- within Energy and Natural Resources and Environment topic(s)

- in European Union

In recent years, shareholder activism has gained significant influence on the fate of public companies worldwide. This trend does not stop at Switzerland. During 2017, we recorded in Switzerland a peak in activity of shareholder activists, going beyond previous thresholds with some prominent and – from an activist's point of view – in fact quite successful cases.

1 INCREASED SHAREHOLDER A CTIVISM IN SWITZERLAND

Originating from the USA, shareholder activism and hedge fund activism in particular have been on the upswing throughout the world - and increasingly in Europe - since the financial crisis. This global trend is now also affecting Switzerland.

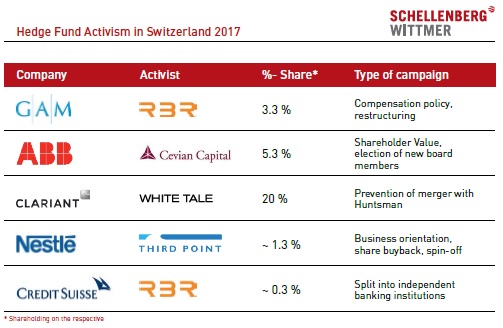

Following prominent cases such as the failed attempt of Elliott Advisors in 2011 to take control over the board of directors of Actelion, or the successful proxy fight in 2013 between Carl Icahn and Transocean Ltd (then still listed on the SIX Swiss Exchange) as well as other isolated cases in previous years – we recorded a new peak in economic or hedge fund activism relating to Swiss public companies in 2017.

The main drivers of this development are above-average returns of activist hedge funds, which are well above the returns from hedge funds in general. On the typical features of Hedge Fund Activism, see our May 2014 Newsletter, Section 2.3.

2 CURRENT SWIS S HEDGE FUND A CTIVIST CA S E S I N 2017

2.1 GA M

At the beginning of 2017, Swiss shareholder activist Rudolf Bohli purchased 3.3 percent of the share capital of Swiss asset manager GAM Holding AG, through his hedge fund RBR Strategic Value. Bohli sharply criticized the compensation paid to the management. However, the shareholders' meeting of 26 April 2017 rejected Bohli's proposals of newly appointing his three candidates to the board of directors, introducing a compensation committee and simplifying the asset manager's group structure.

The activist shareholder was nevertheless able to make a respectable success: the shareholders' meeting rejected the variable compensation for the executive board as well as the board of director's compensation report (cf. Section 4 below).

At the end of June 2017, RBR Strategic Value sold its GAM investment with profit. Subsequent to the activist work of Rudolf Bohli, the company appointed a Chief Restructuring Officer; moreover, the compensation incentives of the executive board were subject to a closer review.

Major Hedge Fund Activism cases in chronological order from January to November 2017

2.2 CLARIANT

The Swiss chemical company Clariant also attracted the attention of hedge fund activists in 2017. Following the announcement of the intended merger of Clariant with Huntsman in May 2017, White Tale (an investment partnership of the activist US hedge fund Corvex and investment company 40 North, part of US construction supplier Standard Industries; incorporated solely for this purpose) increased its original investment step by step from less than 3 percent in Clariant to more than 20 percent in approximatively four months.

This was done with the intention of preventing the intended merger of Clariant with Huntsman, which would have required a capital increase at Clariant and therefore the approval of two thirds of the votes represented at the scheduled shareholders' meeting. White Tale considered the contemplated merger devastating for the company's value due to Clariant's alleged too low valuation in the parties' merger agreement. Moreover, the merger would allegedly lack strategic logic and therefore the business development of Clariant would be viewed negatively.

Shortly after White Tale disclosed it had exceeded the threshold of 20 percent in the share capital of Clariant, the merging partners terminated their merger contract by mutual agreement. They did so as it was foreseeable – on the basis of the voting block of more than 20 percent built up by White Tale – that the required two thirds majority could no longer realistically be achieved at the scheduled extraordinary shareholders' meeting of Clariant.

Following the cancellation of the proposed merger with Huntsman, White Tale's pressure shifted to a request to Clariant to review all options for a strategic realignment of the company, including the contemplated sale of the Plastics and Coatings Division, and to support the election of White Tale representatives to the Clariant board of directors.

2.3 NESTLÉ

Daniel Loeb and his hedge fund Third Point, (which was holding a minority stake of slightly more than one percent of the share capital of Nestlé AG) sent on 25 June 2017 an open letter to the shareholders; outlining demands for an increase in productivity by introducing specific margin targets, launching a share buyback program while increasing the net debt to equity ratio as well as the sale of business areas which are not part of the core business, namely Nestlé's 23 percent share in L'Oréal.

Immediately after publication of the open letter from Third Point, the executive board of Nestlé announced on 27 June 2017 its intention to improve the future value chain model on the basis of a profitable and selective growth and thereby increasing the margin, as well as undertaking selective divestments. Furthermore, the immediate launch of a share buyback program totalling CHF 20 billion was announced as well as the prospect to increase Nestlé's net debt to equity ratio in the future.

Since Nestlé's announcement, no news regarding further actions of Third Point at Nestlé could be taken from the media. It can however be assumed that the hedge fund will continue to be in regular dialogue and exchange with the company.

2.4 CREDIT SUIS SE

Credit Suisse AG was the target of an activist initiative twice this year (cf. also below, Section 3.1).

