Basic Features

The umbrella partnership - C corporation structure ("Up-C") is an indirect mode for an operating partnership to conduct an initial public offering ("IPO"). It derives its name from the Up-REIT structure, widely used by real estate investment trusts since the 1990s. An Up-C is composed of two entities: the parent company, which is a C corporation ("PubCo"), which will be organized as a holding company, and PubCo's subsidiary, which is the then-existing operating partnership, usually structured as a limited liability company or a limited partnership (a "Flow-through Entity"). The Flow-through Entity's capital structure will be modified by reclassifying the interests of its original owners ("Original Partners") into a new class of interests that is exchangeable for PubCo common stock. The Up-C structure makes it possible for the Flow-through Entity to undertake an IPO while maintaining its partnership status, principal assets and operating business. Private equity-backed and venture capital-backed companies generally favor the Up-C structure because these financial investors often use flow-through entities to hold their interests in portfolio companies. The Up-C structure is a convenient tool to offer the portfolio companies' shares to the public through an IPO.

Structuring the Up-C

- Pre-IPO. The Flow-through Entity

begins as a limited liability company or partnership, which is

owned by the Original Partners.

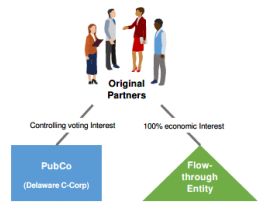

- PubCo formation. The Original

Partners incorporate PubCo as a C-corporation. PubCo will have two

classes of common stock. PubCo's Class A common stock

("Class A Shares") will be offered in the IPO.

PubCo's Class B common stock ("Class B Shares") is

held by the Original Partners, and it provides voting rights but no

economic rights.

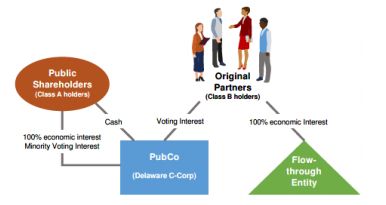

The Original Partners are expected to recapitalize the Flow-through Entity by using a single class of units that can be subsequently exchanged for Class A Shares or redeemed for cash, typically at the option of PubCo. This recapitalization may be through a newly issued class of units or those units held by Original Partners (if they intend to partially exit from their investment in the Flow-through Entity). - Post-IPO. Class A Shares are sold to

the public through an IPO. PubCo is effectively a holding company,

which has the Flowthrough Entity as its subsidiary. The

Flow-through Entity continues to hold the principal assets and

operate the business. PubCo's certificate of incorporation and

bylaws are amended to provide that each Original Partner will

receive one or more of the newly created Class B Shares that will

vote along with the Class A Shares. Holders of Class B Shares

participate in any stockholder vote on an as-exchanged basis. This

enables the Original Partners to continue to exercise control over

PubCo commensurate with their economic interests in the

Flow-through Entity.

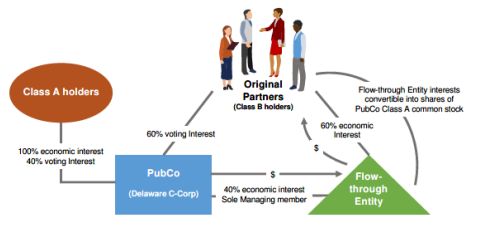

- Final structure. PubCo uses the IPO

proceeds to purchase a controlling interest in the Flow-through

Entity. The Flowthrough Entity, in turn, redeems partnership

interests from the Original Partners. For tax purposes, this

redemption is treated as a "disguised sale" or a direct

purchase of partnership interests by PubCo from the Original

Partners.

Rationale and Benefits of the Structure

Prior to the IPO, the entity's business was conducted through the Flow-through Entity, which is a pass-through structure and does not pay entity-level taxes. Through the implementation of the Up-C structure, the pass-through entity remains in place, and PubCo pays the Original Partners for the value of PubCo's tax attributes as those tax attributes are used after the IPO. Each time an Original Partner exchanges Flow-through Entity units for PubCo shares, PubCo will receive a "step-up" in the tax basis of its assets. This tax basis step-up is allocated to PubCo's share of the historic business' assets (based on their fair market value) and any excess is allocated to intangible assets (i.e., goodwill) that are amortizable over a 15-year straight-line basis ("Section 197 intangibles"). In order to implement the Up-C, PubCo, the Original Partners and the Flow-through Entity will have to enter into various agreements, such as a tax receivable agreement ("TRA"), an exchange agreement and a registration rights agreement.

