and premiums paid for the Turkish currency participation accounts will be subject to below withholding tax rates;

Please note that the above stated rates are applicable to interests and premiums which will be paid for checking accounts and private checking accounts the day after the publication date of the above mentioned Decree, dated 02.01.2013.

Please note that the above stated rates are applicable to interests and premiums paid for deposit accounts, which are opened or its maturity date renewed, after the day following the publication date of the above mentioned Decree, dated 02.01.2013.

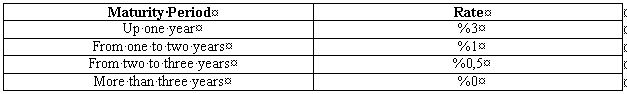

New Rates of Resource Utilization Support Fund on Loans

Pursuant to the Council of Ministers Decree No 2012/4116, Resource Utilization Support Fund (published in the Official Gazette in August 26, 2006 and No. 20264) (the "RUSF") rates are determined with regard to loans granted by foreign institutions as foreign currency and gold to Turkish residents other than banks and financial institutions. The rates are stated below;

Please also note that the above stated RUSF rates are applicable to the loans which are granted the day following the publication date of the above Decree, dated of 02.01.2013.

Corporate Income Tax Circular No.26

Pursuant to Corporate Income Tax Circular No. 26 (dated 12 January 2013), the servers, which are used by the foreign investors during sale and purchase transactions performed in TURKDEX (Turkish Derivatives Exchange) and/or ISE (Istanbul Securities and Stock Market) based on the brokerage agreements signed with Turkish resident companies will not be deemed as permanent establishment.

Taxation of Foreign Investment Funds

Following the changes made by Law No. 6322 (published in the Official Gazette dated June 15, 2012 and No. 28324) to the Corporate Income Tax Code (Law No. 5520) (published in the Official Gazette dated June 21, 2006 and No. 26205) (the "CIT Code"), further clarifications have been provided by the Communique No. 7 (published in the Official Gazette dated December 31, 2012 and No. 28514) with regard to the taxation of foreign investment funds and portfolio management companies.

Pursuant to the explanations provided under Communique No. 7, portfolio management companies will not be deemed as permanent establishment of the foreign investment funds if the below conditions are met, with regard to income which is derived through the below stated instruments;

- All kind of securities and capital market instruments,

- Derivative exchanges,

- Warrants,

- Foreign currency,

- Derivatives based on commodity,

- Credits and similar financial instruments,

- Commodities traded under precious metal exchanges.

Please find below the conditions to be met in order to benefit from the above stated regulation;

- The transactions which are conducted on behalf of the foreign investment fund by the portfolio management company shall fall under the customary services of the portfolio management company,

- The relationship between the foreign investment fund and the portfolio management company shall be similar to a relationship between two independent parties,

- The cost of the portfolio management services shall be at an arm's length price and a transfer pricing report shall be submitted,

- The portfolio management company shall not have more than %20 shareholding interest in the foreign fund.

Venture Capital Funds

Pursuant to Article 325/A of the Tax Procedure Code (Law No. 213) (published in the Official Gazette dated January 10, 1961 and No. 10703 - 10705) (the "TPC"), which was amended by Law No.6322, taxpayers who are subject to corporate income tax are allowed to allocate funds from the income of the relevant financial year, in order to invest as capital into venture capital investment companies and to purchase shares of venture capital investment funds in that financial year.

Also, pursuant to Article 10 of the CIT Code, which was amended by Law No.6322, venture capital fund allocated by the taxpayers could be deducted from the corporate income tax base. Please find below the conditions in order to benefit from such deduction right;

- The venture capital fund which is allocated in the relevant financial year shall not exceed %10 of the income declared for that financial year, and the total of the venture capital fund shall not exceed %20 of the equity (please note that both conditions shall be fulfilled on the same time),

- The allocated venture capital fund shall be invested, in the relevant financial year, in venture capital investment companies or funds established or will be established in Turkey which are subject to the supervision of the capital markets board,

- The venture capital fund shall be separately stated on the corporate income tax return

E-Invocing

Pursuant to Communique No. 421 of the TPC the use of the electronic invoice and the electronic commercial books has become compulsory for the below stated taxpayers.

