Highlights

Legal framework:

1. General Fiscal Legislation:

- Fiscal Law, Law No. 453, and its amendments: Law No. 528, Amendments and Additions to Law 453, Fiscal Equity Law, and to Law No. 528, Amendments and Additions to the Fiscal Equity Law; establishing the most important legal tax framework and taxes like VAT, Withholding Tax, Stamp Tax, Importation taxes, for almost all the activities that take place in the country.

- Regulations to the Fiscal Law, Decree No. 46-2003 and its Amendments, complement the legal tax framework applied in Nicaragua.

- Tributary Code, Law No. 562 and its Amendments, establish the rights and obligations of both taxpayers and the Tax Authority, as well as some penalties on unpaid taxes and the administrative procedures to solve controversies between taxpayers and the Tax Authority.

2. Special Fiscal Regimes:

- Law No. 282, Temporary Admission and Expedite Exports Law, and its Regulations, Decree No. 80-2001.

- Decree No. 46-91, on Exports Industrial Free Trade Zones and its Regulations.

- Nicaraguan Industry:

- Tourism Sector Regime, regulated by:

- Law No. 306, Tourism Industry Incentives

- Law and its Regulations.

-

- Energy Sector Regime, regulated by:

- Law No.272, Energy Industry Law and its Amendments.

- Law No. 277, Hydrocarbons Supply Law.

- Law No. 443, Geothermal Resources Exploration and Exploitation Law and its Amendments

- Law No.467, Hydroelectric Subsector Promotion

- Law and its Amendments.

- Law No. 554, Energy Stability Law and its Amendments.

- Mining Regime, regulated by Law No. 387, Mining Exploration and Exploitation Law and its Amendments.

- Livestock Sector, regulated by Law No. 453, Fiscal Equity Law and its Amendments.

- Coffee Growers Sector, regulated by Law No. 453,

- Fiscal Equity Law and its Amendments.

1. INCOME TAX

1. General Aspects

a. Income Tax Rate

The general statutory corporate income tax rate for Nicaraguan legal entities is 30% on net income. The income tax cannot in any case be superior to 30% of the taxable income obtained by taxpayers.

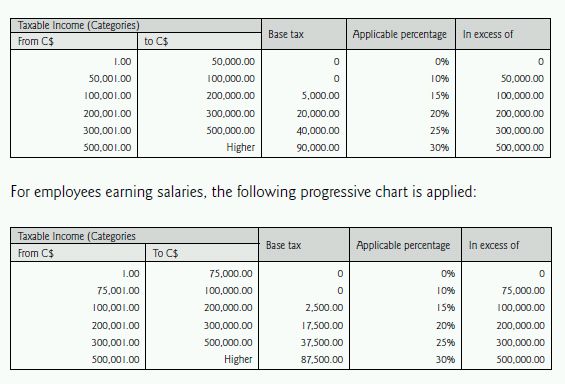

For individuals in general, the tax to be paid is based on a progressive chart established in Córdobas (Exchange rate varies as per Central Bank Official Exchange Rate published on a monthly basis), at this time 21 Córdobas, approximately, are equivalent to One U.S. dollar.

2. Taxable base

All revenues are subject to income tax unless otherwise excluded by law from the taxable base, even though if they have been earned periodically, eventually or occasionally.

3. Deductions

As a general rule all costs and expenses are deductible provided that they are related, proportional and necessary to the income producing activity.

The following deductions are made when calculating the net income tax:

a. Payments of expenses, caused during the taxable year in any business or activity affected by tax and that was thought to be necessary for the existence or maintenance of all source creator of taxable income.

b. Interests paid and caused during the taxable year for debts charged to the taxpayer, provided these had been invested or used in the production of taxable income

c. The sale cost of goods or merchandises produced or acquired in any business, and the cost of services rendered and of the other necessary economic activities to generate taxable income.

d. Losses coming from bad loans, duly justified;

e. One quota of paying off or depreciation necessary to renovate or substitute assets deferred and depreciable assets, necessary or proper for the existence or maintenance of the source producer of taxable income.

f. The gross increment of minimum reserves corresponding to debtors, loans and high risk investments for significant or irrecoverable losses in the financial institutions, which could deduct these increments according to the prudential norms of evaluation and classification of assets dictated by the Comptroller of Banks and Other Financial Institutions.

g. Deductions to insurance businesses and similar: To insurance businesses, of guarantees, of capitalization, or of any combination of the same, will be permitted to determine its net income, deducting the amount that at the end of the exercise shall have the increments of the mathematic and technical reserves and those that propose preventing reimbursement of insurance policies not yet earned definitively for being subject to reimbursement. The amount of said reserves will be determined by the norms that to that effect are dictated by the Comptroller of Banks and Other Financial Institutions.

h. The contribution made from individuals employed in any of the Social Security System's regime.

i. Up to 10% of their annual taxable profits for donations made by the contributor, including the red Cross, Fire Department, the State and its institutions and municipalities.

