- within Litigation, Mediation & Arbitration, Strategy and Employment and HR topic(s)

- with Senior Company Executives and HR

- with readers working within the Insurance industries

"...that whole law started on the basis of my going home in the evening in the early '70s and watching the Watergate hearings. And watching at the end of the hearings where certain companies would testify as to making political contributions to Nixon."1

The Foreign Corrupt Practices Act (FCPA) prohibits the bribery of foreign officials in order to obtain or retain business. But its origins are rooted in the investigations of financial contributions related to the Watergate scandal. Recently, the FCPA has entered a new period of increased enforcement by both the Securities and Exchange Commission (SEC) and the US Department of Justice (DOJ). Recognizing this stepped-up scrutiny, NERA has developed a proprietary database of settlements from 2002 through 2008. This paper examines settlement patterns and the extent of indirect impact in the form of civil litigation.2

Introduction

Recently, the SEC entered a period of increased enforcement of the FCPA. This Act generally prohibits the bribery of foreign officials and requires that a company retain accurate books and records. As acknowledged by the Director of the Division of Enforcement of the SEC:

In the past two years we've seen a marked increase in Commission FCPA enforcement. Since January 2006, the Commission has filed more than 30 FCPA actions, which is more than were filed during the prior 28 years combined. We have also seen a significant increase in the sanctions levied in FCPA cases. Since January 2006, the Commission has ordered the payment of more than $200 million in penalties, disgorgement, and prejudgment interest for FCPA violations. The Department of Justice is also very active in this area.3

On 27 March 2008, the DOJ stated, "One of the Department's most potent weapons in combating foreign corruption is the FCPA. Since 2001, the Department has substantially increased its focus on FCPA violations."4

While the SEC and DOJ both regulate enforcement of the FCPA, each plays a specific role:

The Department of Justice is responsible for all criminal enforcement and for civil enforcement of the anti-bribery provisions with respect to domestic concerns and foreign companies and nationals. The SEC is responsible for civil enforcement of the anti-bribery provisions with respect to issuers.5

With the apparent willingness to devote resources to the enforcement of the FCPA, it is likely that there will be an increase in both DOJ and SEC actions in the coming years. Both domestic and foreign public companies may have to deal with increased scrutiny and potential criminal prosecutions and fines. Some companies may also experience significant costs from indirect exposure to the FCPA through securities class actions arising from financial reporting issues related to FCPA claims.

Overview Of The FCPA

A Short History Of The Act

"The most troublesome problem confronted by the Commission has been that of political contributions and illegal payments overseas."6

In its current form, the FCPA, originally passed in 1977, has three basic provisions7:

- The Act requires issuers who register their securities with the SEC to keep detailed books, records, and accounts which accurately record corporate payments and transactions.8

- SEC registered issuers must institute and maintain internal accounting control systems to assure management's control, authority, and responsibility over the firm's assets.

- Domestic corporations, registered with the SEC or not, are prohibited from bribing a foreign official, a foreign political party, party official, or candidate for the purpose of obtaining or maintaining business.

The origins of the FCPA involve heightened concern over the influence of (illegal) campaign contributions in the Watergate era. Investigations by the SEC found that US companies had routed contributions to support politicians running for office indirectly through bribes to overseas companies or individuals. Stanley Sporkin, former director of the enforcement division at the SEC, addressed this trend in an SEC Historical Society Interview:

So after watching these hearings I remember coming in one day and asking Bob Ryan of the staff, to go out and find out from Gulf Oil how Gulf Oil made these payments and how did they book an illegal payment. And he came back within a day and had the whole case. They had set up two phony subsidiaries they called Bahama x and Bahama y. They put $5 million into each one of them and took the money back to the companies' offices and put it in the safe of the CEO, and that's where the payments came from. And the reason they did it that way is that they capitalized the amount of the slush fund because they didn't want to violate the Internal Revenue laws, which would have happened if they would have expensed those payments.9

The results of the SEC investigations were revealing—over 400 US companies admitted to making questionable or illegal payments in excess of $300 million to foreign government officials, politicians, and political parties. This discovery, however, did not lead to a large number of FCPA actions. In fact, there were few formal FCPA investigations or settlements during the years following the FCPA's enactment. During the Reagan administration, FCPA enforcement declined and in 1983 the Wall Street Journal reported that the DOJ had disbanded its multinational fraud branch.10 The SEC settled only six actions between 1977 and 1995.11

