1 PRIVATE CLIENT

1.1 Dividend allowance update

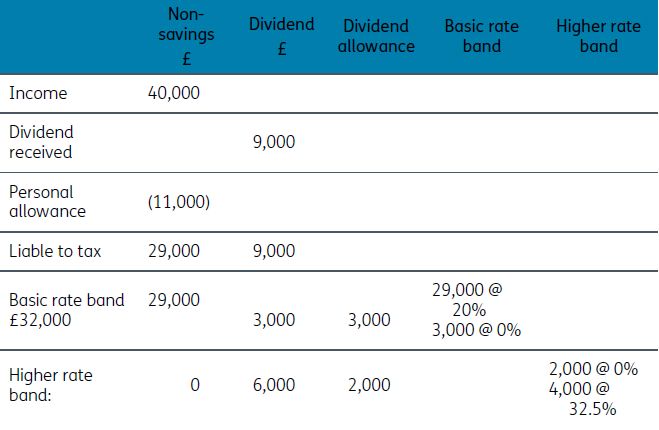

HMRC has issued a factsheet explaining that the proposed 'dividend allowance' will not exclude up to £5,000 of dividend income from taxation, but be applied as a zero- rate of tax on the first tranche of dividend income.

Crucially, dividend income will continue to be taxed as the top slice of income but with the first £5,000 taxed at 0%. The zero-rated dividend income will remain 'taxable' income so will still need to be taken into account when considering how tax bands are utilised as well as allowances and charges based on total income.

Example

Take the position for someone in 2016/17 with non-dividend income of £40,000, receiving dividends of £9,000 outside of an ISA. The personal allowance is £11,000 and basic rate band £32,000.

www.gov.uk/government/publications/dividend-allowance-factsheet

2 PAYE AND EMPLOYMENT

2.1 First-tier Tribunal (FTT) decision on termination and restricted shares

In the case of Sjumarken v HMRC [2015] UK FTT 375 TC the FTT has ruled on a termination agreement that involved the lapse of options and the receipt of restricted shares. It confirmed that where restricted shares were received, the relevant value for employment tax purposes was their value as restricted rather than the full value.

Mr Sjumarken was made redundant by his employer BNP Paribas in October 2005. At redundancy, he was entitled to the release of shares under the company's share incentive plan. This plan was unfortunately named; confusingly, it was not a tax- advantaged HMRC approved share incentive plan, as they were then known, but taxable restricted shares.

HMRC argued that the shares had been released to him and therefore should be taxed on their full value, but he was able to demonstrate that the shares were in fact held in an account for him and could only be sold according to a timetable thus making them restricted shares for the purposes of the employment related securities legislation. This meant that on receipt he was taxable but only on the restricted value. The parties were left to agree the valuation on that basis between them.

In addition, Mr Sjumarken argued that he had surrendered some long dated options as part of his termination agreement. The offer he had received was increased materially during negotiation. He argued that their surrender could constitute negative earnings. The court did not accept that the reason for the increased offer could be ascribed to the 'surrendered' share options and in fact the options had already lapsed.

www.bailii.org/uk/cases/UKFTT/TC/2015/TC04557.html

3 BUSINESS TAX

3.1 HMRC issues Spotlight 25 on Stamp Duty Land Tax avoidance

Following the decision in the APVCO 19 Ltd and others HMRC has issued Spotlight 25 inviting users of SDLT avoidance schemes to approach them with a view to settling liability.

We reported on the Apvco 19 Limited case concerning SDLT avoidance and retrospective legislation in our Update of 6 July. As HMRC sets out in the Spotlight, the Court of Appeal rejected the taxpayers' breach of human rights argument, because the Government had clearly indicated that SDLT schemes could be the subject of retrospective legislation.

HMRC points out that it has a '100% record in defeating SDLT avoidance schemes'. It invites taxpayers to contact them to discuss how they can withdraw from their scheme and settle their liability. The point that HMRC implies, and is important for the taxpayer to bear in mind, is not so much that HMRC has a complete court record (it can always lose the next case) but that the Court of Appeal has again, in line with the Huitson case, accepted that retrospective legislation can be effective, as here, where the Government had explicitly warned of its possibility in the area.

www.bailii.org/ew/cases/EWCA/Civ/2015/648.html

3.2 EU gives State Aid approval for 25% film tax credit on all qualifying expenditure

In the March 2015 Budget, the Government announced that it would further support the film industry by increasing the rate of film tax relief to 25% for all qualifying productions. Previously, the rate was 25% for the first £20 million of qualifying expenditure and 20% for spending above this threshold. The Government has announced that this change has received EU State Aid approval and will be backdated to apply from April 2015. Finance Act 2015 indicated the start date for the new rates, to cover films whose principal photography was not completed by that date, could not be before 1 April 2015.

www.gov.uk/government/news/chancellor-were-backing-british-film-industry

4 VAT

4.1 VAT reduced rate: installation of energy saving materials

HMRC has updated its Brief 13 2015 concerning energy saving materials following an adverse decision of the CJEU that the UK was implementing the relief too widely.

We reported the somewhat odd wording of this Briefing in our Update of 10 August 2015. The drafting has been sorted out and now explicitly agrees with the interpretation we gave at that time.

It now states:

If there are to be any legislative changes, they won't be implemented before Finance Act 2016. Until then, supplies of the installation of energy savings materials will continue to be reduced rated and any changes will only apply to future supplies and not to supplies already made.

4.2 VAT compulsory charge on single-use carrier bags in England

HMRC has issued Brief 14 2015: charging VAT on single-use carrier bags in England.

Regular readers will recall that we trailed the introduction of a compulsory charge on single use carrier bags in our Update of 19 January 2015.

As planned, this is to take effect from 5 October 2015 for suppliers with 250 or more full time equivalent employees.

Whether or not a VAT registered supplier comes within the scope of the compulsory charge, any amount charged for a bag is tax inclusive at the standard rate of VAT.

For corporation tax and income tax, receipts from the compulsory charge on single-use carrier bags should be brought into account in calculating trading profits.

The Brief comments that the Government 'expects the proceeds to fund good causes in England.'

We have taken care to ensure the accuracy of this publication, which is based on material in the public domain at the time of issue. However, the publication is written in general terms for information purposes only and in no way constitutes specific advice. You are strongly recommended to seek specific advice before taking any action in relation to the matters referred to in this publication. No responsibility can be taken for any errors contained in the publication or for any loss arising from action taken or refrained from on the basis of this publication or its contents. © Smith & Williamson Holdings Limited 2015