According to the "Notice of Tax Procedural Law" numbered 2012/99 421, luboil licenced taxpayers and taxpayers who produce, construct and import cola drink, alcoholic drinks and tobacco products, and other taxpayers who purchase products from the mentioned groups are obliged to use e-Invioce and e-Ledger applications.

According to the "Notice of Tax Procedural Law" with the item number of 412 published on 14.12.2012 by Revenue Administration in the Official Gazette numbered 28497, it is obligated to implement E-Invoice and E-Ledger applications for the taxpayers mentioned below.

Lube oil licensed firms within the scope of Petroleum Market Law and taxpayers who purchase products from them in 2011 calendar year with gross sales revenue of 25 Million TRY as the date of 31/12/201.

Producers, constructors and importers of the products (cola drinks, alcoholic drinks and tobacco products) included the (III) numbered list attached to the Private Consumption Tax Law and taxpayer companies who purchase products from them in 2011 calendar year with a gross sales revenue of 10 Million TRY as the date of 31/12/2011

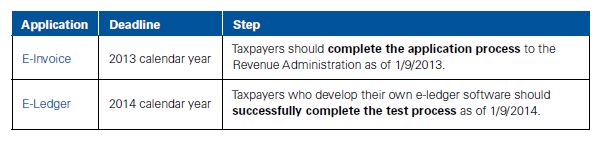

Deadlines

Taxpayers within the scope of the obligation should complete the implementation process within the specified period according to this table.

Organizations out of the Scope

Administrations, corporations and foundations that are stated in 10/12/2003 dated and 5018 numbered Public Finance Management and Control Law; and State-owned Economic Enterprises (Ministries, Regulation and Supervision Agencies, Social Security Organizations, etc) are not obligated to implement E-Invoice and E-Ledger.

Implementing E-Invoice and E-Ledger: Top 10 Questions

Ten questions related to the scope, deadlines and implementation of the E-Invoice and E-Ledger

1. If my company has purchased any of the goods from the taxpayers that are mentioned in Communiqué, will my company be in the scope of the obligation?

- Yes. If companies purchased any good from those taxpayers in 2011 calendar year, they are obligated to implement E-Invoice and E-Ledger.

2. Can my company use the "E-Invoice Portal" that is hosted by Revenue Administration if the number of invoices within my company is less?

- Yes. Companies may use the "E-invoice Portal" that is hosted by Revenue Administration. They don't have to integrate E-Invoice application to their systems.

3. My company wants to perform e-invoice integration. What is the deadline for completing the integration process?

- Companies have to apply for Revenue Administration before on September 1, 2013 in order to start using e-invoice in the 2013 calendar year.

4. Can companies draw up a hardcopy invoice for the taxpayers that are obligated within the scope of E-Invoice?

- No. Hardcopy invoices that are sending to companies in scope of E-Invoice will not be valid.

5. Which ledgers can be included within the scope of e-ledger?

- Journals and general ledger are included to the scope of E-Invoices.

6. Can companies integrate E-Invoice systems considering the fact that information systems of companies are located and managed abroad? Are companies allowed to store and archive electronic invoices abroad?

- Application of such taxpayers will be evaluated and approved by Presidency. Electronic invoices must be stored in Republic of Turkey or locations that are under the laws of Republic of Turkey but this may not prevent archiving a copy of electronic invoices abroad.

7. How can companies acquire the E-Ledger software?

- Taxpayers should use one of the E-Ledger software that is approved by the Revenue Administration or companies may develop their E-Ledger software in-house.

8. Companies want to develop E-Ledger software in-house. Can we start using it after completing the development process?

- No. E-Ledger software that you developed in house should be approved by Revenue Administration.

9. Should electronic ledgers needed to be approved?

- Electronic ledgers are electronic documents which are needed to be approved by the Financial Signature of Presidency. Electronic Ledgers are chartered for the beginning and end of the accounting year.

10. Is it possible to keep both electronic and hardcopy ledgers?

- No. It is not allowed to keep both hardcopy and electronic ledgers.

Responsibilities and Penal Sanctions

- Taxpayers who integrated e-invoice application to their own system needs to maintain sustainability of the system. (7 days 24 hours)

- In the case of violation except compelling reasons, integration permissions will be revoked. Maintenance, repair and review activities have to be performed within two days and those activities have to be reported to Revenue Administration.

- In the case of violation to the Communiqué, punitive articles of Taxation Procedure Law will be applied.

- Taxpayers that are obligated to use e-ledger application can not generate printed ledgers. Otherwise their ledger will be considered as invalid.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.