Labuan IBFC maintained its role to intermediate regional business and investment, driven by Asia's continued economic growth

The strengthening of the global economic recovery and increased market confidence in 2017 have fueled the growth momentum of Labuan IBFC in the regional landscape. Despite the slight business moderation in the key market segments of banking and insurance, the growth trajectory of the Centre remained positive.

LABUAN IBFC SECTORAL BUSINESS PERFORMANCE

Labuan Companies: Increased company incorporations

In tandem with the rebound in global economy, new company incorporation achieved commendable growth of 19.1% or 941 new companies as compared to 790 companies in 2016. This reflects the increased interest for investments and business setups in Labuan IBFC, mainly from the Asia Pacific region. Notwithstanding this, other regions showed marked growth, depicting increase in the geographical spread of market interest for Labuan IBFC.

Number of Registered and Operating companies

Banking Business: Banks remained sound with increased capital buffer

In 2017, the number of banks increased to 54, an increase of 5.9% over the previous year. The growth is reflected by a heightened interest in the investment banking sector, in line with the growth in the regional wealth management activities. The year under review also saw a moderate performance by the banking sector with greater focus on the overseas business. Non-resident financing, particularly from the ASEAN countries, contributed almost 70% of the industry total loans comprising both conventional and Islamic lending.

The assets, comprising mainly loans and advances contracted marginally by 0.5% to USD50.7 billion during the year. Nonetheless, there was a significant hike in Islamic financing by 61.6% due to increased demands for shariah compliant financing.

Total Assets and Number of Banks in Operations

Deposits and Loans by Country

While Labuan banking profitability moderated in 2017, the industry remained resilient and well capitalised. The shareholders' fund increased from USD2.8 billion to USD3.3 billion in 2017. As a result, the risk weighted capital ratio (RWCR) of the industry stood at 37.9% as compared to 35.7% in 2016.

Riding on the current global economic recovery, Labuan banks are expected to grow and expand their businesses and innovate their product offerings, opportunising on the financial technology advancements.

Insurance Business: Increased premiums

Labuan IBFC continued to serve the rapidly expanding regional insurance needs. In 2017, there were 14 insurance and insurance related new set-ups in Labuan IBFC.

Number of Insurance and Insurance-Related entities

The gross written premiums increased by 2.2% to USD1.4 billion of which 63.2% of these businesses were retained in Labuan. This was mainly driven by general reinsurance and captive premiums amounting to USD943 million and USD361 million, respectively.

The contribution from foreign business increased to 60.9% and it remained as the significant portion of the Labuan insurance sector's business pie. The fire risks maintained its dominance with 36.7% of the total premiums. Notwithstanding, the underwriting margin contracted to USD91.9 million due to increase in catastrophic-related claims during the year, thus resulting in the overall claims experience to increase from 35.2% to 63.5%. Consequently, the overall industry profitability moderated to USD170 million in 2017 as compared to USD387.3 million in the prior year.

Distribution of Gross Premiums

Despite this, the Labuan insurance sector's financial footing remained sound and stable with strong buffer of solvency margin 5 times above the regulatory requirements.

Other Labuan Niche Businesses: Continued to expand

Riding on the positive momentum of the regional economy, other Labuan niche businesses, such as in wealth management, commodity trading and money broking activities recorded growth.

Under the wealth management sector, the Labuan private foundations continued to draw interest from the Asia Pacific region as viable solutions for estate planning and wealth management purposes. In the year under review, there were 151 active foundations in Labuan. With the region's increasing number of high net worth individuals, it is expected that this segment of business will continue to provide an upside opportunity for the jurisdiction.

Of the total 151, 32 were charitable foundations, established for various non-profit or philanthropic purposes.

Growth in Number of Labuan Foundations

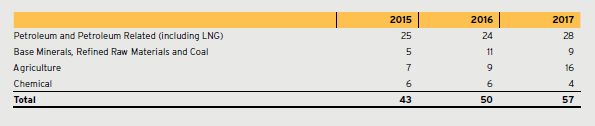

The Labuan international commodity trading sector recorded 12 new Labuan International Commodity Trading Companies (LITCs) in the year under review. The accumulated income generated by the LITCs increased by 39.2% to USD23.8 billion as compared to USD17.1 billion of the preceding year; with a majority of the income stream derived from trading in petroleum and petroleum-related products. In line with the increase in revenue, the profit before tax of LITCs also increased by more than two-fold to USD755.4 million from USD238.3 million in 2016.

Breakdown on Types of LITCs

The money broking had also gained traction in recent years as evidenced by the momentous growth of more than 300% since 2013; and majority of the money brokers in Labuan are providing electronic platform for the trading of currencies. This trend is in line with the wave of financial innovation across the region, displacing traditional brokers with more efficient digital platforms providing wide accessibility to clients at lower costs. Acknowledging the potential of fintech, Labuan IBFC promotes and supports digital innovations in the Labuan financial market.

The Labuan leasing business performance reflected a slowdown mainly due to the sluggish global oil and gas activities. As a result, total accumulative assets leased declined to USD48.8 billion. In contrast, aviation leasing showed encouraging growth with 19 new asset leasing structures set up . Moving forward, Labuan IBFC intends to expand the growth in this sub-sector by capitalising on its past experience in aviation leasing and the Asia market's expected growth in aviation market.

Value of Asset Leased and Number of Leasing Companies in Operations

Moving Forward: Transformation of the Centre

Taking cognisant of the global dynamic environment, Labuan IBFC also needs to remain agile by refocusing on its priorities. For this purpose, the Centre needs:

- To be continously business focus by enhancing its business environment, promoting higher business substance and modernising its tax and legal framework;

- To ensure reputation resilience by having effective supervisory role and enhancing prudential and regulatory requirements; and

- To enhance Labuan IBFC's role in the development of the Labuan Island.

With the growth momentum achieved in 2017, Labuan IBFC is confident that it will continue to gain traction leveraging on its unique value propositions as a midshore business and financial centre for the Asia-Pacific region.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.