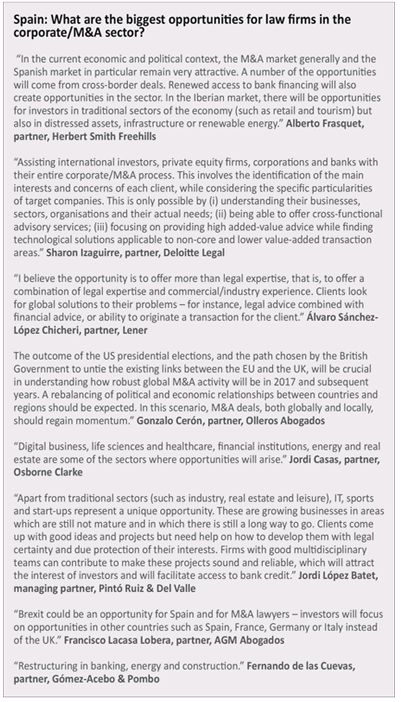

Investors are currently involved in a fierce battle to acquire assets in Spain, but with many clients worried about failing to complete transactions, they are becoming more inclined to negotiate hard on fees – meanwhile, in Portugal, despite deals in energy, finance and real estate, some argue investor interest is waning

The fact that, in the context of Spanish M&A, it is currently a sellers' market means that there are a significant number of bidders competing to buy any major asset that becomes available. The good news for lawyers is that with a plethora of investors showing an interest in most assets on the market, there is high demand for legal advice. However, there is a downside. Given the fierce competition between bidders, investors know that there is a reasonable chance that they may not be successful in completing the prospective deal – consequently, some clients are reluctant to spend significant amounts of money for legal advice on a transaction that may only have a slim chance of being finalised. As a result, there is significant pressure on fees, with some lawyers admitting that they will provide initial advice on a transaction free of charge. However, many other lawyers, understandably, recoil at this notion and argue that firms are too willing to acquiesce to client demands and consequently sell their services far too cheaply. Meanwhile, in Portugal, while some lawyers point to significant activity in the country's energy, finance and real estate sectors, others say that investor interest in Portuguese assets has cooled somewhat in the last year.

Governance concerns

One of the major developments in the last year is that corporate governance has become a more important consideration in M&A deals, says Julio Lujambio, partner at Pérez-Llorca. "There is great attention on [companies'] internal processes," he explains. Lujambio also says that, given that it is currently a "sellers' market", there are a lot of competitive bidding processes. He continues: "This is good in that there is a lot of room for legal advisers, but the problem is that it means lawyers are not always completing deals."

Increasing corporate governance requirements mean that corporations have to "pass more stages and take more time" before they can complete a deal and this means that funds are sometimes winning bids because they are more efficient and quicker, according to Allen & Overy partner Iñigo del Val. However, Jorge Vázquez, partner at Ashurst, says: "Many funds are taking a more distant approach to competitive bidding M&A processes – or even withdrawing from them - because they feel there is too much competition. They are less willing to spend time and money in these situations because they feel they have less chance of winning the deal."

There is money to be spent in the Spanish market, says Garrigues partner Javier Marzo. "Foreign direct investment is growing, particularly in real estate, and there are still some opportunistic and distressed deals," he adds. "We are optimistic, Spain is on the right path, 2016 will be a good year." Alejandro Ortiz, partner at Linklaters, says there are a lot of new players in the Spanish market, including sovereign wealth funds, Asian and Middle East investors, and Canadian pensions funds. He continues: "For example, LPs [limited partners that traditionally invest in private equity funds] are now investing directly in Spain and competing with private equity funds – we are also seeing traditional private equity funds looking at medium-sized deals and not only large deals as used to be the case." Another partner adds that private equity funds that were formerly looking for billion-Euro deals, now see €300 million to €350 million deals as the "sweet spot".

Lawyers are being approached by international investors regarding potential M&A transactions in Spain, which shows that activity levels may increase in the near future, says Clifford Chance partner Luis Alonso. Meanwhile, he adds that the role of general counsel has been changing during recent years and that they are, consequently, much more involved in the decision-making process: "They [general counsel] are getting closer to the CEO role, as legal aspects of M&A transactions are becoming more relevant year by year."

Free advice

The current market conditions are leading to the creation of new venture capital funds with around €40 million to €50 million in funds that are interested in investing in Spain, according to Carlos Blanco Morillo, partner at Roca Junyent. "There is a lot of liquidity in the market," he adds. One partner remarks that, due to the highly-competitive nature of the M&A market in Spain, the vendors are more commonly conducting full due diligence exercises so the "sellers' legal advisers are doing a lot more of the work. The partner adds that some corporate lawyers do work for clients "for nothing in the first phase" as some private equity clients are reluctant to pay legal fees if the deal is not completed. There is a feeling that private equity funds are more likely to switch legal service providers, whereas, with corporations, a relationship of trust with their lawyers is more important.

