Below is an update regarding important changes to New York and Connecticut state laws relevant to estate planning and to certain real estate transactions.

Overview and planning points

As explained in more detail below:

- New York clients may wish to accelerate plans to make taxable gifts in order to avoid the extended three-year "clawback" for taxable gifts made within three years of death.

- Connecticut has clarified the scheduled increase in the Connecticut estate and gift tax exemptions. Given that such increases are gradual, Connecticut residents who plan to use their increased Federal gift tax exemption will want to time their gifts carefully.

- The Connecticut General Assembly passed a bill (which is expected to become law) making significant changes to Connecticut trust law, including changes permitting dynasty trusts and asset protection trusts.

- Clients purchasing or selling real estate in New York City should be aware of increased New York State real estate transfer taxes taking effect on July 1, 2019.

- The Connecticut General Assembly passed a law increasing the real estate conveyance tax on certain transfers of Connecticut residential property. If signed by the Governor, the increase will apply to transfers for consideration in excess of $2.5 million after July 1, 2020.

New York and Connecticut Estate Planning

Extension of New York's three-year "clawback" for certain taxable gifts

New York does not impose a state-level gift tax. However, New York has extended its "clawback" on taxable gifts (generally gifts in excess of the annual exclusion) made within three years of death. In general, if a New York resident dies prior to January 1, 2026 having made a taxable gift within three years of death, New York will impose an estate tax on the gift (at a top rate of 16%) if the combined value of the New York taxable estate and the taxable gifts made within three years of death exceeds the New York estate tax exemption (currently $5.74 million). Further, there may be a tax cost associated with the clawback that should be taken into consideration in determining whether to make taxable gifts.

The Federal gift and generation-skipping transfer ("GST") tax exemptions are currently $11.4 million but, absent further legislation, are scheduled to decrease to $5 million (indexed for inflation from 2010) in 2026. Because of the potential for a decrease in the Federal gift and GST tax exemptions prior to 2026 and the potential effect of the New York clawback, we encourage clients who would like to use their increased Federal exemptions to begin the process now. Doing so would permit clients to take advantage of certain multi-year strategies and reduce the possibility of the imposition of a New York estate tax on the gifts.

Connecticut's estate and gift tax exemptions

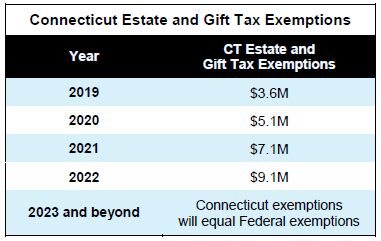

As we reported in our February 11, 2019 Alert Memorandum, the enactment of two conflicting bills by the Connecticut General Assembly in 2018 led to a period of uncertainty regarding the Connecticut estate and gift tax exemption amounts for 2020 and beyond. That uncertainty has now been resolved. The Connecticut estate and gift tax exemptions for 2019 and future years are as follows:

Although the Governor's budget included a proposal to repeal the Connecticut gift tax, the Connecticut General Assembly did not include this proposal in its final budget.

Given the scheduled increases in the Connecticut gift tax exemption, Connecticut residents who wish to make use of the increased Federal gift tax exemption should pay special attention to the timing of taxable gifts.

Connecticut trust law changes

The Connecticut General Assembly passed a bill, which the Governor is expected to sign, making significant changes to Connecticut trust law. In particular, beginning in 2020, Connecticut is poised to permit 800-year dynasty trusts (so that the trust may continue for multiple generations, thereby maximizing the benefit of the GST tax exemption), asset protection trusts (permitting the donor of the trust, in certain circumstances, to be a trust beneficiary without the donor's creditors being able to reach trust assets) and directed trusts (pursuant to which persons who are not acting as Trustee may, for example, direct trust investments or distributions).

In addition, Trustees of irrevocable trusts created after 2019 (and of revocable trusts that become irrevocable after 2019) will be required to send certain notices to current trust beneficiaries or someone appointed to receive notice on their behalf.

New York Real Estate Transfer Taxes

New York State currently imposes two different taxes on transfers of real property located in the state (with exceptions for most gifts), one generally paid by the seller (referred to as a "transfer tax"), which applies to both residential and commercial properties, and one generally paid by the buyer (referred to as a "mansion tax"), which applies to residential properties (including condominiums, cooperative apartments and one-, two- and three-family homes) if the consideration for the transfer is $1 million or more.

