Prior to 1 May 2014 or 1 April 2015 (see further below) suppliers making 'prompt payment discount' (PPD) offers were or are permitted to put on their invoice, and account for, the VAT due on the discounted price, even if the full price (ie the undiscounted amount) is subsequently paid. Customers receiving PPD offers may only recover as input tax the VAT stated on the invoice.

Finance Act 2014 introduced legislation to change this position so that it is no longer (or will no longer be) the default position that the VAT is calculated on the discounted amount whether the discount is taken up or not.

The change took effect on 1 May 2014 for supplies of broadcasting and telecommunication services where there was no obligation to provide a VAT invoice. For all other supplies the change takes effect on 1 April 2015.

After the change, suppliers must record VAT on the undiscounted sale price. However they will only have to account to HMRC for VAT on the amount they actually receive and customers may recover the amount of VAT that is actually paid to the supplier. When the change takes effect, suppliers offering prompt payment discounts will have the option to either:

- issue a credit note to evidence the reduction in consideration where the discount is taken up; or

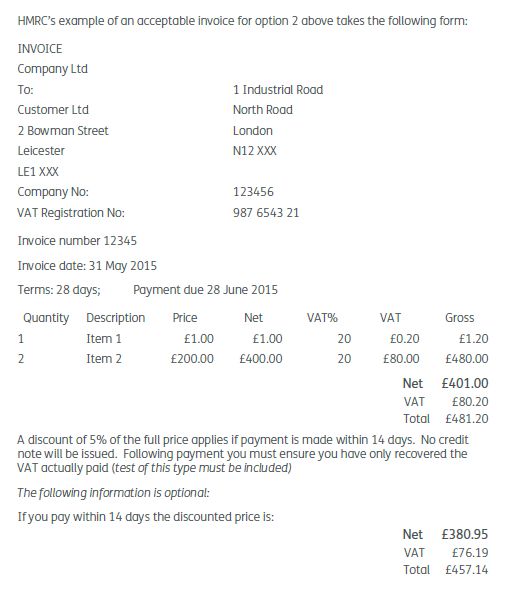

- if they do not wish to issue a credit note, the invoice must contain the following information (in addition to the normal invoicing requirements):

- the terms of the PPD (PPD terms must include, but need not be limited to, the time by which the discounted price must be made);

- a statement that the customer can only recover as input tax the VAT paid to the supplier.

HMRC advise that it may be helpful if the invoice contains the following additional information:

- the discounted price;

- the VAT on the discounted price;

- the total amount due if the PPD is taken up.

Where a supplier receives a payment that falls short of the full price but which is not made in accordance with the PPD terms, it cannot be treated as a PPD. The supplier must account for VAT on the full amount as stated on the invoice. In this circumstance if the amount not paid remains uncollected it will become a bad debt in the normal way. If a price adjustment is agreed later, then adjustment must be made in the normal way e.g. a credit note.

HMRC guidance on the changes to invoicing arrangements can be found at the following links:

www.gov.uk/government/publications/revenue-and-customs-brief-49-2014-vat-prompt-payment-discounts

www.gov.uk/government/uploads/system/uploads/attachment_data/file/390184/appendix-rc49.pdf

We have taken care to ensure the accuracy of this publication, which is based on material in the public domain at the time of issue. However, the publication is written in general terms for information purposes only and in no way constitutes specific advice. You are strongly recommended to seek specific advice before taking any action in relation to the matters referred to in this publication. No responsibility can be taken for any errors contained in the publication or for any loss arising from action taken or refrained from on the basis of this publication or its contents. © Smith & Williamson Holdings Limited 2015.