On July 24, 2018, the Securities and Exchange Commission (SEC) proposed rule amendments that would simplify the financial disclosure requirements applicable to registered debt offerings for guarantors and issuers of guaranteed securities, as well for affiliates whose securities collateralize a registrant's securities. The proposed changes are part of the SEC's ongoing efforts to ease disclosure and capital formation burdens for public companies while continuing to ensure that investors have access to material information.

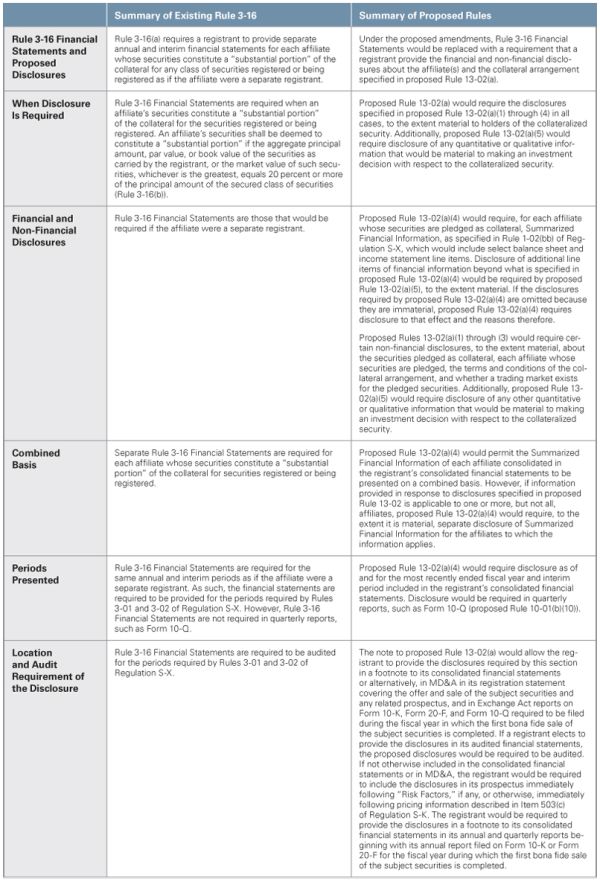

The proposed changes would amend Rules 3-10 and 3-16 of Regulation S-X and relocate part of Rule 3-10 and all of Rule 3-16 to new Article 13 in Regulation S-X, which would comprise proposed Rules 13-01 and 13-02. Below is a brief summary of existing Rule 3-10 and Rule 3-16 and the most prominent proposed changes to such rules. Also included herein is a helpful table, excerpted from the SEC release, that includes side-by-side comparisons of the main features of the existing and proposed rules.

Existing Rules 3-10 and 3-16 of Regulation S-X

Rule 3-10

Under Rule 3-10, each issuer and guarantor of registered debt securities (which effectively includes securities issued in Rule 144A private placements with registration rights) must file its own audited annual and unaudited interim financial statements. However, Rule 3-10 contains five exceptions that conditionally allow a parent company to provide abbreviated disclosures in its own financial statements to cover a subsidiary issuer or guarantor. All five exceptions require that (1) each subsidiary issuer and guarantor be "100 percent owned" by the parent company; (2) each guarantee be "full and unconditional"; and (3) the parent company provide certain disclosures in its consolidated financial statements (the Alternative Disclosures).

The form and content of the Alternative Disclosures are determined based on the facts and circumstances of the issuer and guarantor structure and can range from brief narrative disclosures to, more commonly, highly detailed condensed consolidating financial information (Consolidating Information). Preparation of the Consolidating Information, while less costly than full financial statements, is often challenging and time-consuming, and can be costly, as many registrants do not typically design their accounting systems to capture the required information for each individual issuer or guarantor.

Subsidiary issuers and guarantors that are permitted to omit their separate financial statements under Rule 3-10 are automatically exempt from the public-company reporting provisions under the Exchange Act via Rule 12h-5. The parent company, however, must continue to provide the Alternative Disclosures in its annual and quarterly reports for as long as the guaranteed securities are outstanding, even if the subsidiary issuer or guarantor otherwise could suspend its reporting obligation by operation of Exchange Act Section 15(d)(1) or compliance with Rule 12h-3.

Recently acquired subsidiary issuers and guarantors are addressed separately, and less favorably, under Rule 3-10. A parent company registration statement covering the issuance of guaranteed debt securities must include one year of audited, and, if applicable, unaudited interim pre-acquisition financial statements for recently acquired subsidiary issuers and guarantors that are significant and have not been reflected in the parent company's audited results for at least nine months of the most recent fiscal year.1

Rule 3-16

Rule 3-16 requires separate audited and interim financial statements for an issuer's affiliate if the securities of that affiliate are pledged as collateral for a registered offering and those securities constitute a "substantial portion" of the collateral for the securities being registered. Securities of the affiliate are deemed to constitute a "substantial portion" of the collateral if the aggregate principal amount, par value or book value of the pledged securities (as carried by the issuer), or the market value of the pledged securities, whichever is the greatest, equals 20 percent or more of the principal amount of the securities that are being secured. If this test is met, the issuer must file full financial statements of each qualifying affiliate. Subsequent to the registered offering, the issuer must continue to provide full audited financial statements of each such affiliate in its annual reports but need not provide any interim financial statements in its quarterly reports.

