Why has it taken so long for FinTech to reach the insurance industry? After all, insurance is no small sector, with plenty of facets and geographical reach—just the things that FinTech has already capitalised on in banking, fund distribution, and regulation, to name a few. But the fact is that, while insurance companies are already using various digital tools, nothing particularly revolutionary has rocked their business models or rattled the status quo. How come?

Mark Wilson, CEO of Aviva, gave three answers to this question when he spoke at the Web Summit last month: regulation, risk, and capital. To paraphrase him: the regulatory environment is tough on innovators in this area; risk in insurance is far costlier than in, for example, the taxi industry; and it takes hefty wallets to get things going in this giant industry.

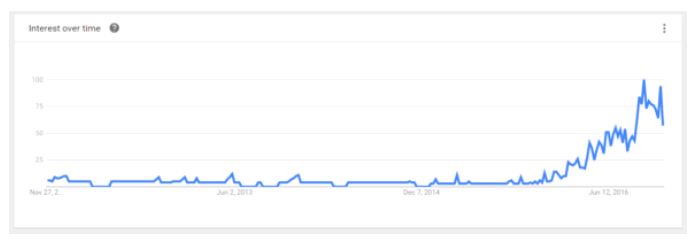

The quicker answer might also be that it doesn't matter why—because the disruption is firmly on its way, regardless. Here's how the term InsurTech's popularity is looking on Google Trends:

Feel free to formulate any sentence you want using the phrase "remarkable uptick."

The birth of this field is likely down to the same technologies enabling RegTech, robo-advisory, social trading, and so on—big data and artificial intelligence. (And perhaps the Internet of Things too, in this case). Mr Wilson spoke of "answering little questions with big data" in the context of Aviva's digital evolution, and, mercifully, provided examples: to insure a home, a company needs to know things like the length of its driveway, to determine its statistical likelihood of being burgled, and what kind of trees are on its street, to know how likely it is to flood due to fallen leaves clogging gutters. (Apparently 6.7 meters is the ideal driveway length). Or, to insure a car, information about its driver's habits like the amount of behind-the-wheel-texting going on comes in handy. These items are gettable with big data, a process that cuts costs to the tune of 30%, according to Mr Wilson.

A new ocean means new fish

Of course, not everyone in the InsurTech sea is an enormous and ancient (though apparently quite agile) whale like Aviva: minnows like the start-up WeSavvy, a B2B solution that lets health insurers reward their customers for hitting a certain number of steps per day (e.g. one euro per 10,000 steps), are vying for attention as well. WeSavvy's value lies in helping the end-user engage with, and even affect, his or her insurance, this kind of customer-centric product familiarity being a hallmark of the current era. It also marks a nice anticipation of the rise of wearables, which have been on the horizon for some time now, though this particular product doesn't require any additional apparatus other than a smartphone. The company is furthermore interested in rewarding other healthy actions too, like sleeping—yes, the dream is finally coming true: you will be able to get paid to sleep.

Another InsurTech company, Metromile, is working along similar lines by monitoring car mileage, and converting the data into customised insurance rate information. If you start thinking creatively, there are lots of things that can be monitored with a view to better informing insurance companies: steps, sleep, and mileage we have already—why not what you buy from the supermarket, how often you brush your teeth, or how much smoke/coffee/chocolate gets into your system?

Other InsurTech products include plan aggregators, peer-to-peer sharing of emergency funds, and insurance product/buyer matchmaking platforms. Big data is a favourite technology, coming hand in hand with artificial intelligence and machine learning, but blockchain is being put to use as well.

Tipping point

The slew of start-ups out there are bound to churn up at least a couple of revolutionary products, if not revolutionary business models. Large insurance companies are on board too: the 320-year-old Aviva has been snapping up start-ups and trying out its own innovation lab; and another incumbent, the Bâloise Group in Luxembourg, has launched a car-insurance product called Game of Roads which they developed in collaboration with the help of a start-up. Earlier this year Google folded up its insurance offering, Google Compare—but the fact that they threw themselves in the game is a sure sign that the opportunistic can already taste disruption in the industry.

Will it be an incumbent, a plucky start-up, or one of the tech giants to crack the insurance industry first? We think that whoever it is, it will be someone with a product that's able to harvest technology to allow users a closer relationship with their insurance goings-on.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.