In accordance with the Law "On Amendments and Additions to Certain Legislative Acts of the Republic of Uzbekistan in Connection with the Adoption of the Basic Directions of the Tax and Budget Policy for 2018" dated 29.12.2017, No. 454 and Presidential Decree No. PP-3454, dated 29.12.2017, "On the forecast of the main macroeconomic indicators and parameters of the State Budget of the Republic of Uzbekistan for 2018," the following changes were made to the tax legislation:

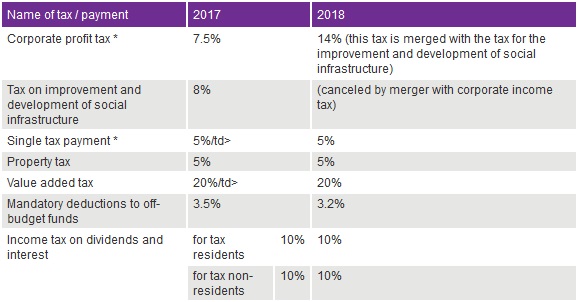

1.Rates of taxes and obligatory payments

Main changes:

- The tax on the improvement and development of the social infrastructure was abolished in connection with its merger with the corporate income tax.

- The general corporate profit tax rate is set at 14%. Taking into account the cancellation of the tax on the improvement and development of social infrastructure, the merged rate decreased (14% in 2018 compared to 2017 - 8% tax for improvement and development of social infrastructure and 7.5% corporate profit tax.)

- Three mandatory contributions (to the Pension Fund, the Republican Road Fund and the Fund for the Development of the Material and Technical Base of Educational and Medical Institutions) are combined into a single payment – "mandatory contributions to state trust funds," and the combined rate is reduced by 0.3 percent.

* There are other rates for certain categories of taxpayers.

Additionally:

- The tax privilege on dividends directed to the registered capital of a legal entity is canceled, and from 1 April 2018 such dividends are subject to taxation (Part 4 of Article 156 of the Tax Code).

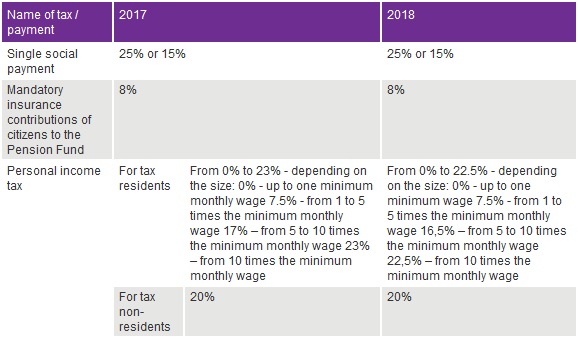

2. RATES OF TAXES AND OBLIGATORY PAYMENTS RELATED TO PAYROLL

- The main change: Average and maximum rates of personal income tax are reduced by 0.5 percent

Additionally:

- The amount of mandatory monthly contributions to the Individual Accumulation Pension Accounts has been increased from 1% to 2%, while the procedure for reducing the personal income tax for the amount of funds transferred to the Individual Accumulation Pension Accounts has been preserved.

3. Taxation of permanent establishments of non-residents

The tax on net profit was abolished: Non-residents operating in Uzbekistan through a permanent establishment, in addition to the profit tax of legal entities, paid to the budget a tax on net profit (profit less the amount of income tax) at a rate of 10% (part 8 of Article 154 of the Tax Code)

According to the changes made to Article 154 of the Tax Code, permanent establishments will pay only profit tax at a rate of 14%. The tax on net profit will not be levied on them.

The amount of taxable income calculated for corporate profit tax of a permanent establishment has been reduced to 7%: Previously, corporate profit was calculated from at least 10% of all expenses directly related to the receipt of income from activities through a permanent establishment, irrespective of whether they are incurred in Uzbekistan or abroad.

4. The list of deductable and non-deductable expenses for the corporate profit tax is adjusted

In accordance with tax legislation, the taxable base for corporate income tax is defined as the difference between aggregate income and deductible expenses. Amendments were made to Articles 145 and 147 of the Tax Code, the list of deductible expenses was expanded (such as, expenses for trust management services).

In addition, article 146 of the Tax Code has been amended to change the procedure for writing off a number of expenses of the reporting period deductible in the future.

5. The tax on the corporate property of legal entities will only apply to immovable property

From 1 January 2018, corporate property tax for fixed assets will be levied only on immovable property of legal entities, including those owned by non-residents. The tax also applies to real estate received under a financial lease (leasing) agreement.

Movable property (machinery and equipment, transfer devices, transport and other fixed assets) is excluded from taxable objects (which was previously taxable), and now the tax will not be paid from the value of movable property. However, please note that objects of construction and equipment not commissioned within the set terms are still subject to corporate profit tax. As before, the property tax on them is paid at a double rate.

6. The reduction of the rates of corporate profit and property taxes for exporter companies is abolished

From 1 April 2018, the reduction in the rates of corporate profit and property taxes for companies exporting for hard currency goods (works, services) of their own production is abolished. Exporter companies will pay corporate profit tax and corporate property tax at general rates.

7. Benefits for organizations included in the localization program are canceled

Since 1 April 2018, the following privileges have been canceled for organizations included in the list of localization projects:

- Exemption from customs payments (with the exception of fees for customs clearance) for imported technological equipment and spare parts to it, as well as components not produced in the republic, used in the technological process in the production of localized products;

- Exemption from corporate profit tax, a single tax payment in the part of products produced under localization projects;

- Exemption from corporate property tax in the part of fixed assets used to produce of localized products.

8. Single tax payers to pay land tax for land plot more than 1 hectares

Previously single tax payers did not generally pay any land tax. Starting from 1 January 2018, single tax payers having a land plot more than 1 hectare on the rights of ownership, use or lease will be paying the land tax.

Dentons is the world's first polycentric global law firm. A top 20 firm on the Acritas 2015 Global Elite Brand Index, the Firm is committed to challenging the status quo in delivering consistent and uncompromising quality and value in new and inventive ways. Driven to provide clients a competitive edge, and connected to the communities where its clients want to do business, Dentons knows that understanding local cultures is crucial to successfully completing a deal, resolving a dispute or solving a business challenge. Now the world's largest law firm, Dentons' global team builds agile, tailored solutions to meet the local, national and global needs of private and public clients of any size in more than 125 locations serving 50-plus countries. www.dentons.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.