Proposed Amendments to Rules 3-10 and 3-16

Proposed Rule 3-10

The proposed amendments to Rule 3-10 would make it easier to omit separate financial statements as well as reduce the required alternative supplemental financial and nonfinancial disclosure about the subsidiary issuers and/or guarantors and the guarantees. The proposed amendments to Rule 3-10 would:

- Replace the condition that a

subsidiary issuer or guarantor be 100 percent owned by the parent

company with a condition that it be consolidated in the parent

company's consolidated financial statements.

- Removing the "100 percent owned" condition would permit certain joint venture entities to provide credit support in the form of a guarantee(s). It also would provide additional financing flexibility for public companies that use the so-called "UP-C" structure. While the "100 percent owned" test only considers shares with voting rights for corporate subsidiaries, it considers all membership interests (voting and nonvoting) for noncorporate subsidiaries. In an Up-C structure, although the publicly traded parent company typically owns 100 percent of the voting interests in the private operating partnership or operating limited liability company, because it does not own 100 percent of all of the membership interests in the noncorporate private operating entity, such entity is not considered "100 percent owned" under Rule 3-10. Accordingly, the private operating entity and the publicly traded parent company cannot sell or guarantee registered debt without preparing separate audited financial statements for each entity and making the private operating entity a separate reporting company under the Exchange Act.

- Replace the specific issuer and

guarantor structures permitted under the five exceptions in Rules

3-10(b) through (f) with a broader two-category framework where the

parent company's role as issuer, co-issuer, or full and

unconditional guarantor with respect to the guaranteed security

will determine whether the issuer and guarantor structure is

eligible for the benefits of the rule. Under this framework, an

issuer and guarantor structure would be eligible if (1) the parent

company issues or co-issues (on a joint and several basis with one

or more of its consolidated subsidiaries) securities that are

guaranteed by one or more consolidated subsidiaries; or (2) a

consolidated subsidiary issues or co-issues (with one or more other

consolidated subsidiaries of the parent company) the securities,

and the securities are guaranteed fully and unconditionally by the

parent company.

- Because the role of the parent company would determine whether an issuer or guarantor structure is eligible, the role of the subsidiary guarantors would be irrelevant for determining overall eligibility. As a result, the existing conditions that subsidiary guarantees be full and unconditional and, where there are multiple guarantees, be joint and several no longer would be imposed on subsidiary guarantors.

- The SEC expects issuer and guarantor structures that currently qualify under Rule 3-10 to continue to qualify under either of the two alternative categories in the revised framework.

- Replace the Consolidating Information

specified in existing Rule 3-10 with more abbreviated financial and

nonfinancial disclosures:

- The proposed financial disclosures

would require, for each issuer and guarantor, summarized financial

information, as specified by Rule 1-02(bb)(1) of Regulation S-X.2 The

proposed change in requirements would provide significant relief as

compared to existing rules because (1) only select captions from

the balance sheet and income statement would have to be presented

and (2) summarized financial information would not require

disclosure of any information related to the statements of cash

flows.

- The summarized financial information of each issuer and guarantor may be presented on a combined basis; information related to subsidiaries that are not issuers or guarantors (and any consolidating adjustments) would no longer be required. This compares favorably against the current requirement of condensed consolidating financial information that includes separate columnar information about the parent company, subsidiary issuers and guarantors, and any other subsidiaries of the parent company on a consolidated basis, consolidating adjustments and the total consolidated amounts.

- The summarized financial information would be required only for the most recently completed fiscal year and any interim period included in the parent company's consolidated financial statements (as compared to the current requirement, which covers all periods included in the parent company's most recent consolidated financial statements).

- The proposed nonfinancial disclosures

would include, to the extent material, certain qualitative

disclosures about the guarantees and the issuers and guarantors, as

well as any additional information that would be material to

holders of the guaranteed security.

- For example, if a subsidiary guarantee is not full and unconditional or joint and several, and such terms are material, (1) the terms should be disclosed and (2) separate summarized financial information should be provided for any subsidiary guarantor that has not provided a full, unconditional, and joint and several guarantee.

- The proposed financial disclosures

would require, for each issuer and guarantor, summarized financial

information, as specified by Rule 1-02(bb)(1) of Regulation S-X.2 The

proposed change in requirements would provide significant relief as

compared to existing rules because (1) only select captions from

the balance sheet and income statement would have to be presented

and (2) summarized financial information would not require

disclosure of any information related to the statements of cash

flows.

- Permit the proposed disclosures to be

provided outside the footnotes to the parent company's audited

annual and unaudited interim consolidated financial statements in

the registration statement covering the offer and sale of the

subject securities and any related prospectus, and in Exchange Act

periodic reports filed during the fiscal year in which the first

bona fide sale of the subject securities was first made.

