1- The System in General

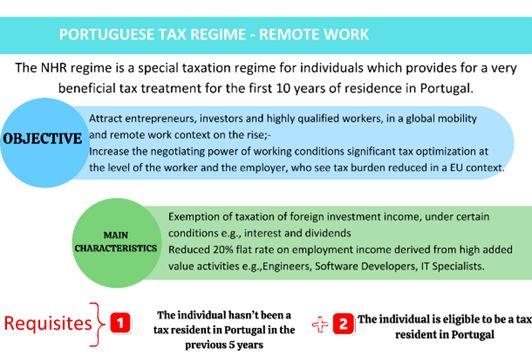

Non-Habitual Residents (NHR) is an advantageous taxation system applied in Portugal since 2009 and granted to people who meet the conditions. NHR focuses on entrepreneurs, investors and professionals specialized in their fields.

The system exempts certain types of income from tax in order to attract foreign-sourced earnings to Portugal, especially employment, retirement, interest and dividend income, and the system provides a flat 20% advantageous taxation rate for incomes from value-added businesses instead of normal rate that is up to 48%1 on incomes above € 78,834 per year.

2- Conditions of the NHR System

Two cumulative conditions are required to be eligible for NHR status. These:

- Meeting the conditions for being a tax resident under Portuguese law; and

- Not have been a tax resident of Portugal in the last five years prior to the intention to apply for NHR status.

Documents such as tax residency certificates from other countries2 should be submitted to the Portuguese authorities3 as the proof of criteria. In addition, the advantages of the NHR system are not indefinite; they show their effect for ten years.

Under Portuguese law, there are four alternative conditions for a person to become a tax resident, these are:

- The person stays in Portugal for 183 days (continuously or not) within twelve months.

- The person in Portugal for a period shorter than 183 says, but he has on any day during the period mentioned in the previous subparagraph that includes one-night stay, an home under circumstances which imply his intention to keep and occupy such abode as his" habitual residence". (Accordingly, this condition cannot be provided with short-term touristic housing rentals that are unsuitable for the person's life-activities centre, that is "habitual residence".)4

- On December 31 of any year, he or she is a crew member of a ship or aircraft, as long as they are at the service of entities with residence, head office or effective management in that territory; Portugal.5

- The person performs public service abroad under the order of the Portuguese state.6

If these conditions are met, the acquisition of NHR status does not occur automatically it will be through approval of Portuguese authorities after the application, which must be done latest on the last day of March of the following year being tax resident in Portugal. Moreover; an application for NHR status can only be made after completing the registration of residency in Portugal.7

According to the guide published by the Portuguese Tax and Customs Authority, the NHR application can also be made through a representative. After the appointment of the representative and acceptance of the appointment, there is no need to carry out the application in person.8

The applicant must be careful about appointing a representative because it will be essential to work with a law firm that can establish communication between the country where the person is located and the Portuguese authorities, is familiar with foreign languages and foreign and international legal systems, and has international connections.

3- Advantages of NHR System

The most fundamental factor for determining the advantageous tax rate provided by the NHR system is whether the relevant income Portugal or foreign sourced. According to the widespread definition in international taxation, the source country is defined as the country where the income-generating investment is made or the production or service is carried out by determining the physical location of the capital or labour force.9 However, in the increasingly globalized and digitalized world, it would be appropriate to take a professional assessment for each income. In the following, the ratios regarding the incomes originating from Portugal and abroad will be discussed in general.

The flat taxation rate of 20%, instead of default progressive rate that can reach up to 48%, applies to the employment income or self-employed income earned by people who meet the requirements of the NHR system, from Portugal sourced, value-added activities such as arts, science or technology.

According to the current practice, to benefit from the advantageous rate, the person in the NHR system must show the appropriate activity code in the tax return for the relevant period, with their evidence. Incomes that do not meet the criteria sought by the NHR system will be subject to the general income tax rules in Portugal.

On the other hand, foreign sourced employment income may be exempt from tax in Portugal if two alternative conditions are met. These:

- Existence of a "double taxation treaty" indicating that the income will be taxed in the source state. Or;

- In the absence of such an agreement, it is understood that the income is taxed in the source country and it is not deemed as obtained in Portugal.

For persons who meet the NHR criteria, their retirement income is subject to a tax rate of 10% only, if it is not deemed as obtained in Portugal.

Investment income such as dividends, interest and other types of income like royalty income and rental income are also exempt from income tax in Portugal if there is an agreement to tax the income in the source country and it is not deemed as obtained in Portugal. However; this system does not apply if they are earned in "tax haven" countries blacklisted by Portugal. Revenues from capital gains are mostly related to jurisdiction and type of capital, and professional tax advice should be sought.

4- Examining the Practical Effects of the NHR System for Türkiye

A detailed cost-benefit analysis is required at the beginning of application to an NHR-like tax advantage system. In the studies, it has been shown that people with above-average income groups benefit more from NHR-like systems.10

In this context, the person who wants to benefit from such a system should decrease his/her transaction cost as much as possible. It can be said that the most suitable people and companies for this are the technology sector members who have adopted the remote working system and carry out their activities in a digital environment without being tied to a physical place. For such people, the cost of moving to another country is relatively low. Because in this case, it won't be necessary to deal with the cost of moving a factory or large-scale office and the tax advantages of the NHR system will be started to be used with a relatively low transaction cost.

