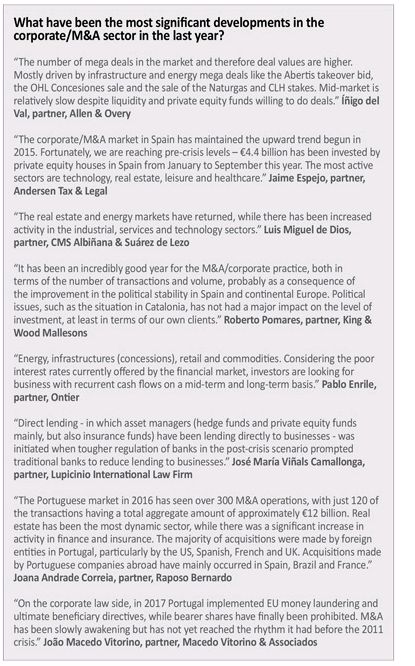

In the early part of 2017, it was all going so well for M&A lawyers, with international investors competing to snap up the best assets in Iberia; but then came the crisis in Catalonia, which has left investors feeling nervous

During the first half of this year, things were looking particularly good for M&A lawyers in Iberia. Energy and infrastructure assets were attracting multiple bids leading to auctions that proved to be a rich source of instructions for law firms. In addition to investors fighting over the biggest assets, smaller funds have also been taking their first plunge into the Iberian M&A market.

However, the latter part of the year saw Spain thrown into a constitutional crisis as the Catalan independence movement gathered momentum. Now the country is shrouded in uncertainty, and this state of affairs is making investors nervous. Forecasts for GDP growth have been revised down and M&A activity has slowed as deals are put on hold while potential acquirers await the outcome of the regional election in Catalonia.

However, despite the political uncertainty, spirits remain high among some M&A lawyers. "The mood is shifting and there is more optimism," says Ramon y Cajal partner Guillermo Muñoz-Alonso. "There is more finance available, and at better terms – there are also smaller funds taking an interest in the Spanish market for the first time, including some from jurisdictions that had not been very active in this market before, such as South Africa." Gómez-Acebo & Pombo partner Fernando de las Cuevas says that investors are targeting Spanish infrastructure and renewables projects. He adds that, while banks had considerable amounts of bad debt, there are now much fewer "debt deals".

International investment is growing and "global markets are a clear opportunity", according to Sharon Izaguirre, partner at Deloitte Legal. She adds: "In Spain, international investors are targeting hotels and the tourism sector in general, as well as industrial and engineering-related assets, and the agri-food industry." Izaguirre also says emerging economies like India, China or Latin America (particularly Colombia, Chile and Peru) will also generate opportunities for lawyers.

Freshfields partner Javier Monzón says that, following a widespread trend of Spanish companies successful internationalising their businesses, there are significant cross-border opportunities for lawyers in that such companies are now "more attractive targets for international investors". He cites the examples of Spain's Santander selling Allfunds bank to funds Hellman & Friedman and GIC, and Atlantia and Hochtief's bids to takeover Spanish infrastructure management company Abertis. "In both cases, the companies have actual, and potential, growth opportunities abroad," he explains.

Another boost to M&A activity in Spain has been the increase in funds involved in direct lending, says Carmen Reyna, partner at Pérez-Llorca. "Some corporates don't have access to finance from banks, or the rates for borrowing are too high, but there are direct lenders from the US and the UK making finance available." Muñoz-Alonso says that there was a surge in direct lending around five years ago and, while then it was more opportunistic in nature, there has been a shift and lenders are now thinking more long term.

Money on the table

Baker McKenzie partner Luis Casals says there are many investors putting "a lot of money on the table" and looking for investment in Spain. He adds that investors are open to opportunities in any sector and that the investment takes a range of forms, including hybrid vehicles, minority stakes, lower yields and "longer investment periods". Casals continues: "It's a sellers' market, there is activity involving real estate and health-related businesses, while funds are buying hospitals, pharmaceutical companies, nursing homes, gym chains, technology and bio-food companies, hotels and energy and infrastructure assets. We´re busier than last year and we anticipate 2018 will bring more M&A activity."

There are now more auctions involved when Spanish assets are being sold, says Roca Junyent's Madrid office managing partner Carlos Blanco. "There are a lot of quick deals," he adds. "The number of auctions is an obvious consequence of the high liquidity of the market." However, one partner says that the impact of the political uncertainty in Catalonia on the M&A market should not be underestimated: "GDP growth will be reduced, the impact from Catalonia will affect the whole economy."

