Introduction

The Constitution Amendment Bill for Goods and Services Tax (GST) has been approved by The President of India and the GST council have decided to enforce GST from 1st July 2017.

It was agreed that tax revenue from small tax payers with annual turnover of less than INR15 million under the GST regulations will be divided between the states and the centre in the ratio of 9:1 for the purposes of scrutiny and audit. All taxes above this annual turnover threshold will be equally shared between the states and the centre.

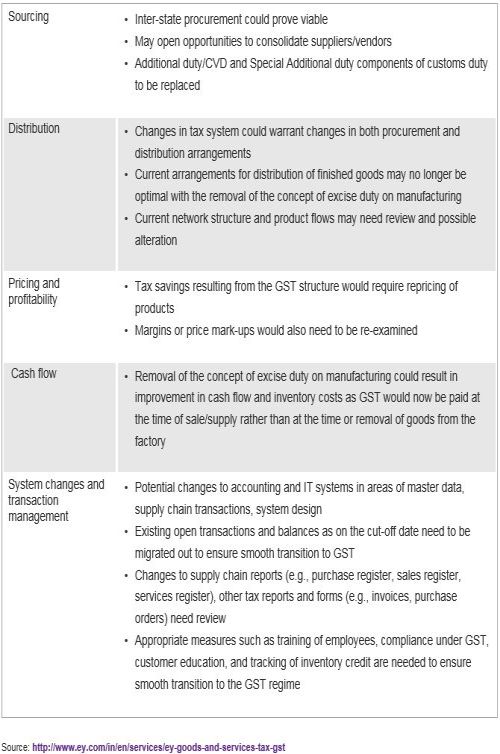

Currently, businesses in India have to contend with indirect taxes and restructure their systems and supply chain to fit this current tax regime. With GST being introduced, it will reform the Indian economy by creating a common Indian market and reducing the cascading effect of tax on the cost of goods and services. GST will have a far-reaching impact on almost all aspects of the business operations in the country. Further, it will lead to increased tax compliance which may attract more foreign direct investments across sectors due to tax transparency and ease of doing business.

These are some of the salient features of the proposed GST system:

- GST is defined as "any tax on supply of goods and services other than on alcohol for human consumption".

- The power to make laws in respect of supplies in the course of inter-state trade or commerce will be vested only in the Union Government. States will have the right to levy GST on intra-state transactions, including services.

- Central taxes such as central excise duty, additional excise duty, service tax, additional custom duty and special additional duty as well as state-level taxes such as VAT or sales tax, central sales tax, entertainment tax, entry tax, purchase tax, luxury tax and Octroi will be subsumed under the GST.

- Entertainment tax, imposed by states on movie, theatre, etc, will be subsumed under GST, but taxes on entertainment at panchayat, municipality or district level will continue.

- GST may be levied on the sale of newspapers and advertisements. This would mean substantial incremental revenues for the Government.

- Stamp duties, typically imposed on legal agreements by states, will continue to be levied.

- Administration of GST will be the responsibility of the GST Council.

Impact of GST on businesses in India

While companies should still be wary of the exact fixing of the rate at which tax will be charged and chances of inflation in the early days of implementation, on the whole, GST should improve the gross domestic product of the country in the long run.

Some of the other major benefits of GST implementation include reduced logistics cost, supply chain efficiency, reduction in costs for tax and regulatory compliance, better market penetration and export effectiveness.

Taxation of M&A transactions

Amendments have been proposed in relation to the tax treatment of the sale of unquoted shares, receipt of listed securities and capital gains taxable if securities transaction tax was not paid on acquisition of shares in the Indian Union budget for the financial year 2017-2018.

'Fair market value' deemed to be sale consideration for sale of unquoted shares

Under the existing provisions of the Income Tax Act, income chargeable under "capital gains" is computed by taking into account the full value of consideration received on transfer of a capital asset. It is proposed that where the sale consideration of a capital asset, being unquoted shares, is less than the fair market value, the full value of consideration shall be deemed to be the fair market value for the purposes of computing the income under "capital gains tax". Hence, the actual price paid may not be considered to be the sale consideration. However, it is uncertain how the fair market value of an unquoted share of a company will be determined.

From an M&A transaction perspective of structuring and reorganisation, this proposed change may lead to unfavourable tax consequences for a group as a whole notwithstanding the actual value at which such shares were proposed to be transferred. Thus, it could force such transactions to take place at fair market value and consequential tax considerations have to be seriously considered.