As part of the New York State 2020 Budget, the New York State real estate transfer and mansion taxes were increased for transfers of certain property located in New York City.

Note that in addition to the New York State transfer tax and mansion tax, New York City or other local transfer taxes may apply.

Transfer tax on real property

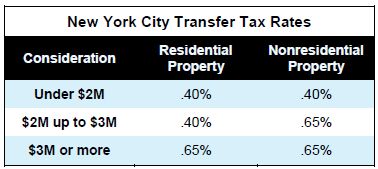

Under current law, transfers of real property located in New York State are subject to a transfer tax equal to .40% if the consideration is $1 million or more. Under the new law, the transfer tax has increased for transfers of New York City residential property if the consideration is $3 million or more and for transfers of New York City non-residential property if the consideration is $2 million or more, as shown in the chart below:

The transfer tax rates apply to the entire consideration once the relevant threshold has been met. For example, if the consideration for a transfer of New York City real property is $3.5 million, the .65% rate applies to the entire $3.5 million, for a transfer tax of $22,750.

Mansion tax on residential property

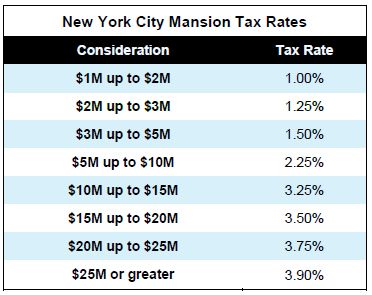

Under current law, transfers of residential property located in New York State are subject to a mansion tax equal to 1% of the consideration if the consideration is $1 million or more. Under the new law, the mansion tax has increased for transfers of New York City residential property if the consideration is $2 million or more, as shown in the chart below:

As with the transfer tax rates, the mansion tax rates apply to the entire consideration once the relevant threshold has been met. For example, if the consideration for the transfer of a New York City residence is $3.5 million, the 1.5% tax rate applies to the entire $3.5 million, for a mansion tax of $52,500.

Effective date of increases

The increased real estate transfer and mansion taxes will apply to transfers occurring on or after July 1, 2019. However, there is an exception for transfers made pursuant to a binding written contract entered into on or prior to April 1, 2019.

Connecticut Real Estate Conveyance Taxes

Tax on real property conveyances

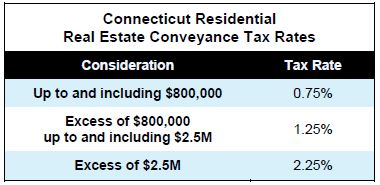

Under current law, with some exceptions, transfers of Connecticut residential property are subject to real estate conveyance tax at graduated rates equal to 0.75% on consideration up to and including $800,000 and 1.25% on consideration in excess of $800,000. This tax is generally paid by the seller.

The Connecticut General Assembly budget bill, if signed by Governor Lamont, will increase the Connecticut real estate conveyance tax rate for certain transfers of Connecticut residential property. Under the proposed new law, as shown in the chart below, a new 2.25% tax rate will apply to consideration in excess of $2.5 million on transfers of Connecticut residential property made on or after July 1, 2020.

Unlike New York State, which applies its transfer and mansion taxes at a single tax rate based on total consideration, Connecticut applies its real estate conveyance tax at each graduated tax rate only to the amount in excess of the prior threshold. For example, if the consideration for the transfer of a Connecticut residence after July 1, 2020 is $3.5 million, the new 2.25% rate applies only to the $1 million of consideration in excess of $2.5 million. Such a transfer would result in a residential real estate conveyance tax of $49,750 ($6,000 at the 0.75% rate, $21,250 at the 1.25% rate and $22,500 at the 2.25% rate).

Income tax credit

Sellers who continue to own their primary residence in Connecticut after a transfer that is subject to the new 2.25% graduated tax rate may recoup part or all of the real estate conveyance taxes paid at that rate through property tax credits against their Connecticut income tax. Such residents can take the credit beginning in the third calendar year after the transfer. The amount of the credit in a given year will equal the lesser of one-third of the real estate conveyance taxes paid at the 2.25% rate and the real property taxes paid on the primary residence for such calendar year. The unused portion of the credit can be carried forward for up to six years.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.