- with Inhouse Counsel

- with readers working within the Metals & Mining industries

We are pleased to present the latest edition of our Bermuda Public Companies Update which features a recap of significant transactions involving Bermuda public companies listed on the NYSE and Nasdaq for the period of Q2 through Q3 2016.

The year to date has been a generally poor one for new listings in the US and worldwide and is the slowest since 2009 globally. In 2015 there were a total of 196 IPOs on the principal US exchanges. As of the end of Q3 2016 there have been only 87 IPOs. Some hope, however, can be derived from Q3 2016 activity, which was the strongest quarter for IPOs thus far in 2016, with 40 IPOs raising US$6.6 billion (even though IPO activity and proceeds still fell short of the levels seen during the same period in prior years). An influx of deals in September indicated that investor appetite for new issuances may be strong.

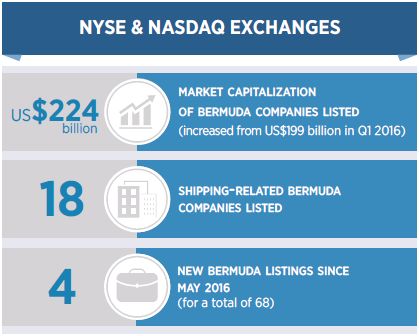

IPO activity involving Bermuda public companies was relatively strong when compared to the general state of the market. There have been four new listings of Bermuda companies on the NYSE and Nasdaq since our previous edition in May. As foreshadowed in that edition, Triton International (NYSE:TRTN) completed its merger with TAL International Group, Inc. (NYSE:TAL) and the XL Group (NYSE:XL) completed the redomicilation of its parent holding company to Bermuda from Ireland. The Bank of N.T. Butterfield & Son Limited (NYSE:NTB) (Bermuda's oldest bank) completed its IPO on the NYSE in September. Most recently, Nordic American Offshore Ltd. (NYSE: NAO) redomicled from the Marshall Islands to Bermuda so that it is incorporated in the same jurisdiction as its major shareholder, Nordic American Tankers (NYSE:NAT), thus adding to the growing cadre of Bermuda public companies in the shipping industry (see infographic to the right).

On the M&A front, last month Japanese casualty insurer Sompo Holdings Inc. announced its acquisition of property and casualty insurance provider Endurance Specialty Holdings Ltd. (NYSE: ENH) for US$6.3 billion. This significant transaction is evidence that last year's trend of consolidation in the insurance industry is continuing – with particular interest in Bermuda insurers coming from acquirers in Japan and China.

We have included further details of market developments in this edition of our update, along with statistical information about the size of the Bermuda public companies market which we hope will be of interest to our legal colleagues, clients and Bermuda market followers.

HIGHLIGHTED TRANSACTIONS

NYSE

- Genpact Limited (NYSE:G) completed the acquisition of Endeavour Software Technologies Private Limited for an undisclosed sum. (May)

- Ancala Partners LLP completed the acquisition of International Energy Group Ltd. from Brookfield Infrastructure Partners L.P. (NYSE:BIP) for an undisclosed sum. (May)

- Multi Packaging Solutions International Limited (NYSE:MPSX) completed a US$145 million secondary offering of 10,000,000 common shares at US$14.50 each. (June)

- Validus Holdings, Ltd. (NYSE:VR) completed a US$150 million offering of 6,000,000 depositary shares each representing a 1/1,000th interest in a share of its 5.875% Non-Cumulative Preference Shares, Series A, par value US$0.175 and a US$25,000 liquidation preference per share. (June)

- Clayton, Dubilier & Rice, LLC acquired MG LLC from White Mountains Insurance Group, Ltd. (NYSE:WTM) for an undisclosed sum. (June)

- Brookfield Infrastructure Partners L.P. (NYSE:BIP) acquired an 18% stake in Rutas de Lima S.A.C. from Sigma - Sociedad Administradora de Fondos de Inversion S.A. for an undisclosed sum. (June)

- Samsara Properties Limited completed the sale of its 4.9% stake in Belmond Ltd. (NYSE:BEL) for US$48 million. (June)

- Triton Container International Limited (nka:Triton International Limited (NYSE:TRTN)) completed its merger with TAL International Group, Inc. (NYSE:TAL). (July)