- Taxpayers who have mineral oil license in accordance with to Law 5015 (Petroleum Market Law) (published in Official Gazette in 20 December, 2003 and No. 25322) and taxpayers who purchase goods from the preceding taxpayers and who has the gross sale of TL 25.000.000,

- Taxpayers who produce, process and/or export goods which are under the List No.3 of the Special Consumption Tax Law and taxpayers who purchase goods from the preceding taxpayers and who has the gross sale of TL 10.000.000.

- in addition to the above stated taxpayers, if the both seller and the buyer of a trade prefer or are obliged to use e-invoice, the taxpayers are obliged to issue e-invoice in their transactions performed between each other.

The gross sale amount to determine whether a taxpayer falls under the scope of e-invoice is the one stated at the balance sheet of the taxpayers. It is also clarified that the sector is not important to be subject to obligatory e-invoice application for the taxpayers stated under (c) above. For the determination of the gross sale, the 2011 financials of the taxpayers will be considered.

It has been also stated in the Communique No.421, the mandatory use of e-invoice will come into force in 1 September, 2013 and the mandatory of the use of e-commercial books will come to force in 1 September, 2014.

Tax authority has issued the TPC circular No. 58 (dated 8 February 2013) in order to provide further explanations and clarifications with regard to the TPC Communique No. 421. According to the circular No.58, only the purchase of goods will trigger the mandatory use of e-invoice, and the purchase of the services will not trigger the mandatory use of e-invoice.

Advance Ruling

TPC Communique No. 425 (published in the Official Gazette dated March 27, 2013 and No. 28600) contains additional explanations regarding Article 140 of the TPC. Pursuant to Article 140 of the TPC, tax inspectors are not allowed to conduct assessments contrary to laws, decrees, regulations, communiques and circulars. Pursuant to Communique No. 425, assessment committees, which evaluate the assessment reports prepared by the tax inspectors, shall also take advance rulings into consideration. Accordingly, tax inspectors will be take advance rulings into consideration in their tax inspections since the tax inspection reports contrary to any advance ruling issued by the commission will be returned to the tax inspector by the assessment committee.

New Value Added Tax Rate for Residences

Pursuant to Article 7 of the Council of Ministers Decree No. 2012/4116, value added tax rates are re-determined for residences, depending on their square meters, the kind of the material used in the construction and the location. Four criteria have been regulated by the Council of Ministers in order to determine the VAT rate of a residence. If a residence meets any of the regulated criteria, a VAT rate of %8 or %18 could be applicable. These criteria are stated as below:

- Whether a residence is placed in a state which is subject to a metropolitan municipality pursuant to Metropolitan Municipality Law Code (Law No. 5216) (published in the Official Gazette dated July 23, 2004 and No. 25531),

- Whether a building is classified as luxury or first class building pursuant to the "Table regarding the Determination of the Classes of the Buildings" (published in the Official Gazette dated December 15, 1982 and No. 17899),

- Whether the residence is constructed in an area which is valued more than TL 500 per square meter,

- Whether the residence is smaller than 150 m2 net.

Judgment of the Constitutional Court with regard to court fees

Pursuant to Article 28 of the Law Regarding the Fees (Law No. 492) (published in the Official Gazette dated July 17, 1964 and No. 11756) which was amended by Law No. 6009 (published in the Official Gazette dated July 23, 2010 and No. 27659), one fourth of the court fees regarding the court judgments shall be paid in advance, and the rest shall be paid two months following the court judgment. The above stated provision has been brought before the Constitutional Court by arguing that it is against the certainty principle of the tax law, since there is no way of knowing the amount to be paid by the party who is not present at the judgment hearing and that the party will not be able to know the amount until the notification of the final judgment. Following the above stated claim, Constitutional Court cancelled the term "...following the court judgment."

Council of Ministers Decree Issued in respect of Independent Audit

The corporations which meet the below stated criteria under to the Decree No. 2012/4213 (published in Official Gazette in 23 January, 2013 and No. 28537),

- Corporations which have total assets equal to 150.000.000 Turkish Lira or more,

- Corporations which have net sales revenue equal to 200.000.000 Turkish Lira or more,

- Corporations which have 500 employees or more.