Tax Receivable Agreement

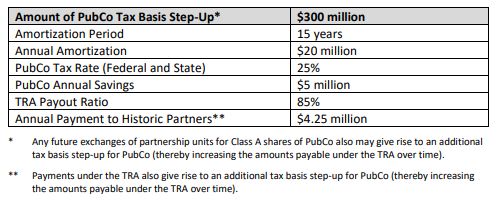

The TRA typically requires PubCo to share tax savings with the Original Partners. The Original Partners and Pubco will customarily share an 85:15 split on the benefits from the tax basis step-up generated by PubCo's purchase of its interest in the Flow-through Entity and any net operating losses incurred. PubCo will pay the negotiated percentage (e.g., 85%) of the value of the actual state and federal income tax savings to the Original Partners.1 For tax purposes, these payments are treated as contingent installment sale proceeds, generating both additional step-up and deemed interest deductions for PubCo. The additional step-up has the effect of increasing the amounts of subsequent TRA payments.

An illustration of potential TRA economics is as follows:

The TRA may also provide for a lump sum payment to the Original Partners in case of a merger, asset sale or other form of business combination or change in control. The Original Partners are ordinarily not required to remain owners of the Flow-through Entity, and they remain entitled to receive any payments under the TRA should they choose to divest their ownership.2 The Up-C structure allows the Original Partners to maintain their interests in the Flow-through Entity, with its tax structure, and be subject to only one level of tax. The public stockholders are also benefitted by the Up-C structure through PubCo's resulting increased cash flow.

Exchange Agreement

PubCo's Class B shares will not be offered to the public. The exchange agreement, however, will provide the Original Partners with liquidity through a right to exchange Original Partners interests for the publicly traded Class A Shares on a one-for-one basis. In that case, a corresponding number of Class B shares fall away. In order to minimize any burdens on PubCo, the exchange agreement will specify some limitations for exchanges. The agreement may also limit exchanges in order to limit the effect of such exchanges on the trading market for the Class A Shares.

Registration Rights Agreement

When Original Partner interests are exchanged for Class A Shares, these securities will be "restricted securities" as defined in Rule 144 ("Rule 144") under the Securities Act of 1933, as amended, unless registered pursuant to an exchange registration statement or a resale registration statement. PubCo, the Original Partners, the holders of Class A Shares and those who hold securities that are convertible or exchangeable into Class A Shares may choose to enter into a registration rights agreement. This agreement will enable them to request that PubCo file with the Securities and Exchange Commission either a resale or an exchange registration statement for the sale of the Class A Shares.

Rule 144 Relief

On November 1, 2016, SEC Division of Corporation Finance staff (the "Staff") issued a no-action letter with respect to the required Rule 144 holding period and tacking of an Original Partner's holding period for the Flow-through Entity units. Rule 144(d)(1)'s holding period for the Class A Shares commences upon the earlier acquisition of the Flow-through Entity units if: (i) the Original Partners paid the full purchase price for the Flow-through Entity units at the time they were acquired from the Flowthrough Entity; (ii) the Up-C governing documents contemplate and provide the terms for the exchange of Flow-through Entity partnership interests for PubCo shares such that each Original Partner has the same economic risk as if it was a holder of the PubCo shares during the entire period such Original Partner holds the Flow-through Entity partnership interests; and (iii) no additional consideration is paid by the Original Partners for the PubCo shares. The holding period requirement is either six months or one year depending on the issuer's reporting requirements, and usually commences when a person acquires a security.

In effect, the Original Partners may choose to rely on Rule 144 in reselling their restricted Class A Shares instead of having PubCo file a registration statement.

In Acquisitions and Winding Up

An entity that relies on an Up-C structure can use cash or the PubCo shares as acquisition currencies. It can also use the Flowthrough Entity units. The sellers will contribute the target company to the Flow-through Entity in exchange for Flow-through Entity units that may, at some point in the future, be exchanged for PubCo shares. The sellers and PubCo will enter into a TRA. The sellers benefit from this pass-through structure, and the target company becomes a disregarded entity for tax purposes. This mode of acquisition benefits the sellers with tax deferral, a single layer of tax and liquidity through the ability to exchange.

An entity that relies on an Up-C structure may also choose to "unwind" such structure due to a continued decrease of PubCo's stock price, upon weighing the benefits against detriments or for change of control considerations. In doing so, its TRA provisions will often be accelerated and the dual class share structure is eliminated in order to gain full ownership of the Flow-through Entity.

To read the full article click here

Footnote

1 The Tax Cuts and Jobs Act reduced the general corporate tax rate from a maximum graduated rate of 35% to a flat rate of 21% for taxable years beginning after December 31, 2017. This lower rate decreases the value of the basis step-up, which, in effect, decreases the amount of TRA payments. Other impacts of tax reform on the Up-C structure include limits on the use of net operating loss carry-forwards, limits on interest deductions and bonus depreciation/expensing provisions.

2 In implementing the TRA, PubCo will have to make TRA payments and accurately disclose potential liabilities under the TRA. Additional accounting, modeling and compliance work is expected from PubCo.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2019. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.