1 General news

1.1 Labour policy, university tuition fees and pensions relief

On Friday, Ed Miliband, leader of the Labour party, spoke on university tuition fees and at the same time set out Labour's policy concerning pensions, proposing lowering both the annual and lifetime allowances further, to £30,000 and £1,000,000 respectively. Tax relief on contributions by those earning over £150,000 will be capped at basic rate relief.

He said: 'Those with incomes over £150,000 currently get pensions tax relief at more than twice the rate of basic rate taxpayers.

So Labour today confirms our previously announced policy that people with incomes over £150,000 will get tax relief at 20 per cent: the same rate as basic rate taxpayers.

And we will continue this government's policy of reducing the annual allowance and lifetime limit that caps the amount people can put into their pensions tax free.

We will reduce the lifetime allowance for tax-free savings to £1million: still 25 times higher than the average defined contribution pension.

And we will reduce the annual allowance for what you can save tax free in your pension to £30,000: still nearly ten times higher than the average pension contribution.'

There has already been opposition to the proposal, which would be a significant blow to:

- taxpayers with fluctuating income through their lifetime, such as women taking extended maternity leave or others on career breaks, who try to top up their pension pots over a short period, yet never approach the lifetime limit;

- public sector workers in defined benefit schemes, such as nurses and other health sector workers on modest salaries who would be caught by such a provision if they move between grades; and

- those who have saved modest yet regular amounts or with successful funds management who breach the £1m threshold.

http://labourlist.org/2015/02/full-text-milibands-speech-pledging-tuition-fees-cut/

1.2 Criminal offence for facilitating tax evasion

The Chancellor, George Osborne, has confirmed in the House of Commons that he is considering further ways of tackling tax evasion. Coupled with this the chief secretary to the Treasury, Danny Alexander, has proposed a new specific criminal offence of 'corporate failure to prevent economic crime'. This would be aimed at those who facilitate illegal tax evasion and could include banks and accountancy firms.

The Chancellor said in Parliament:

'Ahead of the budget I set the Treasury to work on providing further ways to pursue not just the tax evaders but those providing them with advice. Anyone involved in tax evasion, whatever your role, this government is coming after you. Unlike the last government, who simply turned a blind eye, this government is taking action now and will do so again at the budget.'

www.publications.parliament.uk/pa/cm201415/cmhansrd/cm150223/debtext/150223-0001.htm

1.3 Party political tax policy proposals comparison

As the general election approaches, Smith & Williamson has collated some of the key tax proposals aired by a selection of the parties over the last few months. These policies are of course likely to evolve further as we approach the Budget, followed by publication of the various parties' election manifestos. However, we thought it would be useful to provide an early comparison and suggest some particular areas to consider in the run up to the election, some of which may warrant action before the end of the tax year.

Our comments are set out on our website and are based on information available and analysed up to 24 February 2015.

www.smith.williamson.co.uk/election-2015/political-party-tax-proposals

2 Private client

2.1 CJEU decision on French social contributions for non-French residents

The Court of Justice of the European Union (CJEU) has recently announced its decision in a case on French Social contributions (FSC) paid by non-French residents who own French real estate but work in another Member State. Since 2012 FSCs were payable in respect of income from French rental property owned by non-French residents at the rate of 15.5%. The CJEU agreed and confirmed that the charging of FSC on such investment income was unlawful. Taxpayers with rental income in France on which FSCs have been paid should consider making a repayment claim.

In the case of M de Ruyter, a Dutch national resident in France, the taxpayer claimed that he was incorrectly subject to double social contributions - both in France and the Netherlands on the same income, while EU law stated that a resident of an EU Member State should only pay social contributions in one Member State. The court agreed (case C-623/13), confirming that the prohibition on overlapping laid down by Regulation No 1408/71 is not conditional on the pursuit of a professional activity and therefore applies irrespective of the source of the income received by the person concerned.

It is unclear how France will respond to the case. However, in the meantime it appears that claims can be made for 2013 and 2014 and possibly 2012.

http://curia.europa.eu/jcms/upload/docs/application/pdf/2015-02/cp150022en.pdf

3 PAYE and employment

3.1 Employment related securities (ERS) and internationally mobile employees

SI 2015/360 amends ITEPA 2003 s.431B, so that it will only apply to ERS that are within the scope of UK earnings at the time of acquisition. S.431B automatically applies a market value on ERS as though there were no restrictions where their purpose (or one of their main purposes) is the avoidance of tax (income tax or corporation tax) or national insurance. It comes into force on 6 April 2015. This is anti- avoidance measure that removes the opportunity of an automatic tax free uplift to market value for shares used for avoidance purposes that aware awarded to employees while they are not subject to UK income tax.

www.legislation.gov.uk/uksi/2015/360/made

3.2 Advisory fuel rates changes from 1 March 2015

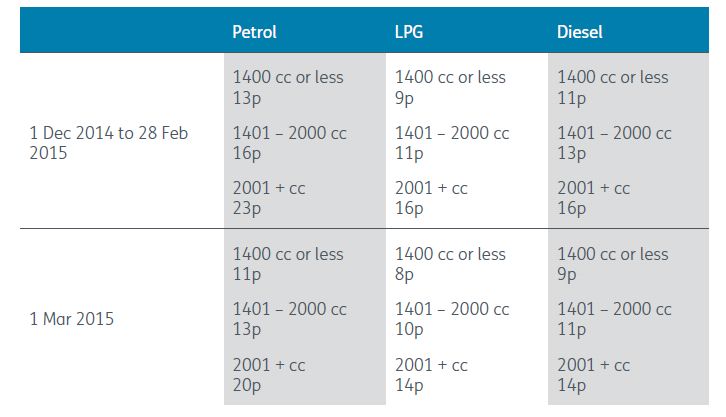

Advisory fuel rates for pence per mile that can be used by employee company car drivers are changing from 1 March 2015, with significant reductions in the rates, which are based on falling fuel prices:

The rates apply when:

- an employer reimburses employees for business travel in their company cars;

- an employer requires employees to repay the cost of fuel used for private travel;

- and a VAT registered trader determines the VAT element of mileage allowances.

HMRC have continued to confirm that people can use the previous rates for up to 1 month from the date the new rates apply, as negotiated with the Chartered Institute of Taxation some years ago. This is particularly important given that the rates have fallen as otherwise making payments at the former higher rates could result in adverse tax consequences. This therefore gives employers and VAT registered traders one month to update their accounting systems.

www.gov.uk/government/publications/advisory-fuel-rates

3.3 Ability to access state pension if resident in the EEA or Switzerland SI 2015/349 provides that for the purpose of accessing the State Pension, the agreements on social security made between the UK, Australia, Canada and New Zealand, cover persons resident in the EEA or Switzerland where they have a sufficient link to the UK.

www.legislation.gov.uk/uksi/2015/349/made

To view the full article please click here.

We have taken care to ensure the accuracy of this publication, which is based on material in the public domain at the time of issue. However, the publication is written in general terms for information purposes only and in no way constitutes specific advice. You are strongly recommended to seek specific advice before taking any action in relation to the matters referred to in this publication. No responsibility can be taken for any errors contained in the publication or for any loss arising from action taken or refrained from on the basis of this publication or its contents. © Smith & Williamson Holdings Limited 2015.