The banking and finance sector is generally considered to evolve at a very slow pace, but could there be a revolution on the horizon?

The world of finance is beginning to change. Though there is a tendency to view the world of bankers and lenders as one of the most traditional and conservative of industries, it is being forced to adapt to a new environment that can be quite difficult to predict. Banks are now facing stiff competition from new providers of finance – indeed, this environment is so fiercely competitive that banks are seeing their profits decline. The traditional banks now face the challenge of players such as the so-called ´Fintech´ companies – and it is important to point out that these new market entrants are not hampered by the same burden of regulation that the mainstream banks have to deal with. It is a time of great uncertainty for the financial sector in Iberia, particularly considering the collapse of Banco Espírito Santo in Portugal, which was, as lawyers point out, something that many never imagined would come to pass.

To set the scene, Spain's banking and finance sector has seen major changes made to the insolvency law in the last 12 months. "The introduction of the new cram-down mechanism into the Spanish insolvency law has provided an alternative for restructuring Spanish debt," says Linklaters´ partner Ben Crosse. "This is giving clients an efficient process and they don´t necessarily have to look outside of Spain for a solution." Meanwhile, there had been predictions that direct lending by funds would be a significant trend in the last year have not happened, according to Crosse. "The banks have liquidity and the need for direct lending hasn´t materialised in the amounts expected some months ago."

Ángel Pérez López, partner at Uría Menéndez, says the leverage of "dissident lenders" has decreased considerably as a result of the recent amendments to Spanish insolvency law. "Most banks now understand that kicking the can down the road cannot be the solution when the levels of debt are unsustainable," he says. Pérez López adds that banks are now prepared to "take equity or use equity-like instruments, or even accept haircuts, when the business plan of the debtor clearly indicates they should be able to maximize their recoveries in the long-term". Pérez López adds that it has been a very good year for restructurings, while bond issuance has given Spanish companies a good opportunity to go to the international markets.

Francisco Uria, partner at KPMG Abogados, says the `Banking Union´ process – both the European Union´s Single Supervisory Mechanism and the Single Resolution Mechanism – is a massive issue for the banking sector. He adds that banks in Spain will be benchmarked against other European banks and this – considering, for instance, the question of corporate governance review – could create opportunities for lawyers.

Competition hots up

César Herrero, partner at DLA Piper, says there has been a huge diversification in sources of funding that has led to an "increasingly competitive funding landscape". He adds: "The increase in liquidity has meant an increase in deal activity, though there have been lots of ups and downs, with regard to the level of activity." Rafael Aguilera, partner at Gómez-Acebo & Pombo, says a relevant issue in the last year has been the impact of regulation of SOCIMIs (Spanish real estate investment trusts), which has "implied a significant amount of work for the financing and capital market departments of law firms". Meanwhile, Andrés Lorrio, partner at Jones Day, says among the biggest challenges banks will face are of capital adequacy requirements and regulatory reforms.

One partner remarks restructuring was an "impressively profitable" line of work for law firms that paid "substantial fees". He adds that, in some cases, a restructuring could generate as much in legal fees as 10 traditional financing deals. Meanwhile, Clifford Chance´s Epifanio Pérez says that the market is now moving towards more refinancing as companies have sold their bad assets and should be more efficient. "We´re seeing more leveraged finance and acquisition finance deals – the Spanish economy is now developing well, M&A is coming back, and, sooner or later, private equity, will come back."

Crosse argues that there will not necessarily be a return to the traditional banking sector. "There are new credit providers with a different way of looking at things – for example, there is the influence of the US market, that is ´covenant-lite´ loans that use documentation similar to that used for bonds and new liquidity from funds interested in direct lending – so there is plenty of interesting work to come through so the outlook is really quite positive," he says.

Herrero says that the workload of banking lawyers has changed. "You do now a little bit of everything, rather than only being focused on leveraged buyouts or corporate finance – much of lawyers´ work has transferred from restructuring and refinancing into coordinating deals."

Less restructuring work

Pérez López says there is still a lot of work relating to the disposal of banks´ non-core assets, however he says there is a "reduced pipeline" of restructuring work. Pérez López adds that there are good opportunities in real estate financing and new leveraged acquisitions, as well as work in relation to the international components of transactions, though he says project finance work in Spain will be limited. But Latin America will provide project finance opportunities, according to Pérez López. "Investment in project finance in Colombia will be tremendous," he says.

Clifford Chance´s Pérez says that infrastructure and energy are two sectors in which there will be activity in the coming year. "There might be some M&A in the energy sector – M&A is coming back, there are also lots of recapitalisations and leveraged finance deals, but we do not expect mezzanine finance work to come back." Fernando Bernad, partner at Cuatrecasas, Gonçalves Pereira, says that Latin America should be a place where firms with Spanish experience can give value added. "They are now sophisticated jurisdictions," he says. "We´ve gained experience in Chile, Mexico and Brazil and our share of the Latin American market is increasing – part of the future will be there, while commercial real estate financing, in general, is another area that is picking up."