Even with limited enforcement, many in the business community complained that the FCPA provisions lacked specificity and had a negative effect on US competitiveness. A statement by the General Accounting Office (GAO) before the Senate Committee on Banking, Housing, and Urban Affairs in 1981 noted that more than 30% of the respondents to a questionnaire (sent to 250 companies in the Fortune 1000) reported lost business due to the FCPA. Many also complained that the Act had created an uneven playing field, giving companies from countries without antibribery restrictions a competitive advantage.12

Whether due to political reasons, legislative uncertainty, or simply the lack of improved computing power and electronic records available today, the investigation and prosecution of FCPA violations to date has not been a high priority. Increased availability and scrutiny of financial data, even from countries with developing financial systems, may make the detection of FCPA violations more likely in the future.

Recently, the SEC announced a move towards international accounting standards beginning in 2014.13 The implementation of such standards may push international regulatory bodies towards a more coordinated antibribery policy. This, coupled with the SEC's move towards international mutual recognition of financial regulation, likely means the SEC and DOJ will not be alone in pursuing such cases.14

Recent FCPA Settlements

Settlement Statistics

To assess the frequency of settlements and the magnitude of penalties, NERA has collected and analyzed information on FCPA settlements from 2002 through 2008. The 10 largest regulatory settlements have ranged from $16 million to $800 million.15 These figures include settlements with the SEC and DOJ.

Exhibit 1: The Top 10 Regulatory Settlements

As shown in Exhibit 1, the top 10 FCPA regulatory settlements included payments to both the SEC and the DOJ. For example, as seen in column (5), Baker Hughes and Willbros Group paid criminal fines to the DOJ totaling $11 million and $22 million, respectively, and in a deferred prosecution agreement, Chevron paid $27 million.

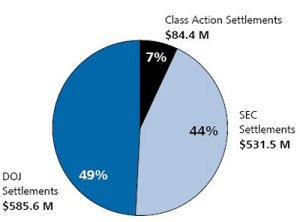

In a number of cases, securities fraud class actions arising from alleged FCPA violations have been filed. Exhibit 2 shows the composition of aggregate payments from 2002 to 2008 to the SEC, DOJ, and class action settlements. Though SEC and DOJ settlements comprise the bulk of the total, settlements related to securities class actions filed in connection with FCPA-related allegations are not insignificant. Further, these results may be skewed by the recent Siemens settlement of $800 million. Without this unusually large case, settlements related to the securities class actions would actually be approximately 21% of the total.

The number of SEC monetary settlements per year has generally increased, with some fluctuation, from 2002 to 2008, as seen in Exhibit 3. Following the trend of settlements over the past five years, and considering recent statements made by the SEC, the total number of settlements going forward may continue to increase.

Exhibit 2: Total FCPA-Related Civil And Regulatory Settlements By Public Companies 2002–2008

Exhibit 3: Total Number Of FCPA SEC Settlements Including A Monetary Component

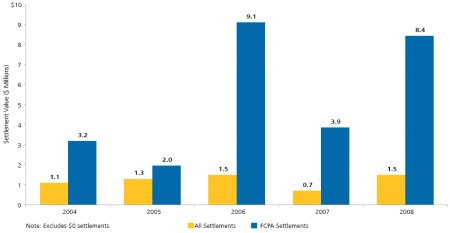

Exhibit 4: The Median SEC Settlements Of FCPA vs. All Securities Fraud Settlements16

FCPA violations including a monetary settlement tend to be more expensive to settle than the typical securities fraud violations investigated by the SEC that result in a monetary settlement. From 2004-2008, the median for non-zero company SEC settlements related to FCPA violations was higher than the median for non-zero company SEC settlements overall.

The FCPA And Securities Litigation

The direct impact of alleged FCPA violations is limited to penalties and the disgorgement of ill-gotten gains. These costs represent a one-time charge to the income statement and may often be relatively small compared to the firm's total value. However, the behavior connected to the alleged FCPA violation can sometimes have a lasting impact on the company's business. A review of recently settled FCPA-related securities class actions demonstrates the link between alleged FCPA violations, ongoing revenue, and the potentially large impact on firm value.17

In the next section, we examine several instances in which FCPA-related investigations by the SEC and/or the DOJ resulted in a significant impact on a company's business.