The taxpayer will have the right, in its case, to apply as deduction one depreciation quota for extinguishment of non-renewable resources, over the base of cost of the acquisition of the non-renewable resource or of the exploitation right, provided the use of this resource is an element of cost in the production activity of the business.

It is important to notice that, in order to apply the deductions listed before, it is necessary that the contributor had registered and established in a correct way all payments and charges made, otherwise, such deductions could not be applicable.

4. Depreciation

The accepted methods of depreciation are mainly straight-line methods; applied to the number of years that according to the useful life of said assets are determined in the Regulation of the law and the accelerated method. The method used or chosen for the contributor may not be varied before. In all cases taxpayers shall carry a registry authorized by the Tax Authority, detailing the depreciation.

Annual quotas to deduct from gross income as reserve for depreciation based in the method of straight line-cost or price of acquisition divided by the useful life of the asset, are determined as follows:

5. Transfer Pricing

Nicaraguan legislation does not include specific transfer pricing rules for purposes of Income Tax.

6. Inflation Adjustments

Nicaragua does not have inflation adjustment mechanisms. However, the Central Bank of Nicaragua publishes a monthly report indicating the official exchange rate for the U.S. dollars in Córdobas, which is adjusted accordingly.

7. Payment and Filing

Ordinary Tax Year covers a period between July 1st and June 30th of the next year, but there´s also the option of requesting a calendar year, particularly the users of these are transnational or multinational corporations that need to homologate their consolidated financial statements.

Income tax must be paid through a Declaration Formulary authorized by the Nicaraguan Tax Authority ("Dirección General de Ingresos -DGI-", in Spanish), filing by all taxpayers during the three months following the end of the approved Tax Year. All individuals receiving payment from one employer are exempt of presenting an annual declaration.

8. Interests and Penalties on Unpaid Tax

Unpaid taxes are subject to lateness interest that should be assessed at the official rate fixed by the Tax Administration, and penalties vary according to infraction are established by our Tributary Code.

It is important to notice, that our legislation establishes that if a contributor omits to file the Declaration Formulary and does not pay the corresponding income tax, such contributor can be responsible under the crime of forgery in civil and criminal matter.

9. Dividends Tax

In Nicaragua, a 10% rate is applying to dividends or profit shares paid, transfer, anticipate or distributed to partners or shareholders.

10. Cross Border Payments

In general terms, there is no specific taxation on cross-border payments, except when the services provided locally or from abroad and the benefit is for the local company. In that event, a withholding tax is generally charged as follows: 20% if payments are made to non-domiciled individuals and, 10.5% for payments made to non-domiciled legal entities.

11. Withholding Taxes

Generally 30% as Income Tax, and 15% as VAT.

12. Dividends

A 10% tax is charged.

13. Royalties

Royalty payments for residents are subject to a 2% tax rate, from a US $ 50.00 bill issued. For royalty payments made by a non resident person it must be apply a 21 % tax rate.

14. Technical, Administrative or other Advisory Services

Whether rendered in Nicaragua or abroad by a non-domiciled individual, advisory services are subject to 20% and a 10.5% if is rendered by a legal entity also nondomiciled, as a withholding for foreign remittance tax. On the other hand, for individuals and legal entites domiciled in Nicaragua the following withholding tax is applied: 10% for professional or technical services rendered by individuals and 2% for services rendered by legal entities.

15. Other Services

a. Interests and leasing payments Interest payments are subject to 10% withholding tax rate, such as short, for nondomiciled entities (financial institutions), granting medium or large term loans.

b. Equity reimbursements Equity reimbursements not corresponding to dividends or profit distributions are not taxable items of income for the foreign shareholder. Therefore no withholding taxes should apply.

16. Tax treaties

Tax treaties with the MCC account related to payment of income and personal assets of all Nicaraguan residents or foreign.

