1. Income Tax

1.1. General Aspects

1.1.1. Income Tax Rate

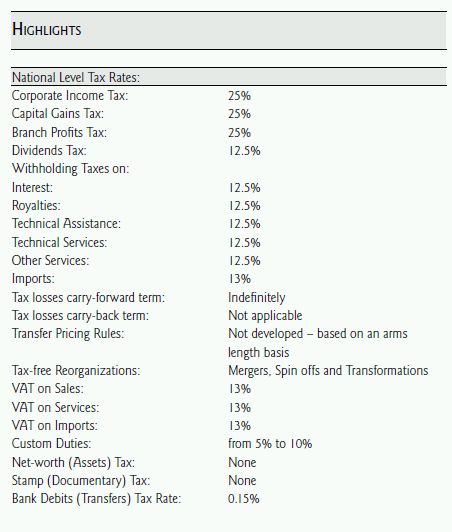

The general statutory corporate income tax rate for Bolivian entities including Bolivian branches of foreign companies is 25%.

1.1.2. Taxable Base

All revenues are subject to income tax unless otherwise excluded by law from the taxable base. Excluded Items of Income are subtracted from Gross Income, i.e., the sum of All Items of Income realized by the taxpayer. The result is the Gross Taxable Income from which Costs and Expenses are deducted. The after- deductions result is the Net Taxable Income to which a 25% tax rate is the Resulting Income Tax from which applicable Tax Credits are subtracted to find the Income Tax Liability.

1.1.3. Minimum Taxable Income

There is no minimum Net Taxable Income.

1.1.4. Deductions

As a general rule all costs and expenses are deductible provided that they are related to the income producing activity. Any costs or expenses related to Excluded and/or Exempted Items of Income are not deductible. Some costs and expenses are limited or forbidden, depending on the facts and circumstances of each case, e.g., related party charges (interests), commissions, among others.

1.1.5. Depreciation

Tangible fixed assets' depreciation is deductible. Depreciation term varies depending on the nature of the asset; 20 years for real estate, 10 years for all other tangible fixed assets, except for motor vehicles and computers for which regulations establish a 5-year term. Intangibles with a fixed cost may also be depreciated in five years. Globally used methods are generally accepted in Bolivia for tax purposes, e.g., straight-line method, declining balance method, etc.

1.1.6. Transfer Pricing

Bolivia has not developed any transfer pricing rules. As a basic premise, all transactions carried out through by related parties should be carried out as if they were deemed to be independent parties.

1.1.7. Tax Losses Carry-forward / Carry-back

A Bolivian taxpayer can carry-forward tax losses for an unlimited period of time.

There is no carry-back possibility.

Tax losses can be credited towards (and are capped by) the taxpayer's net income for the deduction's taxable year. Therefore, a tax loss deduction cannot generate further tax losses.

Tax losses cannot be transferred to other taxpayers (not even to the shareholders), except as provided in the cases of reorganizations. There are three types of tax-free 36 – an overview of main corporate taxes in selected jurisdictions 2010 reorganizations authorized by Bolivian law (statutory tax-free mergers, statutory taxfree spin offs and statutory tax-free transformations). In all cases, the tax attributes of the target company are transferable to the surviving or resulting corporation. In the case of tax-free mergers the above-mentioned general limitations still apply.

Nonetheless, in this case tax losses are transferable to the new or surviving entity. For tax-free spin-offs part of the tax losses of the target entity are transferred to the resulting entities. A limitation was set forth by a decree supreme limiting the carry forward of losses resulting from any of the previous reorganizations in a period of four years. In light of the previous limitation, and taking into account that the law sets forth no limitation whatsoever on the carry forward of losses, it is highly likely to have a favourable ruling in case the supreme decree is challenged.

1.1.8. Tax-Free Reorganizations

In general, operations involving statutory tax-free mergers, statutory tax-free spin offs and statutory tax-free transformations are not taxed with the Corporate Income Tax, the Value Added Tax and the Tax on Transactions.

1.2. Payment and Filing.

For any given taxable year the corresponding income tax return and tax liability must be filed and paid within 12 0 days following the closing of the fiscal year. The closing of the fiscal year varies depending on the type of enterprise and the line of business.

1.3. Penalties on Unpaid Tax or Tax Paid Belatedly

Unpaid taxes are subject to lateness interest that should be assessed at the official rate fixed by the corresponding regulations.