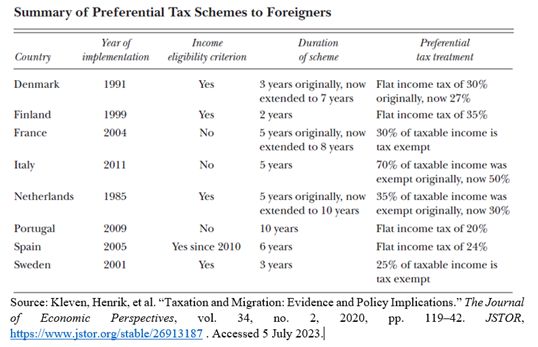

According to related studies, people interested in such a program shouldn't only consider taxes, but also welfare, health, stability, legal system, and social security policies in the target country.11 Therefore, it would be appropriate to analysed the European countries that can meet these characteristics and offer tax advantages to foreign investors. As seen in the table below,12 Portugal offers the most advantageous system in terms of duration and taxation rate among European countries that offer similar systems.

In this situation, it is vital for the person who decides to follow such a path to work with law firms with international connections because it requires the cooperation of lawyers from more than one jurisdiction.

In addition to the advantageous 20% taxation rate in salary incomes, the "double taxation treaties" between Portugal and the source country have great importance in determining the tax rates or tax exemption for foreign investment.

Türkiye has such an agreement with Portugal since 2007.13 Furthermore, a possible scenario can be analysed here: A Turkish entrepreneur who moves his/her activities to Portugal will not pay a tax to Türkiye under Article 7 of the treaty on his/her Portugal sourced income, without engaging any commercial activity in Türkiye, due to his value-added activities and will only pay taxes in Portugal, and this tax rate will be 20% advantageous rate if the person is in the NHR system.

As another example, a Turkish entrepreneur will be exempt from taxation in Portugal for her/his her/his Türkiye sourced earnings from service revenues because Article 15 of the treaty allows taxation of this revenue in Türkiye, and in such a situation NHR system sees taxation in the source country is enough.

Footnotes

1. Current personal income tax rates in Portugal (not in NHR scope): https://info.portaldasfinancas.gov.pt/pt/informacao_fiscal/codigos_tributarios/cirs_rep/Pages/irs68.aspx , Accessed: 6 July 2023

2. The certificate of residence in Turkey is obtained from e-government for natural persons; For legal persons (and also real persons) (for those who fall under their jurisdiction), it can be obtained with a petition to be submitted to the Big Taxpayers Tax Office, Ankara, Antalya, Bursa, Istanbul, Izmir, Kocaeli, Trabzon Tax Offices and Revenue Administration.

See: T.C. Ministry of Finance Revenue Administration Circular of Double Taxation Prevention Agreements / 3: https://www.gib.gov.tr/fileadmin/CifteVergilenen/cvoa_sirkuler_3.htm , Accessed: 5 July 2023

3. The English-languaged guide published by Tax and Customs Authoirty of Portugal: https://info.portaldasfinancas.gov.pt/pt/apoio_contribuinte/Folhetos_informativos/Documents/Non_regular_residents_Registration_for_tax_purposes.pdf , Accessed: 5 July 2023

4. Although it is understood from the related texts that a single day will be enough, it should bet considered that it will be difficult to prove the idea of using the relevant house as a habitual residence as the number of days stay decreases. For a more detailed explanation about this condition: https://www.oecd.org/tax/automatic-exchange/crs-implementation-and-assistance/tax-residency/Portugal-Tax%20Residency.pdf , Accessed: 10 July 2023

5. Article 16 of Indıvıdual Income Tax Code of Portugal https://info.portaldasfinancas.gov.pt/pt/informacao_fiscal/codigos_tributarios/cirs_rep/Pages/irs16.aspx , Accessed: 10 July 2023 ; summary of OECD about the NHR: https://www.oecd.org/tax/automatic-exchange/crs-implementation-and-assistance/tax-residency/Portugal-Tax%20Residency.pdf , Accessed: 10 July 2023

6. https://info.portaldasfinancas.gov.pt/pt/apoio_contribuinte/Folhetos_informativos/Documents/Non_regular_residents_Registration_for_tax_purposes.pdf , Accessed: 5 July 2023

7. Ibid

8. Ibid.

9. Beer, S., & Michielse, G. (2021). "Chapter 11 Strengthening Source-Based Taxation". In Corporate Income Taxes under Pressure. USA: IMF Publications. Retrieved from https://www.elibrary.imf.org/display/book/9781513511771/ch011.xml , Accessed: 10 July 2023

10.OECD (2002) "International Mobility of the Highly Skilled", Paris.; Sandalcı, U., Sandalcı, İ. "Effect Of Taxation On Migration In The Globalization Process". Journal of Management and Economics Research 19 (2021): 110-132 https://dergipark.org.tr/en/pub/yead/issue/60412/779788 , Accessed: 6 July 2023

11. Kleven, Henrik, et al. "Taxation and Migration: Evidence and Policy Implications." The Journal of Economic Perspectives, vol. 34, no. 2, 2020, pp. 119–42. JSTOR, https://www.jstor.org/stable/26913187 . Accessed: 5 July 2023.

12. Ibid

13. 15 December 2006 dated and 26377 numbered Resmi Gazete (official journal of Türkiye): https://www.resmigazete.gov.tr/eskiler/2006/12/20061215-2.htm , Accessed: 6 July 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.