Catalonian concerns

The Spanish economy is "healthy and growing" and this has had a positive impact on M&A, says Cuatrecasas partner Javier Villasante. "The first part of the year was good due to the sound macroeconomic conditions and the strength of foreign investment," he adds. However, Villasante says the pipeline of deals is "now showing signs of deceleration". He continues: "The Catalan situation is starting to affect the M&A market and may have a significant impact in the long run." De las Cuevas adds that, due to the uncertainty in Catalonia, there is concern about Spain among international investors.

One M&A partner says companies based in Catalonia have faced "commercial pressure" to relocate their businesses. "The Spanish economy is interlinked, some companies have been told that if they don't move their domicile, some businesses won't continue working with them," he explains. The partner adds that there also concerns among clients that, in the event Catalonia was to become independent, there would be an impact on freedom of movement and potentially double taxation.

The political situation in Catalonia is the latest issue to affect the confidence of international investors and they are now wondering what the next problem will be in Spain. One partner says: "There was the change in the regulation of energy [related to the Spanish government's cuts to solar power subsidies] and now Catalonia - investors are thinking 'what else'?"

José Antonio Sánchez-Dafos, partner at DLA Piper, says there are newcomers coming into the market for corporate and M&A-related legal services. He adds: "Firms are under increasing competition, there are more auctions for law firms to advise on, though some clients want to apply abort fees [a fee payable to a legal adviser in the event the client decides not to proceed with a proposed transaction]. However, there is now a flight to quality, new competitors will enter the market, so firms need to offer better quality services and portray themselves as a trusted adviser."

M&A-related legal work is becoming more commoditised, so lawyers have to be more sophisticated and think globally and more commercially, says Reyna. She adds: "Lawyers have to think outside the box, technology is now doing part of our jobs – artificial intelligence is now doing due diligence." Izaguirre adds that the legal market is "maturing in a direction that favours the integration of law with a wider range of business solutions". She says that, consequently, law firms have to build "systems that provide services based on innovation and a business-focused approach, and that this will replace traditional advice".

Move to US model

Sánchez-Dafos says law firms need to reinvent themselves. "Firms need to move to a US model and have more partners per total headcount," he adds. "The main challenge is talent retention, and one option is the development of alternative career paths." However, Sánchez-Dafos also says that when it comes to working on M&A deals, having flexible working for lawyers is "wishful thinking".

With regard to the outlook for the coming year, Reyna says there are a lot of deals in the pipeline, especially in the real estate, renewable energy and rail sectors. Casals anticipates that there will be consolidation in the legal sector: "There will be more mergers as fees are going down." He continues: "There will be Spanish firms merging with global firms because deals are not local anymore." However, partners also say that there is still a strong business case for Spanish firms remaining independent. One says: "There is the issue of conflicts, the bigger you get, there is an increased risk of conflict."

Portugal: Competitive bids

The volume and value of Portuguese M&A has increased in the last year, according to Cuatrecasas' Lisbon-based partner José Diogo Horta Osório. He adds that there has been a significant number of transactions in the real estate, energy and infrastructure sectors. "We have seen a lot of investors from the UK, US and China," Horta Osório says.

The Portuguese economy is improving with the result that there is increased interest in the country from both domestic and foreign investors, says PLMJ partner Manuel Santos Vitor. "There are more investors from Spain because the Spanish economy is improving and we're also seeing investors from the US and other mature markets," he adds. Santos Vitor also says that, given the current economic climate in Portugal, the bigger the transaction is, the more interest and potential buyers it attracts.

Banks are more prepared to finance investors than they were in the recent past, says Uría Menéndez-Proença de Carvalho partner Francisco Brito e Abreu. "Private equity funds are particularly interested in investing in infrastructure, while family offices are also interested in Portuguese assets," he adds. MLGTS partner Ricardo Andrade Amaro says that a wide range of investors are now targeting Portugal, with the result that there are now sometimes up to 20 bidders for assets, with competitive bids being most common in the infrastructure and energy sectors. "Portugal is on the radar for all types of investors – we are now seeing them coming from Canada and Thailand, for example," he says. However, he warns that the European Union Market Abuse Regulation – with its requirements for the disclosure of financial information and other information-sharing – is causing "discomfort to all parties". Consequently, some investors feel that deals in Portugal are too small to justify having to meet such regulatory requirements, Andrade Amaro says.