- Investments Promotion and Protection Agreements and treaties avoiding double taxation.

- Nicaragua is member of the World Trade Organization (WTO).

- Free Trade Agreements, with Mexico, Dominique Republic and United States of America. (DR-CAFTA).

- Founder Member of the Services Commerce General Agreement.

- Free Trade and Central American Economy Integration Multilateral Treaty.

- Free Trade Agreement with the Republic of Panama.

- Central American Treaty on Imports Duties Equivalence and its Central American Duties Preference Protocol.

- Central American Economic Integration General Treaty with the Governments of the Republic of Guatemala and the Republic of El Salvador.

Currently, Nicaragua is participating in negotiations in order to execute other economic and trade agreements; being one of them the negotiations held with Taiwan.

VALUE ADDED TAX (VAT)

1. Tax Rates

Vat´s general rate is 15%. There is a comprehensive list of exempted goods, and the zero-rated treatment is extensive, applying for exportations. There are also some VAT exemptions for specific activities such as some tourism projects and other specifics areas regulated by law.

2. Taxable Transactions

Any transfer of goods, services rendered and import of goods are taxable.

3. Taxable base

As a general rule, the taxable base is the price or value of the consideration paid for the goods or services.

4. Creditable VAT

As a general rule the VAT taxpayer has the right to credit against payable VAT all VAT paid to its providers for tangible movable property bought or imported and for services hired.

The credit consist in subtracting from the amount of VAT already transferred by the taxpayer, the amount of VAT already transferred to the taxpayer as well as the VAT paid on the importation or admission of goods and services. The credit is a personal right and it is not transferrable but in mergers and successions.

5. Selected VAT incentives

The law regulating VAT does not provide any incentive. However, there are some special laws providing specific incentives related to VAT, such as pensioners matters, tourism, naturals resources, among others.

6. Payment and Filing

VAT has a 1 month taxable period. Therefore, tax must be assessed and a VAT return filed monthly. The VAT return must be filed and paid in full on the filing date, 15 working days after the closing of the monthly period.

II. OTHER TAXES

7. Property taxes

This tax is set for the transfer of real estate or assets subject to registration before a public office; the tax rate goes depending on the price of the goods transferred, as follows:

From US $ 0.00 to US $2, 380 a 1.00% tax rate is applicable.

From US $ 2,381 to US $ 4,770 a 2.00% tax rate is applicable.

Over US $ 4,770 a 3.00% tax rate is applicable.

8. Industry

Given the importance of the industrial sector in Nicaragua, the country has established benefits and special treatments for it, as the following:

A. Tourism Industry:

The tourism industry is one of the most important in the country; therefore, it counts with the incentives established in Law No. 306, Tourism Industry Incentives Law, and its Regulations.

Among such incentives, we mention the most appealing touristic services for investments in Nicaragua:

1. Hotel Industry Services.

a. Mayor Hostels: with a minimum investment of US $ 500,000.00 in the urban area of Managua (capital city of Nicaragua) and US $ 150,000.00 in the rest of the country.

a.1. Hotels.

a.2. Condo-Hotels.

a.3. Apartment-Hotels.

a.4. Time-share accommodations.

a.5. Motels.

b. Roadside inns: with a minimum investment of US$ 200,000.00 in the urban area of Managua, and US$ 80,000.00 in the rest of the country. b.1. Nicaraguan roadside inns program.

c. Minimum Hostels: with a minimum investment of US$ 100,000.00 in the urban area of Managua and, US$ 50,000.00 in the rest of the country.

c.1. Familiar hostals.

c.2. Lodgings.

c.3. Cabins.

c.4. Guesthouse and rooming house.

d. Camping areas and caravaning.

All above mentioned services are subject to the following exemptions:

For a 10 years period counted from the date the Tourism Institute declares the activities have initiated:

1. Exemptions on imports duties and taxes and/or VAT, in local purchases of the following items:

a. Construction materials.

b. Construction fixed accessories.

2. Exemptions on imports duties and taxes and/or VAT, in local purchases of: belongings, movable assets, equipments, vehicles (12 passengers or more), loading vehicles.

3. Exemption on Real Estate Property Tax.

4. Exemption on VAT applicable to design/ engineering and construction services.

5. Partial exemption on 80% Income Tax.

6. If the project is located within a Touristic Development and Planning Special Zone, exonerations on Income Tax shall be up to 90%. For the special case of roadside inns under the Nicaraguan Roadside Inns Program, the exemption is up to 100%.