The Tributary Debt (DT) is the total amount to be paid once the term for the payment of the tributary obligation is due. The DT is constituted by the Omitted Tribute (TO), the Penalties (M) when applicable, expressed in U.F.V's (Housing Promotion Unit, a referential index) and the interests (r), according to the following:

DT = TO x (1 + r/360)n + M

Other penalties apply for non-filing or inaccurate filing, which may range from fixed fines determined by regulations applicable to individual or legal entities, and depending

on the facts and circumstances of each case.

1.4. Dividends Tax / Branch Profits Tax.

There is a 12.5% remittance tax on dividends and branch profits remitted abroad to non-resident alien entities or individuals. It applies only on all dividends remitted abroad, and on all branch profits realized on the taxable year whether they are remitted

abroad or not. If the dividends or profits are reinvested, the tax still applies.

1.5. Cross-border Payments

1.5.1. Withholding Taxes

When Bolivian sourced income is remitted abroad to a beneficiary that is a nonresident alien individual or entity, the payment should be subject to a withholding tax.

1.5.1.1. Dividends

Apart from the corresponding profits taxed at the corporate level, a withholding tax of 12.5% is applicable.

1.5.1.2. Royalties

Royalty payments are subject to an effective 12.5% withholding tax for income and remittance taxes.

1.5.1.3. Technical Services, Technical Assistance and Consulting Services

Whether rendered in Bolivia or abroad by a non-resident, technical services and echnical assistance payments are subject to 12 .5% withholding for income and remittance taxes.

1.5.1.4. Other Services

Payments for services rendered from abroad (no matter their nature) are subject to a 12.5% withholding tax.

1.5.1.5. Interest and Leasing Payments

As a general rule, payments performed pursuant to foreign debt agreements and cross-border leasing agreements are subject to a 12.5% effective withholding for income and remittance taxes.

1.5.1.6. Equity Reimbursements

Equity reimbursements not corresponding to dividend or profit distributions are not taxable items of income for the foreign shareholder. Therefore no withholding taxes should apply.

1.5.1.7. Tax Havens

There are no specific rules regarding Tax Havens.

1.5.2. Limitations for Costs and Expenses Incurred Abroad by Bolivian Taxpayers Costs and expenses incurred abroad may be deducted as long as they are related to the company's activities and are properly documented.

1.5.3. Tax Treaties

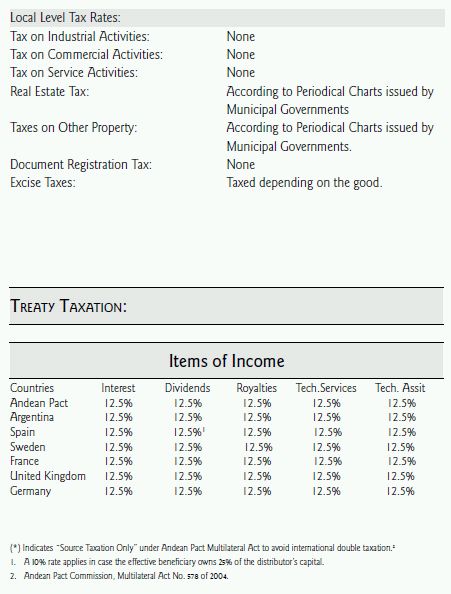

Bolivia has entered into the following tax treaties to avoid double taxation:

- Andean Pact Countries, Directive 578.

- Republic of Argentina (October 30, 1976).

- Federal Republic of Germany (September 30, 1992).

- Kingdom of Sweden (January 14, 1994).

- United Kingdom of Great Britain and Northern Ireland (November 3, 1994).

- Republic of France (December 15, 1994).

- Kingdom of Spain (May 30, 1997).

2. Value Added Tax (VAT)

2.1. General Aspects

2.1.1. Tax Rates

VAT's general rate is 13%.

2.1.2. Taxable Transactions

Sale or importation of movable tangible property. Services rendered in Bolivia.

2.1.3. Taxable Base

As a general rule, the taxable base is the price or value of the consideration paid for the goods or services rendered.

2.1.4. Creditable VAT

As a general rule, is creditable all VAT paid to providers for tangible movable property

bought or imported and for services hired, provided that they constitute a cost or expense of the taxpayer's income producing activity.

2.2. Selected VAT Incentives.

The temporary importation of goods is not subject to import VAT. Among others, the following transactions are VAT exempted: Interests generated from banking operations. Transfer of shares, debentures and other securities Transfer of goods resulting of a securitization process. Assignment of banking, insurance and pension funds portfolios. Cultural activities rendered by Bolivian artists.

