On 5 March 2019, the 2019 budget draft law was presented to Parliament.

The draft law introduces mainly the following corporate income tax measures with retroactive effect as from 1 January 2019:

- A 1% decrease (from 18% to 17%) of the corporate income tax ("CIT") rate;

- A broadening of the scope of application of the reduced 15% CIT rate (now applicable up to a taxable income of EUR 175,000);

- Specific rules on the application of the interest limitation rule in case of tax consolidation.

This tax alert provides an overview of the tax measures provided in the draft law. However, the proposed rules may still evolve throughout the legislative process.

DECREASE OF THE CIT RATE

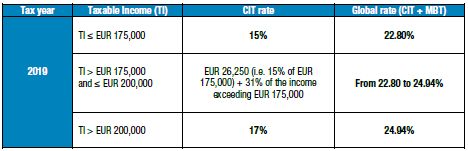

Based on the draft law, effective retroactively as from tax year 2019,

- the CIT rate of 18% is brought down to 17%. This rate applies to taxable income exceeding EUR 200,000. Taking into account the 7% solidarity surcharge (applicable on the CIT rate) as well as the municipal business tax ("MBT") of 6.75% for Luxembourg-City, the aggregate corporate tax rate will be reduced from 26.01% (until 2018) to 24.94%.

- the reduced CIT rate of 15% applies to taxable corporate income not exceeding EUR 175,000 (instead of EUR 25,000 until 2018). Taking into account the 7% solidarity surcharge (applicable on the CIT rate) as well as the MBT of 6.75% for Luxembourg-City, the aggregate corporate tax rate applicable to taxable income up to EUR 175,000 corresponds to 22.80%. Hence, in practice the effective tax rate of many Luxembourg companies will be 22.80% instead of 24,94%.

- Finally, income above EUR 175,000 but not exceeding EUR 200,000 is taxed at an intermediary rate varying between 15 and 17%. This is to smooth the transition from the reduced CIT rate to the standard CIT rate.

AMENDMENT OF THE TAX CONSOLIDATION REGIME

The draft law amends the Luxembourg tax consolidation regime (Article 164bis of the Luxembourg income tax law, "LITL"). The main amendment aims to introduce retroactively as from 1 January 2019 the optional provision under the EU Anti-Tax Avoidance Directive ("ATAD") regarding the interest limitation rule at the level of the fiscal unity. More precisely, the EBITDA and exceeding borrowing costs can be determined at the level of the consolidated group. In addition, the draft law introduces additional amendments to clarify some aspects of the tax consolidation regime, such as the use of tax losses or tax credits.

Amendments related to the limitation to the deduction of interest

Interest limitation at tax consolidated group level becomes the rule

Effective retroactively as from 1 January 2019, in case of tax consolidation, exceeding borrowing costs and EBITDA are determined at tax consolidated group level, i.e. at the level of the integrating company, instead of being computed at the level of each of the entities belonging to the tax consolidated group.

The possibility to have the limitation applied at consolidated group level instead of being applied at the level of each entity is optional under ATAD. When implementing ATAD, the Luxembourg Government first decided not to use the option. However, a commitment was made subsequently at the very end of the legislative procedure to introduce such option with retroactive effect as from 1 January 2019, which is the aim of the new provision of the draft law.

The application of the interest limitation at group level means that:

- In a first step, the tax result of each integrated entity of the tax consolidated group is computed individually without applying the limitation to the deduction of exceeding borrowing costs provided by Article 168bis LITL;

- In a second step, once the tax results of all entities have been integrated at the level of the integrating entity, the computation of the EBITDA and exceeding borrowing costs of the integrating entity is performed and the limitation of either 30% of the EBITDA or EUR 3m exceeding borrowing costs applies.

Entities belonging to a tax consolidated group may still decide to opt to have the interest limitation rule, and so the computation of exceeding borrowing costs and EBITDA, applied at the level of each entity.