One partner argues that his firm provides work for clients on a complimentary basis, or at a reduced rate, with the aim of clawing back fees when billing for subsequent work. However, another partner at a rival firm says this is unrealistic: "I can't believe in one deal that you will recover fees from a previous deal. We [Spanish law firms] are softer than Anglo-Saxon firms in terms of fees – clients pay fees for failed deals in France, for example, that they wouldn't do in Spain."

Spanish law firms need to "maintain red lines" when it comes to fees and stop being so willing to do work at lower rates," says one market source. The source adds that the Spanish market is a sophisticated market and it should act as such. Another partner remarks: "When clients ask for an engagement letter, firms should not go down from the quoted figure, but some clients are getting fees that are 50 per cent less than that." However, one Madrid-based partner at an Anglo-Saxon firm remarks: "We can't bring prices down, we would be fired." Meanwhile, Ortiz argues that the level of expertise at law firms in Spain is very high. He adds: "International clients often acknowledge this and remark on the high quality they find in the Spanish legal market."

Uría Menéndez partner Manuel Echenique says prominent investment banks are not currently as involved in the market for M&A advice on deals in Spain as in the pre-crisis period. He adds: "The M&A boutiques are gaining significant market share, even in significant M&A transactions where no balance sheet is required from the investment bank." Echenique adds that with the new macro-economic environment, corporate and M&A work should again be the "engine" of law firms. He continues: "We have seen the best year ever in 2015 and 2016 is looking good, but we need to focus on selective transactions – M&A is lucrative, but it generates a lot of conflicts of interest."

Artificial intelligence

Artificial intelligence is expected to have an impact on corporate and M&A practices, according to Alonso. "Computers will be completing due diligence work in a few hours that would require several days for trainees and junior lawyers," he adds. Araoz & Rueda partner Pedro Rueda says that artificial intelligence will soon be "broadly available" to all law firms. Rueda also has faith that his firm's strategy of remaining independent is the right one: "Being independent gives us an edge and helps us in getting referrals from law firms without a presence here [in Spain]." PwC partner Javier Gómez says that, if lawyers are able to take the initiative when dealing with clients, they will become the client's "trusted adviser". But he adds maintaining profit levels is a challenge for law firms. "If fees don't get higher, there is a need to reduce costs."

Cybersecurity is a major challenge for law firms, according to Alonso. He adds: "Law firms keep the most sensitive information of major corporations and, for this reason, they are a major target for hackers. National governments and other leading institutions, even the FBI and the CIA, have suffered attacks from hackers in the past and, unfortunately, it is only a matter of time before law firms also suffer serious attacks. Cybersecurity is, no doubt, a major priority for any law firm." Internationalisation is another major challenge facing law firms, says Cuatrecasas partner Javier Villasante. "Most of our main corporate clients are going international and major Spanish law firms are implementing strategies to follow them" he says. In addition, providing sufficient inspiration to young lawyers is also a challenge for firms, according to Villasante: "Not every associate wants to become partner, and we need to motivate them, especially those willing to pursue the partnership track". Meanwhile, Villasante says diversity is a key issue facing law firms. "We need to promote policies that prove more efficient in retaining female legal talent in the long term", he adds.

Lawyers in Spain will be hoping that the end of ten months of political uncertainty – following the reappointment of Mariano Rajoy as Prime Minister after a confidence vote – will give investors more confidence. One partner comments that some international clients were considering closing their offices in Spain prior to confirmation that Rajoy would continue to lead the Spanish government.

Portugal: Energy in demand

Investors are particularly interested in acquiring Portuguese energy sector assets at present, according to MLGTS partner Ricardo Andrade Amaro. He adds: "Portuguese energy companies are selling minority stakes to funds – in general, in 2016, there has been huge interest in the Portuguese market and revenue from M&A/corporate work will increase in 2017."

However, there is an opposing view that investors' interest in the Portuguese market cooled in the last 12 months. FCB Sociedade De Advogados partner Pedro Guimarães says that, while 2015 was a tremendous year for his firm, investors have been wary about the Portuguese market in 2016, and that this has been partly – though not primarily – due to the fact that "some investors feel Portugal is over-bureaucratic".

