In Brief

As part of Japan's BEPS reforms, Japanese domestic law was amended by the 2014 tax reforms to adopt the principles reflected in the 2010 OECD Report on the Attrition of Profits to Permanent Establishments. The new law will affect both corporations and individuals and will come into effect for the 2017 calendar year for individuals. This news alert discusses the changes affecting individuals.

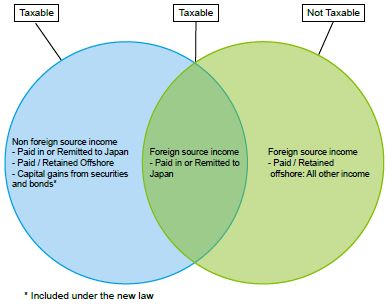

From 1 January 2017, the scope of taxable income for non-permanent residents (NPRs) will change. Currently, a NPR is not taxable on worldwide income but on Japan-source income, regardless of where it is paid, and any non-Japan sourced income paid in Japan, remitted, or effectively remitted to Japan. Under the new domestic rules with effect from 1 January 2017, a NPR is taxable on all income except foreign source income that is not paid in, remitted or effectively remitted to Japan.

Non-Permanent Residents

A NPR is an individual who meets the following conditions

- Maintains a domicile in Japan or has maintained an abode in Japan for one year or more

- Does not possess Japanese nationality

- Has maintained a domicile or abode in Japan for 5 years or less in the preceding 10 years.

Changes in Scope of Taxation under New Law

The current scope of taxation for a NPR individual is summarized as follows:

The adoption of the "Attribution of Income" principle under the new AOA generally aligns with treaty concepts on how to determine the scope of income that should be taxed in Japan. For individuals, foreign source income is now defined under the Foreign Tax Credit clause and includes almost all sources of income generated from sales of foreign assets except sales of securities and bonds.

As a consequence, from 1 January 2017 capital gains on securities and bonds (with a few exceptions where special treatment applies) will become taxable for all tax residents of Japan, regardless of whether the gains are remitted or not.

The following summarizes how a NPR individual will be taxed from 1 January 2017.

2017 Tax Reforms

Perhaps, realizing the additional tax burden that the new definitions would place on non-permanent residents who historically would not have been taxed on their share and security related gains retained offshore, the government made a further clarification to the rules in the recent 2017 tax reforms.

Effective from 1 April 2017, any gains arising on the sale of shares or securities, with the exception of those relating to shares or securities acquired by a non-permanent resident after 1 April 2017, can be excluded when determining the taxable income of a non-permanent resident.

This will have the effect of limiting the taxation of gains on overseas shares and securities for an NPR to those relating to acquisitions subsequent to the later of 1 April 2017 or their arrival in Japan.

Double Tax Relief

Japan's network of tax treaties will allow further limited protection from the new definitions. Under the tax regulations, where a gain is realized on a sale of shares or securities overseas, and the country in which it is realized has the right to tax the gains under a tax treaty with Japan (i.e. gains are taxed on a source country basis), it may continue to be considered a foreign source of income.

The following is a list of countries under which such treatment would apply. Please note separate rules can apply for the sale of shares in certain types of business or for substantial share holdings.

Where double taxation arises in a country other than those listed below, relief should be considered in the other country.

* The treaty between Japan and the USSR continues to apply to Russia and other successor states of the former USSR.

Taxation of Capital Gains

Capital gains arising from the sale of securities/ bonds are calculated as follows

Capital Gain: Proceeds on the sale – (Cost Basis" and

selling expenses)

"Cost basis used for shares: Fair market value on the day of

sale / acquisition

The tax rate applicable is 15.315% for national tax (including restoration surtax) and 5% for local tax.

A point to note is that the above valuation of capital gains in Japan may be different from other countries so capital gains in Japan may or may not translate into capital gains and consequent taxation in other countries.

Deloitte's View

The new scope of taxation will be imposed from 1 January 2017 and will affect foreign nationals who realize income from the sale of foreign securities / shares during the period that they are NPRs.

There will then be a three month period before the more relaxed regime applies from 1 April 2017.

Affected individuals may wish to consider advancing pending security sales to 2016 prior to the new rules coming into effect or delaying disposals until after 1 April 2017.

Individuals who have significant holdings in overseas securities should consult their tax advisors on the tax impact of disposals and possible planning around double taxation and tax treaties.

Companies may wish to communicate the change to current employees and especially their foreign national employees who are currently on an assignment in Japan and had been informed of the pre-2017 regime.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.