Linklaters partner Marcos de Sousa Monteiro says that, while there has been a noticeable shift in private equity funds' focus towards infrastructure, there are also real estate funds that are "looking for an advantage and who see Portugal as good for their portfolio". He adds that there has been an increase in interest from Australian and Canadian investors, and there have also been opportunities to advise "African-focused" private equity funds on deals. "There is also M&A work related to the financial and industrial sector in the pipeline," says Sousa Monteiro.

Benefits of global uncertainty

Caiado Guerreiro senior associate Jorge Ribeiro Mendonça says transactions in the real estate sector have been the "engine of the recovery". He adds: "Political stability is helping international investors, while Portugal's tax regime is also proving attractive." Meanwhile, CCA Ontier partner Domingos Cruz says deal flow has increased with technology sector deals with a value of €10m to €15m being a particular trend. He also says Portugal is benefitting from global uncertainty related to Brexit, US president Donald Trump, and the political situation in Catalonia. "Portugal is seen as a safe harbour, there is stability, and Portuguese bonds are no longer seen as garbage," says Cruz.

According to Antas da Cunha Ecija managing partner Fernando Antas da Cunha, hedge funds are targeting Portugal, while sale and leaseback deals are common in the real estate sector. In addition, Antas da Cunha says there are new players in the technology, media and telecommunications (TMT) sector. "Companies want to come to Portugal," he says.

The Portuguese market is evolving and there is an increasing number of 'secondary deals' – in which private equity firms buy assets from other private equity firms, says De Sousa Monteiro. "These tend to be quicker deals, where there is less pressure on fees – given the complexity, it can be quite stressful," he explains. Another partner remarks that clients are now prepared to pay higher fees, and that, two years ago, it would not have been possible to charge the fees that are charged today.

Given that there are lots of bidders for some of the bigger assets in Portugal, there is a growing trend for clients to ask law firms to agree to 'abort fees', says Vieira de Almeida partner Paulo Trindade Costa. Another partner remarks that the legal fees charged by Portuguese firms are among the lowest in Europe. "Some clients talk to us as if our fees are high, but our fees are at the level of those in Poland, for example," he says. Lawyers also say that the billable hour is an increasingly outdated concept and that clients now require a range of different fee structures, including capped fees. However, in general, foreign clients are willing to pay more for M&A advice.

Generally speaking, clients demand less day-to-day corporate legal advice compared to before the global crisis, though there are perhaps more clients now than there were two or three years ago, says Santos Vitor. He adds that technology is becoming more important for law firms. "Law firms are trying to use more technology, technology companies are increasingly approaching law firms to offer technology for due diligence and other purposes, though a lot of this technology is developed in English and the problem is that a very important part of our work is in Portuguese," says Santos Vitor. The issue with a lot of legal technology is that it needs to be adapted to the Portuguese language, says Trindade Costa, who adds that the increased use of technology also raises the question of how to incentivise young lawyers. Firms also need to become more international in their outlook, according to Trindade Costa. He adds: "There are big transactions in Lusophone Africa, which is reaching the point where it needs to have an M&A market."

Machine learning

One M&A partner remarks that his team is "always working with our IT guys on machine learning". Meanwhile, some firms are working with legal technology providers to test out prototypes in a law firm environment. While there is a view that artificial intelligence will do a lot of the work currently carried out by young lawyers, some partners argue that technology will actually help younger lawyers to do their jobs better. One remarks: "Artificial intelligence will be useful for young lawyers as it will help them to be more aware of potential problems [when preparing cases]."

Law firms will have to find different sources of income in future, lawyers say. "Law firms could become multidisciplinary practices where lawyers act as project managers," remarks one partner. Another major issue facing firms is how to attract, retain and train talent. According to one M&A partner at a leading Lisbon firm, "technology will take away the training young people had, so training processes will have to evolve – we have to keep feeding the ranks, the rate at which people leave the firm has doubled in the last 10 years".

The legal arms of the 'Big Four' auditors could potentially become as big in Portugal as they are in Spain, according to one partner. To date, Deloitte has incorporated the Portuguese firm CTSU Sociedade de Advogados to its legal network, and Lisbon firm RRP Advogados has become part of the EY global law network. Referring to the advances made by members of the 'Big Four' into the Portuguese legal market, the partner remarks: "We need to be prepared for this new type of competitor." Another M&A partner notes that the 'Big Four' are already involved in the major deals in Portugal as auditors and they will "try to target the sophisticated legal work – we will see them on the biggest transactions in future".

Regarding the outlook for the coming year, Trindade Costa says he is not pessimistic, but believes there is uncertainty. "The growth forecast is small for the coming year, there may be significant opportunities in the telecoms sector, but if interest rates go higher, we will have a problem."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.