Case Studies

"...if a corporation has secured a clearly material amount of business by bribing those in control of a country rather than through more conventional means, such as competitive excellence, is this something that is important for investors to know? Might it be argued that such business is more vulnerable, more fragile, and more susceptible to loss than business secured through more customary means?"18

In November 2006, Willbros Group, Inc. ("Willbros") settled with the SEC and DOJ for $32.3 million in disgorgement, fines, and penalties in connection with allegations of bribing foreign officials in Bolivia, Ecuador, and Nigeria. However, this amount was small compared to the apparent impact on Willbros' market capitalization following the news of Willbros' potential violation of the FCPA after the market closed on 16 May 2005.19 Willbros' stock price declined by 30.90% to close at $11 on 17 May 2005, representing a $105 million aggregate decline in market capitalization.

A securities class action lawsuit was filed against Willbros in connection with its alleged FCPA violations.20 According to the complaint, 63% of the company's employees were located in Nigeria.21 Company officials were allegedly quoted as saying, "That's Nigeria, of course.

You have to pay bribes to get work," and "You either bribe them or you don't get the job."22 Given Willbros' dependence on revenues from its foreign operations, especially in Nigeria, the fallout from the investigation was substantial. According to the company's 2004 Annual Report, 60% of Willbros' contract revenues resulted from operations in Africa, South America, and the Middle East.23

In the case of FARO Technologies, Inc. ("FARO"), a securities class action lawsuit was filed when the company was accused of overstating sales, understating the cost of goods sold, and concealing its overstatement of profit margins through alleged violations of the FCPA.24 Compared to the $2.95 million settlement paid by FARO to the SEC and the DOJ, the company's $43.4 million loss in market capitalization at the first public announcement of the FCPA-related investigations implies an impact far above disgorgement, fines, and penalties.

On 29 June 2006, in its delayed annual report for 2005, FARO revealed that an internal investigation uncovered "referral fee payments in possible violation of the FCPA [of] $165,000 and $265,000 in 2004 and 2005, respectively, which were recorded in selling expenses in the Company's statement of income." Further, "[t]he related sales to customers to which payment of these referral fees had been made totaled approximately $1.3 million and $3.24 million in 2004 and 2005, respectively."

The alleged bribery-related revenues amounted to 31% and 36% of sales in China in 2004 and 2005, respectively, and sales in China accounted for 4% and 7% of total sales in those years.25

Exhibit 5: FARO Technologies, Inc.

The company acknowledged how the halt in the allegedly illegal activity could affect its business:

Depending on how this matter is resolved, the Company's sales in China could be significantly impacted. The termination of certain personnel and the cessation of improper payments in China may have a significant adverse effect on future operations in China because such action could negatively influence the decisions of a significant number of customers of the Chinese subsidiary to do business with that subsidiary. The potential magnitude of the loss of sales in China as a result of potential violations of the Foreign Corrupt Practices Act cannot be estimated at this time.26

Clearly, the effect of FCPA enforcement may go beyond disgorgement and cease-and-desist orders.

Another striking example of FCPA-related secondary effects can be seen in the case of Titan, Inc. ("Titan"). In mid-2004, a planned merger between Titan and Lockheed Martin Corp. disintegrated as a result of investigations by the DOJ and SEC into Titan's alleged FCPA violations.

The securities class action complaint in the matter alleged that "Titan made millions of dollars of potential illegal bribes or 'suspect payments' as late as 2003 that it failed to disclose and improperly accounted for in Africa, the Middle East, and Asia."27 In addition, there were allegations unrelated to the FCPA of "improper recognition of revenue and the inflation of accounts receivable of about $25-$30 million on a contract with the Benin national telephone company," and a $5 million supercomputer was allegedly gifted to the Saudi Ministry of the Interior.28

On 25 June 2004, the Wall Street Journal reported that, because of Titan's failure to resolve the DOJ investigation related to its foreign activity, the merger with Lockheed Martin "appeared to collapse." In response to this announcement, Titan's equity market capitalization fell by $302 million at the market close on 25 June 2004. Indeed, the next day Lockheed Martin issued a press release announcing the termination of the merger agreement.29

Titan's problems didn't end with the termination of the merger. On 1 July 2004, Moody's reported that it was considering the possibility of downgrading Titan, stating:

Moody's has placed The Titan Corporation ("Titan") on review for possible downgrade to reflect concerns about its reputation and cash flow from the impact of the company's alleged violation of provisions set forth in the Foreign Corrupt Practices Act. Increases in accounts receivable since December 31, 2003 along with other business issues will also be explored during the review. The decision to place the company on review for possible downgrade considers the announcement by Lockheed Martin to terminate its merger with Titan.30

A week later, Titan publicly acknowledged losses associated with its alleged illegal activities in a press release announcing results for the second quarter of 2004. The press release reported net losses expected in the range of $62-$78 million, including an operating loss of $20-$25 million, half of which "pertain[ed] to impairment of fixed assets directly related to the termination of a program by a civilian government agency in the second quarter, and a reduction in scope of planned business activities in Saudi Arabia."31 In addition, the company said it "expect[ed] to record a charge of approximately $11 million, after-tax, pertaining to our discontinued Titan Wireless activities in Benin, Africa." [Emphasis in original]

In connection with these events, Titan lost a merger deal and paid $13 million in fines to the DOJ and over $28 million to the SEC. All told, the company's market capitalization also dropped markedly over this period, from $1.68 billion prior to the first announcement of the investigation, to a low of $934 million shortly after the merger with Lockheed Martin was canceled.32

With the increase in FCPA enforcement over the past few years, we can expect cases like Willbros, FARO, and Titan to become more common. Implicated companies may, of course, pay fines, penalties, and disgorgements.

Market Reaction To FCPA Announcements

"Using financial market data, an event study measures the impact of a specific event on the value of a firm. The usefulness of such a study comes from the fact that, given rationality in the marketplace, the effects of an event will be reflected immediately in security prices."33

The way the price of a publicly traded security reacts to news is used as both a gauge for the materiality of a company announcement and a measure of the market's view of the financial implications of that announcement.34 A common method in financial economics involves constructing a market model in order to determine the relationship between market and/ or industry movements and a company's stock price. Using this market model, we assess the range of expected stock price movements for the company in question, and determine when stock price movements are out of the ordinary.

Using this methodology, we have analyzed stock price reactions to announcements of an FCPA action by publicly traded companies.35 Exhibit 6 shows the results, ordered by the market-adjusted percentage change in stock price upon the announcement.

Exhibit 6: Market-Adjusted Price Reactions to FCPA-Related News and Announcements

The table indicates that in some instances the implication of an alleged FCPA violation is considered serious by the market, over and above what one might expect given the magnitude of any disgorgements, fines, or penalties paid. For example, when Syncor International Corporation announced to the public that it was investigating suspicious payments in Asia that may have violated the FCPA, its stock price plummeted almost 45% on a market-adjusted basis, implying a loss of $343 million in market capitalization, despite the relative small amount paid in its eventual settlement with the SEC and the DOJ.

Although for most of these companies, there was no statistically significant price reaction, there are a substantial number of companies that experienced negative price reactions that are quite large in light of the relatively small regulatory settlements imposed. The companies with the largest market-adjusted price reactions had resulting 10b-5 actions.36

Conclusion

Our analysis shows that the majority of companies that exhibited statistically significant price reactions at the 5% level to FCPA-related news had resulting 10b-5 actions filed against them. The extent of the fallout from the relatively recent trend of increased FCPA enforcement actions remains uncertain. Given current trends toward globalization, coordinated regulatory scrutiny, and record-keeping requirements of publicly traded companies in the wake of recent market turmoil, enforcement of the FCPA may become a higher priority around the world. And as FCPA-related enforcement against domestic and foreign issuers increases, it is likely that related securities litigation will be an issue in many of these cases.

Footnotes

1. SEC Historical Society Interview with Stanley Sporkin. Conducted on 23 September 2003, by Irving Pollack.

2. The statistics and analyses in this paper focus on settled FCPA actions by the SEC.

3. Linda Chatman Thomsen, Remarks Before the Minority Corporate Counsel 2008 CLE Expo, Speech by SEC Staff. The referenced 30 FCPA actions filed since January 2006 should not be confused with the 33 FCPA settlements with the SEC examined in this paper.

4. Fact Sheet: the Department of Justice Public Corruption Efforts. Department of Justice, 27 March 2008.

5. http://www.usdoj.gov/criminal/fraud/docs/dojdocb.html.