2.3. Payment and Filing

VAT has a one month taxable period. Therefore, the tax must be assessed and a VAT return filed monthly. The VAT return must be filed and paid in full on the filing dates scheduled by the tax authorities for these purposes, which are usually every fifteenth day following the corresponding monthly period's end.

3. Other Taxes

3.1. Tax on Windfalls

This is a national level tax. It taxes the receiver of any windfall depending on his/her relationship with the donor. Depending on said relationship, the tax rate ranges from 1% to 20%.

3.2. Property Taxes

There are municipal (local territorial level) taxes on real estate and vehicles. The rate for these taxes is set in municipal ordinances adopted by each locality annually, therefore they may vary.

3.3. Financial Transactions Tax

This tax is a national level tax. It was created to tax any credit or debit n the taxpayers account and it is withheld by Bolivian banks (and other savings institutions). It applies on any deposited funds that are either withdrawn or transferred from checking or savings account. The taxable base is the amount withdrawn or transferred.

The tax rate is 0.15 per thousand. There are very limited exemptions. It is an important tax to keep in mind when structuring transactions cash-flow. Although the tax was created with a two year term limit, law 3446 extended this term for another period, this time of 36 months commencing on July 21st, 2006.

3.4. Excise Tax

This tax is applicable to the sale or definitive importation of certain luxury goods (e.g. cigarettes, Vehicles, alcoholic drinks, etc.).

4. Customs Regime General Aspects

4.1. Custom Duties

Importation of goods is subject to import VAT at a general rate of 13%. In addition to import VAT, imports are also subject to custom duties (GA) that range between 5% and 30%, also depending on the type of M&E being imported. It is important to point out that Bolivia has entered into Preferred Custom Duties Agreement (PCDA) with many countries, reducing the applicable custom duties for certain M&E from a certified origin.

Zero-rated custom duties regimes are available for some activities or importers.

These must be checked further on case-by-case basis.

4.2. Taxable Base

Custom duties are computed on the CIF value of the goods, while import VAT is computed on the CIF value plus the corresponding custom duties. Custom valuation rules in place in Bolivia are those of the GATT (1994) valuation code, which are similar to the current WTO valuation rules. For valuation purposes, the Andean Pact valuation rules in Decisions 378 and 379 apply. These rules are also similar to the first mentioned rules.

4.3. Transfer Pricing

Bolivia has not developed any transfer pricing rules. As a basic premise, all transactions carried out through by related parties should be carried out as if they were deemed to be independent parties.

4.4. Filing and Payment

An import return must be filed upon nationalization of the goods.

4.5. Selected Custom Duties Regimes Available

Importation of M&E can be performed through a variety of customs regimes different to the ordinary importation regime. Each of these special custom duties regimes has a different customs duties and import VAT treatment.

4.5.1. Ordinary Importation Regime

It applies to all goods that will remain permanently in Bolivian territory without any use or jurisdictional restrictions. Full payment of custom duties and import VAT is required upon nationalization.

4.5.2. Temporary Importation Regime

It applies to M&E and spare parts listed by the applicable regulations as capital goods. This regime is used whenever the goods are expected to remain in Bolivia for 90 days extendable to other 90 days. During this time, payment of custom duties and import VAT will be suspended.

4.5.3. Temporary Importation Regime for Leased Equipment

The rules of this regime are similar to the above-explained rules.

4.5.4. Free Trade Zone Regime

Bolivia has a convenient Free Trade Zone regime that should be carefully explored by importers and other parties with business interest or permanent operations in Bolivia.

5. PAYROLL TAXES / WELFARE CONTRIBUTIONS

5.1. Payroll withholding tax

Employers should withhold an amount equal to 13% of the amount paid a salary to each employee, unless said employees are able to offset said tax with all the VAT credit resulting from goods and services obtained.

5.2. Retirement Contributions

The contribution to private funds made by the employee is equal to at least 12.21% of the employee's wage. Employers are responsible for withholding such contributions from employees' wage.

5.3. Health Contributions

The employee must be affiliated to any Health Administering Entity (HAE) approved by the National Health System. Contributions to the HAE by the employer are equal to 10% of the employee's wage.

5.4. Other Contributions

The employer must also fund 1.71% of the workers salary for a professional risk insurance of the employee and 2%, for the Social Housing Plan.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.