2. Aerial Transport Touristic Activities.

a. Services within the country.

b. Charters flights with destiny to Nicaragua.

c. Passengers aerial transport services towards the country, excepting the charter modality.

All above mentioned activities are subject to the following exemptions: Exemption on imports duties and taxes, VAT and any other fee or tax on the purchase of the following items:

1. Aircrafts: airplanes, light aircrafts, seaplanes, helicopters.

2. Publicity material and paperwork.

3. Equipments for ramp services.

4. Equipments and materials for telecommunication and information technology.

5. Lubricant, supplies, engine pieces, turbines, mechanic spare parts, navigatio equipment, etc.

6. Local purchase of food and soft drinks.

3. Receptive and Internal Tourism Activities and Ground Touristic Collective Transport.

a. Travel agencies.

b. Tours-Operators.

c. Companies rendering touristic collective ground transport services for individuals, within and towards the countries under the Central American Touristic Integration System.

All above mentioned activities are subject to the following exemptions:

1. Exemption on imports duties and taxes and VAT on new or used vehicles in perfect mechanic state, as buses, small buses, double traction vehicles used by tour-operators companies.

2. Exemption on imports duties and taxes and VAT on the purchase of information technology equipments, accessories and, telecommunication equipment.

3. Exemption on imports duties and taxes and VAT on the purchase of haunting weapons, ammunitions and items for sport fishing.

4. Exemption on imports duties and taxes of boats for sport fishing.

4. Touristic Activities on Diversion, drinks and food services.

a. Restaurants with or without bars, with a minimum investment of US $ 100,000.00, including the price of the property, within the urban area of Managua and, US $ 30,000.00 in the rest of the country.

b. Touristic bars.

c. Disctotheques and night clubs.

d. Casinos, hippodrome facilities and other racetracks with bet systems and other games of chance.

All above mentioned activities are subject to the following exemptions:

1. Exemption on imports duties and taxes and VAT on local purchases of construction materials and fixed accessories.

2. Exemption on imports duties and taxes and/or VAT in local purchases of belongings, movable assets, motorboats and/or motor vehicles (12 passengers) new or used in perfect mechanic state and, loading vehicles declared necessary by the Tourism Institute, as well as on the purchase of equipment to save water and energy and those necessary for the project's security.

3. Exemption on Real Estate Property Tax (10 years).

4. Exemption on VAT for design/engineering and construction services.

5. Depreciation of goods.

6. In order to promote and create a Nicaraguan Touristic Bars Web, specific incentives will be granted for promotion and marketing purposes, to be carried out by the Tourism Institute, in national and international fairs, printed, pamphlets and maps, Internet promotion, etc.

7. If the project qualifies and, if it is approved by the Nicaraguan Touristic Bars Program, it will receive a partial exemption up to 80% Income Tax.

8. If the project is located within a Touristic Development and Planning Special Zone, then the exemption will be up to 100% Income Tax.

5. Leasing of ground, aerial and aquatic vehicles to tourists.

a. Services with a fleet of 15 ground vehicles.

b. Leasing of motorcycles with 2 and 4 wheels and, sail beach cars with a fleet of 10 units.

c. Aquatic vehicles, with a minimum of one boat or ship.

d. Leasing of nautical motorcycles, 6 vehicles..

e. Aerial vehicles (air motors or paragliding) 5 units.

All abovementioned activities are subject to the following exemptions:

1. Exemption, each 2 years, on import duties and taxes, excepting VAT, for the purchase of new ground, aerial or aquatic vehicles destined to be leased exclusively to tourists.

2. Exemption, each 2 years, of VAT in the purchase of computers, accessories and other telecommunication equipments to be used in the vehicles leasing activities.

B. Energy Industry.

The energy industry is divided in several sectors, among them:

B. Electricity.

This sector is regulated by the Electric Industry Law (Law 272), its Regulations (Decree No. 42 -98) and, Energetic Stability Law (Law 572); as well as all applicable amendments.

In this sector, all imports duties and taxes on machinery, equipment, material and supplies destined exclusively to the generation, transmission, distribution and commercialization of the offering and supply of electric energy for public use, are exempted for a 3 years term.

Fuels used for the electric generation are indefinitely exempted from any taxes.

