- with readers working within the Retail & Leisure industries

On September 24, 2019, in an important step toward full implementation of the Foreign Investment Risk Review Modernization Act (FIRRMA),1 the Department of the Treasury published proposed rules to implement FIRRMA's provisions regarding certain foreign investments in real estate in the United States.2 FIRRMA, which was enacted in 2018, provided the Committee on Foreign Investment in the United States (CFIUS) with expanded jurisdiction to review foreign investments in the United States and to recommend that the President block or otherwise interfere with such investments.3

Prior to FIRRMA, CFIUS had jurisdiction to review foreign investments in US real estate only in connection with foreign acquisitions of control over a US business. FIRRMA expanded CFIUS's jurisdiction to include certain transactions involving the purchase or lease by, or a concession to, a foreign person of certain real estate in the United States, even where there is no accompanying investment in a US business. Under the proposed rules, these transactions are termed "covered real estate transactions," and consist of the purchase, lease or concession to, a foreign party of "covered real estate." There are two categories of "covered real estate": (i) real estate that "is located within, or will function as part of, an air or maritime port," and (ii) real estate near US military installations or other property owned by the US government that "is sensitive for reasons relating to national security."

The proposed real estate rules are open for public comment through October 17, 2019, which provides a very short period of time for public input. Below we describe key elements of the proposed rules on which interested parties may wish to submit comments.

What is the Proposed Scope of "Covered Real Estate Transactions"?

Types of Transactions Covered. As noted, the proposed rules apply generally to transactions involving the "purchase, lease, or concession to," a foreign person of covered real estate, provided that the investing foreign person acquired certain "property rights" as part of the transaction. Specifically, a transaction will be a covered real estate transaction only if a foreign person attains at least three of the following as part of the transaction:

- The right to physically access the real estate;

- The right to exclude others from physical access to the real estate;

- The right to improve or develop the real estate; and

- The right to attach fixed or immovable structures or objects to the real estate.

These rights are deemed to exist "whether or not shared concurrently" with another party. Thus, an otherwise covered real estate transaction will still be subject to CFIUS review even if it results in a US party holding title jointly with a foreign party as long as the foreign party is afforded at least three of the above fundamental property rights as a consequence of joint ownership.

The proposed rules expressly state that the extension by a foreign person of a mortgage, loan or similar financing arrangement for the purchase, lease, or concession of covered real estate will not, by itself, constitute a covered real estate transaction. However, if it appears that, because of imminent actual default or other condition, there is a "significant possibility" that the foreign person may, by extending such a mortgage, loan, or similar financing arrangement, actually obtain ownership of, a lease for, or a concession to the covered real estate as a result of the default or other condition, that would be a covered real estate transaction.

Covered Real Estate. FIRRMA's expansion of CFIUS' jurisdiction with respect to investments in real estate is limited to real estate in or around specific sites—certain airports, maritime ports, military installations, and other "sensitive" properties owned by the US government. These sites are divided into two categories. The new rules contain specific provisions and definitions for each:

- Real estate within, or that will function within or as part of, airports and maritime ports. The proposed rules capture most major and "joint use" airports—airports handling both civilian and military air traffic—as determined by the Federal Aviation Administration. Similarly, the rules define maritime ports to include the top 25 "tonnage, container, or dry bulk ports" as well as certain strategic seaports listed by the Department of Transportation.

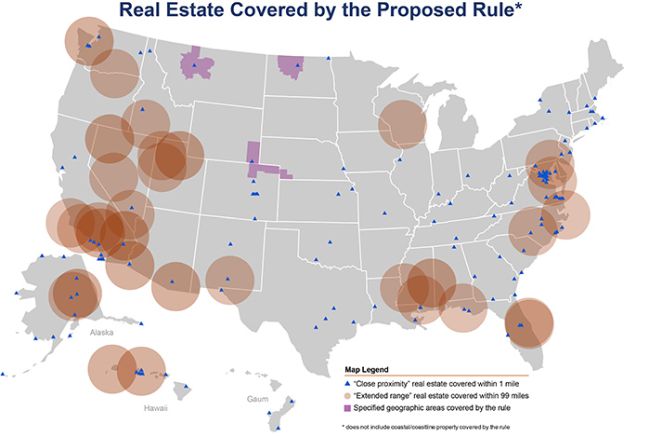

- Real estate within certain distances of US military installations and other US government property. The proposed rules further divide covered real estate within certain distances of military installations and other government property that is sensitive for national security reasons into different categories:

- Real estate located within "close proximity" (i.e., one mile from the outer boundary) of a designated military installation or other government property.

- Property within an "extended range" (i.e., within 99 miles of the "close proximity" boundary and, where appropriate, up to 12 nautical miles) of such specified property. The extended range category applies to various combat training, range, and testing facilities and may also include adjacent airspace.

- Real estate in specified counties and other geographic areas near missile ranges located in Colorado, Nebraska, North Dakota, Montana, and Wyoming.

- Any part of certain identified property located within 12 nautical miles of the US coastline.

The proposed rules include a list of military installations and other qualifying US government property and their corresponding vicinity restrictions in an appendix.4 The properties identified on this list, as well as any added in the final rules, will materially delineate the scope of CFIUS' review of foreign investments in US real estate.

