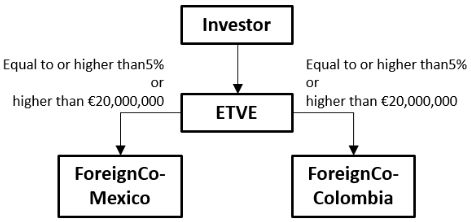

The use of Spanish holding companies to invest in Latin America ("LATAM") offers a number of tax benefits for investors.

These benefits come from the use of double taxation treaties ("DTT"), combined with a special tax regime in Spain for holding companies (the "ETVE Regime"). Holding companies taxed under the ETVE Regime are known as ETVEs.

As a result, channeling investments into LATAM countries through a Spanish holding allows the optimization of the taxation on income and profits distributed from a LATAM subsidiary.

1. What is the ETVE Regime?

The Spanish Corporate Income Tax Law ("CIT Law") foresees a special tax regime for holding companies, the ETVE Regime, which provides for tax benefits at the level of both the Spanish ETVE, and its shareholder. This special regime is particularly favorable to non-Spanish tax resident investors:

- Taxation of income at the level of the Spanish holding company or ETVE: income (dividends and capital gains) derived by the Spanish holding company from its foreign subsidiaries is exempt from Spanish Corporate Income Tax ("CIT"), provided certain conditions are met. Further, dividends are usually exempt from withholding tax or, can benefit from a reduced withholding tax, in the source state, pursuant to the DTT entered into with Spain and the jurisdiction of the tax residence of the subsidiary paying the dividends.

- Taxation of income at the level of the non-Spanish tax resident investor: dividends distributed by the ETVE (out of income generated by the LATAM subsidiaries) to the non-Spanish tax resident investors are not considered as obtained in Spain, and are thereby not subject to Spanish taxation.

2. What are the requirements for the ETVE?

- The company's corporate purpose must include the management and control of participations of non-resident subsidiaries through proper human and material resources;

- The ETVE shares must be nominative; and

- The application of the ETVE regime must be notified to the Spanish Tax Authorities.

3. ETVE's Tax Regime

3.1 Income obtained by ETVE:

The Spanish CIT Law foresees a participation exemption regime for dividends and capital gains applicable to all CIT taxpayers who meet the relevant requirements. Dividends and capital gains obtained by the ETVE can also benefit from such general exemption.

As a general rule, foreign dividends and capital gains are exempt from Spanish CIT if:

- The percentage of shareholding is at least 5%, or the acquisition value of the shareholding is over €20,000,000, and it has been maintained for at least one year; and

- The subsidiary is subject to an identical or similar CIT with a nominal tax rate of at least 10%. This condition is deemed as met where there is a DTT between the jurisdiction of tax residence of the relevant subsidiary and Spain.

Income obtained through a foreign Permanent Establishment ("PE") is exempt if:

- The PE is subject to a similar or identical CIT with a nominal tax rate of at least 10%. This condition is deemed as met where there is a DTT between the jurisdiction in which the PE is located and Spain.

3.2 Dividends paid by the ETVE

If dividends are paid:

- To non-Spanish tax resident

shareholders: there is no taxation in Spain (it is considered as

income not obtained in Spain) except for:

- Dividends derived from non-exempt income (under the Spanish participation exemption regime); or

- Dividends paid to a shareholder with tax residence in a tax haven.

- To Spanish tax resident corporate shareholders: exemption under the Spanish participation exemption regime, provided all relevant conditions are met.

- To Spanish tax resident individual shareholders: subject to Spanish Personal Income Tax ("PIT"), as savings income1 (at a 19%-23% tax rate).

3.3 Capital gains from the sale of ETVE shares

If capital gains are derived from the sale of ETVE shares:

- By non-Spanish tax resident

shareholders: there is no taxation in Spain, except for:

- Capital gains allocated to assets others than those related to exempted foreign shareholdings; or

- Shareholders with tax residence in a tax haven.

- By Spanish tax resident corporate shareholders: exemption under the Spanish participation exemption regime, provided all relevant conditions are met;

- By Spanish tax resident individual shareholders: subject to PIT as savings income (at a 19%-23% tax rate).

4. LATAM and the potential of ETVEs as Investment Vehicles

The greatest value of ETVEs for non-Spanish tax resident investors with shareholdings in LATAM subsidiaries is the mitigation of taxation in the repatriation of income obtained from their foreign investments under the ETVE Regime. In addition, the ETVE is a Spanish tax resident company, which is entitled to benefits provided under the DTTs signed by Spain with LATAM jurisdictions.

As of today, Spain is a signatory to 14 double tax treaties with LATAM countries comprising: Argentina, Bolivia, Brazil, Chile, Columbia, Costa Rica, Cuba, Dominican Republic, Ecuador, El Salvador, Mexico, Panama, Uruguay and Venezuela.

In 2017, the MSCI Emerging Markets Index, identified Brazil, Mexico, Columbia and Chile as emergent economies. As such, these countries offer potentially attractive investment opportunities. There also exists a greater liberalization of trade and higher level of convergence in terms of regulations within these economies. These are the key factors in considering the potential for LATAM future investments.

Through the use of the ETVE regime and DTTs, Spain renders itself as an attractive jurisdiction in order to channel investments into LATAM countries.

Footnote

[1] The Spanish PIT distinguishes between two taxable bases: (i) The general base, which includes income from economic activities, work, etc.; and (ii) the savings base, which includes the passive income and certain capital gains.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.