Also, the below corporations are subject to independent audit regardless of the above stated criteria;

- Corporations which are subject to Capital Markets Law,

- Corporations which are subject to regulations and supervision of Banking Regulation and Supervision Agency,

- Insurance, reassurance and private pension funds,

- Corporations which operate on Istanbul Gold Market,

- Storage companies with a agriculture license and companies which are established according to Public Store Law and which are incorporated as joint stock companies,

- Media service provider corporations which own a television channel.

Developments in International Taxation

Double tax treaties between Turkey – Brazil, Turkey – Finland and Turkey – Switzerland has come to effect on 01.01.2013. All of the abovementioned treaties are based on OECD Model Tax Convention on Income and Capital.

Double tax treaty between Turkey and Malta has been approved by the Turkish Parliament pursuant to Law No. 6370(published in the Official Gazette dated January 17, 2013 and No. 28531). The Treaty comes into effect with the approval of the Parliaments of both parties. The Treaty is based on OECD Model Tax Convention on Income and Capital. The treaty also includes an "exchange of information" provision and a "limitation of benefits" clause.

The tax Information Exchange Agreement between Turkey and Bermuda has been approved by the Turkish Parliament pursuant to Law No. 6371(published in the Official Gazette dated January 17, 2013 and No. 28531). The Treaty will be applicable with the approval of the Parliaments of both parties. When the Treaty enters into force, the tax administration of both parties will be able to request information from the tax administration of the other party. The treaty will also allow cross-border tax audits to be conducted.

The tax Information Exchange Agreement between Turkey and Jersey has been approved by the Turkish Parliament with Law No. 6418(published in the Official Gazette dated March 01, 2013 and No. 28547). The Treaty, which contains 13 provisions, will be applicable with the approval of the Parliaments of both parties. When the Treaty enters into force, the tax administration of both parties will be able to request information from the tax administration of the other party. The treaty will also allow cross-border tax audits to be conducted.

The Double Tax Treaty between Turkey and Singapore, signed in July 9, 1999, has been amended pursuant to Law No. 6419 (published in the Official Gazette dated March 01, 2013 and No. 28547). The amendments will come to effect with the ratification of the Parliament of Singapore. With the amended Article 26 of the Treaty, exchange of information is expected to improve between Singapore and Turkey.

Amended Turkish Incentive System

Pursuant to the Decree No. 2012/3305 (Decree on State Incentives in Investments) (published in Official Gazette June 19, 2012 and No. 28328) certain investments have privileged investment status. Accordingly, such investments benefit from the incentives provided for the fifth investment zone, regardless of their location. However, if such investments are made in the sixth investment zone, such investments will benefit from the incentives provided for the sixth investment zone. Pursuant to the Decree No. 2013/4288 (published in Official Gazette 15 February, 2013 and No. 28560) the below stated investments are included in the privileged investments stated under Article 17 of the Decree No. 2012/3305;

- Investments in automotive industry which are valued 300.000.000 Turkish Lira or more,

- Investments in motor industry which are valued 75.000.000 Turkish Lira or more,

- Investments in automotive electronics and or auto components which are valued 20.000.000 Turkish Lira or more,

- Investments in electric production industry which are based on certain minerals listed under the Article 4 of Mining Law No. 3213.

Article 29 of the Decree No. 201273305 was amended by Article 2 of the Decree No. 2013/4288. After the stated amendment, investors benefit from subsidized credits, which were granted by public institutions, has been allowed to benefit from the incentives provided under the Decree No. 2012/3305 (except for interest incentive) at the same time.

Pursuant to Article 1/B-4 of the Appendix 4, which is "Subjects of Investment Not Supported or Supported conditionally", of the Decree No. 3305 electricity production investments based on natural gas is excluded from the investments which can benefit from the incentives. Article 1/B-4 of the Appendix 4 was amended by the Decree No. 2013/4288, and certain electricity production investments based on natural gas are now excluded from the Appendix 4.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.