As at the end of June 2018, the stock position of Foreign Direct Investment in Malta stood at €176.5 billion, while the stock position of Direct Investment abroad amounted to €61.5 billion.

Foreign Direct Investment (FDI) in Malta

During the first six months of 2018, FDI flows in Malta went up by €1.9 billion. This is equivalent to an increase of €448.6 million over the corresponding flows in 2017 (Table 1). The main contributors to total FDI flows were financial and insurance activities with a total contribution of 84.1 percent (Table 2). In June 2018, the stock position of FDI amounted to €176.5 billion, an increase of €8.6 billion over the corresponding period the previous year. Similarly to previous years, financial and insurance activities dominated, accounting for 97.3 per cent of FDI stocks in June 2018 (Table 3).

Direct Investment Abroad

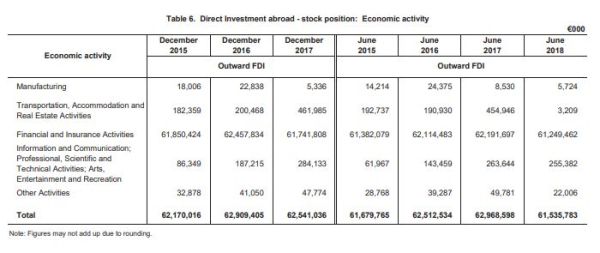

During the first six months of 2018, direct investment flows abroad totalled €3.1 billion, a €35.8 million decrease over the amount registered during the corresponding period in 2017. These changes are attributed to decreases in equity capital (Table 4). Stock position of direct investment abroad was registered at €61.5 billion in June 2018, down by €1.4 billion over the stock position in 2017. Financial and insurance activities constituted 99.5 per cent of the total FDI abroad (Table 6).

Source: National Statistics Office

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.