FOURTH QUARTER 2014

In this quarter we report that while M&A volumes and values may remain choppy in most regions of the globe, including the United States, the offshore market has enjoyed a bumper 2014. In fact, our analysis reveals several new peaks in the market, and highlights the sectors and jurisdictions that are proving to be the engine rooms of an increasingly bullish market.

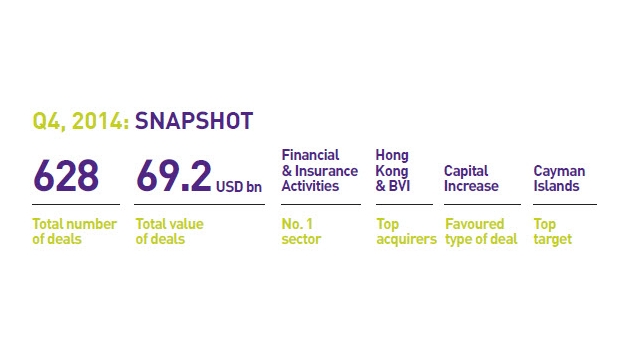

The fourth quarter of last year saw the announcement of 628 deals, worth a cumulative USD69.2bn. Whilst activity levels were on a par with previous quarters, values were higher, with the quarter the second highest by value in what was an exceptional year. The average deal size in the quarter was USD110m, a number overshadowed in only four quarters over the past 11 years, and making the year as a whole the largest on record by that measure, at USD103m.

As always, we are ever aware of the role that a small number of mega deals can play in bumping up quarterly totals. These mega deals are, of course, to be welcomed, and there were two such transactions – worth north of USD5bn – in the fourth quarter, after three in the first half of 2014.

Really big deals are once again happening, and they often place offshore entities centre stage. When we take the temperature of offshore as gainst other world regions, it is heartening to see our markets ranking fourth for deal value in this quarter behind North America, Western Europe and the Far East and Central Asia); ranking sixth for the number of deals; and enjoying third place by average deal size, behind only North America and South and Central America.

FULL YEAR 2014

The year 2014 is a standout year for offshore M&A and IPOs for many reasons. Most notably, we see aggregate deal value for the year up 63% on 2013, with USD277bn spent on offshore deals as against USD170bn in the previous 12 months. What's more, 2014 is the highest year on record for total deal value by some distance: in the past decade, only four years have seen aggregate deal value top USD200bn, and the next highest figure was recorded in 2007, when USD239bn was spent on offshore targets. The number of deals, (2,687) is broadly consistent with an average north of 2,500 that we have seen since 2007, but still ranks third for the past 10 years, behind volumes recorded in both 2009 and 2010.

A further positive message emerges when we look at offshore acquirer deals. These are deals where the acquisitive party is based offshore, although their target might not necessarily be. In 2014 these hit record levels, with the year the busiest we have seen by some distance there.

But while we take heart from buoyant appetite for offshore M&A deals, we are always cautious that markets can just as easily turn down again as we embark on 2015. US President Barack Obama called the end of the financial crisis in his State of the Union address in January, and that is a sentiment we tend to share. But still, global financial markets are far from stable and secure with Eurozone tremors, terrorist attacks, and on-going tensions with Russia all more than capable of seriously unsettling dealmakers at short notice. Faltering growth in parts of Asia, on-going government austerity programmes, fluctuating oil prices and a pending general election in the UK, may all yet have the capacity to dampen activity during 2015.

Nevertheless, 2014 was clearly the best year for offshore M&A on record, and the general trajectory appears to be upward. We see our markets stabilising at strong levels, and we hope that 2015 sets out on a similar footing.

KEY THEMES

- There were 628 deals in the quarter, down on the 689 recorded in the third quarter but likely to edge higher as the flurry of year-end transactions is reported. This three-month period maintains the run of 600-plus deals per quarter that started in Q2 2013 and is gaining traction.

- The value of deals was USD69.2bn, up 38% on the previous quarter and the second highest quarter of an exceptional year. Following the three megadeals, worth in excess of USD5bn, announced in the first half of the year, two more were announced in Q4.

- As a whole, the year 2014 was a peak year for value, with total deal value extraordinarily high at USD277bn, significantly ahead of a previous peak set in 2007.

- This is the fourth quarter in the last five to record more than 10 deals worth more than a billion dollars each, after only four such quarters in the preceding decade. There were 12 billion-dollar deals in Q4 2014, and a mammoth 49 across the year, compared to 28 throughout 2013.

- The financial and insurance activities sector was once again on top, thanks to two deals worth north of USD5bn each. Deal value remains widely dispersed with 17 subsectors showing cumulative deal activity worth more than USD1bn each.

- The most popular deal type is capital increase, a new definition to represent minority stake transactions that do not involve third-party acquirers. There were 225 of these deals, 211 acquisitions, and 135 minority stake deals in the quarter.

- As usual, the Cayman Islands dominated deal volumes as the top target, accounting for a quarter of all deals done offshore. Bermuda, the BVI and Hong Kong were largely level-pegging behind, while in value terms, both Guernsey and Cayman sit on equal terms behind Bermuda, which saw USD20bn of deals, or 29% of the offshore total.

- Outbound deals involving offshore acquirers maintained high levels for every quarter of 2014, with 627 outbound deals worth USD55bn in Q4 2014. The year was by far the busiest on record for outbound transactions, with Hong Kong and BVI-incorporated companies the most active.

- The offshore region remains ranked sixth in the world by deal volume for Q4 2014, but rose back up two places to fourth for value activity. Average deal size rose to third worldwide, behind only North America and Central and South America.

*Offshore-i reports mergers and acquisitions and IPO activity in offshore jurisdictions in Q4 2014 using data from the Zephyr database, published by BvD. The offshore region covers target companies in Bermuda, British Virgin Islands, Cayman Islands, Hong Kong, Guernsey, Jersey, Isle of Man, Mauritius and Seychelles.

The date range is 1 October 2014-31 December 2014 inclusive. Deal status is as announced within the time period covered. Where necessary, deal values have been converted to USD at a rate set by Zephyr. Not all deals have a publically known value. Not all deals are reported immediately, so the figures are subject to change as new information becomes available.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.