- Cairo Communication SpA (BIT:CAI) completed the acquisition of a 49.25% stake in RCS MediaGroup S.p.A. (BIT:RCS) from a group of shareholders including Invesco Ltd. (NYSE:IVZ) for approximately US$300 million. (July)

- Axalta Coating Systems Ltd. (NYSE:AXTA) entered into a definitive agreement to acquire the automotive interior rigid thermoplastics coatings business from United Paint & Chemical Corporation for an undisclosed sum. (July)

- XL Group Ltd. (NYSE:XL) completed the redomiciliation of its parent holding company to Bermuda from Ireland. (July)

- Brookfield Infrastructure Partners L.P. (NYSE:BIP) completed a US$250 million offering of 10,000,000 Cumulative Class A Preferred Limited Partnership Units, Series 5 at a price of US$25.00 per unit. (July)

- Mediobanca Banca di Credito Finanziario S.p.A., Pirelli & C. Società per Azioni, UnipolSai Investimenti SGR and Diego Della Valle completed the acquisition of an additional 13% stake in RCS MediaGroup from Invesco Ltd. (NYSE:IVZ) for approximately US$76 million. (July)

- Axalta Coating Systems Ltd. (NYSE:AXTA) completed a US$1.2 billion secondary offering of 41,621,996 common shares by The Carlyle Group as selling shareholder at US$28.25 per share. (July)

- Axalta Coating Systems Ltd. (NYSE:AXTA) completed the acquisition of a majority stake in Dura Coat Products, Inc. for an undisclosed sum. (August)

- Axalta Coating Systems Ltd. (NYSE:AXTA) acquired Geeraets Autolak BV for an undisclosed sum. (August)

- Removal Stars Limited received a private placement of approximately US$7.8 million in funding from White Mountains Insurance Group, Ltd. (NYSE:WTM) and other investors. (August)

- Genpact Limited (NYSE:G) completed the acquisition of PNMsoft Ltd. for an undisclosed sum. (August)

- Brookfield Infrastructure Partners L.P. (NYSE:BIP), GIC Pte. Ltd., British Columbia Investment Management Corporation, Qatar Investment Authority and Qube Holdings Limited (ASX:QUB) completed the acquisition of Asciano Holdings (Containers) Pty Ltd from Asciano Limited (ASX:AIO) for approximately US$2.2 billion. (August)

- Global Infrastructure Partners, Canada Pension Plan Investment Board, CIC Capital Corporation, GIC Pte. Ltd. and BC Investment Management Corporation completed the acquisition of Asciano Limited (ASX:AIO) from a group of shareholders including Brookfield Infrastructure Partners L.P. (NYSE:BIP) for approximately US$9.5 billion. (August)

- Aspen Insurance Holdings Ltd. (NYSE:AHL) completed a US$225 million offering of 5.625% Perpetual Non-Cumulative Preference Shares. (September)

- Lazard Ltd. (NYSE:LAZ) acquired Verus Partners & Co. Inc. for an undisclosed sum. (September)

- Travelport Worldwide Limited (NYSE:TVPT) completed a US$111.82 million secondary offering by selling shareholders of 7,986,979 common shares at US$14 each. (September)

- Ship Finance International Limited (NYSE:SFL) completed an offering of Convertible Senior Notes due 2021 which was upsized by US$25 million to a total of US$225 million aggregate principal amount. (September)

- Nordic American Tankers Limited (NYSE: NAT) completed a US$110 million secondary offering of 11,000,000 common shares and the underwriters exercised their option in full to purchase an additional 1,650,000 common shares also at US$10 per share. (September)

- The Bank of N.T. Butterfield & Son (NYSE:NTB) completed its US$287.5 million initial public offering of 12,234,042 shares at US$23.50 each. (September)