Exceptions and Other Carve outs. The proposed rules set out a significant number of exceptions to otherwise covered real estate transactions based on the nationality of the foreign party involved or the type of transaction involved. The proposed rules limit review in the follow circumstances:

- Excepted real estate investors and excepted foreign states. As do the concurrently published proposed non-real estate rules, the proposed real estate rules specifically carve out from CFIUS' review transactions involving an "excepted real estate investor." Under the proposed rules, an "excepted real estate investor" is a foreign party that has a "substantial connection" (according to certain factors including nationality and place of incorporation) to an "excepted foreign state," excluding excludes foreign persons who have violated certain US laws or have a history of non-compliance in prior CFIUS-related transactions. CFIUS plans to publish a list of countries qualifying as excepted foreign states separately from the final rules, and that list will be posted on the Treasury Department's website.

- Urbanized areas. Unless the property is within "close proximity" of an identified military installation or is within, or functioning as part of, an airport or maritime port, the proposed rules provide an exception for otherwise covered real estate transactions that involve real estate located within an "urbanized area" or "urban cluster." The terms "urbanized area" or "urban cluster" are defined by the Census Bureau based on population density. This means that most major cities—including Washington, DC—also fall under this exception despite their proximity to major governmental and military centers.

- Individual housing units. The rules provide an exception for the purchase, lease or concession of a single "housing unit"—used for individual or single-family occupancy—as defined by the Census Bureau. The exception also includes any fixtures and adjacent land that incidental to the intended use of the property as a housing unit. To be considered incidental, the size and nature of a particular housing unit's fixtures and land must be "common for similar single housing units in the locality in which the unit is located."

- Retail trade, accommodation or food service sector establishments. The rules provide an exception for the purchase, lease, or concession of covered real estate located within or as part of an airport or maritime port where the terms of the transaction restrict the use of the covered property to retail trade, accommodation or food service.

- Limited commercial office space. The rules also carve-out covered real estate transactions for the purchase, lease by or concession to, a foreign party of commercial office space. The exception is limited, however, to transactions where, upon completion of the transaction, the foreign party does not, in the aggregate, (1) hold, lease, or have a concession with respect to more than 10% of the building's overall square footage, or (2) represent more than 10% of the total number of tenants in the building.

- American Indian and Alaska Native Lands. The rules provide an exception for otherwise covered real estate transactions where the covered real estate is owned by specified Alaskan Native groups or held in trust by the US for American Indians, Indian tribes, Alaska Natives, and Alaska Native entities.

What filing procedures apply to covered real estate transactions?

As discussed in our initial Advisory on FIRRMA,5 the statute significantly enhanced CFIUS' role in protecting national security by making filings with CFIUS mandatory with respect to certain foreign investments in US businesses. Covered real estate transactions, however, are not subject to that mandate. Thus, whether to submit a filing with CFIUS regarding a covered real estate transaction is a matter of discretion for the parties (absent a specific request from CFIUS for a submission).

Although parties to covered real estate transactions are not required to make any filing with CFIUS, if they choose to do so, the proposed rules give them the option to file a short-form "declaration" rather than the longer, traditional form of "notice." This may be an attractive option for some parties, particularly as CFIUS is required to complete its review of a declaration within 30 days (as compared to the longer 45-day period for review of notices). However, CFIUS can request, after reviewing a declaration, that the parties submit a full notice, so parties to covered real estate transactions may want to weigh the benefits and drawbacks of simply filing a notice as an initial matter, depending on the nature of their transaction and the timing of its planned closing.

The procedures for CFIUS's review of transactions involving foreign investment in covered real estate transactions are proposed to be codified in a new part of the Code of Federal Regulations, 31 C.F.R. part 802, separate from the current CFIUS regulations codified at 31 C.F.R. part 800

To avoid potential classification issues, the proposed rules clarify that a covered "control over a business" transaction involving the purchase, lease, or concession of covered real estate is not considered a "covered real estate transaction," and parties to such "control" transactions should follow the filing procedures set forth in 31 C.F.R. part 800. Although FIRRMA gave CFIUS authority to impose fees for making filings regarding both types of transactions, the proposed rules do not include provisions regarding such fees. According to the proposed rules' preamble, the Department of the Treasury intends to publish a separate rule regarding fees at a later date.

Consistent with CFIUS existing rules, the proposed rules also set out significant penalties to be imposed under the new 31 C.F.R. part 802. Like the rules governing other covered transactions in part 800, the proposed rules on covered real estate transactions would establish penalties up to $250,000 per violation for parties who make a "material misstatement or omission" in a declaration or notice or otherwise make a false certification.

Conclusion

The proposed rules also include many explanations and examples, too detailed to summarize here, that reveal much about how CFIUS intends to define its newly delineated oversight. As noted, interested stakeholders have less than one month, until October 17, 2019, to provide comments on these proposed rules.

* Trevor Schmitt contributed to this Advisory. Mr. Schmitt is a graduate of Georgetown University Law Center and is employed at Arnold & Porter's Washington, DC office. He is not admitted to the practice of law in Washington, DC.

- 84 Fed. Reg. 50,174 (Sept. 24, 2019).

- Simultaneously, Treasury proposed FIRRMA-implementing rules not focused on real estate transactions, as discussed in our separate advisory entitled " CFIUS Proposed Rules Firm Up Plans for New Scrutiny of Foreign Investment."

- See New Law Expands and Reforms CFIUS Jurisdiction and US Export Controls, Arnold & Porter (Aug. 13, 2018).

- US government property and their corresponding vicinity restrictions.

- New Law Expands and Reforms CFIUS Jurisdiction and US Export Controls, supra note 3.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.