It is an indispensable requisite for the qualified economic agents, either nationals or foreign, to obtain a concession or license issued by the Energy Institute. Such qualified economic agents must be domiciled in Nicaragua.

The Energetic Stability Law established that the energy sector is exempted from all taxes to lubricants and spare parts used by the electricity generation companies for maintenance of their generation plants. The Energy Institute will approve exoneration requests upon the base of an annual plan the companies must file. Likewise, lamps and save-energy fluorescent light bulbs are exempted from imports and commercialization duties and taxes.

Additionally, the Income Municipal Tax that was paid before the Municipal Authority was modified and transformed into the Consumption Selective Tax, to be paid in an sole account administrated by the Treasure Ministry.

2. Hydrocarbons.

The hydrocarbons sector is regulated by Law No. 277, Hydrocarbons Supply Law, and its amendments; being a sector exempted from importation and temporary protection duties when importing raw oil, partially refined or re-constructed.

Each contractor for exploration and exploitation of hydrocarbons is subject to an annual payment for right of area, which is paid at the beginning of each contractual year. Minimum annual years are determined according to the number of hectares the contractor has as the contractual area at the date when payments must be carried out. Contractors shall pay in cash a royalty to the State on the production coming from contractual area, which will be calculated separately for liquid hydrocarbons and natural gas, which must be paid monthly. The contract stipulates the applicable fees, given that the calculation is carried out according to the area used for the exploration or exploitation of hydrocarbons.

Contractors are exempted from payment of any national or municipal tax on their goods, income from sales assets, services and use of goods acquired in the country as necessary for the activities of exploration or exploitation of hydrocarbons. Additionally, contractors are also exempted from payment of fees, duties, both national and municipal, affecting their income or invested capital during the exploration phase; however, they are obligated to withhold the corresponding tax for purchases or payments of legal services.

3. Geothermal.

This sector is regulated by Law No. 443, Geothermal Resources Exploration and Exploitation Law, and its Regulations, Decree No. 03-2003, and the corresponding amendments. Companies established in the country for geothermal resources purposes will be exempt from the Sales Municipal Tax for a 5 years term from the beginning of their industrial activities; however, concessionaires are subject to the common Income Tax obligations, which rate is up to 30% annual.

Beneficiaries of exploration or exploitation of geothermal resources, contractors and subcontractors may import all goods and necessary equipment, duty free, in order to carry out the exploration and exploitation activities. Once those materials are not used any longer, then they may be re-exported also duty free.

This industry is taxed with 1% on the tons of vapor annually produced, which is to be paid within the first thirty days of each year.

4. Hydroelectric

This sector is regulated by Law No. 467, Hydroelectric Subsector Promotion Law, establishing the following benefits:

a. Exemption on imports duties and VAT on machinery, equipment, materials and supplies destined to the pre-investment activities and construction of plants for the hydroelectric generation.

b. Exemption of Income Tax for a maximum period of 7 years following to the beginning of the project's operation.

c. Exemption of municipal taxes, during the project's construction and for a 10 years period after the commercial activities have initiated, within the following parameters: 75% during the first 3 years; 50% during the following five years and, 25% during the last 2 years.

d. Exemption of Stamp Tax that might cause the project's building process or operations, under a water administration permit for a 10 years period.

C. Mining.

This industry is regulated by Law No. 387, Mining Exploration and Exploitation Special Law, and its amendments; andi t subject to the common rate of 30% Income Tax and, payment of right to extract up to 3%. Such righ to extract payment is considered as expenses when calculating the Income Tax.

A 1% payment on the account of the Income Tax must be paid when also paying the corresponding amount for the mining concession lease. The right of extraction or royalties are exempted when the extracted material is destined for non-profit purposes.

D. Forestry.

Law No. 462, Law for the Sustainable Development, Promotion and Conservation of the Forest Sector, and its regulations, Decree No. 73-2008; establishing a withholding tax rate that varies from 2% to 7.5% for commercialization of wood.

E. Cattle

Rates applicable to this industry are the following:

- Average value per head of cattle for exports: 3 %

- Average value per head of cattle for cut up: 3 %

- Commercialization of cattle in the country: 3 %

- Purchase of cattle by slaughterhouses for meat cuts: 3 %

F. Agricultural.

Agricultural goods dealt in the Agricultural Stock Exchange, are subject to the following withholding tax:

- Primary agricultural goods 1 .5%

- Other goods 2 %

If the annual income obtained from such goods is superior to C$ 60,000.00 (US$2,860.00, approximately) the withholding tax will be under the account of the Income Tax.