This means that the application of the interest limitation rule at tax consolidated group level becomes the rule and the limitation at entity level the exception.

The fact that taxpayers have the choice between the two options is positive since, in some cases, benefiting from a EUR 3m safe harbour at the level of each of the consolidated entities might be more beneficial (i.e. when the tax consolidated group option is applied, there would only be one safe harbour of EUR 3m for the consolidated group). However, before making this choice, a detailed analysis of the long term implications will have to be performed since the choice will be binding until the end of the tax consolidation.

How to opt for the interest limitation at entity level?

According to the draft law, since applying the interest limitation at the level of the consolidated group is the rule, taxpayers only need to be active if they would like to apply the interest limitation rule at the level of each entity of the tax consolidated group.

The choice regarding the application of the interest limitation rule generally needs to be made when filing a request for the tax consolidation regime with the Luxembourg tax authorities (Administration des Contributions Directes). In this request, all entities of the tax consolidated group have to commit to apply the chosen option as long as the tax consolidation will remain in place.

What about tax consolidated groups already in place?

With regard to existing tax consolidated groups, the option to apply the interest limitation rules at the level of each entity will have to be made in a request which will have to be filed before the end of the first accounting year in respect of which article 168bis LITL (i.e. the interest limitation rule) becomes applicable for the first time.

For companies with an accounting year corresponding to the calendar year, this means that a request has to be filed before 31 December 2019. Here, all entities of the tax consolidated group have to commit to apply the option until the end of the tax consolidation.

Other aspects

Finally, the new draft provisions of Article 164bis LITL dealing with the interest limitation rule include most provisions of Article 168bis LITL which have been adapted to the tax consolidation regime: definitions of e.g. borrowing costs and exceeding borrowing cost, grandfathering rule, exemption applicable to financial undertakings, so-called "escape clause", etc.

The new provisions also clarify how to apply the rules on the carry forward of non-deductible exceeding borrowing costs and unused interest capacity when an entity enters/leaves a tax consolidated group.

Amendments aiming to clarify other aspects of the tax consolidation regime

Some other amendments are introduced by the draft law so as to clarify the following aspects of the tax consolidation rules:

- How to determine the taxable income at group level;

- How to use tax losses carried forward;

- How to use tax credits.

Most of these aspects were dealt with either in the Grand Ducal Regulation of 18 December 2015 or in Circulars. In order to clarify and simplify the rules, it has been decided to have all these aspects covered in one single legal provision, i.e. the amended Article 164bis ITL. Therefore, a draft Grand-Ducal Regulation repeals Grand Ducal Regulation of 18 December 2015.

One particular aspect that is governed by the amended Article 164bis ITL is the use of pre-tax consolidation tax losses. Given that these losses, according to the draft law, may only be used following the consolidation of the current year income of all members of the tax consolidated group (to the extent a positive taxable income is realised by the tax consolidated group and the entity that incurred the pre-tax consolidation tax losses), there is a risk of lock in effects and unsystematic results. It remains to be seen whether the Luxembourg legislator will fix these aspects throughout the legislative process.

NEXT STEPS

Overall, the tax measures provided in the 2019 budget draft law are positive.

The decrease of the CIT rate by 1% should contribute to Luxembourg's attractiveness in the post-BEPS era which is characterised by more harmonised tax rules, in particular within Europe. Moreover, the extension of the scope of application of the reduced CIT rate of 15% up to EUR 175,000 of taxable income means that many Luxembourg companies will be subject to an aggregate corporate tax rate of 22.80% rather than 24.94%.

The implementation of the option provided under ATAD to apply the interest limitation rule at the level of a consolidated group is also very important as it provides flexibility to taxpayers. However, given that the option entails that only one EUR 3m safe harbour is available for the tax consolidated group, taxpayers have to carefully analyse which alternative is most beneficial in the long run given that the choice will be binding until the end of the tax consolidation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.