|

BANK OF BUTTERFIELD IPO In September, the Bank of N.T. Butterfield & Son Limited ("Butterfield"), Bermuda's largest independent bank and a specialist provider of financial services, completed its US$287.5 million IPO on the NYSE. Its shares trade under the symbol "NTB" and will also remain listed on the Bermuda Stock Exchange under the symbol "NTB:BH". Conyers acted as special Bermuda counsel to Butterfield for its IPO of 12,234,042 voting ordinary shares priced at US$23.50 each, of which 5,957,447 shares were issued and sold by Butterfield and 6,276,595 shares were sold by certain selling shareholders. This in-demand listing saw the underwriters exercise their option in full prior to closing and is a demonstration of investor confidence in Bermuda's public companies sector. The Butterfield Group offers a full range of community banking services in Bermuda and the Cayman Islands, encompassing retail and corporate banking and treasury activities. In the wealth management area, the Butterfield Group provides private banking, asset management and personal trust services from its headquarters in Bermuda and subsidiary offices in the Bahamas, the Cayman Islands, Guernsey, Switzerland and the United Kingdom. Butterfield also provides services to corporate and institutional clients from offices in several of the regions previously mentioned, which include asset management and corporate trust services. |

NASDAQ

- Markit Ltd. (NasdaqGS:MRKT) completed the acquisition of a stake in commodity markets research and price reporting agency PRIMA for an undisclosed sum. (May)

- Maiden Holdings, Ltd. (NasdaqGS:MHLD) completed a US$100 million offering of 6.625% Unsubordinated Unsecured Notes due 14 June 2046. (June)

- Markit Ltd. (NasdaqGS:MRKT) completed its US$13 billion merger with IHS Inc. (NYSE:IHS). Markit Ltd. became the holding company for the combined groups and was renamed IHS Markit Ltd. (NasdaqGS: INFO). (July)

- IHS Markit Ltd. (NasdaqGS:INFO) offered to exchange US$750 million aggregate principal amount of 5% Senior Notes due 2022 issued by IHS Inc. for up to an equivalent amount of new 5% Senior Notes due 2022 to be issued by IHS Markit Ltd. US$742,848,000 aggregate principal amount of notes were exchanged. (July)

- Arch Capital Group Ltd. (NasdaqGS:ACGL) completed a US$450 million offering of 18,000,000 Depositary Shares, each representing a 1/1,000th interest in a share of its 5.25% Non-Cumulative Preferred Shares, Series E. (September)

|

BERMUDA LIMITED LIABILITY COMPANY ACT 2016: THE OFFSHORE

LLC Bermuda's Limited Liability Company Act 2016 (the "Act") came into force on 1 October 2016 and provides for the formation and operation of limited liability companies ("LLCs"). A Bermuda LLC, like its Delaware counterpart, is a hybrid entity combining characteristics of a limited partnership and a corporation. The central provisions of the Act were closely modelled on the corresponding Delaware provisions, so that Bermuda LLCs will look, feel and operate much like Delaware LLCs. A Bermuda LLC is, like a corporation, a separate legal entity and its members have limited liability. However, as with a partnership, the affairs of a Bermuda LLC are governed by an agreement, rather than by statutorily mandated constitutional documents. This provides great flexibility, as the Act, like its Delaware counterpart, expressly provides that it is to be construed to give maximum effect to the principle of freedom of contract in relation to LLC agreements – thus allowing the LLC agreement to fully reflect the parties' intentions (e.g. regarding voting, governance and allocating profits) and eliminate many of the formal constraints applicable to corporations. Unlike corporations and limited partnerships, Bermuda LLCs are not required to have a separation of ownership and management and can be managed by their members, so there is no need for a board of directors or a general partner. Alternatively, one or more non-member managers can be appointed. Regarding the duties of members and managers to the LLC and to each other, the Act provides that any such duties (including fiduciary duties) may be expanded, restricted or even eliminated by the LLC agreement (except that fraud and dishonesty cannot be permitted). Members and managers can be indemnified (except in respect of their fraud or dishonesty) and the Act expressly permits them to vote in their own self-interest. Bermuda LLCs are able to (i) merge or amalgamate with other Bermuda LLCs or with foreign entities; (ii) discontinue from Bermuda and (iii) convert to Bermuda limited partnerships (with separate legal personality) or to Bermuda corporations. Foreign LLCs can move to Bermuda by continuing as Bermuda LLCs. Lastly, there is a defined winding up regime in the Act based on the well understood corresponding regime for Bermuda corporations. Although Bermuda's legislation is new, its similarity to the corresponding Delaware legislation offers offshore opportunity with the provenance of a tried and tested model. Bermuda's first LLC has already been formed, with Conyers acting on the matter. |

To view the entire report click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]