Herrero says that, year on year, the number of Latin American deals his firm participates in is increasing. "The large scale project finance deals in the immediate future will be in Latin America, however there are very good lawyers in Latin America, for example in Chile," he adds.

Herrero says that clients are now expected to be "all-rounders" in terms of the advice they provide and partner time is required more and more. Crosse says that Spanish clients rely heavily on their lawyers and consequently external lawyers can become effectively an extension of the client´s team. "It´s often different in many more Anglo-Saxon/northern European transactions, in that the matter is generally processed through the legal department, but in Spain, lawyers are very often much closer to the decision makers."

Time for a re-think?

Bernad comments that clients´ desire for more partner input has resulted in changes to the structures of law firms: "Leverage at law firms generally used to be one to five, but now it´s one to two." Uria argues that it is time for law firms to "re-think themselves and their processes". He adds: "To gain efficiency and to provide better services to their clients, law firms should invest heavily in technology and also develop new capabilities and skills in areas like the legal implications of ´big data´." Pérez López says that technology is an important tool for talent retention at law firms. "Associates now have changed their priorities, giving much more importance to their personal life," he adds. "Technology allows them to work away from the office and gives them more opportunities for conciliation between personal and professional life." Clifford Chance´s Pérez says technology "allows lawyers to add value to clients as clients want to be updated regularly". Bernad says that often law firms have huge amounts of information that is not used for business purposes. He adds: "Law firms often used to have departments with each department behaving like different firms because of their different practices – for example, tax, labour, public law, and so on – with different methods used for billing and budgeting – whereas auditors often share their analyses internally."

Pérez says law firms need to improve "cross-selling" within departments and externally: "Cross-selling practices is a priority." However, Crosse says that cross-selling within law firms can be difficult. "If you take your eye off the ball, you get buried in another transaction – it needs constant effort, you may end up missing some cross-selling opportunities." Bernad says that, to help with cross-selling, there is a need to create internal networks within law firms – other than email, which is for "professional matters". Uria says it is important to change the way lawyers relate to clients. He adds: "As a collateral effect of consolidation, especially in the financial sector, there are now fewer clients so to build a long-term relationship cross-selling is increasingly important – the time in which the relationship was limited to a single transaction from time to time is gone."Lorrio says the challenge for law firms in the coming years will be to become more sophisticated as banking and finance becomes increasingly complex: "There are more finance providers, complex regulation, more sophisticated clients and deals and we will need to see more use of the capital markets."

Uria says that banking lawyers are leaving a world they knew – which included a lot of restructuring – and encountering issues such as new banking regulation. "There is also a compliance quest for lawyers and the challenge of digital technology – we, as lawyers, need to use technology better, and it´s important to provide a real international network for clients," he says. Meanwhile, Herrero says efficiency is a key challenge for law firms, as is helping clients in "cross-border markets".

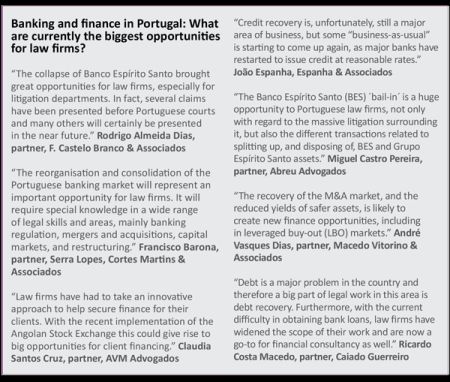

Portugal: Unimaginable situation

Crosse says that one of the challenges and opportunities for law firms is the "sheer variety" of work available. "Clients want a more detailed analysis of their options," he says. Pérez says the increase in real estate finance presents an opportunity for law firms, but the challenge is profitability. "We have to keep profitable and grow fees at a time when restructuring work is decreasing," he adds.

Luís Branco, partner at Morais, Leitão, Galvão Teles, Soares da Silva, says that one of the largest banks in Portugal, Banco Espírito Santo (BES), "suffered a situation never imagined" considering it was such a highly valued brand. He adds: "One of the solutions to this problem has been implemented by the regulator, that is the creation of a bad bank and a new bank, Novo Banco, which is in the process of being sold." Branco says the collapse of BES had an impact on thousands of clients and left investors with "paper that was not worth very much". Further consolidation in the banking sector is expected, according to Branco, with talk of a merger between BPI and BCP. Meanwhile, he adds that the "battle of BES" has had a negative impact: "Banks are presenting negative results and lawyers are doing restructuring work and investor lawsuits rather than finance agreements."

Uría Menéndez-Proença de Carvalho partner Pedro Ferreira Malaquias says there is a lot of regulatory work for law firms all over Europe: "Clients in Portugal used to be regulated by the Bank of Portugal, but there is now a new foreign (EU) supervisor." Paulo Câmara, managing partner at Sérvulo & Associados, says EU ´Banking Union´ implies articulation between the European Central Bank (ECB) and the Bank of Portugal, but asks: "How will this actually work?" He adds that another concern for clients is the "regulatory tsunami" that they face. "Post-BES, there is more concern among clients about reputation and governance," Câmara says. He continues: "There is a huge regulatory crunch on banks, but other entities have lower regulatory requirements – private equity firms are the new power houses and face less regulatory burdens than banks."