One potential issue that may arise is that there are no proposed exceptions for transfer for an unquoted share by a holding company to a subsidiary company which could invite significant amount of unnecessary litigation. Similar to how a transfer of a capital asset by a holding company to its wholly-owned subsidiary company is exempted from tax, it is advisable for the same exception to apply in this scenario.

Receipt of listed securities at less than fair market value to be taxable

The Finance Bill 2017 (the Finance Bill), expected to come into force on 1 April 2018, proposes the following to be included as being taxable under "other income":

- sum of money without consideration, the aggregate value of which exceeds INR50,000; or

- any immovable property without consideration (the stamp duty value of which exceeds INR50,000) or for a consideration which is less than the stamp duty value by an amount exceeding INR50,000; or

- any property, other than immovable property, without consideration (the aggregate fair market value of which exceeds INR50,000) or for a consideration which is less than the aggregate fair market value of the property by an amount exceeding INR50,000.

From an investor's viewpoint, the proposed changes could impact private placement transactions. In effect, investments would likely need to be made at the fair market value. If this is not adhered to, there may be potential tax outflows of up to 30% of the discount (to the fair market value) granted to the specific resident investors. The impact on non-resident investors should also be considered given the exchange control regulations in India and double tax avoidance agreements entered into between India and the investors' respective home jurisdictions.

Capital gains taxable if securities transaction tax not paid on acquisition of shares

Provided that the sale of equity shares or units of equity is subject to Securities Transaction Tax (STT), long-term capital gains resulting from any transfer of such equity shares or units of an equity oriented fund is exempt from tax under the current provisions of the Income Tax Act. Many taxpayers have been misusing this exemption to declare their unaccounted income by entering into sham transactions. Hence, it has now been proposed that this exemption would only be applicable if STT was paid on the acquisition of such equity shares. Whilst curing this misuse, this amendment could also negatively affect certain genuine investment transactions like domestic private equity investments, strategic investments by domestic investors, preferential allotments to certain investors including financial institutions, shares acquired through off market transactions, employees allotted shares under an employee stock option scheme, shares acquired through a merger or demerger, etc. In such cases, shares would have been previously acquired by the investor without payment of STT.

Customs duty and the introduction of "beneficial owner"

On 1 February, 2017, India's Finance Minister Arun Jaitley introduced the Finance Bill. The Finance Bill introduced the concept of "beneficial owner" to subsection (3A) section 2 of Customs Act, 1962, stating that "beneficial owner means any person on whose behalf the goods are being imported or exported or who exercises effective control over the goods being imported or exported".

Further, subsections (20) and (26) of section 2 (i.e. definitions of exporter and importer respectively) have been amended accordingly to replace the words "any owner", with words "any owner, beneficial owner".

Rationale of amendment

In India, companies are given a unique Importer Exporter Code (IEC) which they use for import/export activities. However, companies have been misusing the code by "loaning out" their IECs to hide non-compliance for purposes of saving on duty payable at the time of import, where the final recipient is, in many situations, not the IEC holder. Therefore, in order to enforce accountability under the Customs Act and recover duty payable, the government is including "beneficial owners" as a legal basis for pursuing investigations of tax fraud and duty avoidance.

Impact on Singapore companies

Potential difficulties surrounding the exact definition and application of beneficial ownership may have implications on Singapore companies doing businesses with India in the trade and industry sector. Singapore companies must be particularly prudent when exporting goods into India and ensure that the parties in India they are dealing with comply with the applicable laws and regulations and possess the necessary IECs. In applying the beneficial concept, if ownership lies with the Singapore company, this could lead to the possibility of the Singapore company being made liable to duty and accountable for custom compliance under the Customs Act, as they would now be considered the importer.

Dentons is the world's first polycentric global law firm. A top 20 firm on the Acritas 2015 Global Elite Brand Index, the Firm is committed to challenging the status quo in delivering consistent and uncompromising quality and value in new and inventive ways. Driven to provide clients a competitive edge, and connected to the communities where its clients want to do business, Dentons knows that understanding local cultures is crucial to successfully completing a deal, resolving a dispute or solving a business challenge. Now the world's largest law firm, Dentons' global team builds agile, tailored solutions to meet the local, national and global needs of private and public clients of any size in more than 125 locations serving 50-plus countries. www.dentons.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.