G. Coffee Growers

This sector has a rate of 0% Income Tax.

9. Casinos Tax:

A new monthly tax was imposed per game machine as follows, established by Law No Law No. 528, Law for the Reform and Additions to the Law 453, Law of Fiscal Equity and to the Law No. 528, Law of Reforms and Aditions To the Law of Fiscal Equity:

a. Individuals or legal entities that have less than 101 games machines per authorized game place, will pay for each of them US $ 25.00 (twenty five dollars per machine),

b. Individuals or legal entities with less than 301 games machines per authorized game area, but more than 100 machines, will pay US $ 35.00 (thirty five dollars) per machine.

c. Individuals or legal entities with more than 300 games machines per authorized game area will pay US $ 50.00 (fifty dollars) per machine.

Additionally, the corresponding authorities (Instituto Nicaraguense de Turismo (INTUR), National Police, National Lotery and Tax Administration (DGI) will authorized game areas with a minimum of 10 machines in the municipality with less than thirty thousand habitant, for the rest with a higher number of habitants; these will be authorized with a minimum of twenty five games machines.

a. A monthly tax will be imposed for each game table in the casinos, of US $ 400 (four hundred dollars),

b. Such tax will be registered as an obligatory minimum payment towards annual income tax.

10. Stamp tax

Deeds whereby General, Administrative and/or Special POAs are granted, as well as registration of trademarks, titles of concessions of natural resources, etc., are subject to a Stamp Tax that currently ranges from US$ 0.15 to US$ 238.00, approximately.

The one paying this tax is the one receiving the goods or rights established in the corresponding deed. However, notaries, persons granting documents taxed with this tax, public officers intervening in the deed and, persons possessing the deeds, are jointly responsible for the payment of this tax.

This tax is paid through fixed rates, with varying amounts, and are paid directly at the cash boxes of the Tax Authority authorized to sell stamps; and the stamps are stick and cancelled in the corresponding document.

11. Registration Tax

The registration of documents before the Public Registry Office is subject to registration fees that vary according to the nature of the document to be registered. The applicable fee for most documents (real state transfer, articles of incorporation, etc.) is based on the amount of the price shown in the document. Such fees are established in a recent Presidential Decree (issued in 2009).

12. Municipal Tax

There is a municipal tax applicable to all industrial commercial and services activities carried out in the territory of each municipality. The taxable base is the total amount of gross revenues received for the taxpayer. The tax rate is 1% and is monthly payable.

All natural or legal persons who carried out, industrial, commercial and services activities, must register annually from December 1st to January 31st. The tax rate apply is 2% on the average gross revenues obtained in the last three months the previous year for the contributor.

All persons who own properties in Nicaragua, must pay a real tax (Impuesto sobre Bienes Inmuebles) each year, which must be effective from the 1st of January to 30the of June. The amount of this tax is set and collected annually by the Mayor of each municipality.

III. CUSTOMS REGIME

1. Customs duties

Most Customs Duties go from 0% to 20%, with exemptions for countries with which Nicaragua has free trade agreements such as, USA, Central America, Mexico, Dominican Republic, as may be applicable for specific merchandise.

2. Taxable Base

Customs value. Depending on the merchandise to be imported, such value may vary given the tax and specific duties that may result applicable to the merchandise.

3. Filing and Payment

A form to be filled out when importing goods and paid before customs releases goods. Imports to Free Zones are customs tax-free.

4. Selected Custom Duties Regimes Available

a. Ordinary Importation Regime

According to the Central American Uniform Customs Code (CAUCA), the Definitive Importation, which is the ordinary importation regime, consists in the entry of merchandise to the country in order to be used or consumed definitively within the country. The entry of merchandise under this regime involves payment of the corresponding import duties.

b. Temporary Importation Regime

According to CAUCA, there is a Temporary Importation with Re-exportation in the Same State Regime, regulate by Law No. 382, Temporary Importation Regime, and Decree No. 80- 2001, allowing the temporary entry of merchandise to the country with a specific aim, to be re-exported without suffering any other change than the normal depreciation derived from use. The entry of merchandise under this regime suspends the imports duties. Please see also our comments on the "Active Improvement Regime".

c. Active Improvement Regime

According to CAUCA, there is an Active Improvement Temporary Admission Regime, admitting the entry of merchandise destined to be exported again once transformed, elaborated or repaired in the country. The entry of merchandise under this regime suspends imports duties.

