Why the British Virgin Islands?

The BVI is one of the most popular offshore jurisdictions for investment funds. Here are some reasons why:

Modern, flexible company law

The BVI Business Companies Act 2004 is widely regarded as one of the most modern and progressive company law regimes in the world.

Familiarity to international investors

BVI 'business companies' are the most commonly used offshore vehicles in the world and are very familiar to international investors.

Well regulated

The BVI is internationally recognised as a well-regulated jurisdiction with a robust legal system that actively engages and cooperates with foreign governments and supra national bodies to ensure that its regulation meets international standards.

Tax neutral

An investment fund incorporated in the BVI is not subject to any income, withholding or capital gains taxes in the BVI.

Operative ease

There are no requirements for directors, officers, managers, administrators or custodians to be based in the BVI. There are no restrictions on commercial matters, such as investment objectives, trading strategies, or leverage, trading or diversification limits.

Experience and skill

The BVI hosts a highly skilled workforce of lawyers, accountants, corporate administrators and insolvency experts.

Cost effective

Compared with other jurisdictions, the BVI is extremely cost effective for incorporating, launching and maintaining investment funds.

BVI investment funds

BVI investment funds can be structured as BVI business companies, limited partnerships or unit trusts of which BVI business companies are the most commonly used vehicle.

Similar to other jurisdictions, the BVI law provides for 'segregated portfolio companies'. A segregated portfolio company is a single legal entity with different portfolios of assets and liabilities, each of which may be legally segregated from the assets and liabilities of the other segregated portfolios.

This guide focuses on BVI business companies. Please contact us if you require more information in relation to limited partnership or unit trust structures.

Regulation

The BVI Financial Services Commission (the FSC) is the local regulator.

The Securities and Investment Business Act 2010 and the Mutual Funds Regulations 2010 (together, SIBA) are the main pieces of legislation that govern the business of investment funds in the BVI and contain provisions relating to registration and licensing.

Closed-ended investment funds (ie funds in which investors do not have a right to redeem their fund interests on demand in accordance with the funds documents) fall outside of the definition of a 'mutual fund' under SIBA and are therefore generally not required to make any application for recognition or registration under SIBA or obtain any licences from the FSC.

Open-ended investment funds (ie collective investment vehicles in which investors have the right to redeem their fund interests on demand in accordance with the fund documents) generally do fall under SIBA.

SIBA

SIBA provides for the following categories of open-ended investment funds in the BVI, which must be recognised or registered with the FSC:

Professional funds

A professional fund is the most popular BVI investment funds product. It is aimed at high net worth, professional investors and the minimum initial investment by each investor (other than an 'exempted investor') is US$100,000 (or its equivalent).

A 'professional investor' is defined under SIBA as being a person: (a) whose ordinary business involves, whether for that person's own account or the account of others, the acquisition or disposal of property of the same kind as the property, or a substantial part of the property, of the fund; or (b) who has signed a declaration that he, whether individually or jointly with his spouse, has net worth in excess of US$1,000,000 (or its equivalent) and that he consents to being treated as a professional investor.

An 'exempted investor' is the investment manager, administrator, promoter or underwriter of a fund, any employee of the investment manager or promoter, or such other person as the FSC may specify from time to time.

A professional fund may carry on business for up to twenty-one days prior to obtaining FSC recognition, so long as the application for recognition is lodged with the FSC within 14 of launch. This means it is possible for professional funds to come to market very quickly in the BVI.

Private funds

A private fund is a fund whose constitutional documents specify that: (a) the fund is not authorised to have more than 50 investors; or (b) any invitation to investors to subscribe for fund interests is to be made on a private basis.

'Private basis' is defined under SIBA as including an invitation which is made to certain specified persons or by reason of a private or business connection between the person making the invitation and the investor.

Unlike a professional fund, a private fund must obtain its FSC recognition prior to launch. However, in our experience, this is usually a fairly quick process which takes a couple of weeks.

Public funds

A public fund is a fund which is not a professional or private fund. The product is generally utilised by managers looking to make retail offerings and is therefore subject to more stringent regulation and scrutiny.

Foreign funds

In certain circumstances, it is possible for an existing fund which is incorporated in another jurisdiction to apply to be recognised as a foreign fund. Reasons for doing so include if the existing fund wishes to carry on business 'in or from within' the BVI or market the fund to BVI resident individuals.