Linklaters' counsel Diogo Plantier Santos says there have been significant deals with a real estate component, as well as consolidation in the banking and insurance sectors. Meanwhile, according to Vasco Bivar de Azevedo, partner at Cuatrecasas Gonçalves Pereira, Portuguese assets are currently "very cheap". He continues: "There are some big-ticket transactions, but there have been mostly mid-market deals in the energy and real estate sectors, including some tourism development – there has also been an increase in interest from private equity and venture capital investors, particularly in the tech business area in recent times."

The future of Portugal's banks will determine future M&A activity, says Serra Lopes, Cortes Martins Advogados partner Francisco Barona. He adds that there has been a number of deals recently in the real estate, tourism and start-up sectors. However, Barona says "uncertainty means there are no longer large transactions."

There are some doubts about future prospects for M&A deals in Portugal, argues João Gonçalo Galvão, partner at Campos Ferreira, Sá Carneiro & Associados. "The restructuring of the banking sector will impact on their [banks] ability to finance companies," he says. "There has been a shift in decision-making in the national banking sector, in particular to Spain." Portugal's left-wing government is not deterring clients from investing in Portugal, says Vieira de Almeida partner Paulo Trinidade Costa. However, he adds that the "capacity of the market to feed itself with transactions is a concern". Trinidade Costa continues: "There will be a lot of restructuring and consolidation in the banking sector – new investors are coming, including investment funds from different areas of the world, including Australia and Indonesia." There continues to be interest in Portuguese assets and new players – particularly from China, Brazil and Turkey – have been investing, according to Plantier Santos.

'Carve-outs'

A large amount of transactional activity is related to corporate 'carve-outs' [where a company sells a subsidiary business to outside investors], says Bivar de Azevedo. He adds that, particularly with regard to investors from China, there is a demand for capped or fixed fees from law firms, while venture capital deals tend to generate lower legal fees. SRS Advogados partner Nuno Miguel Prata argues that clients are "less price sensitive than they were three or four years ago" and that the average billing rate is higher now than it was then and law firms are in a position to increase hourly rates. Another partner at a leading firm in Portugal remarks that clients no longer "give the same value to all legal work". The partner adds: "This could put stress on partner relations within a firm as clients will pay different prices for different types of work – firms will therefore have to evolve."

Work done by Portuguese firms is underpriced compared to that done by peers in other European jurisdictions, such as Spain, France and Germany, says Eduardo Paulino, partner at MLGTS. "It's important that international clients come [to Portugal] prepared to pay more adequately," he adds. Guimarães says that, while part of law firms' work is becoming commoditised, clients always value skills such as negotiating and closing. He adds: "Clients do not always want 'one-stop-shops' and we're seeing the development of some specialised boutiques as a result – however, 'one-stop-shops' remain a clear choice for a lot of clients in a lot of cases." Though there are several boutique firms in the Portuguese market, Abreu Advogados partner Ana Sofia Batista says that clients still expect full-service law firms to have experts in several areas, in order to cover their global needs. Meanwhile, the legal arms of the 'Big Four' auditors are a "huge challenge" for mid-market firms in Portugal, says Paulino. "The 'Big Four' are in a position to be very competitive in small and mid-market transactions, though their profile is not so much suited for bigger deals."

Closing borders

There are reasons to be optimistic about prospects for the coming year because the Portuguese business sector is better prepared for attracting investment, according to Paulino. However, he adds that the concern is that there is a global trend to "close borders" and this could have an impact on "open economies". Another partner adds that the increasing trend for protectionism in various parts of the world "doesn't help the global economy". Meanwhile, Barona says he is optimistic about banking restructuring in Portugal, but adds it is a concern that there are huge non-performing loans that need to be restructured, and it is not yet clear how they will be restructured. Francisco Brito e Abreu, partner at Uría Menéndez-Proença de Carvalho, says the continued interest of international investors in Portugal is cause for optimism, but this is tempered by global economic instability. However, he adds that law firms are becoming more efficient and do more in terms of monitoring how much time lawyers spend handling work.

Finally, political changes around the world are causing concern among lawyers. As one partner puts it: "I'm pessimistic about stupid political decisions, such as Brexit – free trade was taken for granted, but then stupid political decisions are an opportunity for lawyers, when rules are implemented, we can help the client get around them." Meanwhile, PLMJ partner Maria João Ribeiro Mata says that, while 2016 was slower than 2015 with regard to deals (in terms of the number of transactions, rather than the value), she is confident that Portugal will be more stable from a political point of view in the coming year and that will attract investors and boost M&A. Speaking at an Iberian Lawyer Corporate and M&A Roundtable prior to the result of the US election, Ribeiro Mata anticipated a victory for the Republican Party candidate Donald Trump and said that this was her biggest concern as she believes the Trump presidency could have a "negative impact on foreign investment in Europe and, specifically, investment in Portugal".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.