ABC Ltd., a company established in USA, has developed a new widget which is used as a spare part in the creation of website. By using this widget when creating the website, the operational costs of the website can be substantially reduced.

ABC holds the worldwide patents on this invention and it wonders how the exploitation of the patents can be arranged in a tax-effective manner.

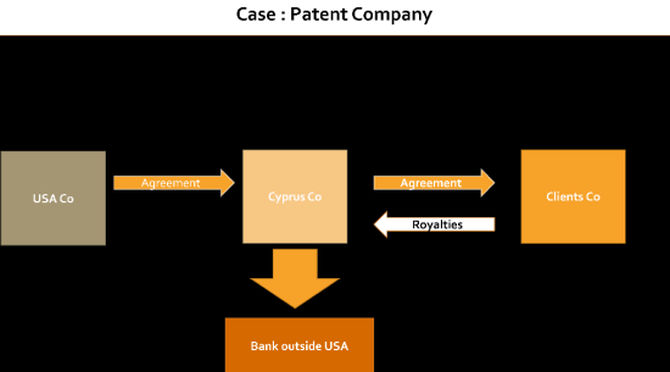

One solution could be:

The patent should be transferred to a company in a low tax country from which the patents are licensed to one or more licensing companies in countries with a dense tax treaty network and which does not levy a withholding tax on royalties paid abroad.

The set-up of a licensing company in Cyprus could meet these objectives. Cyprus has an expanding network of double taxation treaties, thus substantially reducing the withholding taxes on royalties paid to the Cypriot company.

Although the Cypriot company is subject to tax in Cyprus at a rate of 12.5%, the spread between royalties received and royalties paid to the offshore patent-holder can be minimised

Royalties paid by the Cypriot company are not subject to withholding tax.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.