- Permitting the disclosures to be

located outside of the parent company's financial statements is

intended reduce the costs and delays associated with auditing the

disclosures. Additionally, by relocating the disclosures from the

financial statements, the disclosures would become eligible for the

liability protections of the safe harbor under the Private

Securities Litigation Reform Act of 1995.

- If the changes related to the location of the disclosures are adopted substantially as proposed, we expect that underwriters will push for some level of auditor comfort or company certification on any summarized financial information that is not included in the parent company's audited financial statements.

- Permitting the disclosures to be

located outside of the parent company's financial statements is

intended reduce the costs and delays associated with auditing the

disclosures. Additionally, by relocating the disclosures from the

financial statements, the disclosures would become eligible for the

liability protections of the safe harbor under the Private

Securities Litigation Reform Act of 1995.

- Require that the proposed disclosures be included in the footnotes to the parent company's consolidated financial statements for Exchange Act periodic reports beginning with the annual report covering the fiscal year during which the first sale of the subject securities is completed, thereby subjecting these later disclosures to the annual audit (as is the case under the current rules).

- Eliminate the current requirement to provide pre-acquisition financial statements of recently acquired significant subsidiary issuers and guarantors.

- Require the proposed financial and

nonfinancial disclosures for as long as the issuers and guarantors

have an Exchange Act reporting obligation with respect to the

guaranteed securities, rather than for as long as the guaranteed

securities are outstanding.

- In many cases when a debt security is offered and sold on a registered basis, there will be fewer than 300 holders of record. Accordingly, in such cases the reporting obligation of subsidiary issuers/guarantors under Section 15(d) would suspend automatically within approximately one year following completion of the registered offering.

Proposed Rule 3-16

The proposed amendments to Rule 3-16, which reflect the view of the SEC that separate financial statements of affiliates whose securities are pledged as collateral "are not material in most situations," would:

- Replace the existing requirement to

provide separate financial statements for an affiliate whose

pledged securities constitute a substantial portion of the

collateral for any class of securities offered in a registered

offering with a requirement to provide certain abbreviated

financial and nonfinancial disclosures about the affiliate and the

collateral arrangement if material to investors/holders of the

collateralized securities. Disclosures would include the

following:

- A description of the security pledged as collateral and each affiliate whose security is pledged as collateral.

- A description of the terms and conditions of the collateral arrangement, including the events or circumstances that would require delivery of the collateral.

- A description of the trading market for the affiliate's security pledged as collateral or a statement that there is no market.

- Summarized financial information, as specified in Rule 1-02(bb)(1) of Regulation S-X, for each affiliate whose securities are pledged as collateral. The summarized financial information of each such affiliate could be presented on a combined basis and would cover the most recently ended fiscal year and interim period included in the registrant's consolidated financial statements.

- Any other quantitative or qualitative information that would be material to making an investment decision with respect to the collateralized security.

- Permit the proposed financial and nonfinancial disclosures to be located in filings in the same manner as described above for the disclosures related to guarantors and guaranteed securities.

Conclusion

In our experience, the costs and challenges of complying with the rules currently applicable to guaranteed and collateralized securities are significant and continue to increase. This has caused many debt issuers to avoid registered public offerings in favor of Rule 144A private offerings, where the existing rules do not apply.

If adopted substantially as proposed, we believe the amendments may cause many debt issuers, especially those with issuer and guarantor or collateral support structures that currently do not comply with existing rules, to take a fresh look at whether to access the markets via a registered offering. Additionally, many parent companies will welcome the long overdue change that would permit them to cease providing the required financial disclosures for subsidiary issuers or guarantors if the obligation of the subsidiary issuer/guarantors to file periodic reports under Section 15(d) otherwise would have been suspended.

Comments on the proposed amendments are due 60 days after the publication of the proposing release in the Federal Register and may be submitted on the SEC's website. Any final amendments to the SEC rules based on these proposed changes will require further action by the SEC and, as a result, likely will not be in effect until closer to the end of 2018, at the earliest. Additional information is available in the proposing release and the SEC's press release.

Appendix

Set forth below is a table summarizing the main features of existing Rules 3-10 and 3-16 and the proposed rules, which has been excerpted from the SEC proposing release. It is only a summary of certain requirements contained in the current SEC rules and regulations, as well as a summary of the proposed rules; it is not a substitute for the rules and regulations or for the proposed rules. Defined terms used below have the same meaning as in the SEC proposing release.

*Associate Rachel H. Berlage assisted in the preparation of this alert.

Footnotes

1 The requirements to provide separate pre-acquisition financial statements of recently acquired guarantors applies only to Securities Act registration statements and can require more extensive disclosure than Exchange Act periodic reports and acquired business financial statements under Rule 3-05 of Regulation S-X. Furthermore, the significance test for recently acquired guarantors, which compares the net book value or purchase price of the subsidiary to the principal amount of the securities registered, is different from and stricter than the usual significance test for acquiree financial statements.

2 Summarized financial information as understood by Rule 1-02(bb) includes current and noncurrent assets, current and noncurrent liabilities, preferred stock, noncontrolling interests, net sales or gross revenues, gross profit, income/loss from continuing operations, net income/loss and net income/loss attributable to the entity.

To view the full article please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.