Foreign investor interest in the Iberian real estate market has led to a 'hotel boom', while deals are becoming bigger and more complex – however, the good news is tempered by a shortage of good assets and fears that supply could outstrip demand. Is a real estate bubble being created?

The Iberian real estate market is back with a bang, according to lawyers, with the recent glut of transactions – which are becoming larger and more intricate in nature – demonstrating that confidence has returned. Indeed, some lawyers argue that the current levels of activity show that the real estate sector is now as buoyant as it was before the crisis.

One of the most notable transactions of late was Merlin Properties Socimi's €1.79 billion purchase of Testa Inmuebles en Renta. Meanwhile, Lone Star Funds' €1 billion residential golf resort project in Vilamoura on the Algarve demonstrates that there is hot property to be found in Portugal.

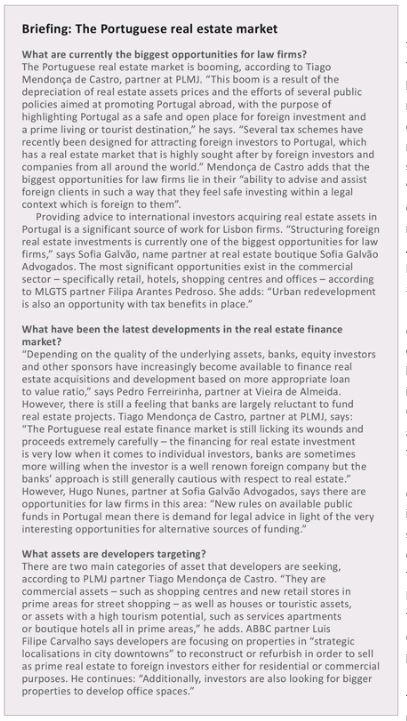

"The market is now back to normal and it is expected that the share of real estate-related work in the coming years will keep increasing," says Orson Alcocer, partner at DLA Piper in Madrid. Optimism abounds in Portugal, meanwhile, where the surge in foreign capital targeting assets in the country is picking up increasing momentum. Ricardo Reigada Pereira, a managing associate in Linklaters' Lisbon office, says: "The share of speculative investors chasing big-ticket deals remains high, but it has been recently decreasing by virtue of the arrival of the more core and traditional-type investors – in any event, distressed and opportunistic investments still represent a significant portion of the total volume."

Hotel boom

Pedro Ferreirinha, partner at Vieira de Almeida, points out that developers are, in the main, looking for buildings in Lisbon and Oporto that can refurbished and quickly reintroduced into the residential and retail markets: "They are clearly more focused on investments with a shorter time to market that can benefit from the competitive incentives scheme that Portugal has in place for property rehabilitation."

ABBC partner Luis Filipe Carvalho, who cites a "hotel boom" in Lisbon, adds: "This conjuncture led to an increase of the average square metre price which impacted the national market creating a greater demand for leases instead of acquisitions, due to the lack of access to credit for housing purposes."

Madrid and Barcelona have been the hubs for investors in Spain, according to lawyers. José Luis García-Manso, partner at Pérez-Llorca, says: "Buildings in the city centre of Madrid and Barcelona are highly sought after for refurbishment, while residential development is growing again in specific areas. In addition, the hotel sector in Barcelona and Madrid is booming. Last but not least, we are seeing growth in logistics developments." However, García-Manso points out that the core assets in these cities are becoming harder to come by, leaving investors looking for opportunities in different regions.

Diego Armero, partner at Uría Menéndez, concurs: "Most investment funds are looking for yielding assets, not only prime assets in Madrid and Barcelona, but also assets in secondary locations. Some are even focusing on buying land and investing in the development of new properties, this being very recent and promising news."

It has largely been private equity funds, REITs and international investors snapping up assets but lawyers say many different types of players are moving into the market. "US opportunity and hedge funds, European fund managers and investment banks should remain active in the sector whereas core investors are expected to increase their appetite for Portuguese real estate assets," Reigada Pereira claims. "It remains to be seen whether players most affected by Portuguese turmoil recover their mojo – the recent legal changes introduced in the tax framework applicable to Undertakings for Collective Investment may prove to be pivotal in that regard, as well as the Portuguese REITs which are expected to take off and enhance the ability to attract new investors."

More innovative deals

The emergence of a more sophisticated client base is resulting in ever-more intricate transactions too. Emilio Gómez, head of real estate at Hogan Lovells in Madrid, observes that lawyers are "facing more complex and innovative deals now compared to those 10 years ago". Bernat Mullerat, partner at Cuatrecasas Gonçalves Pereira, adds: "The current real estate market has brought larger and more complex deals. This allows law firms to increase the size of teams involved in the deals and to bring together expertise from a range of practice areas related to real estate, such as private equity, contract, financing, planning, litigation and restructuring. More complex deals require in-depth knowledge of legal requirements and of market practice."

Gómez argues that this complexity extends to investment and financing structures, which is the "driver that real estate lawyers have to play with". Other lawyers in Spain say that the financing market, especially the alternative financing market, is driving investments. "The leading traditional credit institutions are financing real estate projects again and new market participants have entered the Spanish lending market, for example, direct lenders such as hedge funds," García-Manso comments. "We have also seen certain projects financed by insurance companies – the pricing of loans, in terms of margin, is relatively low if compared to other financings such as project and acquisition financings."

Fernando Azofra, partner at Uría Menéndez, agrees that most Spanish and international banks, and also some investment funds, are "back on track to finance transactions", adding that this includes development finance. Meanwhile, Ferreirinha cites the availability of significant funds in the Portuguese market as an influence: "We have witnessed some major international players entering the market with the acquisitions of significant retail portfolios, stand-alone retail and hospitality projects and sale and lease back transactions."

High office vacancy rate

Despite the positive messages, there is a degree of caution about the future. Many observers believe it will be a challenge to maintain the current momentum, especially in Portugal, if the market does not develop in a sustainable and balanced way. "Low inflation is a risk for the economy and therefore for the real estate market," warns Filipa Arantes Pedroso, a partner at Morais Leitão, Galvão Teles, Soares da Silva & Associados in Lisbon. "The vacancy rate in offices is still high, the higher demand last year and this year has not increased the rents – the increase of hotels in Lisbon and Oporto is enormous and there is a risk of the offer being higher than the demand."

Ferreirinha expands on this point, claiming the biggest concern for investors in the retail and office sectors is the performance of the economy and the capacity of tenants to pay their rent. Meanwhile, the main challenge for developers is the optimisation of the "time to market" of their products.

In Spain, uncertainty regarding the result of this year's parliamentary general elections has not helped investor confidence. In addition, anxiety over the shortage of good assets and the rising prices of assets is expected to limit opportunities in the market. "I believe that competition has become tougher in the last two years, and clients must now find their own niche to be able to still find true opportunities," Alcocer adds.

Gómez has further concerns: "Office occupiers, for instance, demand more efficient spaces since many workers work remotely, but in turn require some new common areas for leisure and teamwork. Online sellers demand new high-tech logistics spaces. Finally, shopping centres must be "repackaged" in terms of tenants and uses."

The real estate market may now have reached pre-recession levels but – after the painful crash in 2008 and the effects on commercial and residential property – lawyers know not to take anything for granted.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.