6. PLI Address by SEC Commissioner A.A. Sommer, Jr., December 1975.

7. Congressional Research Service (CRS) report dated 3 March 1999 (http://www.fas.org/irp/crs/Crsfcpa.htm).

8. http://www.usdoj.gov/criminal/fraud/fcpa/history/1998/amends/senaterpt.html: "The FCPA amended the Securities Exchange Act of 1934 to require issuers covered under that Act to maintain transparent books and records and provided for civil and criminal penalties."

9. SEC Historical Society Interview with Stanley Sporkin. Conducted on 23 September 2003, by Irving Pollack.

10. In a speech regarding the FCPA before the United Nations in August 1981, US Attorney General William French Smith said that the administration intended to "eliminate the more offensive provisions of our law," including the ban on paying bribes. http://www.multinationalmonitor.org/hyper/issues/1984/08/reagan.html

11. Of the actions brought in 1986, SEC v. Ashland Oil, Inc. was the most important, as it established that shareholders could seek reimbursement for illegal payments made by a company. See "FCPA Digest of Cases and Review Releases Relating to Bribes to Foreign Officials under the Foreign Corrupt Practices Act of 1977," Shearman & Sterling, LP, 13 February 2008.

12. In a report to Congress in 1981, the GAO recommended that the criminal penalties relating to the accounting provisions of the FCPA be repealed. http://archive.gao.gov/f0102/115367.pdf, http://archive.gao.gov/d46t13/114503.pdf.

13. See Roadmap for the Potential Use of Financial Statements Prepared in Accordance with International Financial Reporting Standards from US Issuers, Commissioner Elisse B. Walter, US Securities and Exchange Commission, 27 August 2008.

14. See http://www.sec.gov/about/offices/oia/oia_multilateral.htm and http://www.iosco.org/.

15. To date, the SEC and the DOJ have both imposed fines and/or penalties in such cases. The SEC has also required disgorgement of allegedly ill-gotten gains.

16. Preliminary NERA data. Final data forthcoming on www.securtieslitigationtrends.com.

17. This is not to say that an alleged FCPA violation will always significantly impact a company's business. However, depending on the circumstances, the impact on a company's business can and sometimes does dwarf any regulatory settlement imposed.

18. PLI Address by SEC Commissioner A.A. Sommer, Jr., December 1975.

19. "Willbros Updates Status Of Audit Committee Investigation," Dow Jones News Service, 16 May 2005, 5:25pm EST. This news story also includes other negative disclosures that may have impacted Willbros' stock price.

20. The securities class action lawsuit was eventually settled for $10.5 million. See http://securities.stanford.edu/1034/WG05_01/.

21. Consolidated Amended Class Action Complaint In Re Willbros Group, Inc. Securities Litigation. Master File No. 05-CV-1778. Southern District Texas, Houston Division, 9 January 2006, page 17.

22. Ibid, page 30.

23. Ibid, page 2.

24. Consolidated Second Amended Class Action Complaint.In Re FARO Technologies Inc. Securities Litigation. Civil Action No. 6:05-cv-1810-ACC-DAB. Middle District of Florida, 22 February 2007, page 21. The lawsuit was eventually settled for $6.875 million. See http://securities.stanford.edu/1035/FARO05_01/.

25. Ibid, page 92.

26. Ibid, page 93.

27. Class Action Consolidated Complaint In Re Titan, Inc. Securities Litigation. Master File No. 04-CV-0676-LAB(NLS). Southern District of California, 17 September 2004, page 19.

28. Ibid, page 23-27.

29. Ibid, page 54.

30. Ibid, page 56.

31. Ibid, page 58-59.

32. The securities class action litigation was eventually settled for approximately $60 million. See http://securities.stanford.edu/1030/TTN04-01/.

33. "Event Studies in Economics and Finance," MacKinlay, A. Craig, Journal of Economic Literature, Vol. XXXV (March 1997), pp. 13-39.

34. For securities class action litigation, event studies are commonly used to assess the materiality of price movements related to fraud allegations.

35. The market model analysis employed here involves measuring the relationship between the stock price movements of each company against the S&P 500 Index prior to the first apparent announcement of FCPA-related allegations. This model is then used to assess the statistical significance of the market-adjusted price movements on the day of this FCPA-related announcement. The use of a different market index or news event dates may yield different results.

36. Titan, discussed above, had a statistically significant price reaction following the canceled merger announcement rather than on the date of the first FCPA-related announcement. The market-adjusted price reaction after this announcement was about -30%, and it too had a resulting securities class action.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.