The most recent activist initiative occurred mid- October 2017, when the hedge fund RBR Strategic Value (of Swiss investor Rudolf Bohli) demanded the renunciation of the Universalbank and the division of Credit Suisse AG into three parts: an investment bank, an asset manager and a portfolio manager. Bohli claimed that by sub-dividing the bank into three business areas, the current value of the bank could be doubled.

According to its own statements, Bohli's hedge fund was holding between 0.2 and 0.3 percent of Credit Suisse's share capital. Although Bohli's plans received significant media attention, their implementation was called into question. The largest shareholder of Credit Suisse, the fund company Harris Associates L.P. announced that it rejected the plan from RBR. Whether Bohli's hedge fund will be able to attract other major investors to its side to implement its plans will become clear in the coming weeks and months. Bohli was at least able to chart a short-term success: following the announcement of his plans, the share price of Credit Suisse rose by approximately 1.9 percent.

3 CURRENT SWIS S SOCIAL POLIC Y A CTIVISM CASES

Aside from classic hedge fund or economic activism casesmentioned above, we also recorded two typical cases of social policy activism in Switzerland in 2017 (cf. our May 2014 Newsletter, Section 2.2).

3.1 CREDIT SUIS SE

At the annual ordinary shareholders' meeting of Credit Suisse AG on 28 April 2017, several shareholder activists with small shareholdings as well as independent proxy advisors along with Greenpeace activists requested the dismissal of the chairman of the board of directors for socio-political reasons. The chairman was accused of unsustainable management as well as Credit Suisse's questionable involvement in the financing of the North Dakota Access Pipeline, which is intended to run through the sacred sites of the Standing Rock Sioux Native American Reservation in the US state of North Dakota.

Despite this criticism, both the chairman of the board of directors and all other remaining members of the board of Credit Suisse were confirmed for another year. In addition, the executive board and the board of directors were granted discharge with 88.53 percent of the shareholder votes.

3.2 LAFARGEHOLCIM

At the ordinary shareholders' meeting of LafargeHolcim Ltd on 3 May 2017, various shareholders – supported by proxy advisors Ethos and Actares – requested rejection of the compensation report and the refusal to grant discharge to the members of the board of directors and the executive board. One reason for this request – amongst others – was the so-called Syria affair (the group allegedly paid protection money to local ISS terrorist groups).

At the shareholders' meeting in spring 2017, the shareholders granted discharge to the board of directors and the executive board with an unusually low approval rating of only 61 percent of the votes. The re-election of all members of the board of directors, on the other hand, was approved with more than 90 percent of the shareholder votes.

4 CURRENT SWIS S CORPORATE GO VERNANCE A CTIVISM CASES

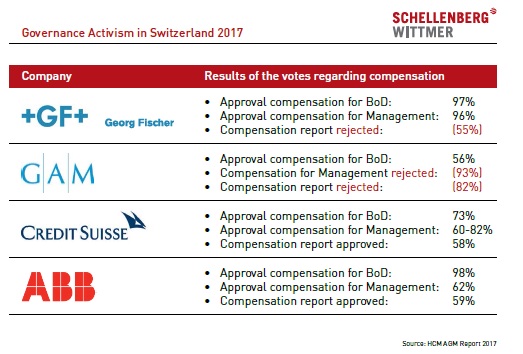

In 2017, ordinary shareholders' meetings of Swiss public companies were also affected by shareholder activism regarding matters of corporate governance (on Governance Activism cf. our May 2014 Newsletter, Section 2.1).

The approval ratings on issues of governance – in spite of sometimes heated debates, namely in the area of management compensation – were generally, as before, at or above 90 percent of the votes represented at the relevant shareholders' meeting. However, the results at individual public companies are increasingly displaying greater diversification; moreover, predictions regarding results of votes, in particular in the case of consultative votes on the compensation report, have become significantly less certain.

The voting results regarding compensation at the shareholders' meetings of selected Swiss companies under fire

As can be taken from the above overview of prominent governance activism cases of 2017, at both Georg Fischer AG and GAM the consultative vote on the compensation report was rejected by the shareholders' meeting. At both Credit Suisse AG and ABB Asea Brown Boveri AG, the approval ratings of the shareholders' meeting regarding the compensation report were below average compared with previous years. The shareholders of Credit Suisse approved the bonuses paid to the group management retrospectively for the previous business year with only

59.6 percent of the vote. Moreover, for the first time an ordinary shareholders' meeting (at GAM) rejected the request from the board of directors for a binding vote on the variable compensation of the executive board.

5 CONCLUSION AND OUTLOOK

Whether one likes it or not – shareholder activism is not just a temporary phenomenon, but can and will have the potential to affect every Swiss public company of any orientation and size in the years to come and can – from one day to the next – unexpectedly place it in the media spotlight. The approach of activists is therefore increasingly shifting from an "acting in the background" to a more effective public work under the media's attention.

Even if not all activist initiatives ultimately lead to tangible effects, they are certain to attract the attention of the media and an ever wider public. With regards to governance and social policy activism, shareholder activism can certainly be attributed to have positive effects on the commercial and social policy responsibility of a public company. The voices generally describing the (hedge fund) activists as investors without obligations, attacking our domestic economy and focussing on short-term profit maximization fall too short. The objectives and methods of the activists, as well as the effects on the companies affected are too diverse.

In an increasingly activist economic environment, Swiss public companies are well advised to be at all times prepared against possible initiatives of shareholder activists and to consider possible defence measures against an activist initiative in advance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.