- within Litigation, Mediation & Arbitration, International Law and Antitrust/Competition Law topic(s)

- with readers working within the Aerospace & Defence, Banking & Credit and Pharmaceuticals & BioTech industries

On 21 December 2012, the Luxembourg Parliament adopted a law (the Law) which contains new tax measures applicable to both individuals and companies as from 1 January 2013. The Law also includes some local VAT measures applicable as of 1 January 2013. This News Flash summarises the most important direct and indirect tax measures included in the Law

A. New tax measures for companies

1. Increase of the solidarity surcharge (contribution au fonds pour l'emploi) from 5% to 7%

The solidarity surcharge rises from 5 to 7% for corporations, which increases the corporate income tax. The overall corporation taxes for corporations established in the city of Luxembourg increases from 28.80% to 29.22% (i.e. 21% corporate income tax plus 7% solidarity surcharge, plus a 6.75% municipal business tax in the city of Luxembourg).

2. Minimum taxation

2.1. Increase of the existing minimum tax for SOPARFIs and extension of scope to SICARs and regulated securitisation companies

Since 2011, unregulated Luxembourg corporations whose net assets consist of more than 90% of financial assets, transferable securities and bank deposits are subject to a minimum flat tax of EUR 1,500 (EUR 1,575 including the solidarity surcharge) per annum. This minimum tax mainly concerns so-called Soparfis (fully taxable holding companies eligible for treaty protection and EU Directives).

The Law increases this minimum tax to EUR 3,000 (EUR 3,210 including the 7% solidarity surcharge).

Further, the scope of the existing minimum tax has been amended by the Law. The 90% threshold now also includes (i) receivables held against related parties and companies in whom the corporation holds a participation and (ii) shares or units held in a tax transparent entity. In addition, all companies who meet this threshold will be in the scope of this minimum tax, irrespective whether they are regulated or not. Hence, SICARs and regulated securitisation companies (i.e., securitisation companies which offer securities to the public on an ongoing basis) should be henceforth subject to the EUR 3,000 minimum tax.

2.2. Introduction of a new minimum tax for companies other than those under 2.1.

In addition to the existing minimum tax referred to under 2.1. above, the Law introduces also a minimum tax which will apply to all corporations that have their statutory seat or their central administration in Luxembourg and which are not subject to the existing minimum tax.

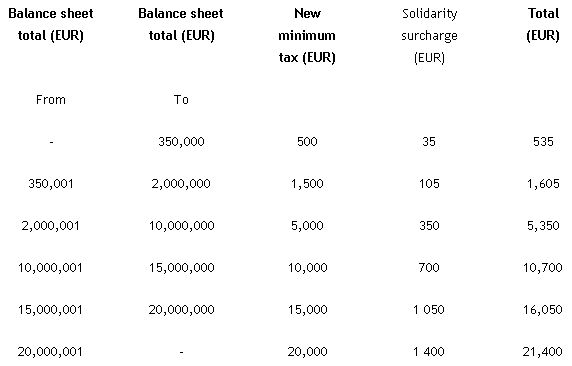

The new minimum tax is determined on the basis of the closing balance sheet total of the concerned tax year, as follows:

2.3. Minimum tax as advance payment

The minimum taxation is no longer a final tax but an advance tax payment on the corporate tax due in the future. However, while standard advance tax payments are refundable, the Law provides that the minimum tax will not be refunded.

Further, minimum tax can also not be reduced by various tax credits which are listed by the Law, such as for example the investment tax credit (bonification d'impôt pour investissement), as provided for by article 152bis of the Luxembourg income tax law (1). Also, the net wealth tax reduction, as provided for by article 8a of the net wealth tax law (2), will not be available for companies which are only subject to the minimum tax.

2.4. Implications in an international context

There were certain interrogations by local tax practitioners as to the compatibility of the minimum taxation with international laws, in particular in scenarios where the Luxembourg corporation only holds assets which are located abroad and Luxembourg does not have the right of taxation by virtue of existing double tax treaties.

The tax authorities have now clarified in their newsletter of 21 December 2012 that the net value of assets generating or potentially generating income which is only taxable in another State than Luxembourg by virtue of a double tax treaty are not to be taken into account when determining the balance sheet total.