Alexandra Maia de Loureiro, partner at SRS Advogados argues that implementing the huge amount of regulatory requirements – from the government, the Bank of Portugal, and the EU – is one of the biggest challenges facing the sector. "We are seeing huge demand from clients for regulatory advice," she adds. According to Maia de Loureiro, the banks´ lack of liquidity in recent years created opportunities for new players with the result that private equity and risk capital, as well as direct lending came in to fill the gap. Meanwhile, Vieira de Almeida partner Pedro Cassiano Santos says that clients face more demanding accounting criteria due to a number of factors including Basel III. "There is less availability of funds from banks' balance sheets," he says. Cassiano Santos adds that after the BES-related difficulties, any placements of a new subordinated nature will be "suffering" and rendered more difficult.

More positive thinking

ABBC partner Nuno Azevedo Neves says a lot of foreign investors are looking for investment opportunities in Portugal, including investments in financial institutions. He adds: "There is now more positive thinking and there will be a change in ownership of the financial system players."Cuatrecasas, Gonçalves Pereira co-managing partner Maria João Ricou says there is more optimism about the economy than a year ago: "There is new interest from investors, trust is increasing, and trust generates trust." Cassiano Santos says there is appetite for investment in Portugal among market newcomers such as specialised credit institutions, new consumer lenders and some of the more innovative players.

PLMJ senior associate Rodrigo Formigal, says the Portuguese economy is growing again and that activity in the banking sector will be part of that growth: "The banking crisis coupled with the economic recovery has created the conditions for new investment opportunities in the banking sector," he says."We will see the universal postal service provider in Portugal assuming a prominent role as a financial services provider when it becomes a postal bank –it will be very interesting to see how the postal bank operation will be different to existing banking sector lending," he says.

A `shot in the dark´

Linklaters´ Portugal managing partner Pedro Siza Vieira says that capital for the financial services sector is scarce "because it is delivering poor returns". He adds that this is why there will be major changes in the sector and more consolidation.Formigal says that the banking crisis – coupled with the widespread dissemination of banking information through the media, which made what was considered a complex subject more accessible to the public – has created increasing amounts of litigious work for lawyers. "Banking lawyers are now working more closely with litigation lawyers because of the large amount of financial services-related litigation," he says.

Ferreira Malaquias says law firms are under "big pressure" to quote fixed fees, but he adds that fixed fees can be a "shot in the dark", because some of the factors that affect the progress of a transaction are out of the lawyers´ control. Ricou says that the problem for law firms is, if they don´t accept fixed fee, another firm will. She adds: "Some law firms accept them [fixed fees] more easily than others."

According to António Rocha Alves, partner at Campos Ferreira, Sá Carneiro, consolidation in the Portuguese financial sector – resulting in the acquisition of control of key Portuguese financial institutions by foreign shareholders – presents a challenge. "I´m not saying foreign ownership is bad, but such consolidation reveals that there is a lack of capital in the Portuguese economy – if we have companies and banks with foreign owners, they may only be willing to make investments that are in the best interests of the Portuguese economy if reforms are pursued to make the economy more competitive," he says. "The challenge for Portugal is therefore to make the economy sufficiently competitive so such investors keep investing in Portugal – having said that, I do not think the essential reforms required to improve the competiveness of the Portuguese economy have been completed or even initiated."

Ricou says that, while the economic outlook is generally more optimistic, the challenges for law firms relate to being forced to adjust to adverse conditions. "The main one is pricing – to what extent will we be able to go back to how life used to be?"

Azevedo Neves says banking and finance departments are increasingly working more closely with M&A and litigation departments. "This type of work brings new challenges, and lawyers have to focus on adding value, and be more flexible, efficient and innovative" he adds.

Ferreira Malaquias believes keeping pace with regulatory changes while delivering a good service to clients is one of the biggest challenges facing law firms. Rocha Alves says that in the changing environment, lawyers need to think creatively: "There are a lot of new matters on which lawyers are required to advise clients without the support of existing case law." Vieira says the future will be characterized by a great deal of uncertainty. "We don´t know what work will come or who the clients will be," he adds.

Filipe Lowndes Marques, partner at Morais Leitão, Galvão Teles, Soares da Silva says the Portuguese banking sector is entering a "brave new world with brand new players in the market". And what of the future? Branco says he would like to see "crucial public investment to come back in some sectors – it´s important for the country". Cassiano Santos says that, with it being election year in Portugal, one of the biggest tasks could be adapting to a new political era. "We may face a radical change in Portugal, like elsewhere in Europe including in Spain" he says.

Indeed, the banking sector in Iberia, as well as society as a whole, could be on the cusp of some seismic shifts in 2015. Those who are most adaptable will be the ones who adjust best to this new world.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.