Directors and authorised representative

Each private fund and each professional fund must have at least two directors, one of whom must be an individual.

A public fund that is a BVI business company must have an adequate number of individual directors (being a minimum of two) who (a) are capable of exercising independent judgment; (b) have sufficient knowledge, skills, experience and understanding of the fund's business to ensure that the governing body is able to fulfil its responsibilities; and (c) have sufficient time and commitment to undertake their duties diligently.

All three categories of funds must have an authorised representative in the BVI to liaise with the FSC on behalf of the fund (unless the fund has a significant management presence in the BVI).

Functionaries

Any fund that is recognised or registered with the FSC under SIBA must have the following functionaries:

- an investment manager;

- an administrator;

- a custodian; and

- an auditor.

In certain circumstances, it is possible to apply to the FSC for an exemption from the requirement to have a custodian. Professional and private funds may also, in limited circumstances, apply to the FSC for an exemption from the requirement to have an investment manager. However, there is no exemption from the requirement to have an administrator; therefore funds may not be 'self-administered' in the BVI.

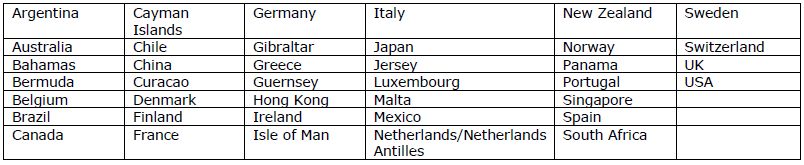

The FSC does not generally impose any additional regulatory requirements on service providers who are based in a 'recognised jurisdiction'. The current list of recognised jurisdictions is:

BVI professional and private funds are required to have an auditor and file audited accounts with the FSC, but there is no requirement to have local BVI audit sign-off. In limited circumstances, it is possible for professional or private funds to obtain an exemption from the requirement to have an auditor.

Incubator and Approved funds

The Securities and Investment Business (Incubator and Approved Funds) Regulations 2015 introduced two new types of open-ended funds in the BVI, being the 'incubator fund' and the 'approved fund'.

Incubator funds

An incubator fund is an open-ended fund that is designed for start-up managers who may be looking to set-up quickly and create a track record.

The key features of an incubator fund are:

- it can have a maximum of 20 investors. The investors must be 'sophisticated private investors' which is defined under BVI law as being a person who has been invited to invest in an incubator fund and the amount of his or her initial investment is not less than US$20,000;

- the minimum investment for each investor is US$20,000; and

- the net assets must not exceed US$20,000,000 or its equivalent in any other currency.

An incubator fund is authorised to operate for a period of two years, which may be extended to three years on application to the FSC. At the end of this time period, or if the incubator fund has more than the authorised number of investors or net assets for an incubator fund, it must either convert to an approved fund, professional fund or private fund or liquidate.

An incubator fund is not required to have a manager, administrator, custodian or auditor. An incubator fund may also have a term sheet rather than a fuller offering document, which must include certain risk warnings.

Approved Funds

An approved fund is an open-ended fund that is aimed at smaller, private offerings or friends and family funds. Unlike the incubator fund, there are no eligibility requirements, no minimum level of investment is required and there is no set time limit on the life of an approved fund (assuming it does not breach any of the key features set out below).

The key features of an approved fund are as follows:

- a maximum of 20 investors; and

- the net assets must not exceed US$100,000,000 or its equivalent in any other currency.

An approved fund must have a third-party administrator but it is not required to have a manager, custodian or auditor. Like the incubator fund, an approved fund may also have a term sheet rather than a fuller offering document, which must include certain risk warnings.

Further requirements for incubator and approved funds

Incubator and approved funds must also:

- have an authorised representative in the BVI;

- have at least two directors (one of whom must be an individual);

- make semi-annual returns to the FSC regarding its assets and number of investors; and

- submit financial statements to the FSC (which need not be audited).

For further information

This guide is intended to provide a summary overview of BVI investment funds. Please contact us or visit mourantozannes.com to obtain our other guides and publications, including the following:

- 'BVI Approved Managers Regime'; and

- 'On-going obligations of BVI private and professional funds'.

We are always happy to receive queries and requests for further information.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.