This means in practice that the impact of the introduction of the new minimum tax for real estate companies holding only one or several properties located in treaty jurisdictions should be remote as it will only be assessed on the basis of the assets Luxembourg has the right to tax (cash at bank for example). Hence, property companies should in practice not be subject to the EUR 21,400 minimum tax as initially feared by the market.

2.5. Minimum taxation for taxpayers subject to the tax unity regime (régime d'intégration fiscale)

Until now, only the parent company of a tax unity was liable to the minimum tax. The Law amends this rule and henceforth the parent company will be liable for the aggregate amount of minimum taxes that would have been due by each of the companies part of the fiscal unity in the absence of the application of the tax unity regime.

However, the aggregate amount of minimum taxation due by the parent company of the tax unity may not exceed EUR 21,400 (including the 7% solidarity surcharge).

3. Investment tax credits

The 7% global investment tax credit available for qualifying investments of up to EUR 150,000 is maintained. However, the additional 3% granted above this amount will be reduced to 2% and the tax credit for additional investments in qualifying assets will be reduced from 13% to 12%.

B. Tax Measures for individuals

1. Tax allowances limitations

(i) Individuals have so far benefited from a lump-sum tax deduction for their professional travel expenses. This tax deduction is determined based on distance units and amounted to maximum EUR 2.970 for taxpayers living more than 30 distance units from their working place. This lump-sum tax deduction is now reduced to EUR 2.574 corresponding to the withdrawal of the allowance for the first 4 distance units.

(ii) The income tax law provides for a deduction of interest expenses which so far amounted up to EUR 672 (doubled for spouses taxed jointly). This deduction is now reduced by 50% and is so limited to EUR 336 (doubled for spouses taxed jointly).

2. Income tax rates

The Law increases the marginal income tax rate for individuals from currently 39% to 40%.

The new tranche of 40% is applicable to individuals whose taxable income is higher than EUR 100,000 (EUR 200,000 in case of joint taxation).

3. Increase of the solidarity surcharge

As announced in our Newsletter of December 2013, the solidarity surcharge is raised by 3% for individual taxpayers.

The surcharge is now set as from 1 January 2013 to 7% of the income tax due for Luxembourg individual taxpayers whose taxable income does not exceed EUR 150,000 (Tax Class 1 and 1a which is applicable to singles, divorced and widowed taxpayers) or EUR 300,000 (Tax Class 2 which is applicable to taxpayers taxed jointly) and to 9% of the income tax due for Luxembourg individual taxpayers whose taxable income exceeds the relevant thresholds.

As a result thereof, the marginal tax rate (including the solidarity surcharge) is raised to respectively 42.8% and 43.6%.

4. Stock options

As announced during the discussions on the 2013 Budget, the Luxembourg tax authorities have issued on the 20 December 2012, an amended version of the circular L.I.R n°104/2 on the taxation of stock options, which replaces circular L.I.R n°104/2 of 11 January 2002.

Until now, freely transferable stock options (not listed on a stock exchange) which are taxable at grant were valued for personal income tax purposes at 7.5% of the value of the underlying shares/assets (unless a valuation was realised by application of recognised valuation method, such as the valuation methods of the US economists Myron Scholes and Fischer Black or any other comparable valuation method).

The circular is modified on this point and provides that the options are now to be valued at 17.5% of the value of the underlying shares/assets (unless a valuation based on a recognised valuation method is made). The new circular (in the same way as the former circular) does not further explain on what grounds this lump sum valuation is based. It is debatable whether such lump sum valuation could be upheld in court proceedings.

The provisions of the circular applicable to non-freely transferable options and other employee participation plans which are taxable at exercise are not impacted by the amended circular.

C. VAT Measures

1. Small sized businesses

Luxembourg VAT law (3) exempts small businesses from VAT. The threshold for being exempt amounted so far to a turnover of EUR 10,000. It is now increased to EUR 25.000.

2. Limitation of the VAT deduction for expenses related to the main residence

Expenses incurred for the construction, transformation or extension or renovation of the main residence is taxable at the favourable tax rate of 3%. The tax benefit is as from 2013 limited to EUR 50,000 per residence constructed/refurbished, whereas it previously amounted to EUR 60,000.

Footnotes

(1) Loi modifiée du 4 décembre 1967 concernant

l'impôt sur le revenu

(2) Loi modifiée du 16 octobre 1934 concernant

l'impôt sur la fortune

(3) Loi modifiée du 12 février 1979 concernant la

taxe sur la valeur ajoutée

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.