d. Passive Improvement Regime

According to CAUCA, there is a Passive Improvement Temporary Exports Regime, allowing the temporary export of national or nationalized merchandise which will be transformed, elaborated or repaired outside the country and, then are imported again to the country and taxed accordingly. The export of merchandise under this regime suspends exports duties.

e. Free Trade Zone Regime

According to Decree No. 46-91, there are three categories falling under the Free Trade Zone Regime, as follows:

1. Free Trade Zone for Exports.

It is composed by all areas within the country, without population residing in, under a special surveillance by the Customs Authority, which is Ahmed to promote investments and exports by means of the establishment of companies dedicated to produce and exports goods and services under an exceptional fiscal and customs regime.

Raw material or merchandise destined to companies within the Free Trade Zone are admitted in the country duty free.

2. Free Trade Zones Operator Companies.

These are companies which sole purpose is to administer the Free Trade Zone for Exports. Once authorized to operate, they are subject to the following fiscal benefits:

2 .2 Exemption of 100% Income Tax, generated by the Zone´s operations, for a period of 15 years after their operations have initatied.

2 .3 Exemption of imports taxes on machinery, equipment, tools, spare parts, etc., necessary for their operations.

2 .4 Exemption of Stamp Tax.

2 .5 Exemption of Conveyance of Real Estate Properties Tax, for those properties affected to the Free Trade Zone for Exports.

2 .6 Exemption on Consumption Selective Tax.

3. Free Trade Zones Users Companies.

These are companies authorized to carry out their business within the territory of a Free Trade Zone for Exports. Companies allowed to be users of a Free Trade Zone for Exports are those devoted to produce and export goods or services, either national or foreign –carrying out all legal procedures to incorporate a company or to open a branch in Nicaragua, which, in either case, their commercial purposes must be exclusively to conduct business under this special regime in Nicaragua-. User Companies are subject to the following benefits:

3 .1 Exemption of 100% Income Tax during the first 10 years, and 60% from the eleventh year onwards. This exemption does not include personal income, salaries, wages or fees paid to the Nicaraguan or foreign personnel working for the User Company; but it does include payments in concept of interests on loan or due to commissions, fees or payments for legal services rendered outsider the country .

3.2 Exemption of Stamp Tax.

3.3 Exemption of all customs taxes and duties and consumption in connection with imports of raw material, materials, equipment, machineries, spare partes, samples, etc., destined to the User Company´s operations; together with all taxes on the necessary equipment to install economic cafeterias, health services, medical assistance, nurseries, etc., aimed to satisfy the needs of the personnel working for the User Company.

3.4 Exemption of customs taxes on transport equipments, loading vehicles, passengers or services, destined to the normal use of the User Company.

3.5 Exemption of indirect taxes, on sales and selective consumption.

3.5 Exemption of Municipal Taxes.

3.6 Exemption of exports taxes on products elaborate in the Free Trade Zone.

Users Companies must have a reasonable number of employees in accordance with their request of admission to this special Regime and, keeping also salaries and labor benefits as offered in their request. User Companies must conduct their business in accordance with the Political Constitution and Labor Code, and labor and social security regulations in force in Nicaragua.

IV. PAYROLL TAXES/WELFARE CONTRIBUTIONS

1. Social Security System

The Nicaraguan Social Security Institute ("Instituto Nicaragüense de Seguridad Social –INSS", in Spanish) manages and operates the Social Security System and the National Health System for the employees. These systems provide services and benefits related to illness treatment (Health Care), disability, maternity, and death insurance. Social Security taxes are applicable to employer and employees. The taxes are based on the monthly salaries with a 6.25% rate for the employer and a 16% for the employee, with a maximum payment of US $ 1,790.

2. Labor training contribution.

In Nicaragua, employers are obliged to pay a contribution of 2% on the total amount of payroll gross salaries. This contribution is established in Decree No. 40-94, Organic Law of the Technology National Institute (INATEC). Employers failing to comply with this obligation are subject to fines ranging from US$25.00 to US$500.00, approximately, plus interests.

3. Retirement Contributions

Non applicable

4. Labour Risk Insurance

This mandatory insurance is covered by the state and is provided by the Nicaraguan Social Security Institute and covers all the labor force, including the accidents the employee might suffer during his working day and also covers the round trip to work.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.